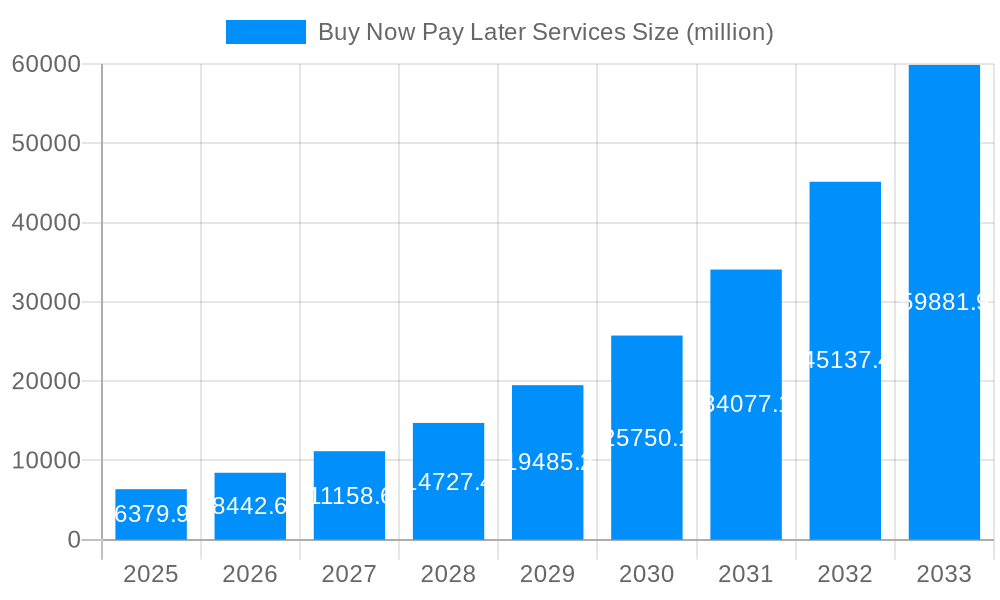

1. What is the projected Compound Annual Growth Rate (CAGR) of the Buy Now Pay Later Services?

The projected CAGR is approximately 32.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Buy Now Pay Later Services

Buy Now Pay Later ServicesBuy Now Pay Later Services by Application (Fashion and Garment Industry, Consumer Electronics, Cosmetic Industry, Healthcare, Others), by Type (Individual, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Buy Now Pay Later (BNPL) services market is experiencing explosive growth, projected to reach a market size of $6379.9 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 32.2%. This surge is driven by several key factors. Firstly, the increasing adoption of e-commerce and the rising preference for convenient and flexible payment options among consumers fuels demand. Secondly, the expansion of BNPL services into diverse sectors like fashion, consumer electronics, cosmetics, and healthcare broadens the market reach. The individual segment currently dominates, but the enterprise segment is witnessing significant growth, fueled by businesses seeking to enhance customer acquisition and loyalty. Furthermore, technological advancements, such as improved risk assessment models and seamless integration with e-commerce platforms, contribute to the market expansion. However, regulatory scrutiny and concerns surrounding potential consumer debt burdens present challenges to sustained growth. Competitive pressures among numerous established and emerging players, including Afterpay, Klarna, and Affirm, further shape the market dynamics.

Looking ahead, the BNPL market's trajectory for 2025-2033 is predicted to maintain a robust growth trajectory, driven by continued e-commerce expansion in developing economies, particularly in Asia-Pacific and parts of Africa. Innovative features like enhanced customer loyalty programs integrated with BNPL and the emergence of embedded finance solutions will likely drive adoption. While potential regulatory changes and macroeconomic conditions may introduce some uncertainty, the overall market outlook remains positive, pointing toward continued expansion and market consolidation amongst major players in the coming years. The shift toward enterprise solutions within BNPL offers a significant opportunity for future expansion and increased market share for players catering to business needs.

