1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Medicine Formula Granules?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chinese Medicine Formula Granules

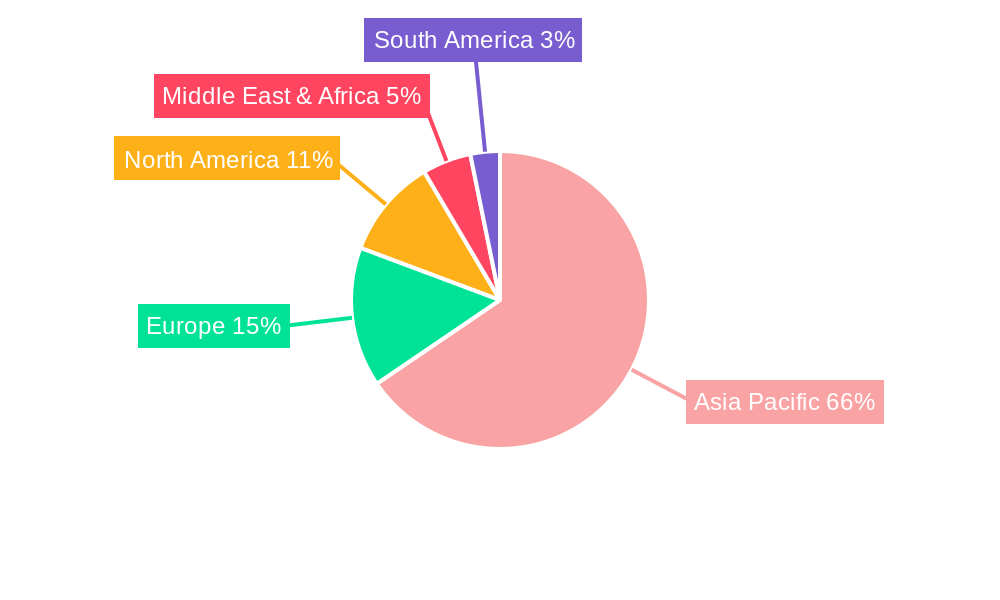

Chinese Medicine Formula GranulesChinese Medicine Formula Granules by Type (Cold Medication, Pain Medication, Others, World Chinese Medicine Formula Granules Production ), by Application (Medical Institutions, Retail Pharmacy, World Chinese Medicine Formula Granules Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

