1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Navigation?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car Navigation

Car NavigationCar Navigation by Type (WinCE Platform, Android Platform, World Car Navigation Production ), by Application (OEM, Aftermarket, World Car Navigation Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

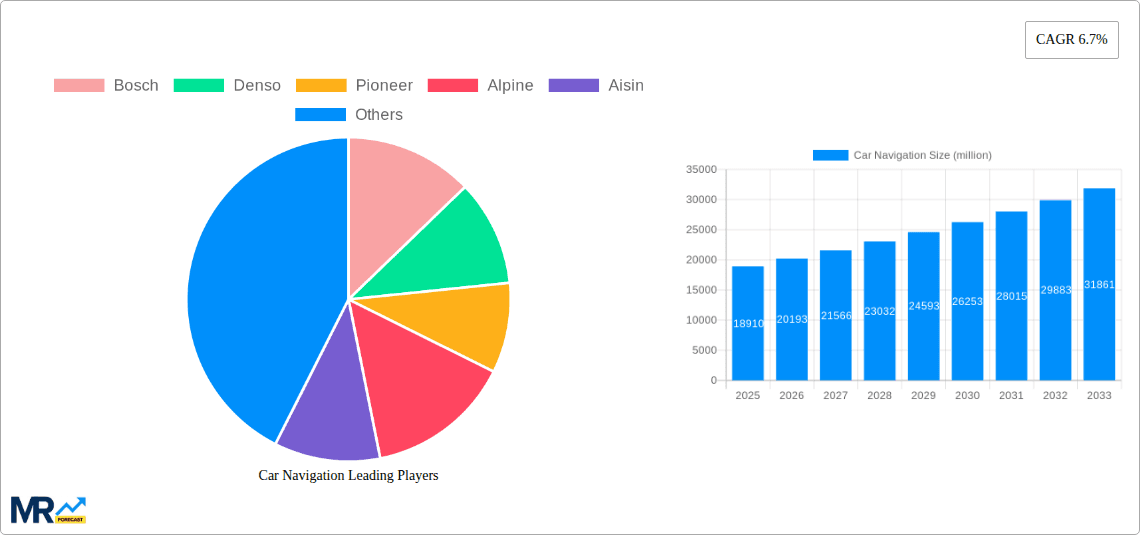

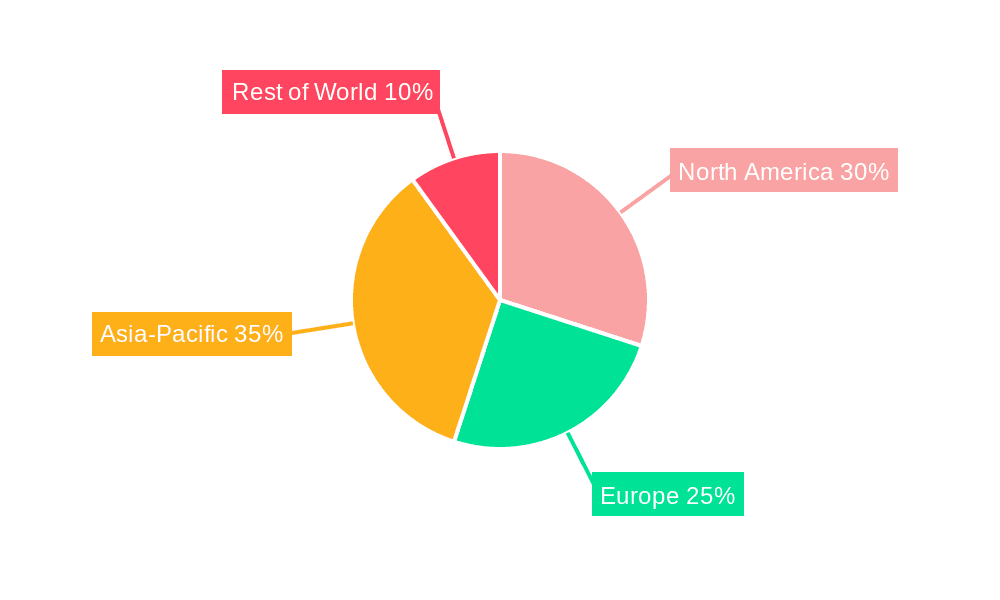

The global car navigation system market, valued at approximately $29.78 billion in 2025, is poised for significant growth over the next decade. Driven by increasing vehicle production, particularly in emerging economies like China and India, and the rising adoption of advanced driver-assistance systems (ADAS) featuring integrated navigation, the market is expected to experience substantial expansion. The shift towards connected cars, enhanced mapping capabilities including real-time traffic updates and improved user interfaces, fuels this growth. Furthermore, the integration of navigation systems with infotainment platforms and the increasing preference for aftermarket installations in older vehicles further contribute to market expansion. The market is segmented by platform (WinCE and Android being prominent), application (OEM and aftermarket), and geographic regions. North America and Europe currently hold substantial market shares due to high vehicle ownership and adoption of advanced technologies, however, the Asia-Pacific region is projected to witness the fastest growth rate owing to increasing vehicle sales and a growing middle class. Competition is intense among established players such as Bosch, Denso, and Pioneer, as well as emerging companies focusing on innovative solutions and cost-effective options. Challenges include the increasing integration of navigation functionalities within smartphones, impacting the standalone navigation device market.

