1. What is the projected Compound Annual Growth Rate (CAGR) of the CFW Pipe Winding Machine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CFW Pipe Winding Machine

CFW Pipe Winding MachineCFW Pipe Winding Machine by Type (Below DN800, DN800 -1600, DN1600 -2200, Above DN2200, World CFW Pipe Winding Machine Production ), by Application (Potable Water Transport, Sewerage Collection, Irrigation Water Transport, Industrial Liquid Material Transport, Petrochemical Transport, Others, World CFW Pipe Winding Machine Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

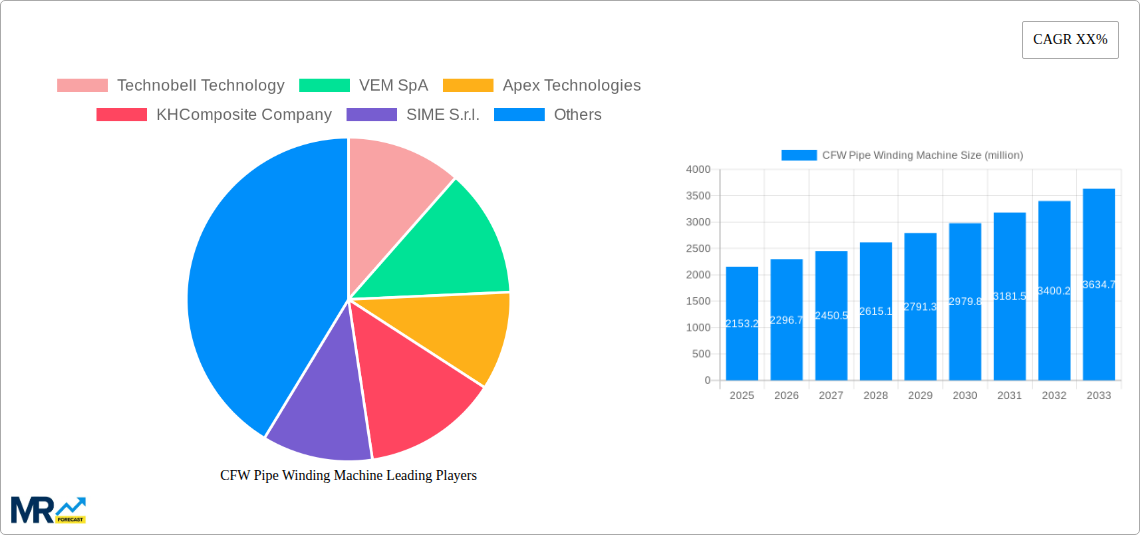

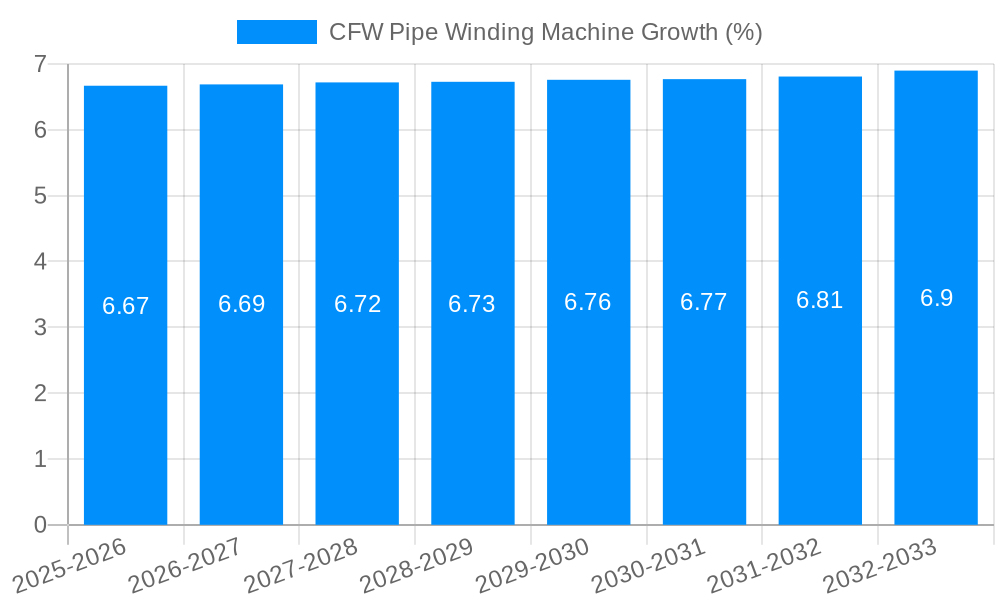

The global Composite Filament Winding (CFW) Pipe Winding Machine market is poised for significant expansion, projected to reach a substantial market size of USD 2153.2 million. This growth is underpinned by an estimated Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. A key driver fueling this expansion is the escalating demand for advanced piping solutions in crucial sectors such as potable water transport and sewerage collection. The increasing need for corrosion-resistant, durable, and lightweight pipes in infrastructure development, particularly in rapidly urbanizing regions, directly translates to a higher demand for the sophisticated winding machines required for their production. Furthermore, the growing adoption of CFW pipes in industrial liquid material transport, including chemical and petrochemical applications, where material integrity and safety are paramount, is another significant growth catalyst. The inherent advantages of CFW pipes, such as their high strength-to-weight ratio and resistance to aggressive environments, make them an increasingly attractive alternative to traditional materials like steel and concrete, thus propelling the market for the machinery that manufactures them.

