1. What is the projected Compound Annual Growth Rate (CAGR) of the Carpooling?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carpooling

CarpoolingCarpooling by Type (/> Online Carpooling Platforms, App-based Carpooling), by Application (/> For Business, For Individuals, For Schools, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

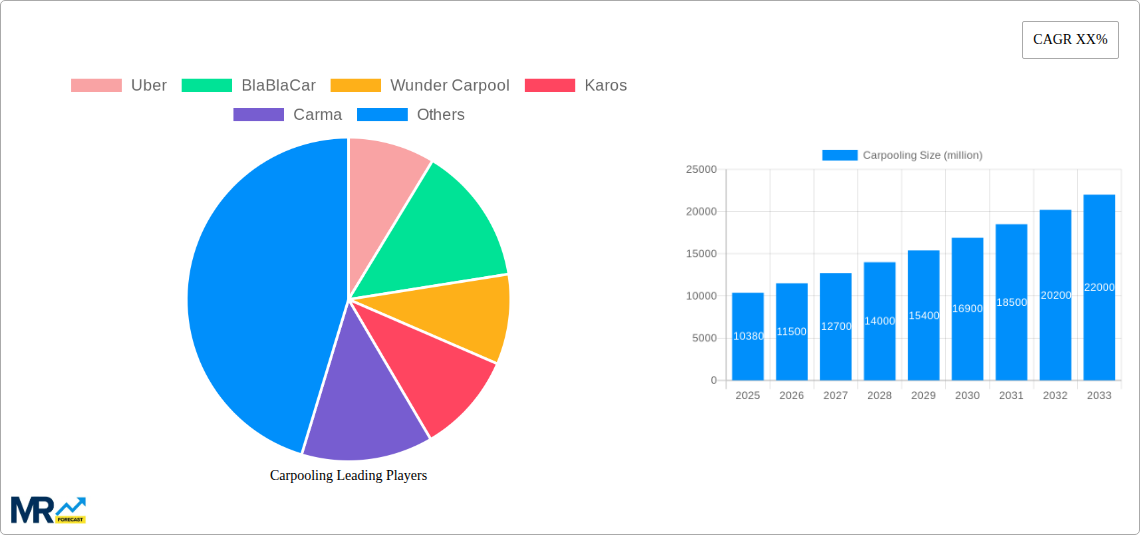

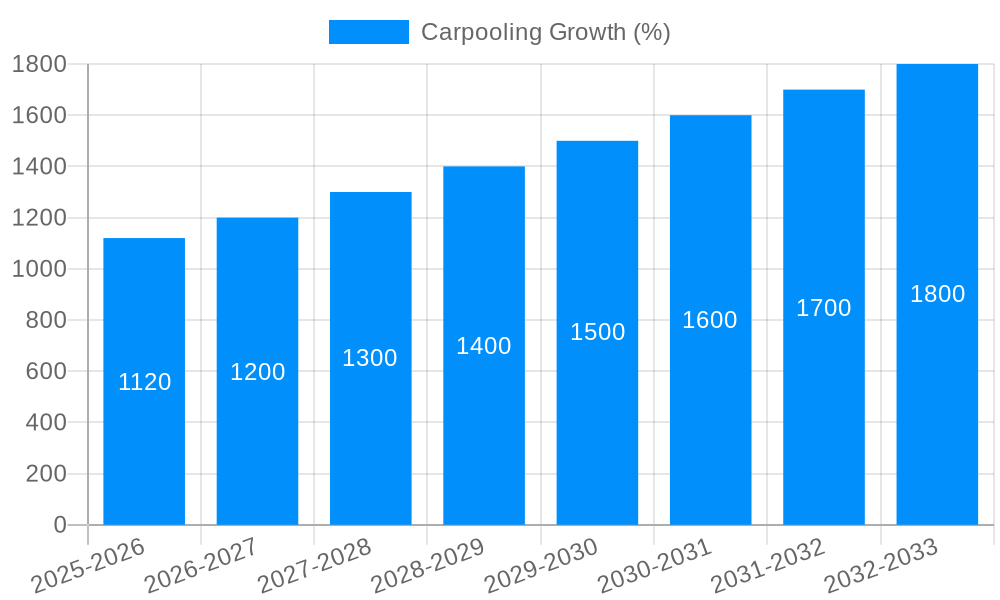

The carpooling market, valued at $10.38 billion in 2025, is experiencing significant growth driven by increasing fuel prices, growing environmental concerns, and the rising adoption of ride-sharing apps. The convenience and cost-effectiveness of carpooling are attracting a wider range of users, from daily commuters to occasional travelers. Technological advancements, such as improved ride-matching algorithms and integrated payment systems within apps like Uber, Lyft, BlaBlaCar, and others, are further fueling market expansion. While regulatory hurdles and safety concerns remain challenges, the industry's continuous innovation and strategic partnerships (e.g., integration with navigation apps like Waze) are mitigating these risks. The market is segmented geographically, with North America and Europe currently dominating, but significant growth potential exists in developing economies with expanding urban populations and increasing smartphone penetration. Competition among established players and new entrants is intense, leading to continuous improvements in service offerings and pricing strategies to attract and retain customers. The forecast period (2025-2033) projects continued strong growth, with the market likely reaching a substantially larger size by 2033, driven by sustained demand and technological innovation. The diverse range of players, from established ride-sharing giants to specialized carpool platforms, ensures a dynamic and evolving market landscape.

