1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarettes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cigarettes

CigarettesCigarettes by Type (Low Tar, High Tar, World Cigarettes Production ), by Application (Male Smokers, Female Smokers, World Cigarettes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

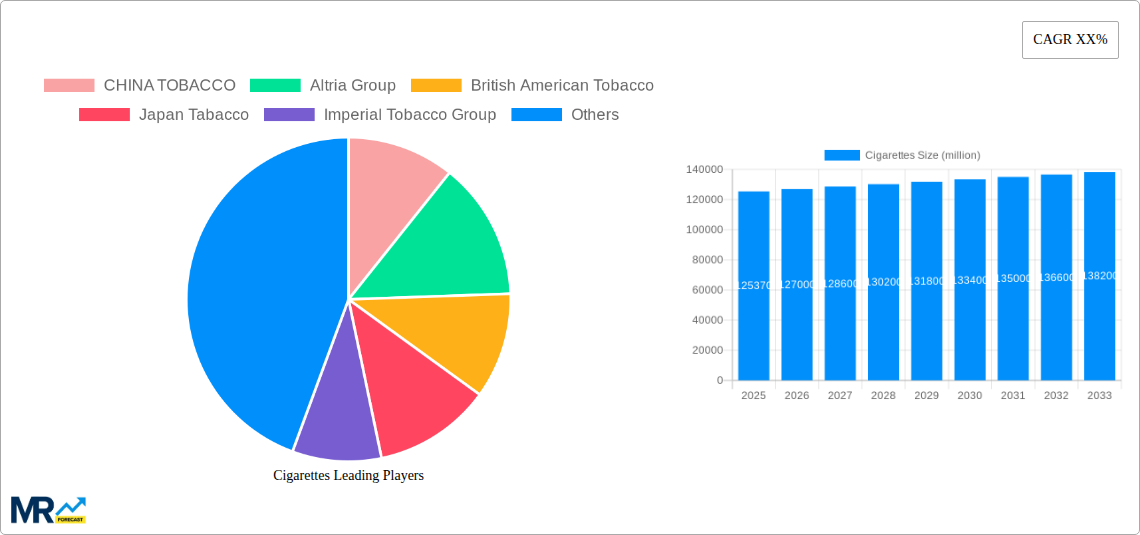

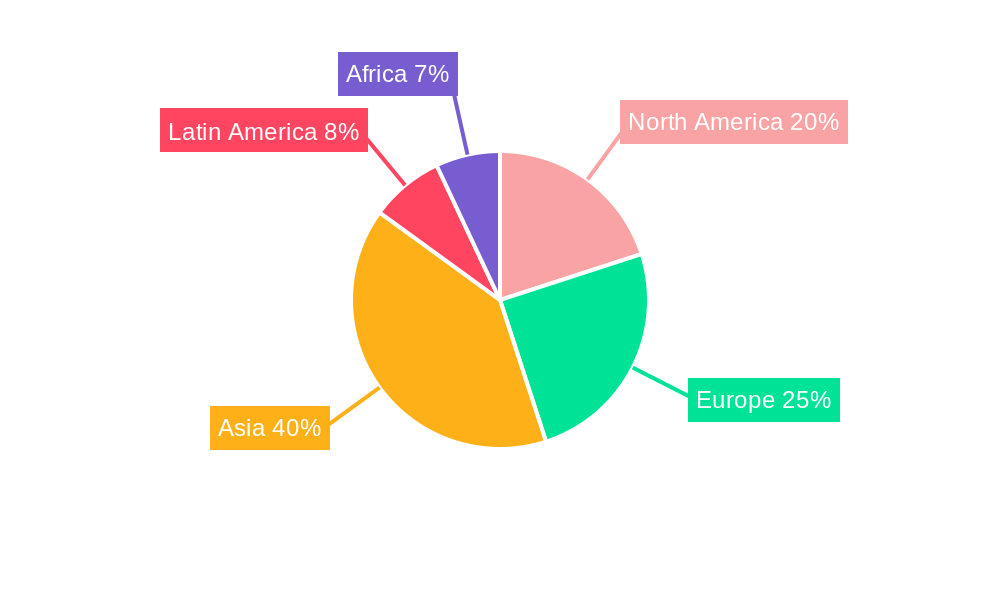

The global cigarette market, valued at $125.37 billion in 2025, is a mature yet dynamic industry facing a complex interplay of factors. While the overall market growth may be experiencing a moderate decline due to increasing health awareness, stringent regulations, and shifting consumer preferences towards healthier alternatives, a steady, albeit slower, Compound Annual Growth Rate (CAGR) is projected. This slower growth is partially offset by price increases and the continued dominance of established players like China Tobacco, Altria Group, and British American Tobacco, who leverage their extensive distribution networks and brand recognition. Emerging markets, however, present opportunities for expansion, even as developed nations experience declining sales. The market is segmented by product type (e.g., menthol, non-menthol, filtered, etc.), price point, and geographic location, all of which contribute to the overall market dynamics.

