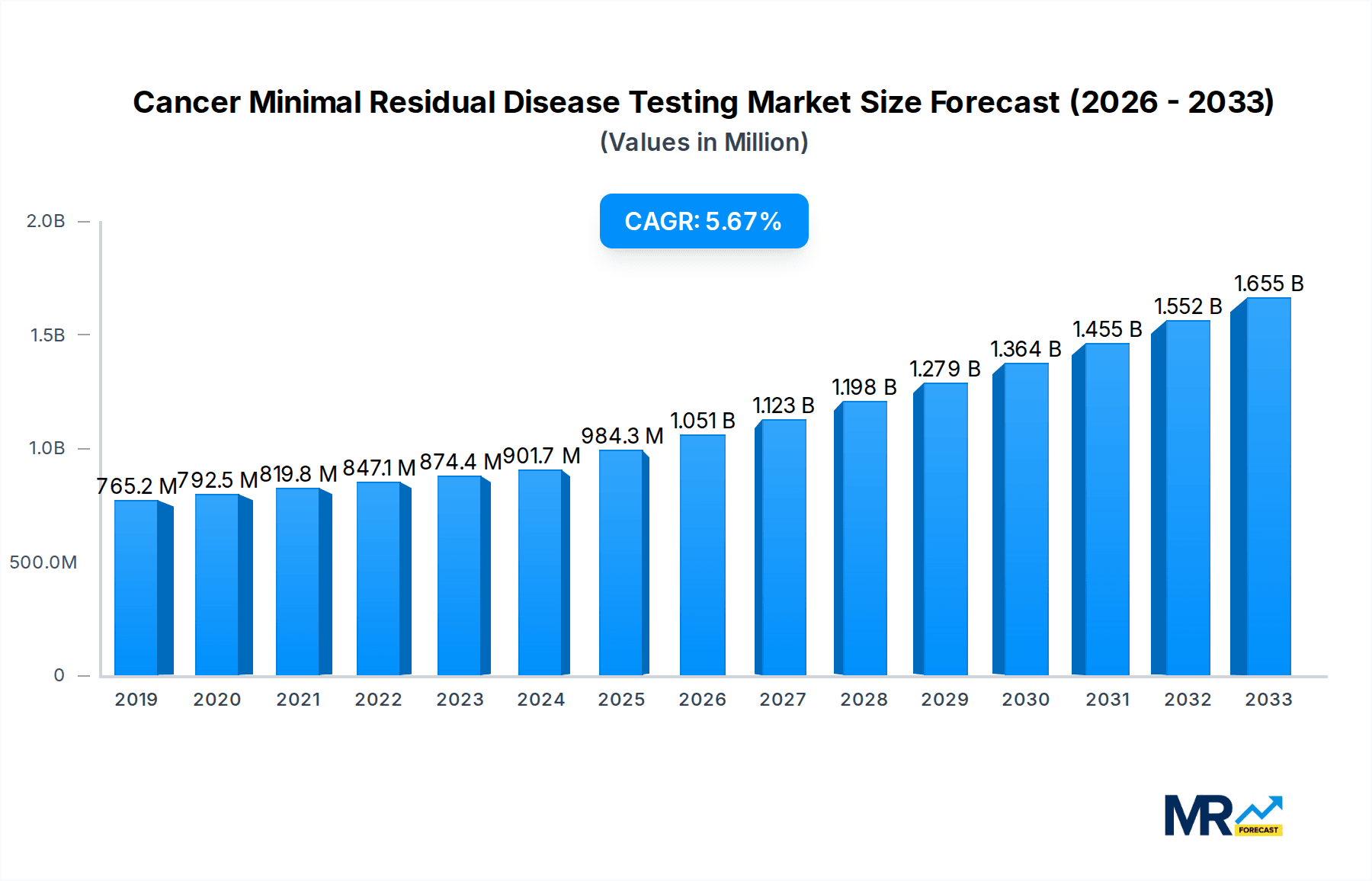

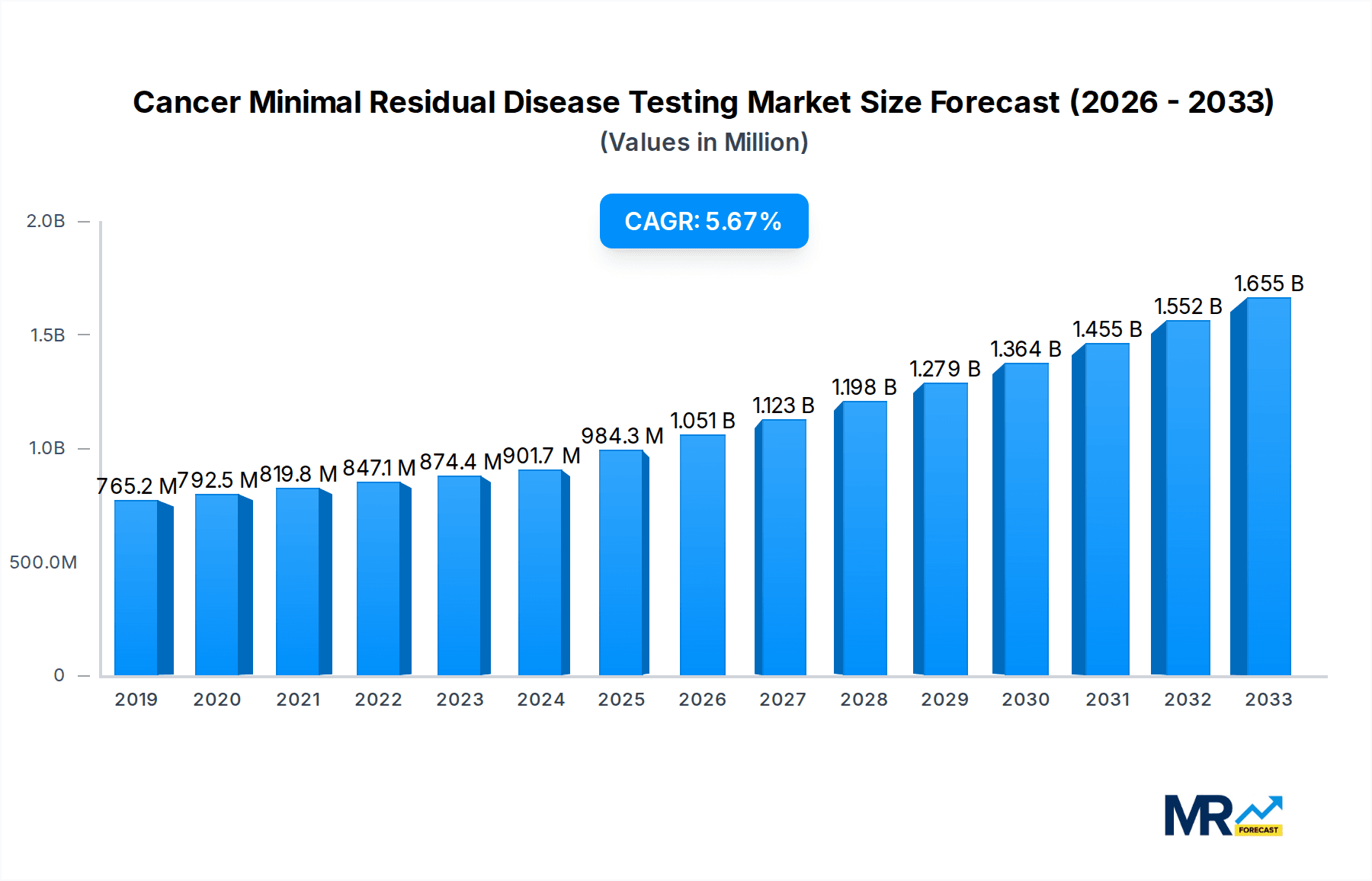

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cancer Minimal Residual Disease Testing?

The projected CAGR is approximately 6.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cancer Minimal Residual Disease Testing

Cancer Minimal Residual Disease TestingCancer Minimal Residual Disease Testing by Type (Flow Cytometry, Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Other), by Application (Hematological Malignancies, Leukemia, Lymphoma, Solid Tumors, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Cancer Minimal Residual Disease (MRD) Testing market is poised for significant expansion, projected to reach a market size of approximately $984.3 million by 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 6.7% during the forecast period of 2025-2033. The increasing incidence of cancer globally, coupled with advancements in diagnostic technologies, are primary drivers propelling the market forward. The adoption of MRD testing is crucial for precise patient stratification, treatment monitoring, and early detection of relapse, offering a paradigm shift from traditional treatment approaches to more personalized and effective cancer care strategies. Flow cytometry and Polymerase Chain Reaction (PCR) currently dominate the market segments, driven by their established efficacy and accessibility in detecting minute cancer cell presence.

