1. What is the projected Compound Annual Growth Rate (CAGR) of the Candy Processing Machine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Candy Processing Machine

Candy Processing MachineCandy Processing Machine by Application (Soft Confectionery, Hard Candies, Others, World Candy Processing Machine Production ), by Type (Enrobing Equipment, Forming & Depositing Equipment, Tempering Equipment, Extrusion Equipment, World Candy Processing Machine Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

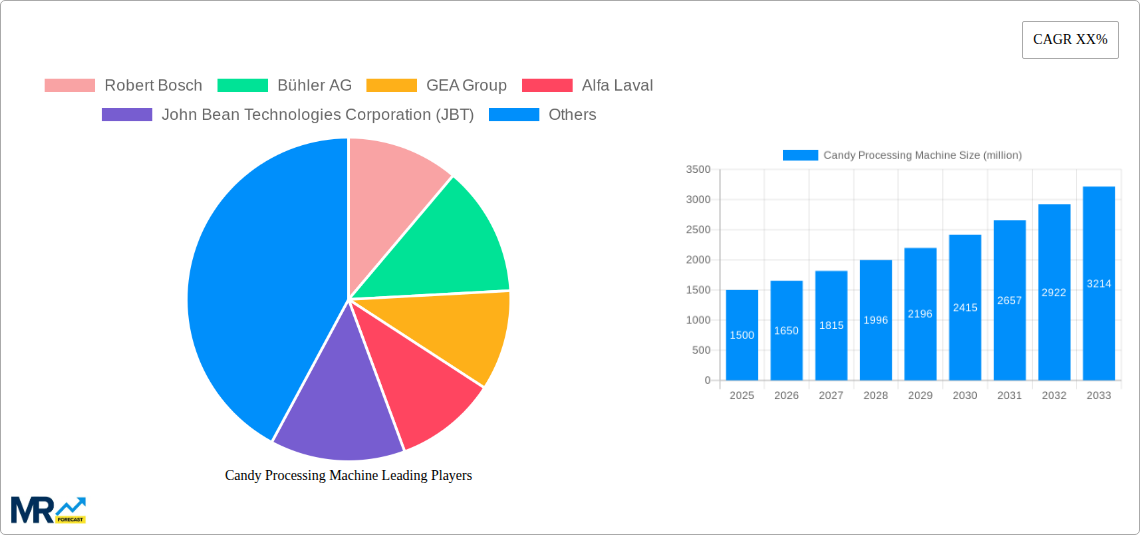

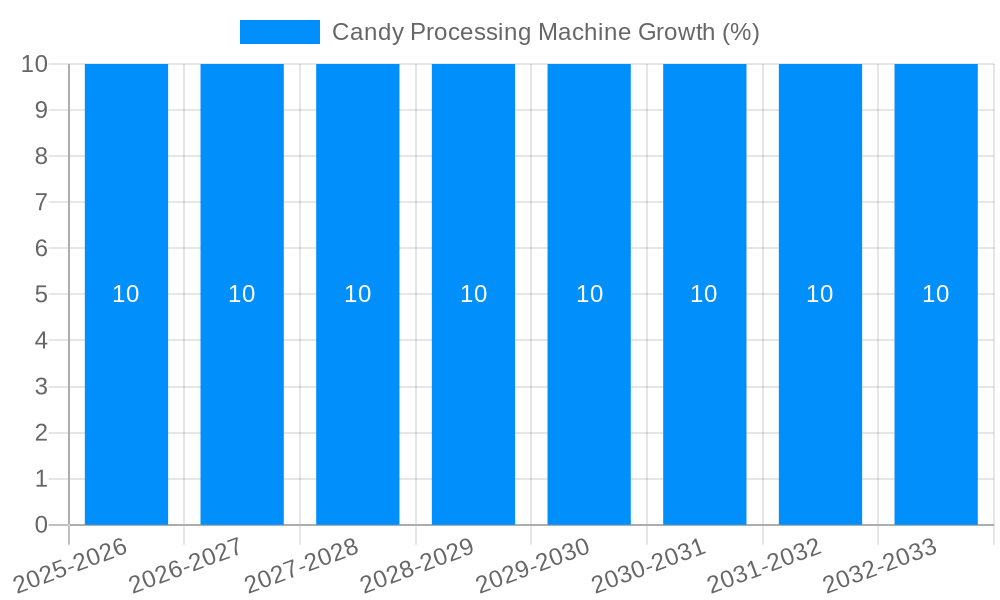

The global candy processing machine market is experiencing robust growth, projected to reach approximately $1,500 million by 2025 and continue its upward trajectory throughout the forecast period. This expansion is driven by a confluence of factors, including the rising global demand for confectionery products, fueled by increasing disposable incomes and evolving consumer preferences for premium and innovative candies. The market is also benefiting from advancements in processing technology, leading to more efficient, automated, and specialized machinery that caters to the diverse needs of candy manufacturers. Manufacturers are investing in sophisticated enrobing, forming, depositing, tempering, and extrusion equipment to enhance product quality, consistency, and production output, thereby meeting the escalating consumer appetite for a wide array of sweet treats. Furthermore, the growing trend of personalized and functional confectionery, such as sugar-free and vitamin-fortified candies, is stimulating the demand for flexible and adaptable processing solutions.

The market dynamics are further shaped by a competitive landscape featuring prominent global players like Robert Bosch, Bühler AG, and GEA Group, alongside specialized manufacturers such as Aasted ApS and Baker Perkins. These companies are actively engaged in research and development to introduce cutting-edge solutions, enhance energy efficiency, and ensure compliance with stringent food safety regulations. While the market is poised for significant expansion, certain restraints, such as the high initial investment cost of advanced machinery and the fluctuating prices of raw materials, may pose challenges. However, the persistent innovation in machinery design, coupled with the growing adoption of smart manufacturing and Industry 4.0 principles in the confectionery sector, is expected to mitigate these challenges and propel the market forward. The Asia Pacific region, particularly China and India, is emerging as a key growth engine due to its large consumer base and expanding confectionery industry, while North America and Europe continue to be mature yet significant markets for high-end processing equipment.