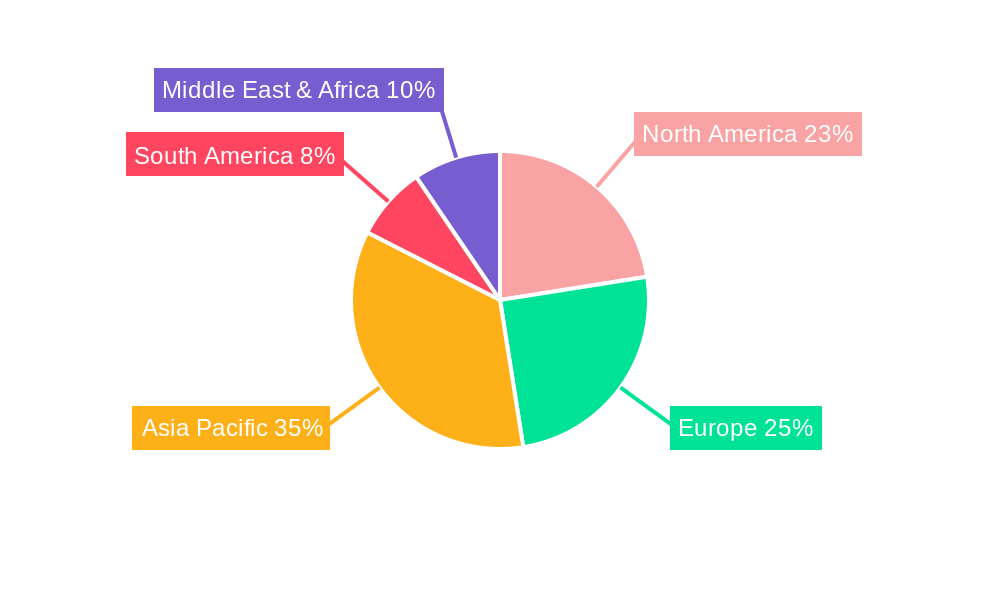

The market segmentation by pipe diameter reveals a robust demand across various sizes, with the "Below DN800" and "DN800-1600" segments likely to dominate due to their widespread application in municipal and industrial projects. The "Above DN2200" segment, while more niche, represents a high-value area driven by large-scale projects like offshore oil and gas pipelines and advanced water management systems. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market for CFW pipe winding machines. This surge is attributed to massive infrastructure investments, ongoing urbanization, and a strong manufacturing base. North America and Europe, with their established industrial infrastructure and focus on upgrading aging water and wastewater systems, will also contribute significantly to market growth. Restraints in the market could include the initial capital investment required for these advanced machines and the availability of skilled labor for their operation and maintenance, though these are being mitigated by technological advancements and training programs.

This comprehensive report delves into the dynamic global market for CFW (Centrifugally Filament Wound) Pipe Winding Machines, offering an in-depth analysis of trends, drivers, challenges, and future growth prospects. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a detailed forecast extending to 2033, this study provides invaluable insights for stakeholders. The market valuation is presented in millions of USD.