Despite the challenges, several factors support the continued growth of dedicated car navigation systems. The demand for high-precision mapping, particularly for autonomous driving initiatives, favors systems integrated within the vehicle itself rather than relying solely on smartphone applications. Advancements in artificial intelligence and machine learning further enhance navigation capabilities, leading to superior route optimization and real-time adaptation to traffic conditions. The growing demand for commercial vehicle navigation, encompassing fleet management and logistics, also contributes to market expansion. This segment requires robust, dependable systems, benefiting from dedicated hardware and software solutions. Therefore, despite competition from smartphone integration, the car navigation system market is expected to maintain a healthy growth trajectory, driven by technological advancements and the expanding automotive industry.

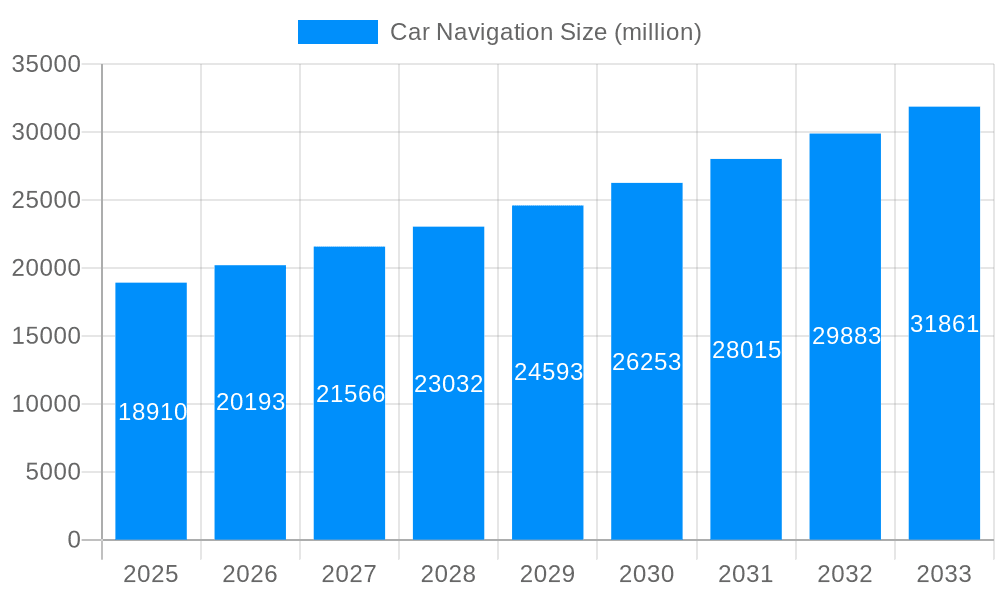

The global car navigation market, valued at several million units in 2024, is experiencing a dynamic shift driven by technological advancements and evolving consumer preferences. The historical period (2019-2024) witnessed a steady growth trajectory, primarily fueled by the increasing penetration of vehicles equipped with integrated navigation systems. The estimated year 2025 marks a pivotal point, with the market poised for accelerated expansion. This growth is fueled by the convergence of several factors. The forecast period (2025-2033) projects a significant surge in demand, exceeding tens of millions of units annually, propelled by the integration of advanced features like real-time traffic updates, augmented reality overlays, and seamless smartphone connectivity. The transition from traditional WinCE platforms to Android-based systems is a prominent trend, offering greater flexibility, customization, and app integration. The dominance of OEM (Original Equipment Manufacturer) installations is expected to continue, albeit with a growing contribution from the aftermarket segment, driven by consumer demand for enhanced features and superior user experiences in existing vehicles. The market's evolution is also shaped by the increasing sophistication of navigation systems, transitioning from simple route guidance to comprehensive infotainment hubs that integrate various functionalities, including entertainment, communication, and driver assistance systems. The competitive landscape is characterized by both established automotive suppliers and technology companies vying for market share, leading to innovation and price competition. The geographical distribution of demand is expanding beyond established markets, with developing economies showing increasing adoption rates, particularly in regions experiencing rapid automotive sales growth. This report delves into the intricacies of these trends, providing valuable insights into the market's future trajectory.

