1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Roof Antennas?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car Roof Antennas

Car Roof AntennasCar Roof Antennas by Type (Fin Shape, Long Strip, World Car Roof Antennas Production ), by Application (OEM, Aftermarket, World Car Roof Antennas Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

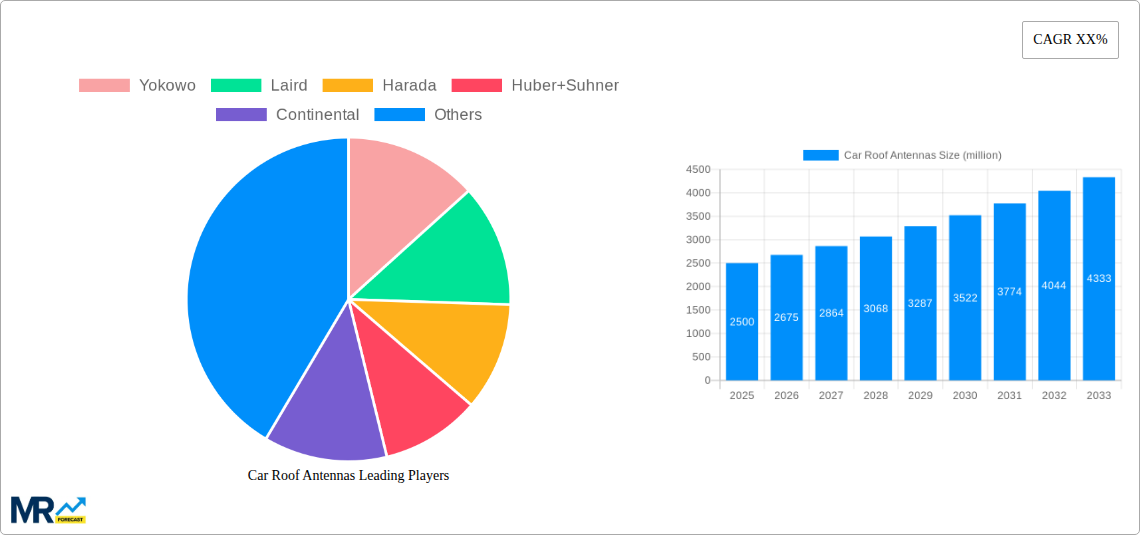

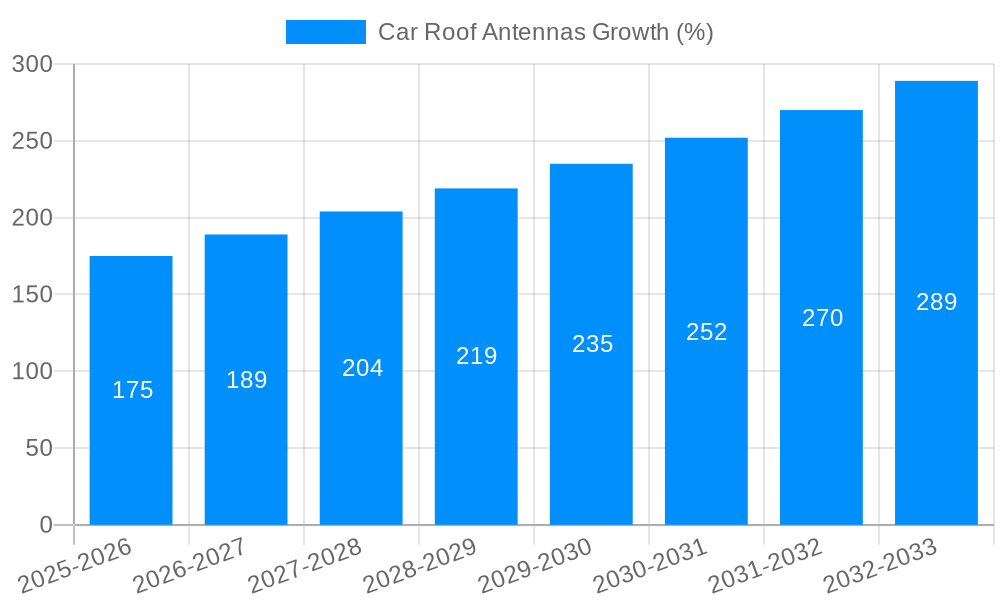

The global Car Roof Antennas market is poised for robust expansion, projected to reach an estimated market size of $5,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This growth is propelled by an increasing demand for advanced in-car connectivity solutions, driven by the automotive industry's relentless pursuit of enhanced user experiences and integrated digital services. The rising adoption of connected car technologies, including GPS navigation, satellite radio, mobile communication, and the burgeoning integration of Wi-Fi and IoT features within vehicles, are primary catalysts. Furthermore, the consistent evolution of vehicle designs, with a growing emphasis on aerodynamic efficiency and sophisticated aesthetics, is influencing antenna form factors. This has led to a higher demand for specialized antenna types like Fin Shape and Long Strip designs that seamlessly integrate into the vehicle's roofline, minimizing drag and contributing to fuel efficiency. The automotive Original Equipment Manufacturer (OEM) segment is expected to dominate market revenue, owing to the direct integration of these antennas during vehicle production. However, the aftermarket segment is also anticipated to witness steady growth as consumers upgrade older vehicles or replace damaged antennas.