The global CFW Pipe Winding Machine market is exhibiting a pronounced upward trajectory, driven by an increasing demand for corrosion-resistant and high-performance piping solutions across various industrial and municipal applications. The market's growth is underpinned by a confluence of factors, including the ever-expanding need for efficient water management infrastructure, robust industrial liquid transportation systems, and the escalating adoption of advanced manufacturing technologies. Notably, advancements in winding technology, such as the integration of sophisticated automation and precision control systems, are enabling manufacturers to produce CFW pipes with enhanced structural integrity and tailored specifications, thereby broadening their applicability. The market is witnessing a significant shift towards machines capable of producing larger diameter pipes, a trend directly linked to the increasing scale of infrastructure projects globally. Furthermore, the growing awareness of environmental sustainability and the long service life of CFW pipes, which reduce the need for frequent replacements and minimize leakage, are contributing to their increased adoption over traditional materials like steel and concrete. The base year of 2025 is expected to see a market valuation of XXX million USD, with projections indicating a substantial CAGR during the forecast period of 2025-2033. Key market insights reveal a growing emphasis on machines that offer higher production speeds and energy efficiency, reflecting the industry's focus on cost optimization and competitive advantage. The evolving regulatory landscape, particularly concerning water quality and environmental protection, is also indirectly fueling the demand for reliable and durable piping systems that CFW technology readily provides. The integration of smart manufacturing principles and Industry 4.0 technologies within pipe winding machines is also a burgeoning trend, promising greater process control, predictive maintenance, and optimized resource utilization, further solidifying the market's robust growth potential. The continued innovation in composite materials and resin formulations will also necessitate advancements in winding machinery to effectively utilize these new materials, creating a symbiotic growth dynamic. The market is also observing a trend towards customization, with manufacturers seeking winding machines that can adapt to diverse project requirements and material compositions.

The global CFW Pipe Winding Machine market is being propelled by a powerful combination of infrastructure development, industrial expansion, and a growing preference for durable and sustainable piping solutions. The imperative to upgrade and expand aging water and wastewater infrastructure across numerous countries presents a significant opportunity for CFW pipes, and consequently, for the machines that produce them. Governments worldwide are investing heavily in projects aimed at improving potable water supply and sewage collection systems, where the corrosion resistance and longevity of CFW pipes are highly valued. Furthermore, the expansion of industrial sectors, particularly in emerging economies, necessitates robust and reliable transportation systems for a wide array of liquids, including chemicals, petrochemicals, and process water. CFW pipes, with their inherent strength and chemical resistance, are becoming the material of choice for these demanding applications. The increasing global population and urbanization trends are also contributing to the demand for enhanced water and wastewater management, directly translating into a greater need for CFW pipe production capacity. The environmental advantages of CFW pipes, such as their long lifespan, reduced leakage rates, and lower carbon footprint compared to some traditional materials, are also increasingly recognized and incentivized, further driving market growth. The development of more efficient and cost-effective manufacturing processes for CFW pipes, facilitated by advanced winding machines, is also making them more competitive and accessible across a wider range of applications. The proactive approach by industries to mitigate risks associated with corrosive environments further amplifies the demand for CFW pipes, thus boosting the CFW Pipe Winding Machine market.

Despite the robust growth potential, the CFW Pipe Winding Machine market faces certain challenges and restraints that could impede its full realization. One of the primary concerns is the initial capital investment required for advanced CFW pipe winding machines, which can be substantial, particularly for smaller manufacturers or those in developing regions. This high upfront cost can limit market penetration and adoption rates. Secondly, the availability of skilled labor to operate and maintain these sophisticated machines is crucial. A shortage of trained technicians and engineers can lead to production inefficiencies and increased downtime, thereby affecting profitability. Furthermore, the fluctuations in raw material prices, particularly for fiberglass, resins, and other composite components, can impact the overall cost of CFW pipe production and, consequently, the demand for winding machines. Supply chain disruptions, as experienced in recent years, can exacerbate these price volatilities. The competition from established materials like steel, concrete, and PVC pipes, which often have lower initial costs or are deeply entrenched in certain applications, remains a significant restraint. While CFW pipes offer superior performance in many areas, overcoming the inertia and established practices associated with traditional materials requires significant market education and demonstration of long-term value. The perceived complexity of CFW pipe manufacturing and the need for specialized knowledge can also deter potential adopters. Finally, the development and standardization of new composite materials and manufacturing processes can create uncertainty and necessitate further investment in research and development for machine manufacturers to keep pace with evolving industry standards.