This report provides an in-depth analysis of the global Candy Processing Machine market, offering a panoramic view of its present landscape and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this research meticulously examines historical trends (2019-2024) and projects future market dynamics. The report delves into the intricate workings of candy processing, exploring key segments such as Soft Confectionery, Hard Candies, and Others, alongside crucial equipment types including Enrobing, Forming & Depositing, Tempering, and Extrusion Equipment. Furthermore, it scrutinizes the industry's development at a global scale, leveraging millions in unit value estimations to paint a clear picture of the market's economic significance.

The global Candy Processing Machine market is exhibiting robust growth, projected to witness a significant expansion from its current valuation to an estimated $3,870.2 million by 2033. This upward trend is underpinned by a confluence of factors, including evolving consumer preferences for diverse confectionery products, increasing disposable incomes in emerging economies, and a continuous drive for enhanced operational efficiency and automation within the food processing industry. The demand for sophisticated machinery capable of producing a wider variety of candies, from intricate artisanal creations to mass-produced popular items, is a primary market driver. This includes a burgeoning interest in specialized equipment that can cater to niche markets such as sugar-free, vegan, and functional confectionery, demanding precision and flexibility in processing. Furthermore, technological advancements are revolutionizing the production process. Innovations in areas like intelligent automation, IoT integration for real-time monitoring and control, and advanced material handling systems are becoming increasingly prevalent. These advancements not only improve product quality and consistency but also significantly reduce waste and energy consumption, aligning with the industry's growing emphasis on sustainability. The market is also seeing a notable shift towards integrated processing lines, where individual machines are seamlessly connected to form a cohesive production system. This approach optimizes workflow, minimizes manual intervention, and enhances overall throughput, leading to substantial cost savings for manufacturers. The rising adoption of advanced hygiene and sanitation features in processing equipment is another critical trend, driven by stringent food safety regulations and increasing consumer awareness regarding product safety. Consequently, manufacturers are investing in machines designed for easy cleaning and maintenance, thereby reducing downtime and ensuring compliance. The competitive landscape is characterized by intense innovation and strategic collaborations between machinery manufacturers and confectionery producers, aiming to co-develop customized solutions that meet specific production needs.