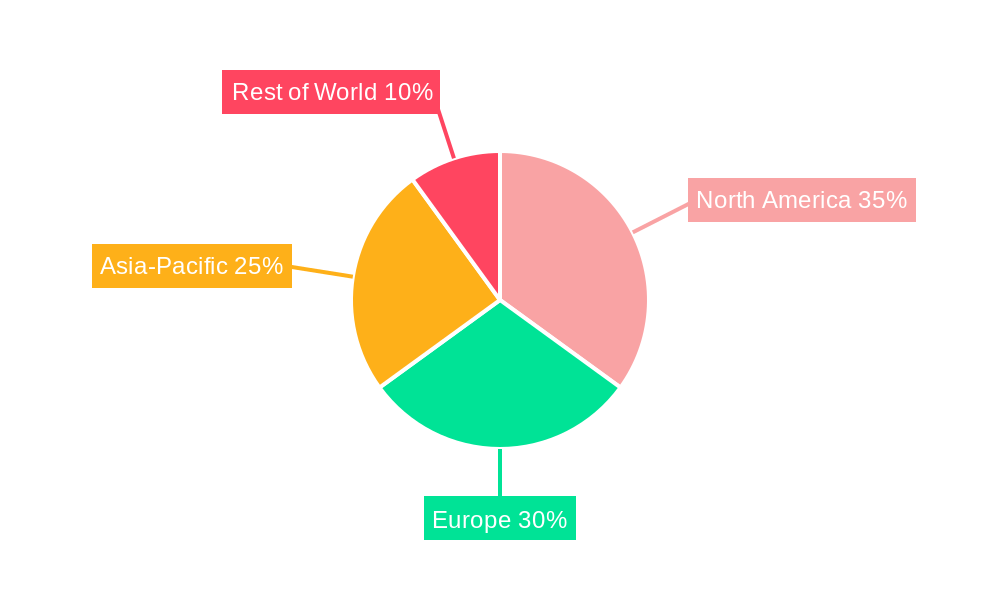

The market is characterized by significant technological advancements, with manufacturers focusing on developing compact, multi-functional antennas capable of supporting a wider range of frequencies and communication protocols. Emerging trends include the integration of 5G capabilities, vehicle-to-everything (V2X) communication technologies for enhanced safety and traffic management, and the development of smart antennas that can adapt to varying signal conditions. Despite this optimistic outlook, the market faces certain restraints, including the increasing complexity of antenna design and manufacturing, which can lead to higher production costs. Supply chain disruptions and the fluctuating prices of raw materials, such as rare earth metals used in some antenna components, also pose potential challenges. Geographically, Asia Pacific, particularly China and India, is emerging as a key growth region due to its massive automotive production and burgeoning consumer base driving demand for connected vehicles. North America and Europe remain mature markets with a strong focus on advanced automotive technologies and stringent regulatory standards for in-car connectivity.

This report provides an in-depth analysis of the global car roof antennas market, offering a detailed examination of trends, drivers, challenges, and growth opportunities. The study encompasses a comprehensive study period of 2019-2033, with a base year of 2025 and an estimated year also of 2025, followed by a detailed forecast period from 2025-2033 building upon the historical period of 2019-2024. The report meticulously analyzes the market's trajectory, projecting a significant expansion driven by technological advancements, evolving automotive designs, and increasing demand for connected vehicle functionalities. With an estimated production volume in the hundreds of millions of units, this market presents substantial opportunities for stakeholders.

The report delves into the intricate landscape of car roof antennas, segmenting the market by Type into Fin Shape and Long Strip antennas, and by Application into OEM and Aftermarket segments. It also considers the overarching World Car Roof Antennas Production as a key metric. Key industry players such as Yokowo, Laird, Harada, Huber+Suhner, Continental, TE Connectivity, Ace Tech, Fiamm, and S-Conn Enterprise Co. are thoroughly profiled, with their strategic initiatives and market share meticulously evaluated. Furthermore, the report highlights critical Industry Developments, providing insights into emerging technologies and regulatory shifts that are shaping the future of this dynamic sector.