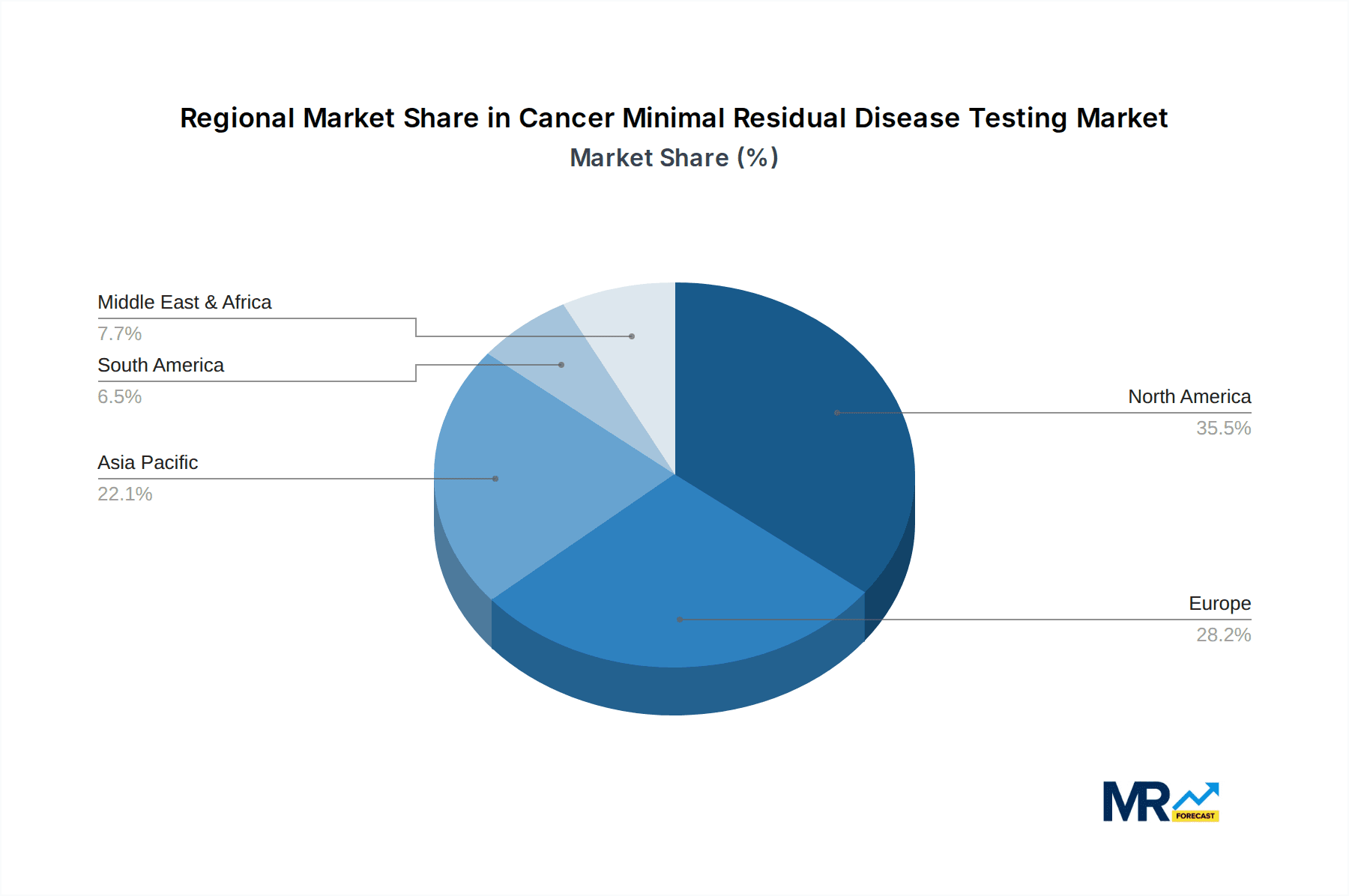

The market's trajectory is further bolstered by the rising focus on personalized medicine and the increasing reimbursement for advanced diagnostic tests, particularly in developed regions like North America and Europe. While the market shows robust growth, certain restraints, such as the high cost of advanced testing platforms and the need for specialized expertise, may temper the pace of adoption in some emerging economies. Nevertheless, ongoing research and development efforts, including the expansion of Next-Generation Sequencing (NGS) applications, are expected to overcome these challenges, making MRD testing more accessible and comprehensive. Key applications like hematological malignancies, including leukemia and lymphoma, are leading the demand, with a growing emphasis on solid tumors as well. The competitive landscape features a mix of established players and innovative startups, all vying to capture a share of this expanding market through technological advancements and strategic collaborations.

