1. What is the projected Compound Annual Growth Rate (CAGR) of the Card Digital Camera?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Card Digital Camera

Card Digital CameraCard Digital Camera by Type (Interchangeable Lens Type, Non-Interchangeable Lens Type), by Application (Amateurs, Professional), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

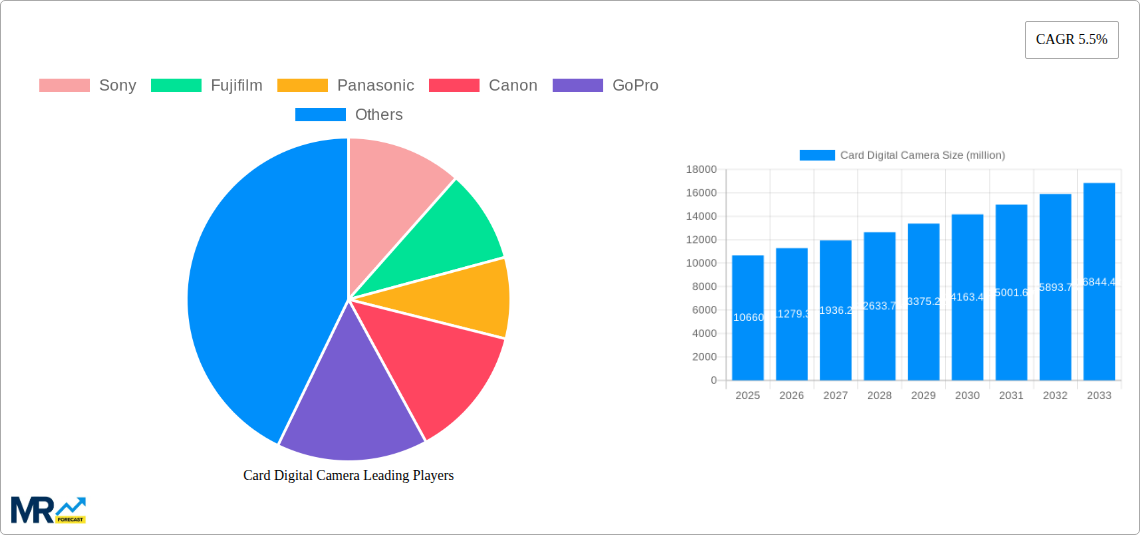

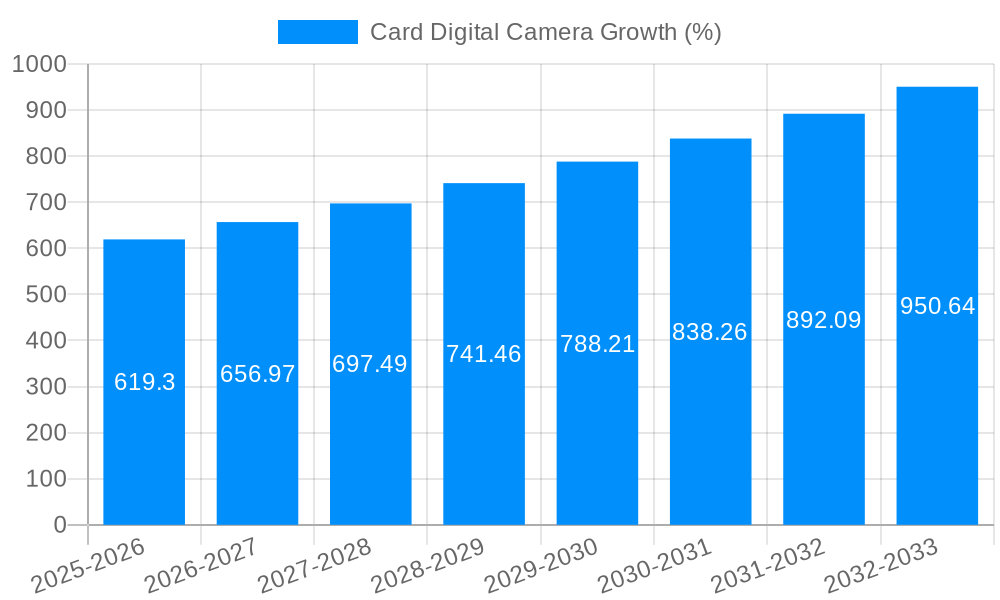

The global card digital camera market, currently valued at approximately $10.66 billion (2025), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This growth is fueled by several key factors. The increasing popularity of vlogging and social media platforms necessitates high-quality, compact cameras for content creation. Advancements in image sensor technology are delivering superior image quality and low-light performance in increasingly smaller form factors, making card cameras more appealing to both amateur and professional photographers. Furthermore, the integration of advanced features like 4K video recording, improved autofocus systems, and smartphone connectivity enhances the user experience and drives market adoption. However, the market faces challenges such as the increasing capabilities of smartphone cameras, which offer convenient alternatives for casual photography. Competition from established players like Sony, Canon, Nikon, and GoPro, along with emerging brands, also intensifies the market dynamics.