The global car roof antennas market is experiencing a dynamic evolution, driven by a confluence of technological advancements and shifting consumer preferences, with World Car Roof Antennas Production projected to reach staggering figures in the hundreds of millions of units during the forecast period of 2025-2033. A primary trend is the escalating integration of advanced functionalities within these seemingly simple components. Modern vehicle antennas are no longer solely responsible for radio reception; they are increasingly becoming sophisticated hubs for a multitude of wireless communications, including GPS, cellular (4G, 5G), Wi-Fi, Bluetooth, and even satellite radio. This multi-functionality is a direct response to the growing demand for connected car services, encompassing navigation, infotainment, telematics, and over-the-air (OTA) updates. The OEM segment is witnessing a significant surge in the adoption of these integrated antenna solutions, as automakers strive to enhance the in-car user experience and differentiate their offerings. The pursuit of sleeker, more aerodynamic vehicle designs is also fueling a shift towards low-profile and integrated antenna solutions. Traditional whip antennas are gradually being replaced by aesthetically pleasing Fin Shape and discreet Long Strip designs that blend seamlessly with the vehicle's exterior. This design evolution is crucial for improving fuel efficiency and reducing wind noise, aligning with broader automotive industry goals. Furthermore, the increasing penetration of electric vehicles (EVs) presents a unique opportunity for antenna manufacturers. EVs, with their complex electronic systems, often require specialized antenna designs to mitigate electromagnetic interference and optimize signal strength for various communication protocols. The aftermarket segment, while historically driven by replacement needs, is also evolving to offer upgraded and multi-functional antenna solutions, catering to a growing segment of car enthusiasts and those seeking enhanced connectivity. The study period of 2019-2033, with a strong emphasis on the base year of 2025, reveals a consistent upward trajectory in the adoption of these advanced and integrated antenna systems, underscoring their indispensable role in the modern automotive ecosystem.

The car roof antennas market is experiencing robust growth propelled by several interconnected factors, with the projected World Car Roof Antennas Production reflecting the substantial demand. A primary driver is the ubiquitous expansion of connected vehicle technologies. As vehicles transform into sophisticated mobile platforms, the need for reliable and high-performance antennas to support a myriad of communication services—from navigation and emergency calls to in-car Wi-Fi and OTA software updates—has become paramount. This increasing reliance on seamless connectivity is directly boosting the demand for advanced antenna solutions, particularly within the OEM segment. Automakers are prioritizing the integration of these functionalities from the factory floor to offer a superior user experience and capitalize on the burgeoning automotive software and services market. Furthermore, the relentless pursuit of vehicle electrification is indirectly fueling antenna innovation. Electric vehicles, with their complex power trains and numerous electronic components, often generate significant electromagnetic interference. This necessitates the development of specialized, highly efficient antennas that can maintain signal integrity for critical communication systems like V2X (Vehicle-to-Everything) communication, autonomous driving sensors, and advanced infotainment. The trend towards sleeker, more aerodynamic vehicle designs also plays a crucial role. Consumers and manufacturers alike are favoring integrated and low-profile antenna designs, such as the increasingly popular Fin Shape antennas, over traditional whip antennas. This aesthetic evolution not only enhances the visual appeal of vehicles but also contributes to improved aerodynamics and reduced fuel consumption, aligning with environmental regulations and consumer expectations. The growing global automotive production figures, particularly in emerging economies, further contribute to the overall demand for car roof antennas, ensuring sustained growth throughout the forecast period of 2025-2033.

Despite the promising growth trajectory, the car roof antennas market faces several challenges and restraints that could temper its expansion. One significant hurdle is the increasing complexity and cost associated with integrating multiple antenna functionalities into a single unit. As vehicles require support for an ever-growing number of wireless standards (5G, Wi-Fi 6E, V2X, etc.), the design and manufacturing of these multi-functional antennas become more intricate and expensive. This can impact the profitability margins for manufacturers and potentially lead to higher costs for consumers, particularly in the Aftermarket segment. Another restraint is the rapid pace of technological obsolescence. With the swift evolution of wireless communication standards, antennas designed for current technologies may quickly become outdated, necessitating frequent redesigns and upgrades. This requires substantial R&D investment and a nimble manufacturing process from companies like Yokowo and Laird to stay competitive. The miniaturization trend also presents a design challenge. While smaller antennas are desirable for aesthetic reasons and aerodynamic efficiency, achieving high performance across multiple frequency bands within a compact form factor can be technically demanding. This is especially pertinent for the Fin Shape antenna designs, which offer limited internal space. Furthermore, stringent regulatory requirements related to electromagnetic compatibility (EMC) and spectrum allocation can add layers of complexity and cost to antenna development and certification. Navigating these diverse and evolving regulations across different geographical markets can be a significant operational challenge. Finally, the increasing reliance on integrated solutions within the vehicle chassis, rather than purely external roof-mounted antennas, could pose a long-term restraint, although the report focuses on traditional roof antennas. The study period of 2019-2024 indicates a continuous effort to overcome these challenges through innovation.