The global CFW Pipe Winding Machine market is poised for significant growth, with certain regions and segments demonstrating exceptional dominance and acting as key drivers. Among the segments, the DN800 - 1600 and DN1600 - 2200 categories within the Type segmentation are expected to witness substantial expansion. This is directly attributable to the escalating demand for medium to large diameter pipes for critical infrastructure projects, particularly in the Potable Water Transport and Sewerage Collection applications. As urbanization continues its relentless pace, especially in Asia Pacific and emerging economies, the need to transport vast quantities of water efficiently and safely, as well as manage wastewater from growing populations, becomes paramount. These diameter ranges are ideal for municipal water distribution networks, inter-city water mains, and large-scale sewage interceptors. Companies like Hubei Apex Technology and Hengshui Fangchen FRP Equipment Technology are well-positioned to capitalize on this trend with their advanced winding machines designed for these specific pipe sizes.

Geographically, Asia Pacific is emerging as a dominant region, fueled by massive infrastructure investments, rapid industrialization, and a burgeoning population. Countries like China and India are leading the charge with ambitious projects aimed at modernizing their water and wastewater systems, developing new industrial zones, and expanding irrigation networks. The significant investments in petrochemical and industrial sectors in this region also contribute to a robust demand for CFW pipes for transporting a variety of corrosive liquids. The World CFW Pipe Winding Machine Production figures are heavily influenced by the manufacturing capabilities and export potential within this region, with manufacturers increasingly focusing on optimizing their production lines to meet the surging demand.

The Potable Water Transport application segment is another significant dominator. The global imperative to provide clean and safe drinking water to all populations necessitates extensive and reliable piping networks. CFW pipes, with their inherent resistance to corrosion, biofouling, and chemical degradation, offer a superior solution for maintaining water quality over long periods. This directly translates into a sustained demand for the winding machines capable of producing these pipes. Regions like North America and Europe, while more mature, continue to drive demand through upgrades of existing infrastructure and the adoption of advanced materials for new projects. The DN1600 - 2200 segment, in particular, is crucial for these regions as they undertake large-scale rehabilitation and expansion projects for their water conveyance systems. The World CFW Pipe Winding Machine Production statistics will therefore reflect a strong emphasis on machines catering to these diameters and applications.

Furthermore, the Industrial Liquid Material Transport segment is experiencing robust growth, driven by the expansion of chemical, petrochemical, and manufacturing industries. These industries often require pipes capable of handling aggressive chemicals and high temperatures, where CFW pipes excel. Countries with significant industrial bases, such as those in North America, Europe, and increasingly in Asia, are key markets for these types of winding machines. The machines capable of producing pipes for this segment need to be highly adaptable and capable of handling a wider range of resin systems and fiber reinforcements.

In summary, the market's dominance is characterized by:

The CFW Pipe Winding Machine industry is poised for significant growth, propelled by several key catalysts. The ever-increasing global demand for reliable and sustainable water infrastructure, driven by population growth and urbanization, is a primary driver. Investments in modernizing aging water and wastewater systems, particularly in emerging economies, directly translate into a higher need for CFW pipes and, consequently, the winding machines that produce them. Furthermore, the expanding industrial sector's requirement for corrosion-resistant and high-strength piping for transporting various liquids, from chemicals to petrochemicals, acts as another major catalyst. The growing emphasis on environmental regulations and the long-term cost-effectiveness of CFW pipes over traditional materials also contribute to their increasing adoption.

The global CFW Pipe Winding Machine market is characterized by the presence of several established and emerging players who are driving innovation and market growth. These companies offer a diverse range of winding machines catering to various pipe diameters and application needs.

The CFW Pipe Winding Machine sector has witnessed several significant developments that have shaped its growth and technological advancements. These developments reflect an ongoing commitment to improving efficiency, precision, and versatility in pipe manufacturing.

This report provides a comprehensive overview of the global CFW Pipe Winding Machine market, offering unparalleled insights into its current landscape and future trajectory. It meticulously analyzes market segmentation by type and application, examining the growth dynamics within each category. The report details historical trends from 2019 to 2024, presents a detailed forecast from 2025 to 2033, and uses 2025 as the base and estimated year. It identifies key drivers, restraints, and growth catalysts that are shaping the industry. Furthermore, it profiles leading companies and highlights significant technological developments. This in-depth analysis is crucial for stakeholders seeking to understand market opportunities, competitive strategies, and the evolving technological frontiers within the CFW Pipe Winding Machine sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Technobell Technology, VEM SpA, Apex Technologies, KHComposite Company, SIME S.r.l., TOPFIBRA, Hubei Apex Technology, Vidatech Composite Materials, Hengshui Fangchen FRP Equipment Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 2153.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "CFW Pipe Winding Machine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CFW Pipe Winding Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.