1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Detection Technology?

The projected CAGR is approximately 7.87%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chemical Detection Technology

Chemical Detection TechnologyChemical Detection Technology by Type (Portable Equipment, Non-Portable Equipment), by Application (Defense, Civil, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

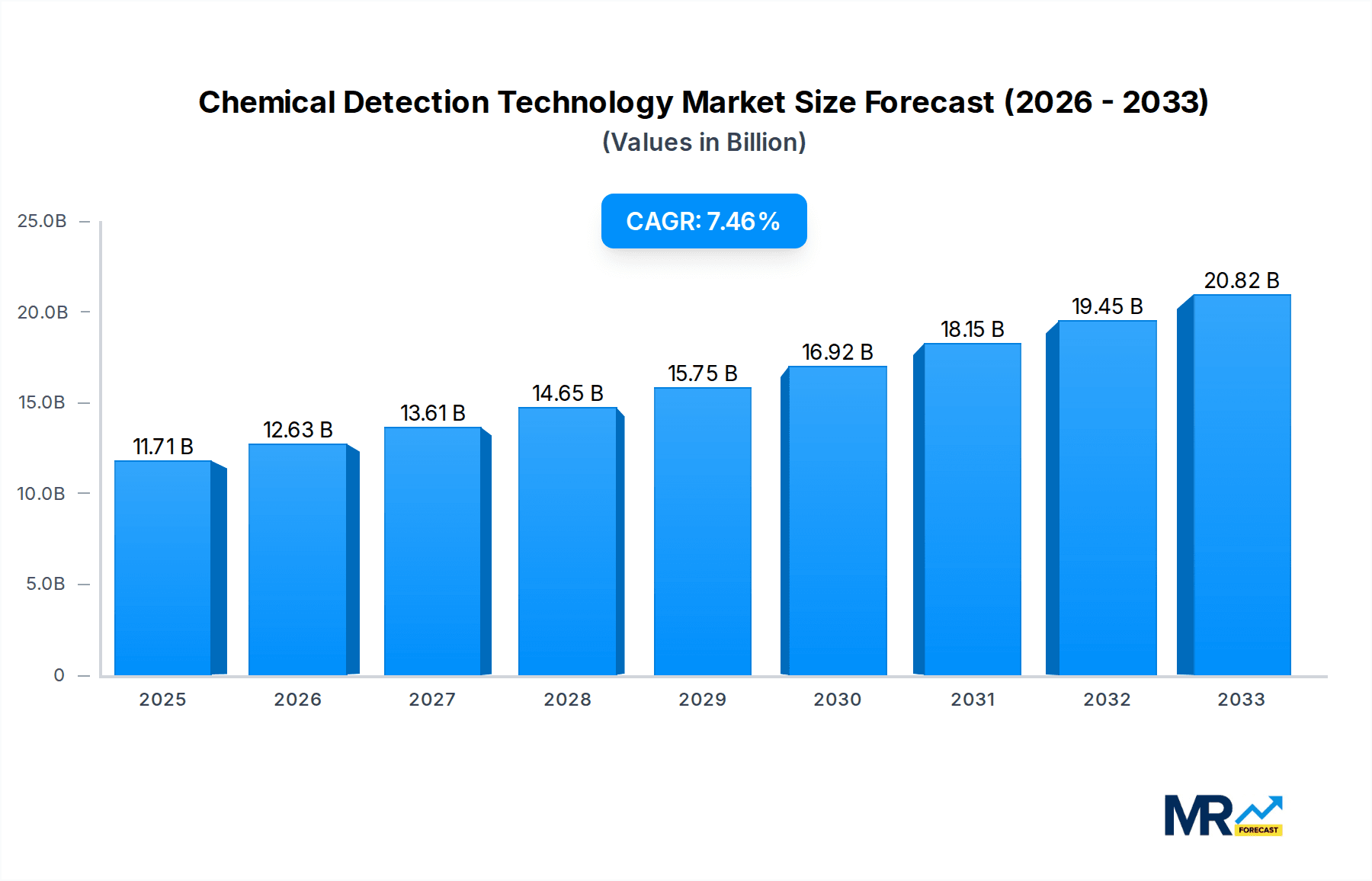

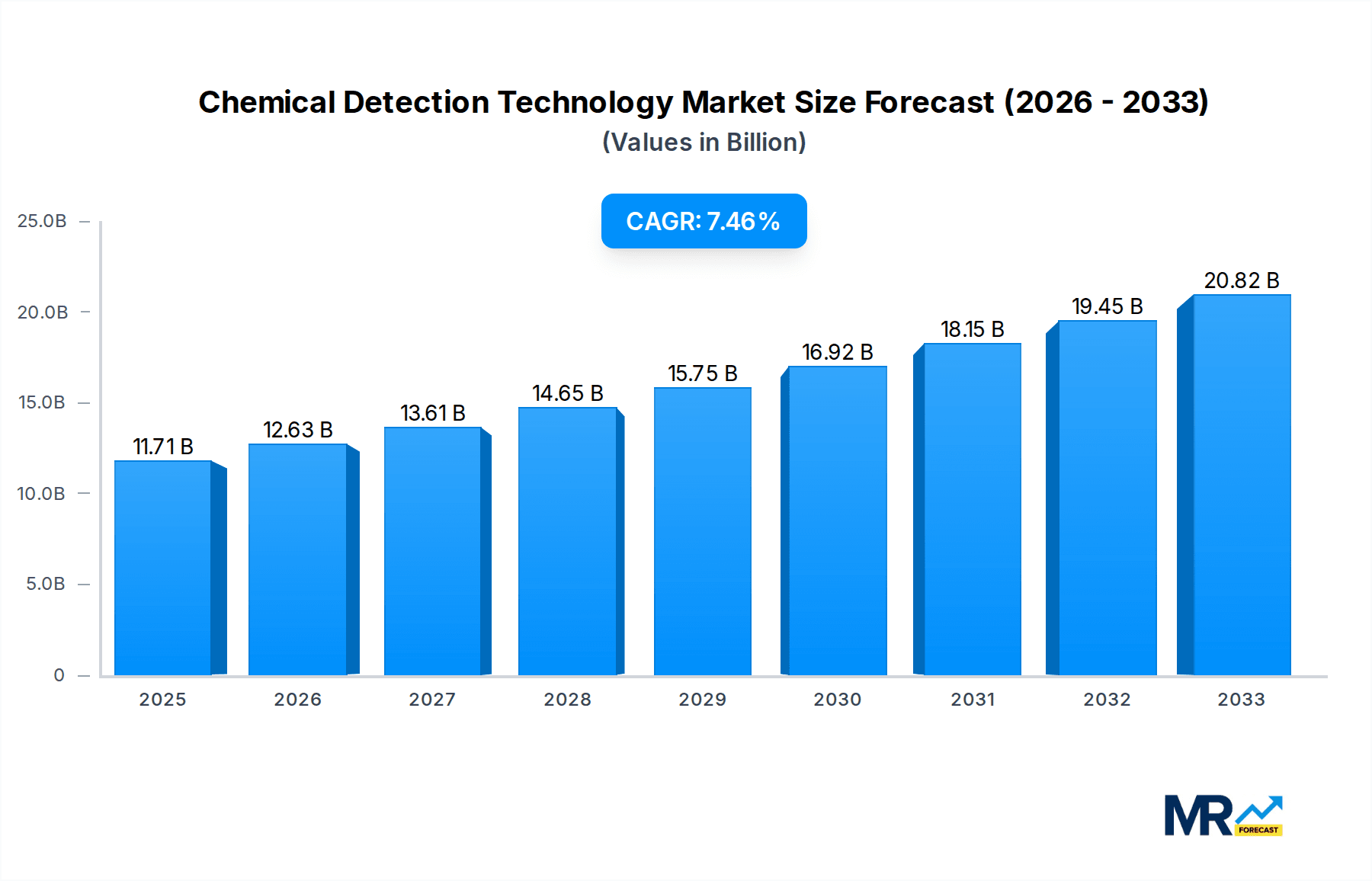

The global Chemical Detection Technology market is poised for substantial growth, projected to reach USD 11.71 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.87% through 2033. This robust expansion is primarily fueled by the escalating need for advanced security solutions across defense and civil applications, driven by increasing global security concerns and the imperative to detect and neutralize chemical threats. The commercial sector is also a significant contributor, with growing demand for workplace safety and environmental monitoring technologies. Key drivers include the rising incidence of chemical warfare threats, the growing emphasis on public safety, and stringent regulatory frameworks mandating the deployment of sophisticated detection systems. Furthermore, advancements in sensor technology, miniaturization, and the integration of artificial intelligence and machine learning are enhancing the capabilities and adoption of these technologies.

