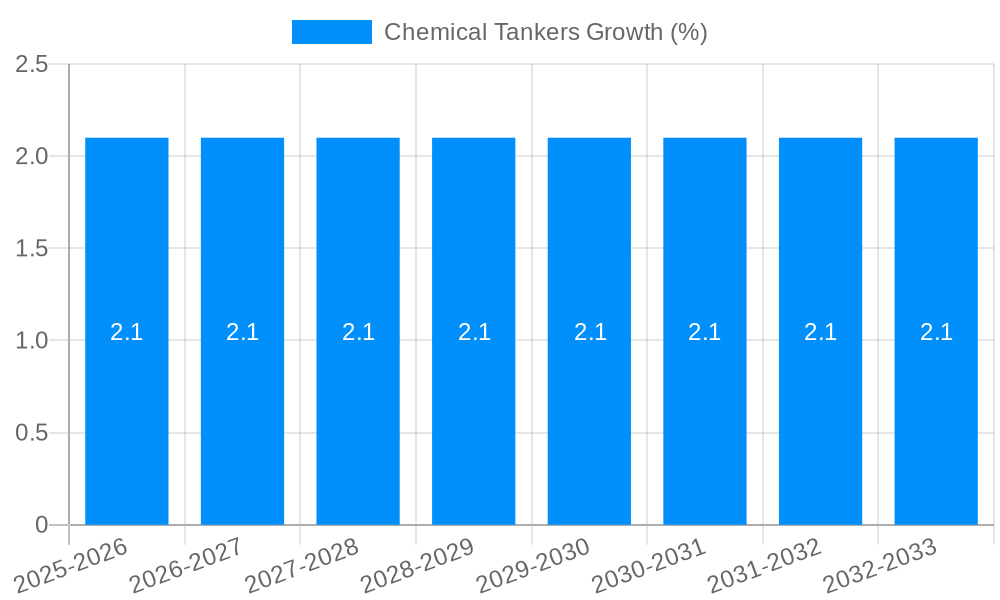

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Tankers?

The projected CAGR is approximately 2.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chemical Tankers

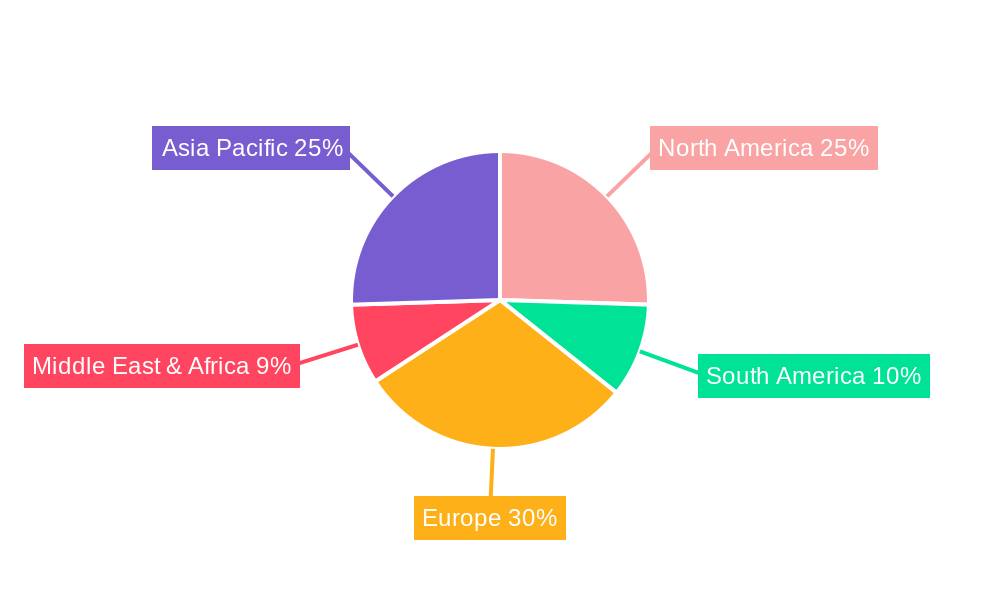

Chemical TankersChemical Tankers by Type (Inland Chemical Tankers (1, 000-4, 999 DWT), Coastal Chemical Tankers (5, 000-9, 999 DWT), Deep-Sea Chemical Tankers (10, 000-50, 000 DWT)), by Application (Organic Chemicals, Inorganic Chemicals, Vegetable Oils & Fats, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

