1. What is the projected Compound Annual Growth Rate (CAGR) of the Smoking Tobacco?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smoking Tobacco

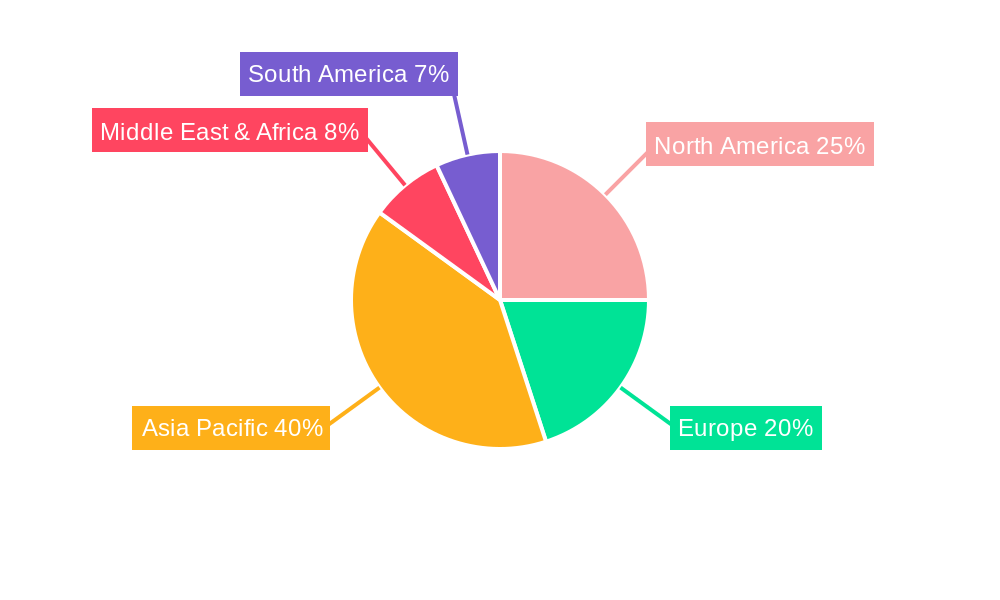

Smoking TobaccoSmoking Tobacco by Type (Fine-Cut Tobacco, Pipe Tobacco, World Smoking Tobacco Production ), by Application (Cigarettes, Cigar & Cigarillos, Waterpipes, Others, World Smoking Tobacco Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