Here's a unique report description on Cancer Minimal Residual Disease Testing, incorporating your specific requirements:

The global Cancer Minimal Residual Disease (MRD) testing market is experiencing a significant upswing, projected to reach a staggering $15.4 billion by 2033, a substantial leap from an estimated $5.2 billion in 2025. This robust growth trajectory underscores the increasing recognition of MRD testing's pivotal role in personalized cancer treatment and management. Historically, the market has demonstrated consistent expansion from $2.1 billion in 2019 to $3.8 billion in 2024, setting a strong foundation for future advancements. The study period from 2019 to 2033 meticulously tracks these developments, with the base year and estimated year of 2025 serving as crucial reference points for understanding the current market landscape and its immediate future. A significant driver of this expansion is the evolving paradigm of cancer care, moving towards precision medicine where early detection of residual disease is paramount for preventing relapse and optimizing therapeutic strategies. The ability of MRD testing to detect even minute traces of cancer cells, often undetectable by conventional diagnostic methods, is revolutionizing treatment protocols, particularly in hematological malignancies. The increasing prevalence of these cancers globally, coupled with the growing demand for sensitive and specific diagnostic tools, is fueling market momentum. Furthermore, advancements in technology, specifically in the realm of molecular diagnostics like Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR), are making MRD testing more accessible, accurate, and cost-effective, thereby broadening its clinical application. The market is also benefiting from favorable regulatory environments in several key regions, encouraging the adoption of novel diagnostic technologies and supporting research and development efforts. The increasing awareness among healthcare professionals and patients about the benefits of MRD monitoring is also a critical factor contributing to its widespread acceptance and integration into standard clinical practice. The growing investment in R&D by key market players further signals a commitment to innovation and the continuous improvement of MRD testing methodologies, promising even greater sensitivity and specificity in the coming years. This confluence of technological innovation, clinical demand, and supportive market dynamics paints a promising picture for the future of cancer MRD testing.

The rapid ascent of the Cancer Minimal Residual Disease (MRD) testing market is being propelled by a multifaceted interplay of scientific, clinical, and economic factors. A primary driver is the undeniable clinical utility of MRD detection in refining treatment strategies and improving patient outcomes. For hematological malignancies, particularly leukemia and lymphoma, the ability to accurately quantify residual cancer cells post-therapy allows oncologists to stratify patients into risk groups, guiding decisions on further treatment intensity, stem cell transplantation, or surveillance. This granular level of information translates directly into more personalized and effective patient care, reducing overtreatment in some and ensuring timely intervention in others. Moreover, the continuous evolution of diagnostic technologies is significantly enhancing the sensitivity and specificity of MRD assays. Techniques such as Next-Generation Sequencing (NGS) and highly sensitive Polymerase Chain Reaction (PCR) are now capable of detecting cancer cells at levels previously unimaginable, pushing the boundaries of early relapse prediction. This technological prowess is making MRD testing a more viable and attractive option across a wider spectrum of cancers, including an increasing focus on solid tumors. The growing body of clinical evidence supporting the prognostic and predictive value of MRD testing is also a critical propellant. Numerous studies are consistently demonstrating a strong correlation between MRD negativity and improved survival rates, bolstering physician confidence and encouraging its broader adoption into clinical guidelines. Furthermore, increasing reimbursement for MRD testing by healthcare payers in developed economies is removing significant financial barriers, making these crucial diagnostic tools more accessible to a larger patient population. This economic enablement, coupled with the growing awareness among both clinicians and patients about the benefits of proactive disease monitoring, is creating a fertile ground for sustained market expansion.