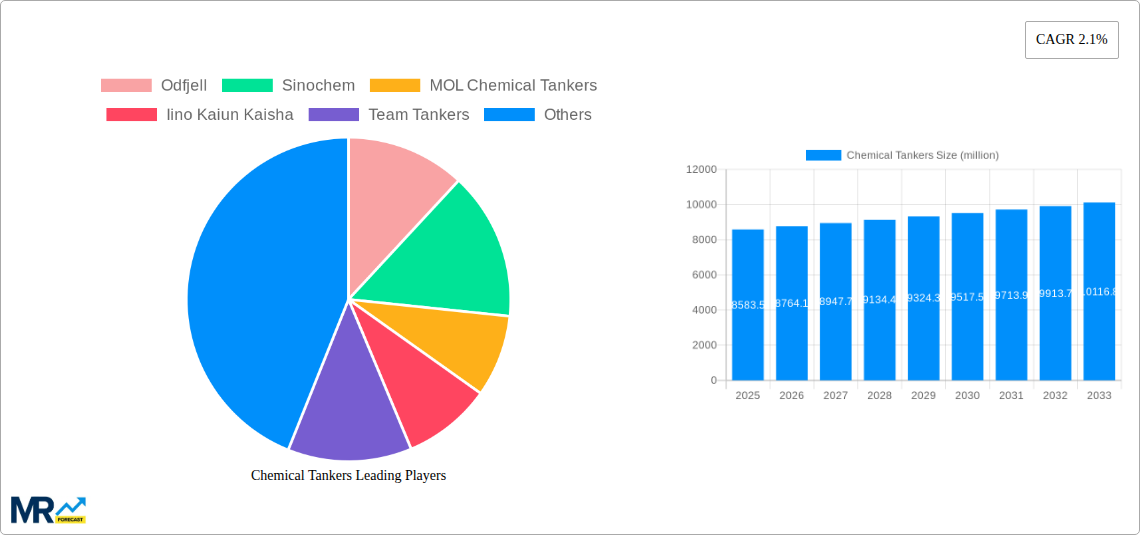

The global chemical tanker market is poised for steady expansion, projected to reach a valuation of USD 8,583.5 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.1% from 2019 to 2033. This growth is underpinned by escalating demand for various chemical products across key industries, necessitating robust and specialized shipping solutions. The market's trajectory is significantly influenced by the robust trade volumes of organic and inorganic chemicals, which form the backbone of manufacturing and industrial processes worldwide. Furthermore, the increasing consumption of vegetable oils and fats, driven by dietary shifts and industrial applications, also contributes to the sustained demand for chemical tanker services. Geographically, the Asia Pacific region, led by China and India, is expected to be a dominant force, propelled by its expanding manufacturing base and growing domestic consumption. Europe and North America, with their established chemical industries and intricate trade networks, will continue to be significant markets. The deep-sea chemical tanker segment, designed for long-haul transportation of large chemical volumes, is anticipated to witness the most substantial growth due to the globalized nature of chemical supply chains.

The chemical tanker market is characterized by a complex interplay of drivers and restraints. Key drivers include the burgeoning global petrochemical industry, advancements in chemical manufacturing technologies, and the continuous need for efficient and safe transportation of hazardous and non-hazardous chemicals. The increasing emphasis on stringent environmental regulations and safety standards is also shaping the market, encouraging investments in modern, eco-friendly fleets. However, the market faces certain restraints, such as the inherent volatility in crude oil prices, which directly impacts shipping costs and operational expenses. Geopolitical uncertainties and trade protectionism can also disrupt global chemical trade flows. The high capital expenditure required for acquiring and maintaining specialized chemical tanker fleets presents another hurdle. Nonetheless, the ongoing diversification of chemical applications, including their use in renewable energy sectors and advanced materials, is expected to create new avenues for market expansion and innovation in the coming years. The strategic importance of companies like Stolt-Nielsen, Odfjell, and Sinochem in navigating these dynamics will be crucial for market progression.