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized carpooling startups. Established players like Uber and Lyft are leveraging their existing infrastructure and user bases to expand their carpool services. Meanwhile, dedicated carpool platforms such as BlaBlaCar and Waze Carpool are focusing on enhancing their user experience and optimizing their matching algorithms to maintain a competitive edge. The successful integration of carpooling features within existing ride-sharing apps has increased market penetration and user accessibility. Future growth will depend on addressing user concerns regarding safety and security, improving the efficiency of ride-matching algorithms, and expanding into new geographic markets. Furthermore, collaboration between transportation authorities and carpooling platforms will be crucial for navigating regulatory challenges and promoting sustainable transportation solutions.

The carpooling market, valued at several million units in 2024, is experiencing significant transformation driven by evolving consumer preferences and technological advancements. Over the historical period (2019-2024), we observed a steady rise in carpool adoption, fueled by increasing urban congestion, rising fuel costs, and a growing awareness of environmental sustainability. The estimated market value in 2025 is projected to reach another significant milestone in the millions. This growth trajectory is expected to continue throughout the forecast period (2025-2033), driven by factors such as improved app-based solutions and increasing government support for sustainable transportation initiatives. The market is characterized by a diverse range of players, from established ride-sharing giants like Uber and Didi Chuxing to specialized carpooling platforms like BlaBlaCar and Waze Carpool. Competition is fierce, with companies constantly innovating to improve user experience, enhance safety features, and expand their service offerings. The market's dynamism is also reflected in the emergence of new business models, including dynamic ride-sharing options and integrated solutions that combine carpooling with public transportation. The integration of advanced technologies such as artificial intelligence and machine learning is further optimizing route planning, matching riders and drivers efficiently, and improving the overall efficiency and convenience of carpooling services. This trend is expected to accelerate during the study period (2019-2033), particularly in urban centers with high population densities and significant traffic congestion. The increasing adoption of electric vehicles and the development of robust charging infrastructure will also contribute to the growth of environmentally friendly carpooling solutions. The market exhibits significant geographic variations, with adoption rates varying across regions based on factors such as infrastructure development, regulatory frameworks, and consumer behavior. However, overall, the future of the carpooling market appears bright, with strong growth potential across various regions and segments.

Several key factors are propelling the growth of the carpooling market. Firstly, the ever-increasing cost of fuel and vehicle ownership is making carpooling a financially attractive alternative for many individuals. Secondly, growing concerns about environmental sustainability and the desire to reduce carbon emissions are driving a shift towards shared mobility solutions. Carpooling contributes to reduced traffic congestion, a major problem in many cities worldwide, offering a more efficient use of road space and reducing commute times. Technological advancements, particularly the development of sophisticated ride-sharing apps, have significantly simplified the process of finding and connecting with carpool partners. These apps offer features like real-time tracking, secure payment systems, and user rating systems, increasing the safety and reliability of carpooling services. Furthermore, government initiatives and policies promoting sustainable transportation, including financial incentives for carpooling, are also contributing to market growth. Increasing urban populations and limited parking availability in many cities further amplify the appeal of carpooling as a practical and convenient alternative to private vehicle ownership. The overall trend towards shared economy models also significantly impacts the market, encouraging more people to consider carpooling as a flexible and cost-effective solution for their transportation needs.

Despite the promising growth prospects, the carpooling market faces several challenges. One significant hurdle is ensuring user safety and security. Concerns about sharing personal information and riding with strangers can deter potential users. Overcoming this requires robust verification systems, real-time tracking capabilities, and transparent safety measures within carpooling apps. Another challenge involves logistical complexities, such as route optimization, scheduling conflicts, and accommodating varying passenger needs and preferences. Developing efficient algorithms and user-friendly interfaces that address these issues is critical for broader market adoption. Furthermore, a lack of awareness and understanding of carpooling benefits, especially in certain regions, acts as a barrier to growth. Effective marketing campaigns and educational initiatives can help overcome this. The regulatory environment also plays a significant role; inconsistent or unclear regulations across different jurisdictions can hinder the growth of carpooling services and create operational difficulties for companies. Finally, competition from other modes of transportation, including public transit and ride-hailing services, presents another challenge. Carpooling needs to differentiate itself by offering unique benefits such as cost savings, flexibility, and environmental consciousness.