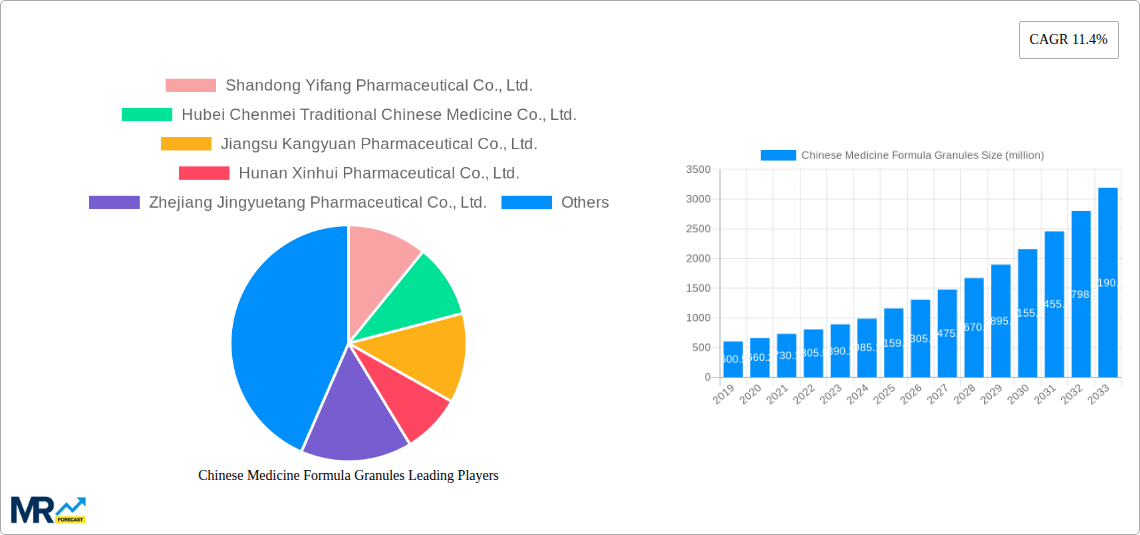

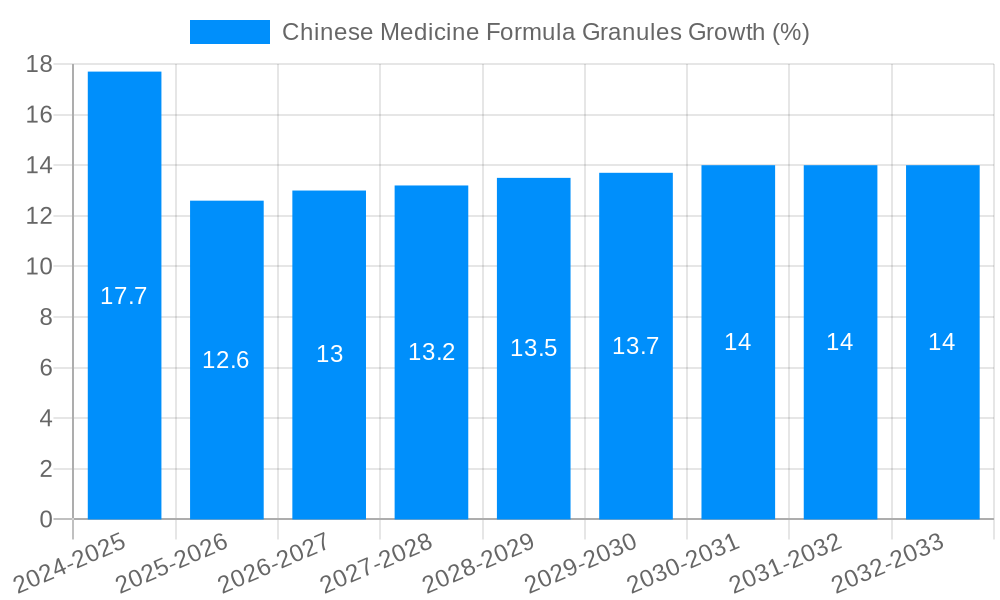

The Chinese Medicine Formula Granules market in China exhibits robust growth potential, with a market size of approximately $2.47 billion (USD) in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing consumer awareness of traditional medicine's efficacy and its role in preventative healthcare contributes significantly to the market's growth. Secondly, the convenience and ease of consumption offered by granules, compared to traditional decoction methods, appeals to a modern, time-constrained population. Thirdly, government support for the modernization and standardization of Traditional Chinese Medicine (TCM) fosters market development and enhances consumer trust. Furthermore, ongoing research and development into new formulations and applications of Chinese medicine granules are expected to contribute to market expansion in the coming years.

However, challenges remain. While the market demonstrates considerable growth, certain restraints need to be considered. These include the potential for inconsistent quality among various producers, requiring enhanced regulatory oversight and quality control measures. Moreover, price sensitivity among consumers, particularly in lower-income segments, could limit overall market penetration. The competitive landscape, with many established and emerging players, necessitates strategic differentiation and branding to capture market share. Despite these challenges, the overall trajectory indicates a strong and sustained growth trajectory for the Chinese Medicine Formula Granules market, driven by a confluence of positive factors, including increasing consumer preference, governmental support, and ongoing industry innovation. This market presents significant opportunities for both established players and new entrants with innovative products and strategies.

The Chinese medicine formula granules market is experiencing robust growth, projected to reach multi-billion unit sales by 2033. The study period of 2019-2033 reveals a consistent upward trend, driven by several key factors detailed below. The estimated market value for 2025 surpasses several billion units, demonstrating significant market penetration. This growth is not solely reliant on domestic consumption; increasing global interest in traditional Chinese medicine (TCM) and the convenience offered by granules is fueling international expansion. The forecast period (2025-2033) anticipates continued expansion, fueled by ongoing innovation in formulation, improved quality control measures, and strategic marketing initiatives targeting younger demographics who appreciate TCM's efficacy alongside its modern, convenient format. The historical period (2019-2024) serves as a solid foundation, showcasing consistent growth that sets the stage for even greater expansion in the coming years. This report analyzes the market's dynamics, highlighting both opportunities and challenges for key players. The base year for this report is 2025. Understanding these trends is crucial for investors, manufacturers, and regulatory bodies alike, as the sector positions itself for continued expansion and increasing global influence in the healthcare landscape. The market's evolution is further detailed in the following sections.

Several factors contribute to the remarkable growth trajectory of the Chinese medicine formula granules market. Firstly, the increasing acceptance and demand for TCM globally are key drivers. Consumers are seeking natural and holistic healthcare solutions, leading to a surge in the popularity of TCM treatments. Formula granules, offering a convenient and standardized dosage form, tap directly into this demand. Secondly, the ongoing modernization and standardization of TCM production processes ensure consistent quality and efficacy, thereby enhancing consumer trust and driving market expansion. Thirdly, government support and policies promoting the development and internationalization of TCM are playing a pivotal role. The Chinese government has been actively investing in research and development, infrastructure, and regulatory frameworks to elevate the status and reach of TCM. This support extends to promoting the adoption of granules as a modern and efficient delivery system for TCM formulations. Finally, continuous research and innovation are leading to the development of new and improved granules, broadening their therapeutic applications and further boosting market appeal. The convergence of these elements positions the Chinese medicine formula granules market for sustained and significant growth throughout the forecast period.