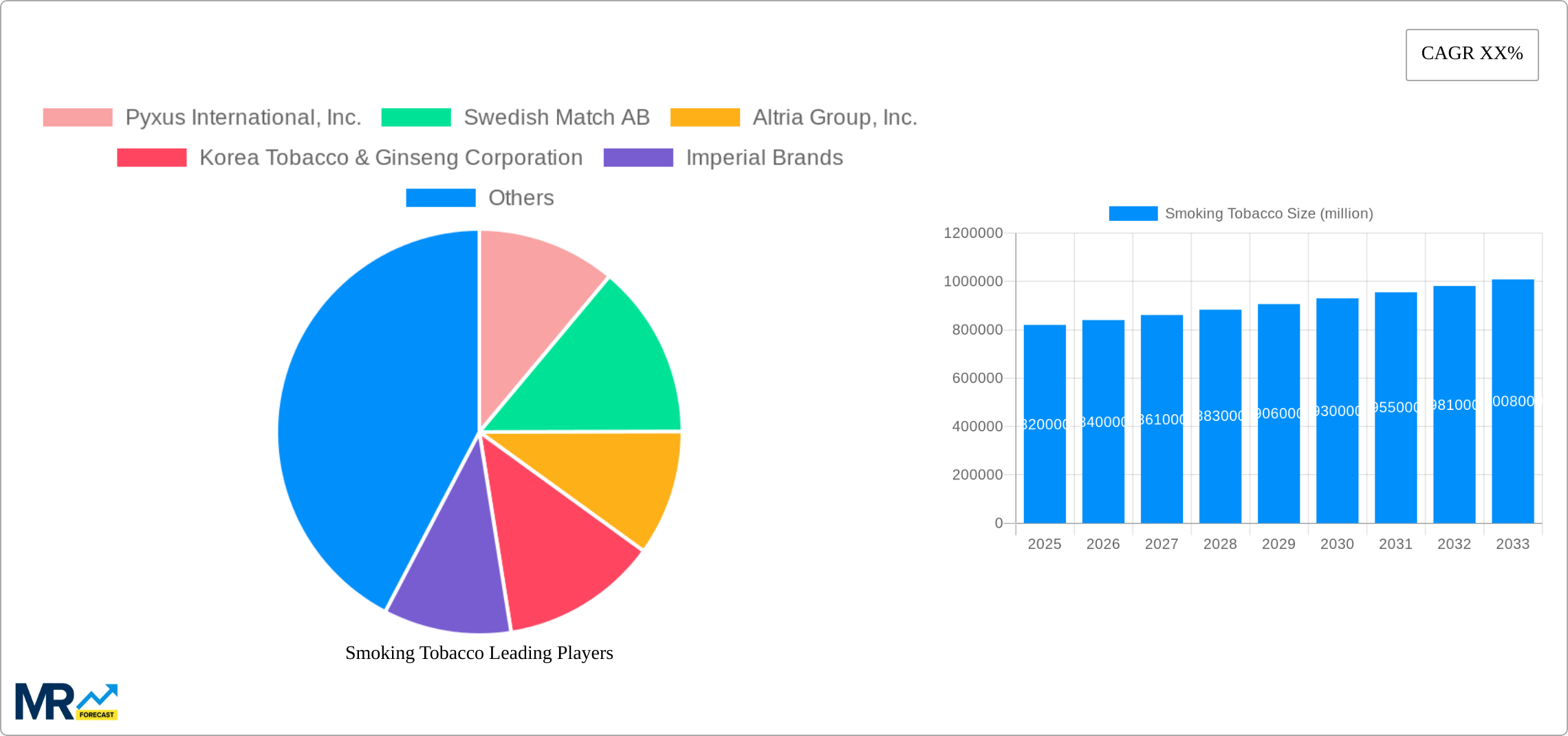

The global smoking tobacco market, while facing significant headwinds due to increasing health concerns and stringent regulations, is still a substantial industry with a projected market size exceeding $800 billion in 2025. The market is characterized by a moderate Compound Annual Growth Rate (CAGR), estimated at around 2-3%, driven primarily by the persistent demand in developing economies and the ongoing innovation in product diversification, such as heated tobacco products. However, the market faces considerable restraints including escalating excise taxes, anti-smoking campaigns, and growing public awareness of the severe health risks associated with tobacco consumption. This leads to a decline in the traditional cigarette segment, which remains the largest application area, albeit experiencing shrinking market share. The fine-cut tobacco and pipe tobacco segments are experiencing niche growth, appealing to specific consumer preferences. Geographic distribution shows a concentration of market share in Asia Pacific and North America, with emerging markets in Africa and South America showing potential for future growth, although this is tempered by the regulatory pressures faced in these regions. The competitive landscape is dominated by multinational corporations with significant brand recognition and global distribution networks, including Philip Morris International, British American Tobacco, and Altria Group, Inc. These companies are actively adapting their strategies to navigate the changing regulatory environment and shifting consumer preferences, exploring new product categories and technologies to maintain market share.

The future of the smoking tobacco market hinges on the delicate balance between persistent demand, primarily in developing countries, and the intensifying global efforts to curb tobacco consumption. Continued innovation in less harmful alternatives like heated tobacco products could offer a lifeline for some market players, but the long-term trajectory points towards a gradual decline in overall market size, particularly in developed nations. The success of individual companies will depend on their ability to effectively manage regulatory hurdles, adapt to evolving consumer preferences, and strategically target emerging markets while acknowledging the ethical considerations associated with the industry. The increasing adoption of digital marketing and targeted advertising, despite regulatory restrictions, reflects the ongoing efforts of industry leaders to sustain their market positions.