The future of the cigarette market hinges on several key developments. Increased taxation and stricter regulations on advertising and marketing will continue to impact sales. The rise of e-cigarettes and heated tobacco products presents a significant challenge, forcing traditional players to adapt and potentially diversify their product portfolios. Furthermore, growing health consciousness among consumers, particularly in developed nations, is pushing demand towards alternatives. However, despite these challenges, the inherent addictive nature of nicotine and the existing established customer base assure some level of sustained demand. Successful companies will be those that adapt to evolving consumer preferences, navigate regulatory hurdles, and strategically target specific market segments.

The global cigarette market, valued at XXX million units in 2025, is projected to witness a complex trajectory over the forecast period (2025-2033). While historical data (2019-2024) reveals a generally declining trend in many developed nations due to increasing health awareness and stringent regulations, emerging markets present a contrasting picture. The continued growth in these regions, driven by factors such as population growth and affordability, is partially offsetting the decline seen elsewhere. This creates a bifurcated market, with mature markets grappling with declining sales and shrinking consumer bases, while emerging markets offer opportunities for expansion, albeit with their own unique challenges regarding public health concerns and governmental policies. The market is also seeing a shift in consumer preferences, with a growing interest in alternative nicotine delivery systems such as e-cigarettes and heated tobacco products. This poses a significant challenge to traditional cigarette manufacturers, forcing them to adapt their strategies and explore diversification into these emerging segments. The overall market growth is therefore expected to be moderate, significantly influenced by the interplay between the declining demand in developed nations and the persistent growth in emerging economies. Price fluctuations in raw materials, particularly tobacco leaf, also add an element of unpredictability to future market projections. The increasing focus on sustainability and ethical sourcing further complicates the industry landscape, prompting manufacturers to address environmental concerns and supply chain transparency. Consequently, manufacturers are exploring innovations, including reduced-risk products and sustainable packaging, to navigate these evolving dynamics and maintain market share.

Several factors contribute to the continued, albeit moderate, growth in the cigarette market, particularly in developing economies. Affordability remains a key driver, especially in regions with lower average incomes, making cigarettes a relatively accessible consumer good. Population growth, particularly in emerging markets, provides a larger potential consumer base for cigarette manufacturers. Cultural factors and social acceptance also play a significant role in some regions where smoking remains deeply ingrained in societal norms. Furthermore, the ingrained habits of established smokers, coupled with a lack of readily accessible cessation programs in certain regions, sustains demand. While many developed nations are witnessing a decline due to increased health awareness campaigns and robust anti-smoking policies, the comparatively weaker regulatory environments and public health initiatives in certain developing nations allow for continued sales growth. The aggressive marketing strategies employed by some cigarette companies, particularly targeting younger demographics in regions with lax regulations, further fuel market growth in specific geographical locations. It's crucial to recognize, however, that these factors are increasingly challenged by growing health consciousness and the rise of alternative nicotine products, creating a dynamic and evolving market landscape.

The cigarette industry faces significant headwinds globally. Stringent government regulations, including higher taxes, stricter advertising restrictions, and plain packaging mandates, are drastically impacting sales in many developed countries. The growing global awareness of the severe health consequences of smoking, coupled with highly effective public health campaigns, is significantly reducing smoking prevalence. This is leading to decreased demand, particularly among younger generations. The increasing popularity of alternative nicotine products, such as e-cigarettes and vaping devices, presents a formidable competitive challenge, diverting consumers from traditional cigarettes. Furthermore, the rising cost of raw materials, including tobacco leaf, along with increasing production and distribution costs, squeezes profit margins. The ethical concerns surrounding tobacco farming and its environmental impact are also attracting increased scrutiny, prompting pressure from consumer advocacy groups and ethical investors. The industry is grappling with the need to balance its commercial interests with the growing demand for corporate social responsibility and sustainability. Lastly, legal battles and litigation related to the health consequences of smoking continue to impose financial burdens on manufacturers.