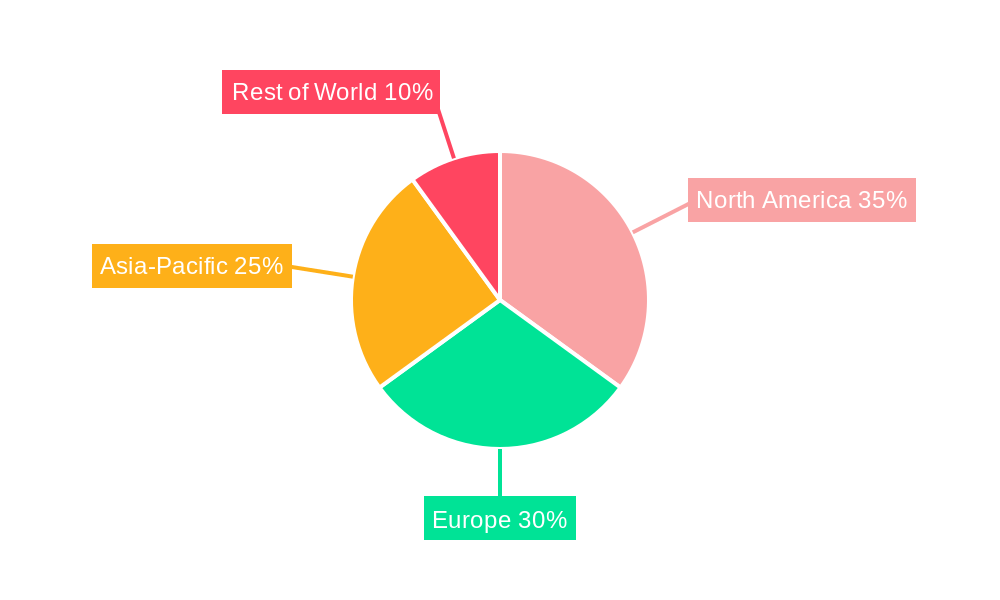

North America: The strong presence of tech-savvy users and established ride-sharing companies like Uber and Lyft have positioned North America as a key market for carpooling. The region's developed infrastructure and high vehicle ownership rates also contribute to its dominance.

Europe: Countries like France and Germany have seen significant growth in carpooling due to government support for sustainable transportation and the popularity of platforms like BlaBlaCar.

Asia: Rapid urbanization and growing concerns about traffic congestion in major Asian cities like Beijing, Mumbai, and Jakarta have fostered the growth of carpooling, especially with the success of platforms like Didi Chuxing and Grab.

The urban commuting segment is expected to dominate the market due to high population density and the need for efficient and affordable transportation solutions in urban areas. The segment's growth is further boosted by government initiatives that promote shared mobility options and reduce reliance on private vehicles. Meanwhile, the long-distance travel segment is anticipated to show moderate growth, although it is often limited by the time constraints of finding suitable travel partners and the need for more flexible scheduling.

In summary, the carpooling market is a complex interplay of geographic factors, technological innovation, and regulatory landscapes. While certain regions have established a dominant position, the continued growth of carpooling services across various segments depends heavily on successfully addressing the market's challenges and capitalizing on its many advantages.

Several factors are significantly boosting the growth of the carpooling industry. Increasing fuel prices and the rising cost of vehicle ownership are making carpooling a more economically attractive option. Simultaneously, the growing awareness of environmental concerns and the desire to reduce carbon emissions are prompting individuals to embrace more sustainable transportation solutions. Government support for shared mobility and initiatives aimed at reducing traffic congestion further fuel this growth. Improvements in technology, specifically user-friendly mobile applications with enhanced safety features, are crucial in improving the convenience and reliability of carpooling services, making them a more appealing alternative to conventional transportation methods.

This report provides a detailed analysis of the carpooling market, covering its current status, future growth potential, major players, and key trends. It examines the driving forces and challenges impacting the industry, providing valuable insights into the market dynamics and opportunities for stakeholders. The report utilizes comprehensive data analysis, covering the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033), offering a complete picture of the carpooling market's evolution and future trajectory. The report's analysis includes detailed segmentation, regional breakdowns, and a competitive landscape overview, allowing readers to make informed decisions and understand the future directions of this dynamic industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Uber, BlaBlaCar, Wunder Carpool, Karos, Carma, SPLT (Splitting Fares), Waze Carpool, Shared Rides (Lyft Line), Via Transportation, Zimride by Enterprise, Scoop Technologies, Ola Share, sRide, Meru Carpool, Grab, RYDE, Didi Chuxing, Dida Chuxing, .

The market segments include Type, Application.

The market size is estimated to be USD 10380 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Carpooling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carpooling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.