The Buy Now Pay Later (BNPL) services market experienced explosive growth during the study period (2019-2024), fueled by the rise of e-commerce and a shift in consumer spending habits. The market's value surged into the multi-billion dollar range, with projections indicating continued expansion throughout the forecast period (2025-2033). The estimated market value in 2025 stands at XXX million, showcasing the significant traction BNPL has gained. This growth is underpinned by several factors, including the increasing popularity of online shopping, a younger generation more comfortable with digital payments and flexible financing options, and the aggressive marketing strategies employed by major players. The market's competitive landscape is characterized by both established financial institutions like Visa and newer fintech companies like Afterpay and Klarna, constantly innovating and expanding their offerings. This competition has led to increased accessibility, lower fees, and diverse product offerings, further driving market growth. However, concerns regarding consumer debt and regulatory scrutiny are potential headwinds that need to be addressed to ensure sustainable growth. The shift towards embedded finance, where BNPL solutions are integrated directly into e-commerce platforms, is a prominent trend, streamlining the checkout process and enhancing user experience. This, in turn, significantly increases user adoption and overall market penetration. The evolving regulatory environment is also a key aspect, with governments worldwide grappling with the implications of this rapidly expanding sector, potentially introducing regulations impacting the industry’s trajectory in the coming years. The analysis of transaction volumes, average transaction values, and penetration rates across different demographics reveals a consistently upward trend, confirming the market's robust potential.

Several key factors are propelling the growth of the BNPL services market. Firstly, the increasing prevalence of e-commerce has created a fertile ground for BNPL services. Online shoppers, accustomed to the convenience of online purchases, readily embrace payment options offering flexibility and immediate gratification. Secondly, the younger demographic, known for its tech-savviness and comfort with digital platforms, is a major driver of BNPL adoption. Their preference for seamless, mobile-first experiences makes BNPL a natural fit for their spending habits. Thirdly, the marketing strategies employed by BNPL providers have been highly effective in building brand awareness and user adoption. Targeted advertising campaigns, partnerships with retailers, and seamless integration into e-commerce checkouts have played a pivotal role in expanding the market's reach. The competitive landscape, with many established players and new entrants vying for market share, also contributes to innovation and the creation of even more attractive and accessible BNPL options for consumers. Finally, the relatively low barriers to entry for merchants who integrate BNPL solutions are also fueling adoption, making it an attractive offering for businesses of all sizes. This ecosystem fosters a positive feedback loop, leading to increasing merchant and consumer adoption and solidifying the BNPL market’s position in the wider financial technology landscape.

Despite its rapid growth, the BNPL sector faces significant challenges and restraints. The most prominent concern is the potential for increased consumer debt. The ease and accessibility of BNPL can lead to overspending and difficulty in managing repayments, potentially resulting in financial hardship for some consumers. This necessitates responsible lending practices and consumer education. Regulatory scrutiny is also a major challenge. Governments worldwide are increasingly examining the BNPL sector to ensure consumer protection and address potential risks to financial stability. Changes in regulations, such as stricter lending requirements or increased disclosure mandates, could impact the industry's growth trajectory. Furthermore, competition within the BNPL market is fierce, putting pressure on profit margins and requiring providers to constantly innovate and adapt to remain competitive. The cost of acquiring new customers and managing defaults also presents a significant financial hurdle for many providers. Finally, potential security breaches and data privacy concerns are inherent risks in any digital financial service, posing both reputational and financial risks to providers. Addressing these challenges effectively will be crucial for the long-term sustainability and growth of the BNPL sector.