The confectionery industry's relentless pursuit of innovation and efficiency is the primary engine driving the global Candy Processing Machine market. A significant catalyst is the ever-evolving consumer palate, with a burgeoning demand for novelty, customization, and healthier indulgence options. This translates directly into a need for versatile and sophisticated processing equipment capable of producing a wider array of textures, shapes, and flavors. Manufacturers are no longer content with standard offerings; they seek machines that can create intricate designs, layered textures, and incorporate functional ingredients like vitamins, minerals, and plant-based proteins. This quest for product diversification necessitates advanced forming and depositing equipment, precise enrobing machines, and flexible extrusion systems. Concurrently, the global increase in disposable income, particularly in emerging economies, has broadened the consumer base for confectionery products, leading to higher production volumes and, consequently, a greater demand for processing machinery. As these markets mature, consumers are also becoming more discerning, demanding higher quality and more aesthetically pleasing products, pushing manufacturers to invest in cutting-edge technology. Furthermore, the imperative for enhanced operational efficiency and cost optimization within confectionery businesses cannot be overstated. High labor costs, the need for consistent product quality, and the pressure to increase throughput are compelling manufacturers to embrace automation. Candy processing machines are becoming increasingly intelligent, incorporating features like advanced robotics, AI-driven process control, and real-time data analytics to minimize errors, reduce downtime, and optimize resource utilization. The drive for sustainability and reduced environmental impact is also emerging as a powerful force, encouraging the development of energy-efficient machinery and processes that minimize waste generation.

Despite the promising growth trajectory, the Candy Processing Machine market faces several hurdles that could potentially temper its expansion. A significant challenge is the high initial investment cost associated with acquiring advanced processing machinery. For many small and medium-sized enterprises (SMEs) in the confectionery sector, particularly in developing regions, the capital expenditure required for state-of-the-art equipment can be prohibitive, limiting their ability to upgrade or expand their production capabilities. This financial barrier restricts market penetration and adoption of the latest technologies. Another considerable restraint is the increasingly stringent regulatory landscape governing food safety and hygiene standards worldwide. Manufacturers must comply with a complex web of regulations concerning food contact materials, sanitation protocols, and traceability, which often necessitates significant investments in machinery that meets these specific requirements. Keeping pace with these evolving regulations and ensuring continuous compliance can be a resource-intensive undertaking. Furthermore, the short product lifecycle and rapid trend shifts within the confectionery market present a dynamic challenge. Manufacturers need processing equipment that is highly adaptable and can be quickly reconfigured to produce new products or variations. Machinery with limited flexibility can lead to obsolescence and increased downtime during product changeovers, impacting overall productivity and profitability. The shortage of skilled labor to operate and maintain sophisticated automated processing equipment is also a growing concern. While automation aims to reduce reliance on manual labor, the deployment and upkeep of these advanced systems require a technically proficient workforce, which is not always readily available. Finally, supply chain disruptions and volatility in raw material prices, exacerbated by global geopolitical events, can impact the manufacturing and pricing of candy processing machines, creating uncertainty within the market.

The global Candy Processing Machine market is poised for significant growth, with the Soft Confectionery segment expected to be a dominant force, driven by evolving consumer preferences for more indulgent and diverse treat options. This segment, which includes products like gummies, caramels, marshmallows, and chewy candies, has witnessed a remarkable surge in demand worldwide. Consumers are increasingly seeking out innovative textures, flavors, and functional benefits within their confectionery choices, and soft candies are particularly amenable to such experimentation. The versatility of soft confectionery allows manufacturers to readily incorporate natural colorings, sweeteners, and beneficial ingredients, catering to the growing health-conscious consumer base. The ease with which these products can be customized and produced in various formats also contributes to their popularity.

Technological advancements in Forming & Depositing Equipment are directly fueling the dominance of the soft confectionery segment. These machines are crucial for creating intricate shapes, layered structures, and precise fillings that define modern soft candies. Innovations in servo-driven systems, volumetric depositors, and multi-component molding technology enable manufacturers to achieve higher levels of precision, consistency, and production speed. This allows for the efficient creation of complex designs and fillings, meeting the demand for visually appealing and texturally varied products. For instance, advanced depositing machines can create multi-colored gummies with different flavor profiles or precisely inject fillings into chewy candies, offering consumers a premium experience.