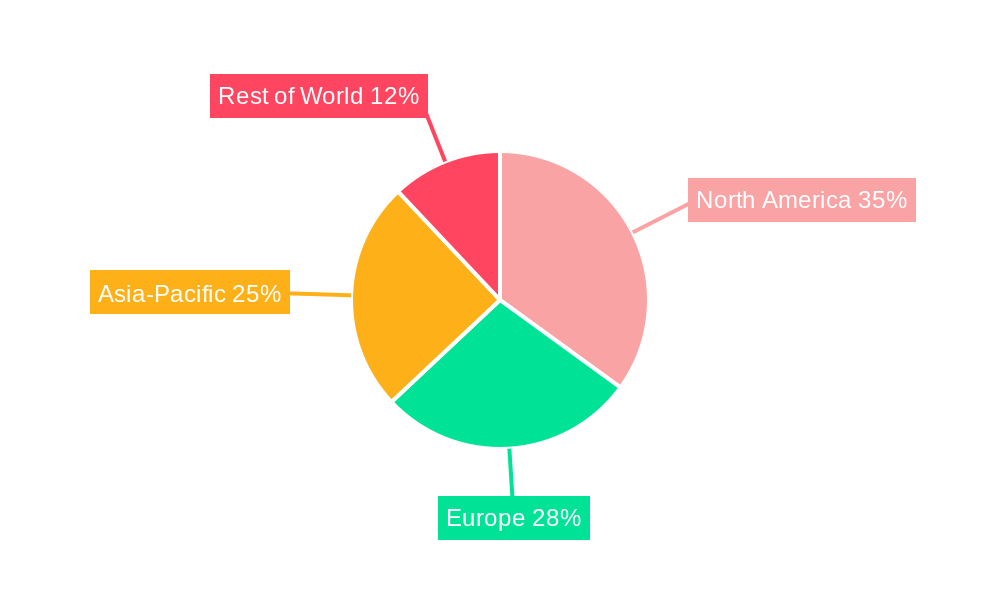

Despite the competitive landscape, the market's positive outlook is sustained by the ongoing demand for dedicated image quality and versatility that surpasses smartphone capabilities. The segment is likely to witness further diversification, with the emergence of niche products catering to specific user needs, such as waterproof or action cameras. Geographical growth will likely be uneven, with developed regions such as North America and Europe experiencing steady growth, while developing economies in Asia and Latin America are anticipated to demonstrate higher growth rates due to increasing disposable incomes and rising smartphone penetration. The forecast period, 2025-2033, is expected to see significant innovation in lens technology, image processing, and connectivity features, further driving market expansion.

The global card digital camera market, while facing significant headwinds from the rise of smartphone photography, continues to demonstrate resilience, particularly within niche segments. The study period (2019-2033) reveals a fluctuating market, with the historical period (2019-2024) showing a decline in overall unit sales, largely attributed to the superior convenience and image processing capabilities of smartphones. However, the market hasn't completely collapsed. Instead, we see a shift in consumer preferences towards specialized card cameras catering to specific needs. The estimated year (2025) shows a stabilization, with niche segments like action cameras and high-end compact cameras showing promising growth. The forecast period (2025-2033) projects modest growth driven by advancements in image sensor technology, improved lens capabilities, and increased demand for professional-grade image quality in specific applications. This growth isn't expected to reach the millions of units sold during the peak years of digital camera popularity, but a dedicated segment of enthusiasts and professionals will continue to drive demand. The base year (2025) serves as a critical point, representing a transition from a broad consumer market to a more specialized and defined user base. This trend reflects a broader pattern of market segmentation, where specialized products cater to specific needs and preferences rather than attempting to be all things to all people. Furthermore, the evolving market necessitates manufacturers focusing on value proposition beyond mere megapixels, emphasizing features like superior low-light performance, robust build quality, and advanced imaging technologies to justify the premium price point. This involves highlighting specific niche applications and targeting distinct consumer groups – from wildlife photographers to vloggers. The market's future depends on manufacturers' ability to effectively cater to these specialized demands.