Despite the burgeoning growth, the Cancer Minimal Residual Disease (MRD) testing market is not without its hurdles. A significant challenge lies in the standardization and harmonization of methodologies across different laboratories and assay platforms. The lack of universally accepted protocols for sample handling, assay design, and data interpretation can lead to variability in results, potentially impacting clinical decision-making and patient management. This heterogeneity is particularly pronounced across diverse testing modalities like Flow Cytometry, PCR, and NGS, each with its own unique strengths and limitations. Another considerable restraint is the high cost associated with advanced MRD testing technologies, especially NGS-based approaches. While these methods offer unparalleled sensitivity, their initial investment in equipment, reagents, and skilled personnel can be prohibitive for many healthcare institutions, particularly in resource-limited settings. This cost factor can limit the widespread accessibility of these advanced diagnostic tools, creating disparities in care. Furthermore, the interpretation of MRD results can be complex, requiring specialized expertise and robust bioinformatics support. Differentiating true residual disease from polyclonal B-cell or T-cell receptor expansions, especially in the context of immunotherapy, can be challenging and requires sophisticated analytical capabilities. The limited regulatory approval and reimbursement landscape in some regions also pose a constraint. While progress is being made, broader and more consistent reimbursement policies are still needed to incentivize the widespread adoption of MRD testing as a standard of care across all relevant cancer types. The availability of skilled personnel trained in molecular diagnostics and bioinformatics is also a bottleneck in certain areas, hindering the seamless integration of these advanced testing platforms into routine clinical practice. Finally, the inherent biological variability of cancer, with its potential for clonal evolution and emergence of resistance mechanisms, necessitates continuous refinement and validation of MRD assays to maintain their clinical relevance.

The Next-Generation Sequencing (NGS) segment, within the Hematological Malignancies application, is poised to be a dominant force in the Cancer Minimal Residual Disease (MRD) testing market, with North America and Europe leading in regional market share. The projected market size for NGS in MRD testing alone is expected to exceed $6.5 billion by 2033, highlighting its transformative impact. This dominance is rooted in several key factors.

Segment Dominance: Next-Generation Sequencing (NGS) & Hematological Malignancies

Regional Dominance: North America & Europe

While other segments like Flow Cytometry and PCR will continue to play a role, especially in specific niches and for initial screening, NGS is set to define the future of highly sensitive and comprehensive MRD detection, particularly within the critically important application of hematological malignancies, with North America and Europe spearheading this transformation.

The Cancer Minimal Residual Disease (MRD) testing industry's growth is significantly catalyzed by the relentless pursuit of improved patient outcomes and the advancement of precision medicine. The ability of MRD testing to detect even the slightest presence of cancer cells post-treatment empowers clinicians to make more informed decisions, leading to personalized treatment strategies and reduced relapse rates. Furthermore, technological innovations, particularly in Next-Generation Sequencing (NGS) and advanced Polymerase Chain Reaction (PCR) techniques, are continuously enhancing the sensitivity, specificity, and speed of MRD detection, making it a more accessible and valuable diagnostic tool. The increasing clinical validation and integration of MRD testing into treatment guidelines across various cancer types, especially hematological malignancies, is a powerful growth driver, building physician confidence and fostering widespread adoption.

This comprehensive report offers an in-depth analysis of the global Cancer Minimal Residual Disease (MRD) testing market, covering its trajectory from 2019 to 2033. With 2025 as the base and estimated year, the report meticulously details market dynamics, including current market size of $5.2 billion and an impressive projected value of $15.4 billion by 2033. It dissects the market by Type (Flow Cytometry, Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Other), Application (Hematological Malignancies, Leukemia, Lymphoma, Solid Tumors, Other), and explores crucial Industry Developments. The report provides unique insights into market trends, driving forces, challenges, and identifies key regions and segments poised for dominance, with a particular focus on the groundbreaking impact of NGS in hematological malignancies and the leadership of North America and Europe. It also highlights significant developments and lists the leading players shaping this dynamic sector, offering valuable intelligence for stakeholders seeking to understand and capitalize on the evolving landscape of cancer MRD testing.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.7%.

Key companies in the market include Adaptive Biotechnologies Corporation, ArcherDX, Inc. (Invitae Corporation), Asuragen, Arup Laboratories, Bio-Rad Laboratories, Cergentis B.V., F. Hoffmann- La Roche Ltd, Guardant Health, ICON plc, Invivoscribe, Laboratory Corporation of America Holdings, Mission Bio, Natera, Inc., NeoGenomics Laboratories, Opko Health, Quest Diagnostics Incorporated, Sysmex Corporation, Genetron Health, .

The market segments include Type, Application.

The market size is estimated to be USD 984.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cancer Minimal Residual Disease Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cancer Minimal Residual Disease Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.