China: China's massive population and relatively high smoking rates make it the dominant market for cigarette consumption, with CHINA TOBACCO holding a near-monopoly position. The sheer volume of sales in China significantly outweighs that of any other single country. However, even in China, health awareness campaigns and government regulation are starting to impact consumption, leading to a slower growth rate compared to previous years.

Southeast Asia: Several Southeast Asian countries remain significant markets, characterized by lower per capita income, higher smoking rates among specific demographics and, consequently, higher affordability of cigarettes. The region presents a key area of growth, though subject to increasing health regulations and the push for public health initiatives.

Price Segment: The low-to-mid price segments are likely to retain their dominant position in many developing countries where affordability is paramount. Premium brands are more likely to be concentrated in developed nations, albeit with increasingly declining sales.

Product Segmentation: While traditional cigarettes retain the largest market share, there's an ongoing shift. The emergence of heated tobacco products and alternative nicotine delivery systems are slowly chipping away at the traditional market's dominance. Nevertheless, traditional cigarettes will likely continue to be the major product for the foreseeable future, especially in emerging markets. The longer-term dominance of this segment, however, is highly uncertain due to the continual expansion of the alternative market.

The dynamic interplay between these regions and segments highlights the complex and evolving nature of the global cigarette market. Future market share will be decided by a multitude of factors including the evolution of public health initiatives, government regulation, and emerging consumer preferences.

Despite the challenges, some growth catalysts remain for the cigarette industry. The continued expansion of the market in developing nations coupled with the potential for innovation in reduced-risk products and the exploration of more sustainable practices within the industry itself could drive moderate growth. Furthermore, successful marketing and distribution strategies in underserved regions can help maintain profitability, even if the overall global consumption rate is decreasing.

This report provides a comprehensive overview of the global cigarette market, analyzing historical trends (2019-2024), present market conditions (Base Year: 2025, Estimated Year: 2025), and forecasting future growth (2025-2033). It offers in-depth analysis of key market drivers, restraints, and growth catalysts, alongside detailed profiles of leading industry players and regional market dynamics. The report's insights are invaluable for businesses operating in or seeking to enter the cigarette market, as well as for policymakers and public health professionals.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

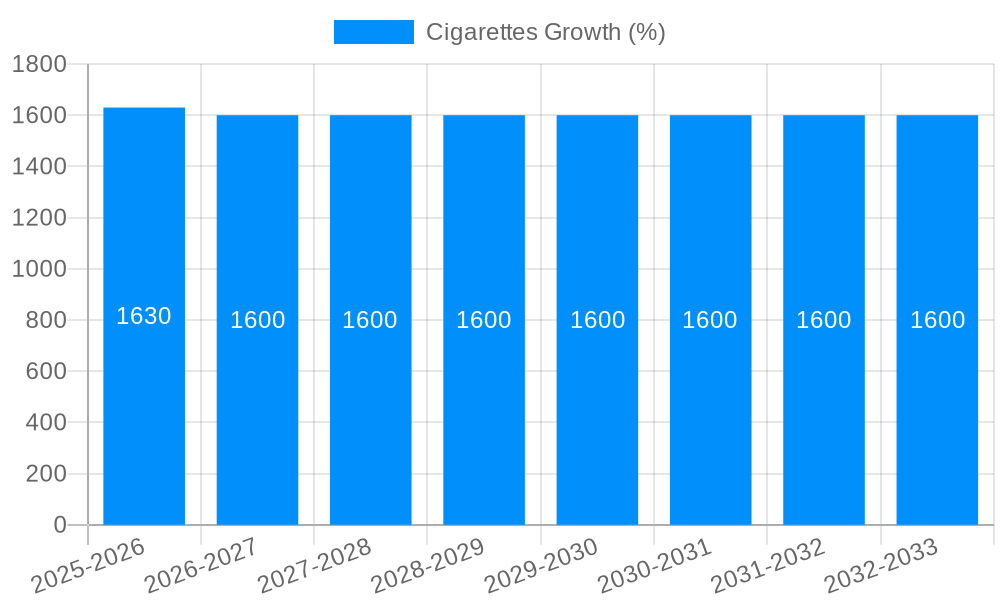

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CHINA TOBACCO, Altria Group, British American Tobacco, Japan Tabacco, Imperial Tobacco Group, KT&G, Universal, Alliance One International, R.J. Reynolds, PT Gudang Garam Tbk, Donskoy Tabak, Taiwan Tobacco & Liquor, Thailand Tobacco Monopoly.

The market segments include Type, Application.

The market size is estimated to be USD 125370 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cigarettes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cigarettes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.