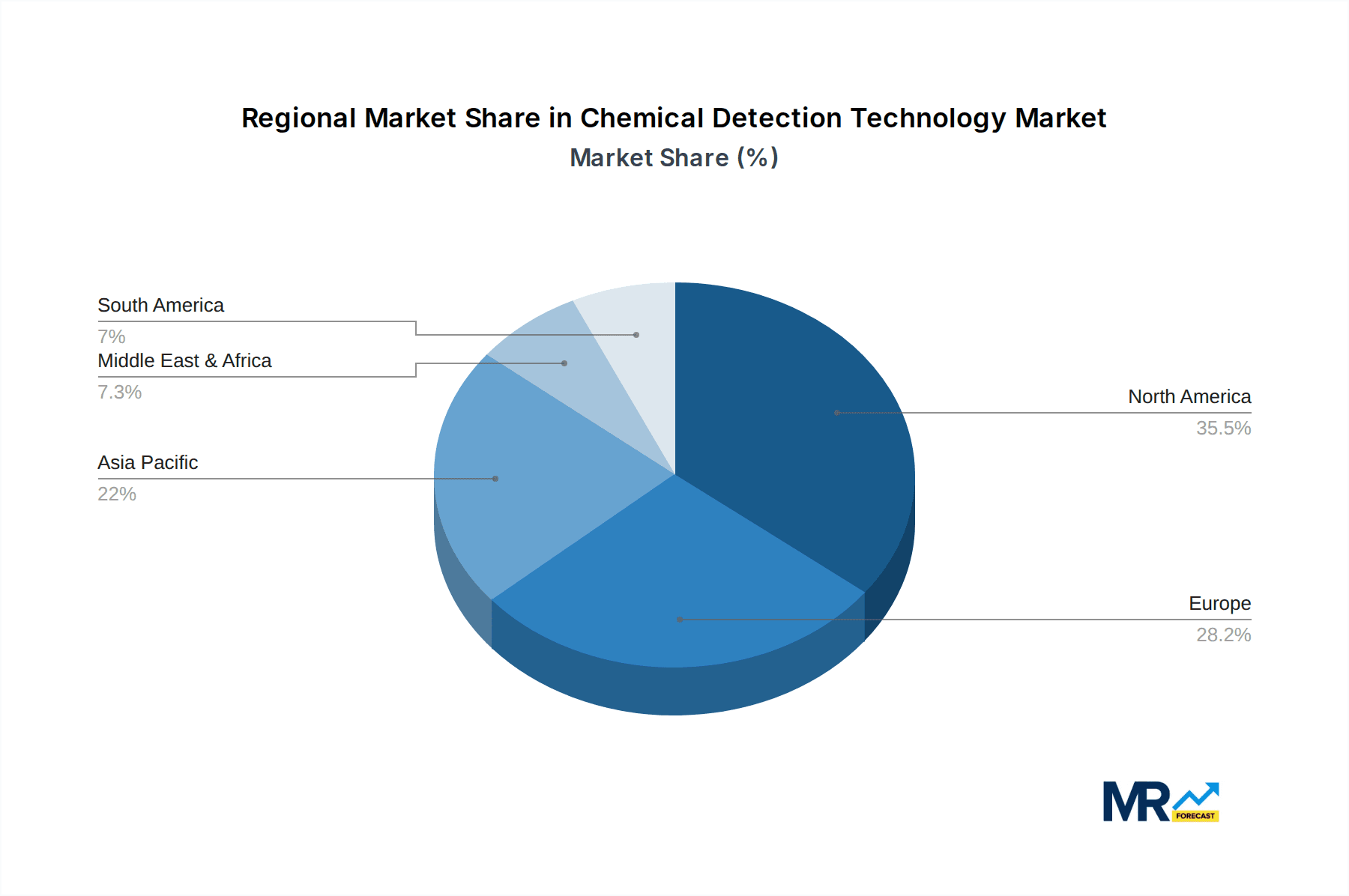

The market landscape is characterized by distinct segments, with portable equipment holding a significant share due to its agility and widespread applicability in field operations and emergency response. Non-portable equipment, on the other hand, is crucial for fixed installations in critical infrastructure and research facilities. Geographically, North America is expected to lead the market owing to substantial investments in defense and homeland security, followed closely by Europe and the Asia Pacific region, which is witnessing rapid industrialization and a concurrent rise in safety consciousness. Emerging markets in the Middle East & Africa and South America also present considerable growth opportunities as awareness and adoption of chemical detection technologies increase. Leading players like Bruker Detection and ChemImage are at the forefront, investing in research and development to introduce innovative solutions that address evolving threat landscapes and stringent operational requirements.

Here's a unique report description on Chemical Detection Technology, incorporating the provided details:

The global chemical detection technology market is poised for substantial expansion, projected to reach an impressive $15.5 billion by 2033, showcasing a compound annual growth rate (CAGR) of 9.8% during the forecast period. This growth is underpinned by a convergence of escalating security concerns, increasing industrial safety mandates, and relentless technological advancements. The study period, spanning 2019-2033, with a base and estimated year of 2025, provides a comprehensive lens through which to analyze historical performance and future trajectories. During the historical period (2019-2024), the market witnessed steady progress driven by early adoption in defense sectors and burgeoning awareness in industrial applications. However, the forecast period (2025-2033) is expected to witness an acceleration in market penetration across a wider array of civil and commercial applications. The increasing sophistication of chemical threats, ranging from traditional warfare agents to novel industrial chemical leaks, necessitates more sensitive, rapid, and adaptable detection solutions. This has spurred innovation, leading to the development of technologies that offer not only