Despite the significant growth potential, the Chinese medicine formula granules market faces certain challenges. One key concern is maintaining the consistency and quality of raw materials used in granule production. Sourcing high-quality, authentic herbal ingredients is crucial for ensuring the efficacy and safety of the final product. Variations in ingredient quality can impact the consistency of the granules' therapeutic effects, hence meticulous sourcing and quality control measures are critical. Another significant challenge relates to regulatory hurdles and the standardization of production processes across different manufacturers. Harmonizing regulations across regions and establishing clear industry standards are important for ensuring product safety and consumer confidence. Furthermore, competition within the sector is intensifying, putting pressure on profit margins and requiring continuous innovation to maintain market share. Finally, effectively communicating the benefits and efficacy of TCM formula granules to a global audience requires robust marketing and educational initiatives, highlighting both scientific evidence and traditional knowledge. Addressing these challenges effectively is crucial for ensuring the sustainable growth of this promising sector.

Dominant Regions: The eastern coastal regions of China (e.g., Jiangsu, Zhejiang, Guangdong) are expected to continue dominating the market due to their established TCM infrastructure, higher per capita income, and greater consumer awareness. However, increasing penetration in less-developed regions of China and other Asian countries with a strong TCM tradition is driving the overall growth. International markets, particularly in countries with significant Asian diaspora populations or growing interest in alternative medicine, present substantial untapped potential.

Dominant Segments: Granules targeting common ailments like digestive issues, respiratory problems, and immune support are currently the most popular and contribute significantly to market volume. However, premium segments focusing on specialized formulations and specific therapeutic needs (e.g., oncology support, women's health) are showing strong growth potential. This reflects an increasing willingness to invest in more targeted and sophisticated TCM solutions. The expansion of online sales channels and direct-to-consumer marketing is also contributing to the overall market dominance of these segments.

Paragraph Expansion: The concentration of manufacturing facilities and strong distribution networks in the eastern coastal regions of China allows for efficient production and distribution of formula granules, thereby contributing to their market dominance. The appeal of formula granules lies in their convenient and standardized dosage, making them especially attractive to busy consumers. The increasing awareness and adoption of TCM in various parts of the world, coupled with the government’s promotion of TCM internationally, contribute to growing market share and significant investment in research and development of new formulations, further solidifying the dominance of this segment. The rising disposable incomes in various parts of China are also pushing the market towards higher-value, targeted formulations, further supporting the segmentation trends.

The Chinese medicine formula granules industry's growth is fueled by several converging factors: increasing consumer demand for convenient and effective TCM therapies; government initiatives to standardize and promote TCM globally; advancements in research and development, leading to improved granule formulations and expanded therapeutic applications; and the rise of e-commerce platforms facilitating broader market access. These catalysts are working in synergy to drive market expansion and solidify the position of formula granules as a key element of modern TCM.

This report provides a detailed analysis of the Chinese medicine formula granules market, encompassing historical data, current market trends, and future projections. It offers in-depth insights into key drivers, challenges, and growth opportunities. The report also profiles major players in the industry and highlights significant developments, offering a comprehensive perspective for stakeholders seeking to understand and navigate this dynamic and expanding market. It combines quantitative data with qualitative analysis, giving readers a holistic understanding of the market landscape and its future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Shandong Yifang Pharmaceutical Co., Ltd., Hubei Chenmei Traditional Chinese Medicine Co., Ltd., Jiangsu Kangyuan Pharmaceutical Co., Ltd., Hunan Xinhui Pharmaceutical Co., Ltd., Zhejiang Jingyuetang Pharmaceutical Co., Ltd., Sinopharm Tongjitang (Guizhou) Pharmaceutical Co., Ltd., Sichuan New Green Pharmaceutical Technology Development Co., Ltd., Shijiazhuang Yiling Pharmaceutical Co., Ltd., Henan Hongri Kangrentang Pharmaceutical Co., Ltd., Hubei Yizheng Pharmaceutical Co., Ltd., Tiandiheng—Pharmaceutical Co., Ltd., Liaoning SPH Good Nursing Pharmaceutical ((Group) Co., Ltd., Shineway Pharmaceutical Group Co., Ltd., China Resources Sanjiu Modern Chinese Medicine Pharmaceutical Co., Ltd., Beijing Chunfeng-Fang Pharmaceutical Co., Ltd., Inner Mongolia Pukang Pharmaceutical Co., Ltd., Guangdong Yifang Pharmaceutical Co., Ltd., Anhui Jiuzhou Fangyuan Pharmaceutical Co., Ltd., Beijing Kangrentang Pharmaceutical Co., Ltd., Jiangyin Tianjiang Pharmaceutical Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD 2467.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chinese Medicine Formula Granules," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chinese Medicine Formula Granules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.