This report provides an in-depth analysis of the global chemical tanker market, offering valuable insights for stakeholders across the value chain. The study period encompasses historical data from 2019-2024 and projects market dynamics through 2033, with a base and estimated year of 2025. We utilize data in the "million unit" for comprehensive market valuation.

The global chemical tanker market is undergoing a period of dynamic evolution, characterized by shifting trade patterns, evolving regulatory landscapes, and technological advancements. The study period of 2019-2033 reveals a trajectory of growth, albeit with fluctuations influenced by global economic conditions and geopolitical events. The base year of 2025 sets a benchmark for understanding current market performance, while projections for the forecast period of 2025-2033 highlight emerging opportunities and potential challenges. Historically, the 2019-2024 period has witnessed increasing demand for specialized chemical transportation, driven by the expansion of the petrochemical industry and a growing need for efficient logistics. Key market insights indicate a sustained demand for Deep-Sea Chemical Tankers (10,000-50,000 DWT) due to their versatility in transporting a wide array of chemicals across major trade routes. The market is also seeing a rise in demand for vessels equipped with advanced cargo handling systems to manage a diverse portfolio of chemicals, including Organic Chemicals, Inorganic Chemicals, and Vegetable Oils & Fats. Environmental regulations are increasingly influencing fleet modernization, with a greater emphasis on emissions reduction and safety protocols. Companies are investing in greener technologies and fuel-efficient designs to comply with stringent international standards. Furthermore, the report identifies a growing trend towards consolidation within the industry, as larger players acquire smaller ones to enhance their market share and operational efficiency. The impact of global trade agreements and the varying economic health of key regions will continue to shape the demand for chemical tanker services. The market's resilience is tested by external shocks, but the fundamental need for chemical transportation ensures its long-term viability. The estimated year of 2025 indicates a stable growth phase, with projected increases in both vessel utilization and charter rates. The strategic importance of chemical tankers in facilitating global supply chains for essential industrial and consumer goods cannot be overstated. The report will delve into the nuances of regional demand, the impact of specific chemical applications on tanker segments, and the strategic responses of leading market participants. The interplay between supply-side dynamics, such as fleet capacity and new vessel orders, and demand-side drivers, like industrial production and consumer spending, will be thoroughly examined to provide a holistic market outlook. The ongoing digital transformation within the shipping industry, including advancements in vessel monitoring and route optimization, is also a significant trend shaping operational efficiencies and cost-effectiveness.

The chemical tanker market is propelled by a confluence of robust economic and industrial factors. The relentless growth of the global petrochemical industry, fueled by increasing demand for plastics, synthetic fibers, and other downstream products, forms a primary driving force. As chemical production scales up in emerging economies, so does the need for reliable and specialized transportation to distribute these essential materials across continents. Furthermore, the expanding applications of chemicals in various sectors, including agriculture (fertilizers), pharmaceuticals, and consumer goods, create a consistent and growing demand for chemical tanker services. The Organic Chemicals segment, in particular, benefits from the expansion of manufacturing activities and the increasing global trade of intermediate and finished chemical products. The Vegetable Oils & Fats segment also contributes significantly, driven by the burgeoning food and oleochemical industries worldwide. This sustained demand translates into higher utilization rates for chemical tankers, encouraging investment in new vessels and fleet expansion. The development of new industrial complexes and chemical manufacturing hubs, particularly in Asia and the Middle East, is creating new trade lanes and increasing the overall volume of chemical cargo requiring transportation. Moreover, the ongoing trend of manufacturing globalization means that the production of many chemicals is concentrated in specific regions, necessitating long-haul transportation services offered by deep-sea chemical tankers. This geographic concentration of production and consumption centers is a key determinant of trade volumes and, consequently, the demand for chemical tanker capacity. The increasing sophistication of chemical products also necessitates specialized handling and containment, driving the demand for tankers with advanced features and compliance certifications, thereby supporting the growth of dedicated chemical tanker operators.