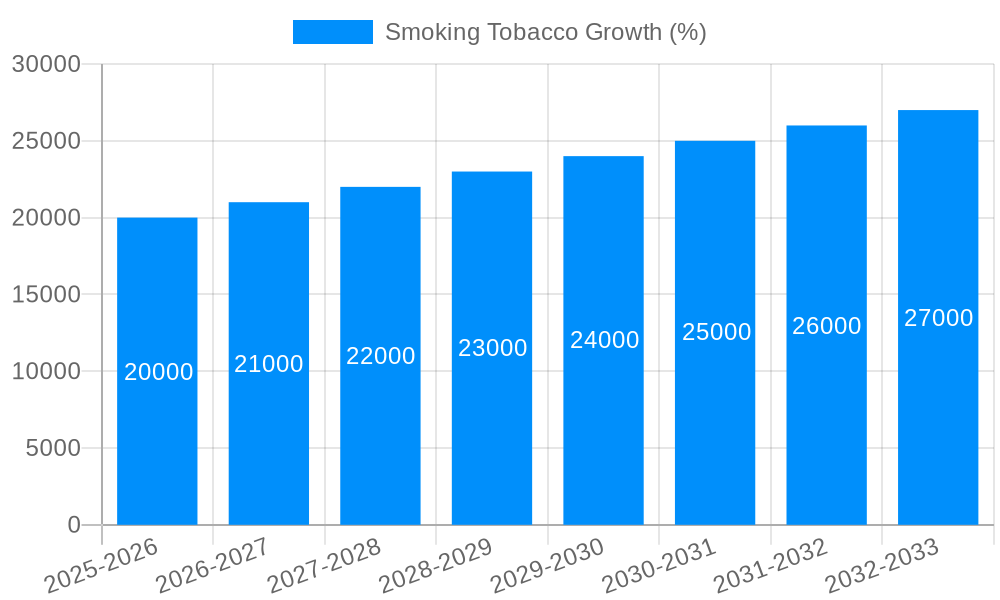

The global smoking tobacco market, valued at XXX million units in 2025, is projected to experience significant shifts during the forecast period (2025-2033). While overall consumption shows a declining trend driven by increasing health awareness and stricter regulations, the market isn't static. We are observing a complex interplay of factors. The decline is particularly pronounced in developed nations with robust public health campaigns and high taxation on tobacco products. However, growth in certain developing economies, often fueled by lower prices and less stringent regulations, is partially offsetting this decline. The market is also witnessing a gradual shift in consumer preferences towards alternative nicotine delivery systems, like e-cigarettes and heated tobacco products, posing a challenge to traditional cigarettes. This trend is particularly evident among younger demographics. Meanwhile, the premium segment of the market, including cigars and pipe tobacco, is exhibiting relative resilience, attracting consumers seeking a more sophisticated smoking experience. This segmentation reflects a broader consumer trend of seeking higher-quality, niche products. The changing landscape is further complicated by the ongoing efforts of major tobacco companies to diversify their product portfolios and invest in reduced-risk products, in response to evolving consumer preferences and regulatory pressures. Companies are strategically navigating these challenges by focusing on targeted marketing campaigns, product innovation, and exploring new markets, leading to a dynamic and multifaceted market outlook. The historical period (2019-2024) showcases a pattern of gradual decline in overall unit sales, but the rate of decline varies significantly across different regions and product categories.