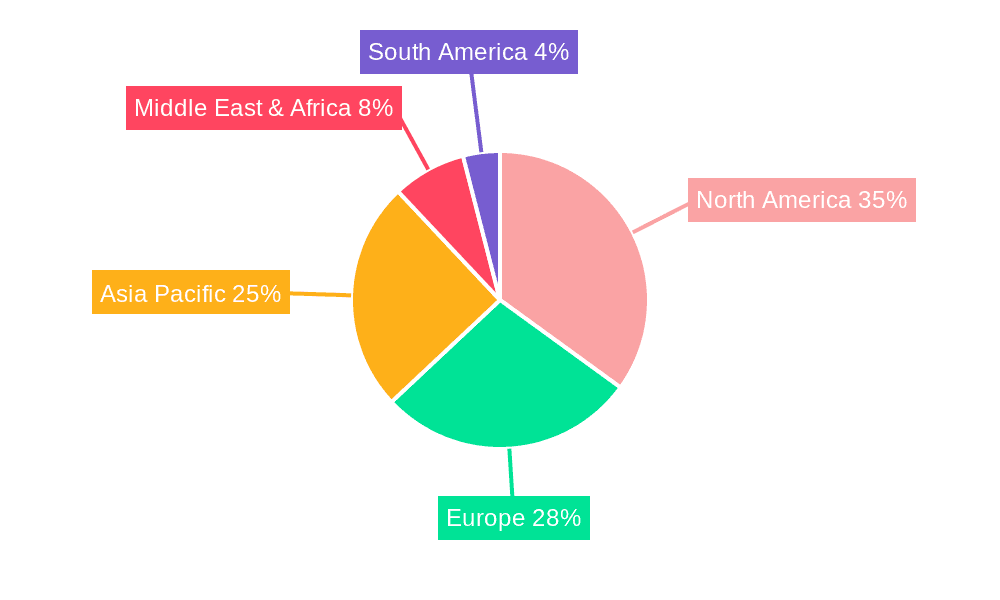

The BNPL market is geographically diverse, with significant growth potential across various regions. However, North America and Europe currently dominate the market, owing to high levels of e-commerce penetration and consumer acceptance of digital financial services. Within these regions, the Individual segment significantly outweighs the Enterprise segment. Consumers are the primary drivers of BNPL adoption, while businesses are increasingly integrating these services into their payment solutions.

North America: The high concentration of leading BNPL providers and a well-developed e-commerce infrastructure contribute to North America’s market dominance. The US, in particular, showcases high adoption rates across several consumer segments, highlighting the market’s strong growth potential.

Europe: Similar to North America, Europe benefits from a mature e-commerce ecosystem and a receptive consumer base. Significant growth is anticipated across various European countries, reflecting the widespread integration of BNPL services into both online and offline retail channels.

Asia-Pacific: While currently exhibiting lower penetration compared to North America and Europe, the Asia-Pacific region possesses immense growth potential driven by rapidly expanding e-commerce markets and a young, digitally-savvy population. Key markets within the region are experiencing substantial adoption.

Application Segment Dominance: The Fashion and Garment Industry currently dominates the application segments, given the high transaction value and the inherent appeal of BNPL services for larger purchases. Consumer Electronics and Cosmetics industries also show substantial adoption rates and significant growth potential. While Healthcare and ‘Others’ (which includes various other sectors like furniture, travel and home goods) are emerging segments, their contributions to the overall BNPL market are relatively smaller compared to the above-mentioned segments.

The dominance of the Individual segment is clear. The ease and convenience of BNPL solutions directly benefit individual consumers, leading to its significant share of the overall market size. Enterprise adoption, while steadily increasing, remains smaller due to the complexity of integration and bespoke solutions required for business applications. These factors combined paint a picture of the market's current focus and its potential future growth across different geographic areas and consumer applications.

The BNPL industry's growth is fueled by several key catalysts. The increasing integration of BNPL into e-commerce platforms creates seamless checkout experiences, boosting consumer adoption. Expanding partnerships between BNPL providers and merchants broaden the reach and accessibility of these services. Continuous innovation in technology, including improved risk assessment tools and personalized offerings, further enhances user experience and expands the market. Finally, the evolution of regulatory frameworks and clearer guidelines will create a more stable and predictable environment, encouraging further investments and growth in this sector.

This report provides a detailed analysis of the Buy Now Pay Later services market, covering market size, growth trends, key players, and future prospects. The report's insights offer valuable information for investors, businesses, and policymakers seeking a comprehensive understanding of this dynamic sector. The extensive analysis considers historical data, current market dynamics, and future projections to deliver a well-rounded perspective on the evolution and continued growth of BNPL services. This comprehensive view includes the impact of significant technological advancements, shifting consumer behavior, and the ever-evolving regulatory environment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 32.2%.