enhanced accuracy but also greater portability and ease of use. Furthermore, stringent regulatory frameworks aimed at enhancing workplace safety and public health are compelling industries to invest in advanced chemical detection systems. The integration of artificial intelligence (AI) and machine learning (ML) into these systems is further revolutionizing their capabilities, enabling real-time data analysis, predictive maintenance, and automated threat identification. The shift towards miniaturized sensors and networked detection grids is also a prominent trend, allowing for wider coverage and more efficient monitoring. The market is characterized by a dynamic interplay between defense-driven innovation and a growing demand from commercial and industrial sectors for improved safety and compliance.

Several potent forces are propelling the significant growth within the chemical detection technology market. Foremost among these is the escalating global security landscape, marked by an increased threat of chemical warfare agents, terrorist attacks involving hazardous materials, and the proliferation of illicit substances. This heightened awareness necessitates robust and immediate detection capabilities, particularly within defense and homeland security agencies. Concurrently, stringent government regulations and international standards governing industrial safety and environmental protection are compelling businesses to adopt advanced chemical detection solutions. Industries such as pharmaceuticals, oil and gas, manufacturing, and agriculture are increasingly investing in these technologies to ensure worker safety, prevent accidental releases, and comply with evolving compliance mandates. The rapid advancements in sensor technology, including the miniaturization of components, improvements in sensitivity and selectivity, and the development of novel detection principles, are also key drivers. Furthermore, the growing integration of these technologies with communication networks and data analytics platforms is enabling faster threat assessment and response, making them indispensable tools for emergency services and first responders. The continuous pursuit of improved operational efficiency and cost-effectiveness also plays a role, as more advanced systems can reduce manual labor and minimize the impact of chemical incidents.