Several factors contribute to the ongoing, albeit slowing, demand for smoking tobacco. In some developing economies, affordability remains a key driver, making cigarettes accessible to a large segment of the population. Cultural norms and social acceptance in certain regions also play a significant role, especially where smoking is deeply ingrained in social interactions. Furthermore, the established infrastructure for tobacco production and distribution provides a readily available supply chain that remains robust despite declining overall sales. The addictive nature of nicotine itself is a powerful driving force, making cessation difficult for many smokers. This creates a captive consumer base for existing brands despite health concerns and increasing costs. Finally, the marketing strategies employed by major tobacco companies, though increasingly regulated, still play a role in maintaining demand among existing consumers and potentially influencing new smokers, particularly in markets with less stringent regulations. The ongoing evolution of tobacco products and the introduction of newer, potentially less harmful alternatives are also impacting the market, even if these alternatives are not necessarily replacing traditional cigarettes entirely.

The smoking tobacco market faces significant headwinds. Increasing health awareness and the established link between smoking and various life-threatening diseases are major deterrents. This leads to government-led public health campaigns and stricter regulations globally, significantly impacting consumption patterns. High taxation on tobacco products, implemented in many countries to discourage consumption and generate revenue, raises prices and reduces affordability, especially for low-income populations. The rising cost of tobacco leaf and manufacturing contributes to increased product prices, further diminishing consumer demand, particularly in price-sensitive markets. The growing popularity of alternative nicotine delivery systems, such as e-cigarettes and vaping products, offers consumers perceived lower-risk alternatives, diverting market share from traditional cigarettes. Furthermore, evolving consumer preferences towards healthier lifestyles and a stronger emphasis on well-being are driving a shift away from smoking among younger generations. Finally, growing regulatory scrutiny and increasing litigation against tobacco companies add significant financial and operational burdens, impacting profitability and long-term sustainability.

The cigarette segment continues to dominate the smoking tobacco market, accounting for the lion's share of global consumption (XXX million units in 2025). While overall cigarette consumption is declining in many developed countries, growth in certain developing Asian and African nations partially offsets this decline.

Asia: Remains a significant market, driven by high populations and varying levels of regulatory control. China, in particular, presents a unique case study with its state-controlled tobacco industry. The diverse cultural landscape within Asia also creates opportunities for targeted product strategies.

Africa: Certain African countries are experiencing increasing cigarette consumption, driven by lower prices and less stringent regulation. However, this growth is often accompanied by substantial public health challenges.

North America: While experiencing a decline in overall cigarette sales, North America exhibits a relatively robust market for premium cigars and pipe tobacco, representing a niche segment with a loyal customer base.

Europe: The European market demonstrates significant regional variation, with many countries having implemented stringent regulations and high taxation leading to lower overall consumption. However, there is also growth within the premium segment.

The Cigarettes segment is expected to maintain its market dominance throughout the forecast period (2025-2033), although the rate of growth will likely be slower than in previous years. The persistent demand despite global declines highlights the enduring challenges of tobacco control and the resilience of the industry's established infrastructure.

Despite the challenges, innovation within the industry offers limited potential for growth. The development of reduced-risk tobacco products, such as heated tobacco products and potentially innovative formulations, could attract some smokers seeking alternatives to traditional cigarettes. Strategic marketing and product diversification efforts by major players, targeting niche segments and experimenting with different product types, are also attempts at sustained market share. Expansion into new, potentially underserved markets in developing countries, though ethically challenging, offers a pathway for limited growth.

The global smoking tobacco market, despite facing significant headwinds, remains a complex and dynamic landscape. While overall consumption is declining in many regions, certain factors like affordability in developing nations and the addictive nature of nicotine maintain a degree of market resilience. The ongoing shift towards reduced-risk products and the evolving regulatory environment create a challenging but potentially innovative future for the industry. Understanding the interplay of these factors is crucial for navigating the complexities of this market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Pyxus International, Inc., Swedish Match AB, Altria Group, Inc., Korea Tobacco & Ginseng Corporation, Imperial Brands, Philip Morris International, British American Tobacco, Japan Tobacco Inc., Scandinavian Tobacco Group, ITC Limited, China National Tobacco Corporation.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Smoking Tobacco," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smoking Tobacco, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.