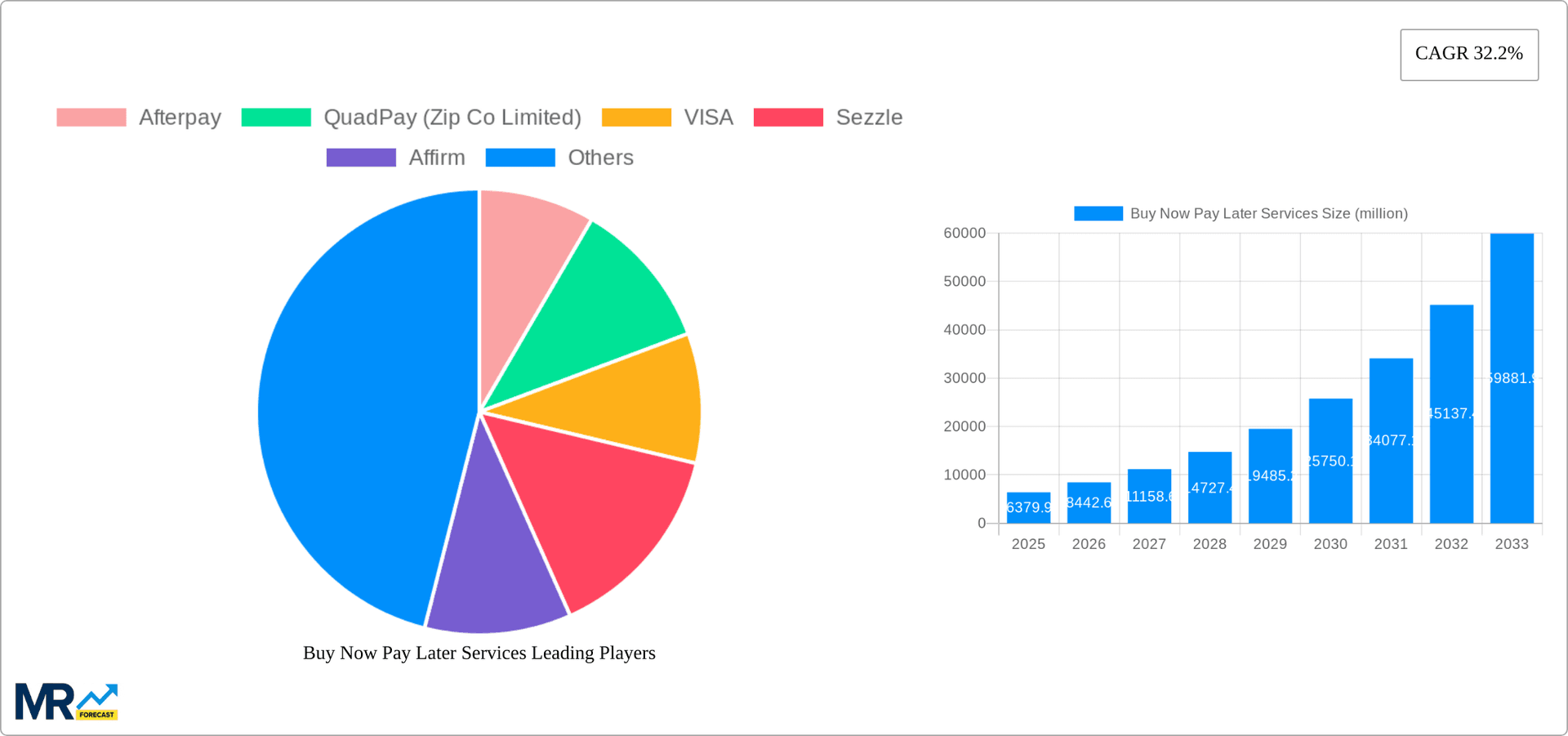

Key companies in the market include Afterpay, QuadPay (Zip Co Limited), VISA, Sezzle, Affirm, Klarna, Splitit, Latitude Financial Services, Flexigroup, Reepay, Akulaku, Hoolah, Atome, Pine Lab, Zest Money BNPL, Openpay, Rely, Limepay, PayRight, .

The market segments include Application, Type.

The market size is estimated to be USD 6379.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Buy Now Pay Later Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Buy Now Pay Later Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.