Despite the promising growth trajectory, the chemical tanker market faces several significant challenges and restraints that can temper its expansion. A primary concern revolves around the increasingly stringent environmental regulations being implemented globally. The International Maritime Organization (IMO) and regional bodies are continuously introducing stricter rules regarding emissions (e.g., sulfur oxide, nitrogen oxide, greenhouse gases) and ballast water management. Compliance with these regulations often necessitates substantial investment in new technologies, retrofitting existing vessels, and potentially higher operational costs, which can impact profitability. The inherent volatility of global trade and geopolitical instability can also pose significant challenges. Trade wars, sanctions, and conflicts can disrupt supply chains, leading to fluctuating demand for chemical transportation and impacting freight rates. The high capital expenditure required for building and maintaining specialized chemical tankers is another significant restraint. The cost of new vessels, coupled with the specialized materials and complex cargo systems needed, represents a substantial financial commitment for shipping companies. Furthermore, oversupply in the market, if new vessel orders outpace demand growth, can lead to downward pressure on freight rates and reduced profitability for operators. The price volatility of bunker fuel, the primary operational cost for shipping, directly impacts the profitability of chemical tanker operations. Fluctuations in oil prices can create uncertainty and make financial planning more challenging. Lastly, labor shortages and the need for highly skilled crew to operate these sophisticated vessels can be a persistent challenge, impacting operational efficiency and safety. The complexity of handling various hazardous chemicals requires specialized training and experience, making recruitment and retention of qualified personnel crucial.

The global chemical tanker market's dominance is not confined to a single region or segment but is characterized by the synergistic interplay of several key geographical hubs and specialized tanker types, with a notable ascendancy of Deep-Sea Chemical Tankers (10,000-50,000 DWT) and a strong performance in the Organic Chemicals segment.

Dominant Regions:

Dominant Segments:

The synergy between these dominant regions and segments creates a robust market. For instance, the petrochemical production in the Middle East necessitates the use of Deep-Sea Chemical Tankers to transport Organic Chemicals and Inorganic Chemicals to the vast consumer markets in Asia-Pacific and Europe. The continuous growth of manufacturing industries in Asia further fuels the demand for both these segments. The report's analysis indicates that the growth in these key areas will continue to shape the market's trajectory, with investments and operational strategies heavily influenced by their dynamics.

The chemical tanker industry is poised for growth driven by several key catalysts. The escalating global demand for petrochemicals, spurred by expanding downstream industries like plastics, automotive, and construction, is a fundamental growth engine. Furthermore, the increasing production and trade of specialty chemicals, driven by innovation in pharmaceuticals, electronics, and advanced materials, create opportunities for higher-value transportation services. The ongoing shift in manufacturing bases towards emerging economies, particularly in Asia, is creating new trade lanes and increasing the volume of chemicals requiring intercontinental transport. This geographical realignment necessitates robust deep-sea chemical tanker capacity. Additionally, the increasing focus on sustainable practices and the development of bio-based chemicals are opening up new cargo types and markets for specialized tankers.

This comprehensive report offers an all-encompassing analysis of the chemical tanker market, meticulously detailing trends, driving forces, challenges, and future opportunities. It provides a granular breakdown of market segmentation by vessel type (Inland, Coastal, Deep-Sea) and chemical application (Organic Chemicals, Inorganic Chemicals, Vegetable Oils & Fats, Other). The report leverages historical data from 2019-2024 and forecasts market dynamics through 2033, with a base and estimated year of 2025, utilizing valuations in the "million unit." Key industry developments and the strategic insights of leading global players are also thoroughly examined, offering stakeholders a strategic roadmap for navigating this complex and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.1%.

Key companies in the market include Odfjell, Sinochem, MOL Chemical Tankers, Iino Kaiun Kaisha, Team Tankers, MTMM, Ultratank, Bahri, Hansa Tankers, Chembulk, WOMAR, Navig8, Ace-Quantum, Koyo Kaiun, Stolt-Nielsen, .

The market segments include Type, Application.

The market size is estimated to be USD 8583.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chemical Tankers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chemical Tankers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.