Several key factors are driving the robust growth of the car navigation market. The rising demand for enhanced safety and convenience features in vehicles is a primary driver. Modern car navigation systems provide real-time traffic updates, avoiding congestion and reducing travel time. Furthermore, these systems often integrate advanced driver-assistance systems (ADAS) such as lane departure warnings and collision avoidance alerts, leading to improved road safety. The increasing affordability of both integrated OEM and aftermarket navigation systems is making them accessible to a broader consumer base. Technological advancements, such as the integration of cloud-based services, high-definition mapping, and improved voice recognition, significantly enhance the user experience, attracting a wider segment of drivers. The proliferation of smartphones and their seamless integration with car navigation systems via platforms like Android Auto and Apple CarPlay are also boosting adoption rates, allowing for personalized experiences and extended functionalities. Furthermore, the growing popularity of connected cars and the demand for infotainment features beyond basic navigation are contributing to the market's expansion. Finally, government regulations promoting road safety and advanced driver assistance technologies indirectly incentivize the adoption of sophisticated car navigation systems.

Despite the significant growth potential, the car navigation market faces several challenges. One major constraint is the high initial cost of implementing advanced navigation systems, especially for OEMs. This can make it challenging to integrate the latest technologies in budget-friendly vehicles. The ongoing competition among various technology providers and the constant evolution of software and hardware necessitate continuous investment in research and development, potentially impacting profit margins for manufacturers. Data security and privacy concerns related to the collection and usage of user location data are increasingly important considerations. Accurate and up-to-date map data are crucial for effective navigation, and maintaining the accuracy of these maps requires substantial investment and ongoing updates. Furthermore, the reliance on cellular connectivity for real-time traffic and other features can create challenges in areas with limited or unreliable network coverage. Finally, the integration complexity of different navigation systems with various vehicle infotainment systems presents an operational hurdle.

The OEM segment is projected to hold a dominant position in the global car navigation market throughout the forecast period (2025-2033). This dominance is attributable to several factors:

Higher Integration Rates: OEM navigation systems are typically factory-installed, offering superior integration with the vehicle's infotainment and other systems. This results in a more seamless and user-friendly experience compared to aftermarket installations.

Branding and Customer Loyalty: OEM-integrated navigation systems benefit from established brand recognition and customer loyalty associated with specific car manufacturers. This can influence purchase decisions, especially for consumers who prefer a consistent and integrated driving experience.

Greater Feature Set: OEM-supplied navigation systems often offer a richer feature set, including advanced functionalities like advanced driver-assistance systems (ADAS) integration and customized user profiles. These added features enhance the overall value proposition for customers.

Direct Sales Channels: OEMs have direct access to their customer base, making it easier to promote and sell their navigation systems through established dealership networks.

Consistent Updates and Maintenance: OEMs are typically responsible for providing regular software and map updates to maintain optimal system performance, ensuring consistent and accurate navigation data over time. This minimizes the burden on consumers and enhances their satisfaction.

While the aftermarket segment is expected to see growth, particularly driven by the replacement market and consumers seeking to upgrade the navigation capabilities in older vehicles, the OEM segment's integrated approach and inherent advantages will maintain its market leadership in the coming years. Geographically, North America and Europe are likely to remain major markets, due to high vehicle ownership rates and the early adoption of advanced technology. However, the Asia-Pacific region will experience significant growth, fuelled by increasing vehicle production and rising disposable incomes.

The car navigation industry's growth is significantly bolstered by several key catalysts. The increasing adoption of connected car technologies enables real-time data integration, enriching the navigation experience with features like live traffic updates and predictive routing. Advanced mapping technologies, including 3D mapping and augmented reality overlays, offer improved visual clarity and enhanced navigation assistance. Finally, the integration of driver-assistance systems with navigation functionalities further enhances safety and convenience, creating a comprehensive driving support ecosystem that elevates the overall driving experience.

This report provides a comprehensive analysis of the car navigation market, offering a detailed overview of market trends, driving forces, challenges, and key players. The report includes historical data (2019-2024), estimated figures for 2025, and future forecasts (2025-2033). It covers key segments, including OEM and aftermarket installations, and different platform types, such as WinCE and Android. The geographical scope is global, with a focus on key regions and countries that contribute significantly to market growth. This report serves as a valuable resource for industry stakeholders, including manufacturers, suppliers, investors, and market researchers, providing valuable insights into the dynamics and future prospects of the car navigation market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bosch, Denso, Pioneer, Alpine, Aisin, Continental, Kenwood, Sony, Clarion, Garmin, Panasonic, Hangsheng, Coagent, ADAYO, Desay SV, Skypine, Kaiyue Group, Roadrover, FlyAudio, Soling, .

The market segments include Type, Application.

The market size is estimated to be USD 29780 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Car Navigation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car Navigation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.