Despite the robust growth trajectory, the chemical detection technology market faces several significant challenges and restraints that can impede its full potential. A primary hurdle remains the substantial cost associated with acquiring and maintaining highly sophisticated detection systems, especially for smaller enterprises or organizations with limited budgets. This cost factor can hinder widespread adoption, particularly in emerging economies or less regulated sectors. Furthermore, the complexity of some advanced technologies can necessitate specialized training for operators and maintenance personnel, adding to the overall operational expenses and creating a barrier to entry for less technically inclined users. The development of false positives or false negatives, while decreasing with technological advancements, can still erode user confidence and lead to unnecessary alarm or delayed responses. Ensuring the reliability and accuracy of these devices across a wide range of environmental conditions, including extreme temperatures, humidity, and the presence of interfering substances, remains an ongoing technical challenge. Standardization and interoperability issues between different detection systems from various manufacturers can also limit seamless integration and data sharing, particularly in large-scale deployment scenarios. Finally, the rapid pace of technological evolution means that existing systems can quickly become obsolete, requiring continuous investment in upgrades and replacements, which can be a deterrent for some organizations.

The Defense segment is anticipated to be a dominant force in the chemical detection technology market, driven by a persistent global security agenda and ongoing geopolitical tensions. Nations worldwide are prioritizing the development and deployment of advanced chemical detection capabilities to safeguard their forces and civilian populations from the ever-evolving threat of chemical warfare agents and acts of terrorism. This segment's dominance stems from substantial government investment in research and development, procurement of sophisticated equipment, and the necessity for rapid and reliable threat identification in volatile environments. The demand for advanced detection solutions within the defense sector is consistently high, encompassing a wide array of applications from battlefield reconnaissance and border security to the protection of critical infrastructure and strategic assets.

Within this dominant Defense segment, Portable Equipment will play a crucial role. The nature of military operations often necessitates mobility and immediate deployment in potentially hazardous environments. Portable chemical detectors, such as handheld sniffers, wearable sensors, and drone-mounted detection systems, provide soldiers and first responders with the ability to quickly assess threats in real-time, gather intelligence, and make informed decisions in the field. The market for these portable solutions is expected to grow significantly as they offer enhanced situational awareness and enable proactive defense strategies.

In terms of geographical regions, North America is projected to lead the chemical detection technology market. This leadership is attributed to several factors, including:

Furthermore, the Civil and Commercial segments are also expected to experience considerable growth, albeit with a slightly different set of drivers. The increasing focus on workplace safety across industries like pharmaceuticals, oil and gas, and manufacturing, coupled with the need for environmental monitoring and public health protection, will drive demand for non-portable and specialized detection equipment in these sectors.

Several key growth catalysts are poised to accelerate the chemical detection technology industry. The escalating global threat landscape, encompassing both state-sponsored chemical warfare and non-state actor terrorism, is a primary driver, pushing for enhanced defense and security capabilities. Simultaneously, an increasing emphasis on industrial safety and stringent regulatory compliance across sectors like manufacturing, oil and gas, and pharmaceuticals is compelling businesses to invest in advanced detection systems. Technological innovation, particularly in the realm of miniaturization, increased sensitivity and selectivity of sensors, and the integration of AI for real-time data analysis, is creating more effective and user-friendly solutions. The growing awareness of environmental monitoring needs and public health concerns also contributes significantly to market expansion.

This comprehensive report delves into the intricate landscape of chemical detection technology, offering invaluable insights for stakeholders across various sectors. It meticulously analyzes market dynamics, projecting a substantial valuation of $15.5 billion by 2033, driven by robust CAGR of 9.8% during the forecast period (2025-2033). The report provides an in-depth examination of key market trends, including the growing demand for portable equipment and the dominance of the defense application segment, alongside emerging opportunities in civil and commercial spheres. It dissects the driving forces, such as escalating security concerns and stringent regulatory mandates, while also addressing critical challenges like high costs and technological complexities. The report highlights the leading players and significant developmental milestones, offering a forward-looking perspective on the industry's evolution. This detailed analysis empowers businesses and governments to make informed strategic decisions, identify investment opportunities, and navigate the evolving threat landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.87% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.87%.

Key companies in the market include S.E.International, S2 Threat Detection Technologies, Romtech, ChemImage, Bruker Detection, Implant Sciences, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Chemical Detection Technology," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chemical Detection Technology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.