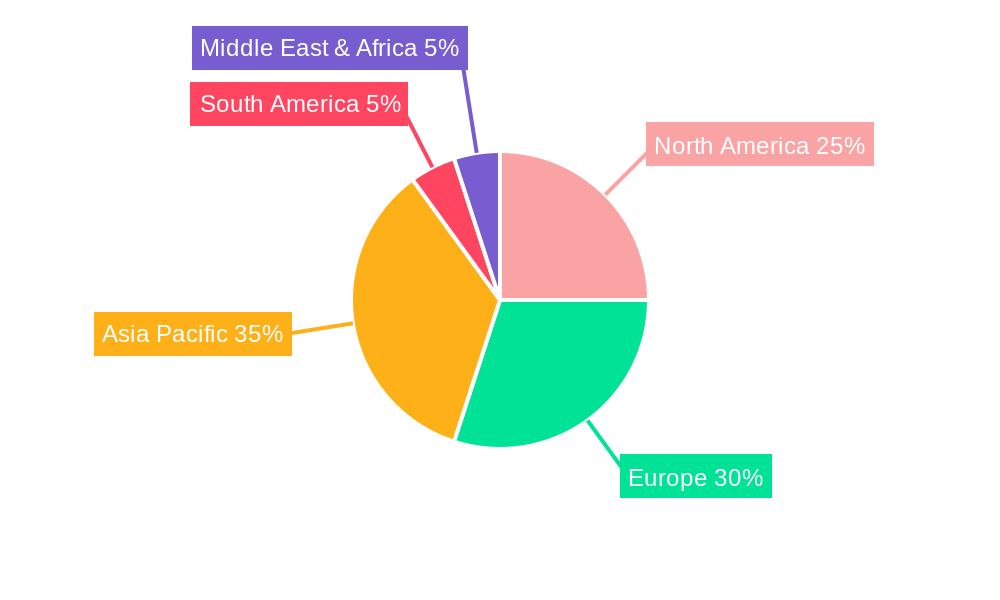

Geographically, North America is anticipated to remain a leading region in the Candy Processing Machine market, owing to its mature confectionery industry, high consumer spending power, and early adoption of advanced processing technologies. The region boasts a strong presence of major confectionery manufacturers who are consistently investing in upgrading their production facilities to enhance efficiency and product innovation. The U.S., in particular, is a significant market, driven by a large consumer base with a penchant for a wide variety of candies, from traditional favorites to novelties. The stringent quality and safety standards prevalent in North America also necessitate the use of high-quality, sophisticated processing equipment.

Furthermore, the Asia-Pacific region is projected to witness the fastest growth rate in the candy processing machine market. This expansion is attributed to the burgeoning middle class, increasing disposable incomes, and a growing appetite for confectionery products across countries like China, India, and Southeast Asian nations. As these economies continue to develop, confectionery consumption is expected to rise exponentially, creating a substantial demand for processing machinery. Local manufacturers in this region are increasingly investing in automated and efficient processing solutions to meet the rising domestic demand and cater to export markets. The growing trend of Western-style confectionery products in these markets further bolsters the demand for specialized processing equipment.

Dominant Segment (Application): Soft Confectionery

Dominant Segment (Type): Forming & Depositing Equipment

Leading Region: North America

Fastest Growing Region: Asia-Pacific

The Candy Processing Machine industry is experiencing significant growth, propelled by several key catalysts. The increasing global demand for confectionery products, fueled by rising disposable incomes and evolving consumer preferences for variety and indulgence, is a primary driver. This surge necessitates more efficient and advanced processing capabilities. Furthermore, the growing emphasis on automation and operational efficiency within the food manufacturing sector is compelling companies to invest in sophisticated candy processing machinery to reduce labor costs and improve throughput. The continuous innovation in confectionery product development, with a focus on healthier options, unique textures, and novel flavors, directly translates to a demand for versatile and adaptable processing equipment.

This report offers a holistic examination of the global Candy Processing Machine market, covering its multifaceted dynamics from 2019 to 2033. The analysis leverages extensive data, including market valuations in the millions, to provide a detailed understanding of segment-specific performance and regional dominance. It scrutinizes key segments such as Soft Confectionery and Hard Candies, alongside essential equipment types like Enrobing, Forming & Depositing, Tempering, and Extrusion Equipment. The report delves into the industry's development at a global scale, identifying the leading players and highlighting their strategic moves and innovations. Ultimately, this comprehensive report serves as an indispensable guide for stakeholders seeking to navigate and capitalize on the evolving opportunities within the dynamic Candy Processing Machine market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Robert Bosch, Bühler AG, GEA Group, Alfa Laval, John Bean Technologies Corporation (JBT), Aasted ApS, BCH Ltd, Tanis Confectionery, Baker Perkins, Sollich KG, Heat and Control, Rieckermann GmbH, Latini-Hohberger Dhimantec, Loynds, CandyWorx, Tanis, Savage Bros, Chocotech, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Candy Processing Machine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Candy Processing Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.