Several factors are subtly but persistently driving growth within specific segments of the card digital camera market. The pursuit of superior image quality remains a primary driver. While smartphones have improved, dedicated cameras still offer advantages in terms of sensor size, lens quality, and dynamic range, especially in low-light conditions. This is particularly crucial for professional photographers and videographers who demand image fidelity exceeding what smartphones can currently deliver. Another factor is the ongoing innovation in sensor technology. Manufacturers continue to refine image sensors, leading to improved low-light performance, higher resolution, and faster autofocus speeds. This allows for more creative control and the capture of images that would be impossible to achieve with a typical smartphone camera. Furthermore, the development of specialized lenses designed for specific photographic applications (macro, wide-angle, telephoto) further enhances the appeal of card digital cameras for professionals and serious hobbyists. Lastly, the rising demand for high-quality video recording for professional filmmaking, vlogging, and content creation continues to support market growth in certain segments. Action cameras, in particular, have benefited from this demand, with advancements in stabilization and image processing enhancing their appeal to a wider audience. The ongoing evolution of video formats and streaming platforms also contributes to this growth. Ultimately, the market is driven by a combination of technological advancements and the persistent demand for superior image quality and specialized functionality that currently outstrips what smartphones can offer.

The card digital camera market faces substantial challenges. The most significant hurdle is the relentless competition from smartphones. Smartphones offer unmatched convenience and accessibility, their cameras constantly improving in quality and becoming more integrated into daily life. This has dramatically reduced the overall market for general-purpose digital cameras. The high initial cost of high-quality card digital cameras is also a significant deterrent for many consumers, particularly in the current economic climate. The cost of lenses and accessories further amplifies this issue, making it a considerable investment for many potential buyers. Moreover, the rapid pace of technological change puts pressure on manufacturers to continually innovate, requiring substantial R&D investment. This necessitates a focus on niche markets to justify the expense. Finally, the evolving market demands a shift in marketing and sales strategies. Focusing on specialized applications and targeting specific user groups is critical for survival in this competitive landscape. Manufacturers must effectively communicate the value proposition of dedicated cameras over smartphones to sustain sales. Unless innovative features and strong marketing are employed, the market may continue to contract beyond specific niches.

North America: This region has historically been a significant market for digital cameras due to high disposable income and strong adoption of technology. While smartphone penetration is high, a segment of professional and enthusiastic photographers continues to invest in high-end cameras. Specific sub-segments, such as action cameras, also show strong regional performance.

Asia-Pacific (specifically Japan and South Korea): These countries have a strong history of camera manufacturing and a culture of photography enthusiasts, supporting a dedicated market for high-quality cameras, even in the face of smartphone competition.

Europe: Similar to North America, Europe exhibits a healthy mix of professional and enthusiast photographers driving demand for specialized cameras. However, the market size is smaller relative to North America and Asia-Pacific.

High-End Compact Cameras: This segment benefits from technological advancements in sensor size and lens quality. Professionals and enthusiasts value image quality and advanced features, making this segment relatively resilient.

Action Cameras: This sector has seen explosive growth, primarily fueled by the demand for high-quality video recording for action sports, vlogging, and other forms of content creation. This segment has seen less impact from smartphones due to specific functionality needs.

Professional DSLR/Mirrorless Cameras: While not strictly "card" cameras in the traditional sense, these professional models serve a distinct market with high demand. Their ability to support interchangeable lenses and extensive customization continues to attract serious photographers.

In paragraph form: The key regions dominating the card digital camera market are North America and the Asia-Pacific region (particularly Japan and South Korea), driven by high disposable incomes, strong consumer interest in photography, and a cultural appreciation for high-quality imaging. While the overall market has contracted, the high-end compact camera segment is notably resilient, as are action cameras. These segments continue to show steady growth driven by advancements in technology and the ever-increasing need for professional-grade image quality in specific applications. The demand for advanced video recording features continues to fuel growth in the action camera segment. In contrast, the professional DSLR/Mirrorless camera segment, while not card cameras, remain a significant market related to the technology, maintaining a considerable market share. The future of the card digital camera market depends on its capacity to continue catering to these niche segments, with technological advancements and marketing strategies tailored to professional and enthusiast consumers.

The ongoing miniaturization of advanced sensor technology, alongside improvements in lens design and image processing algorithms, continues to fuel innovation within specific card camera segments. This, combined with increasing demand for high-quality video recording and specialized camera functionalities, contributes to sustained growth within niche areas of the market. The development of robust and durable cameras designed for specific environments (like action cameras) also contributes significantly to market expansion. Finally, effective marketing strategies targeting specific consumer groups (e.g., professional photographers, vloggers) are vital for fostering growth in the remaining segments.

This report provides a comprehensive analysis of the card digital camera market, covering historical performance, current trends, and future projections. It identifies key market drivers and restraints, explores regional and segmental differences, and profiles leading industry players. The report offers valuable insights for manufacturers, investors, and anyone seeking to understand the dynamics of this evolving market. The focus is on the specific niche segments that demonstrate resilience and growth potential, offering a nuanced perspective beyond simple overall market decline.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Sony, Fujifilm, Panasonic, Canon, GoPro, Nikon, Leica, Ricoh, PENTAX, Hasselblad, Tamron.

The market segments include Type, Application.

The market size is estimated to be USD 10660 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Card Digital Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Card Digital Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.