The global car roof antennas market is poised for significant growth, with specific regions and segments expected to take the lead in the coming years, driven by factors such as automotive production, technological adoption, and consumer demand. The OEM segment is anticipated to be the dominant application, accounting for a substantial portion of the World Car Roof Antennas Production, estimated to be in the hundreds of millions of units during the forecast period of 2025-2033. This dominance stems from the integration of advanced connectivity features as standard in new vehicles. Automakers are increasingly incorporating features like 5G connectivity, Wi-Fi hotspot capabilities, advanced GPS, and V2X communication directly into their vehicle designs, making roof antennas an integral component of the new car buying experience.

In terms of regional dominance, Asia Pacific is projected to emerge as a powerhouse in the car roof antennas market. This leadership is fueled by the region's status as the global manufacturing hub for automobiles. Countries like China, Japan, South Korea, and India have a colossal automotive production capacity, leading to a massive demand for car roof antennas. China, in particular, with its rapidly growing domestic automotive market and its significant role in global automotive supply chains, is expected to be a key driver of this regional dominance. The increasing adoption of advanced automotive technologies, including smart features and connectivity solutions, by Chinese consumers further bolsters the demand for sophisticated antenna solutions. Furthermore, the strong presence of leading antenna manufacturers and component suppliers in the region, such as Ace Tech and S-Conn Enterprise Co., contributes to its market leadership.

Within the Type segmentation, the Fin Shape antenna is expected to witness significant market share growth. This is directly attributable to the ongoing trend of vehicle design optimization. The sleek, aerodynamic profile of Fin Shape antennas aligns perfectly with modern automotive aesthetics, reducing drag and wind noise. As automakers strive for more visually appealing and fuel-efficient vehicles, the adoption of Fin Shape antennas is set to outpace traditional designs. Their integrated nature also makes them ideal for housing multiple antenna functions, catering to the increasing demand for connected car services.

The North American market, particularly the United States, is also poised to be a significant contributor to market growth. The region is at the forefront of connected vehicle technology adoption, with a strong consumer appetite for advanced in-car entertainment, safety features, and telematics. This drives high demand for sophisticated antenna solutions within the OEM segment. The presence of major automotive manufacturers and their strong focus on innovation and technological integration in their vehicle lineups ensures a steady demand for high-performance car roof antennas. The push towards electric vehicles in North America also necessitates advanced antenna solutions for efficient charging communication and V2X connectivity.

While the Aftermarket segment is crucial for replacement and upgrades, the sheer volume of new vehicle production will ensure the OEM segment remains the primary driver of World Car Roof Antennas Production. However, the aftermarket will still represent a substantial market, with consumers seeking to enhance their existing vehicles with newer antenna technologies, particularly those offering improved reception or additional functionalities. The study period of 2019-2033, with the base year of 2025, clearly indicates a sustained demand from both OEM and aftermarket channels, with OEM leading due to new vehicle introductions.

Several key growth catalysts are propelling the car roof antennas industry forward. The relentless advancement of 5G technology and its integration into vehicles, enabling faster data transfer for infotainment, OTA updates, and V2X communication, is a major catalyst. The increasing proliferation of autonomous driving features and the need for reliable sensor communication also demand sophisticated antenna solutions. Furthermore, the growing consumer expectation for seamless in-car connectivity, including Wi-Fi hotspots and advanced navigation, directly boosts demand. The ongoing trend of vehicle electrification, with its unique communication requirements, is also a significant growth driver. Finally, evolving vehicle designs favoring integrated and aerodynamic antennas creates opportunities for innovative antenna solutions.

This comprehensive report serves as an indispensable resource for stakeholders navigating the dynamic car roof antennas market. It provides unparalleled insights into market size, trends, and forecasts, offering detailed segmentation by type and application. The analysis meticulously examines the driving forces behind market growth, including the relentless integration of connectivity features and the rise of electric vehicles. Crucially, it also addresses the inherent challenges and restraints, such as technological complexity and cost, offering a balanced perspective. The report identifies key regions and countries poised for dominance, alongside leading companies actively shaping the industry landscape. It further highlights significant past and future industry developments, offering a forward-looking view. This report equips businesses with the strategic intelligence needed to identify opportunities, mitigate risks, and capitalize on the evolving needs of the automotive sector, ensuring informed decision-making throughout the study period of 2019-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Yokowo, Laird, Harada, Huber+Suhner, Continental, TE Connectivity, Ace Tech, Fiamm, S-Conn Enterprise Co, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Car Roof Antennas," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car Roof Antennas, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.