1. What is the projected Compound Annual Growth Rate (CAGR) of the Buy Now Pay Later Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Buy Now Pay Later Platform

Buy Now Pay Later PlatformBuy Now Pay Later Platform by Type (/> 4-month Interest-free, 6-month Interest-free, Others), by Application (/> Fashion & Garment Industry, Consumer Electronics, Cosmetic Industry, Healthcare, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

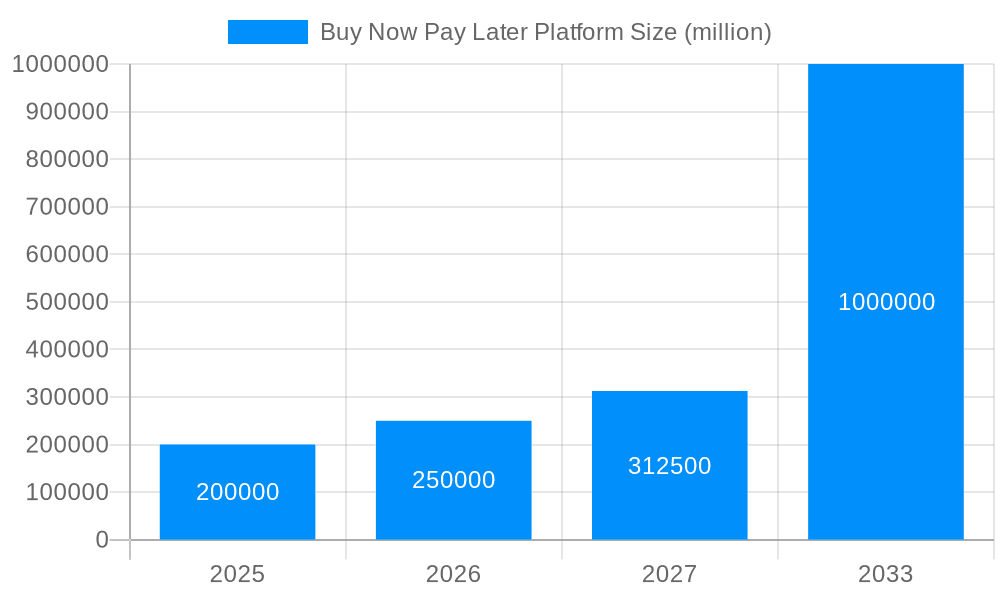

The Buy Now Pay Later (BNPL) platform market is experiencing explosive growth, driven by the increasing preference for flexible payment options among consumers and the rising adoption of e-commerce. The market, estimated at $200 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, reaching an impressive $1 trillion by 2033. This surge is fueled by several factors, including the convenience and accessibility of BNPL services, particularly among younger demographics. The integration of BNPL options into online and in-store checkout processes has further propelled its adoption, offering a seamless and frictionless shopping experience. The diversification of the BNPL market across various sectors, including fashion and garment, consumer electronics, cosmetics, and healthcare, contributes to its broad appeal. Competition is fierce, with established players like PayPal and Visa alongside innovative fintech startups like Afterpay, Klarna, and Affirm battling for market share. Geographical expansion, particularly into emerging markets with growing digital adoption, presents significant growth opportunities. However, regulatory scrutiny and concerns regarding consumer debt management pose potential restraints.

Despite its remarkable growth, the BNPL market faces challenges. Increased regulatory scrutiny concerning consumer protection and responsible lending practices could impact future growth. The risk of rising consumer debt, coupled with potential economic downturns, represents another significant factor. Further, competition among numerous players necessitates continuous innovation and strategic partnerships to maintain a competitive edge. The expansion into new regions also demands careful consideration of local regulations and consumer preferences. Nevertheless, the overall trajectory indicates strong potential for sustained growth within the BNPL ecosystem, underpinned by the persistent demand for flexible and accessible payment solutions in a rapidly evolving digital marketplace. The integration of advanced technologies, such as AI and big data analytics, for improved risk assessment and personalized offers will also play a key role in the future of BNPL.

The Buy Now Pay Later (BNPL) platform market experienced explosive growth during the study period (2019-2024), exceeding expectations and establishing itself as a dominant force in global e-commerce. The market's value surged into the multi-billion dollar range, driven by a confluence of factors including increased consumer adoption, enhanced technological infrastructure, and strategic partnerships with major players like Visa and PayPal. The historical period saw a significant shift in consumer spending habits, with BNPL options becoming increasingly integrated into online checkout processes. This ease of access and the perceived financial flexibility offered by interest-free periods proved particularly appealing to younger demographics and those seeking budget-friendly purchasing options. The success of early adopters like Afterpay and Klarna set the stage for a rapid expansion of the market, attracting significant investment and triggering a wave of new entrants vying for market share. This led to increased competition, fostering innovation in terms of product offerings, repayment flexibility, and integration with diverse retail sectors. By 2025 (estimated year), the BNPL market is projected to reach a valuation in the tens of billions of dollars, showcasing its sustained momentum. The forecast period (2025-2033) anticipates continued growth, though potentially at a more moderated pace as the market matures and regulatory scrutiny intensifies. However, continued technological advancements and the ongoing expansion into new markets suggest that the BNPL platform landscape will remain dynamic and competitive throughout the forecast period. The market's future trajectory will significantly depend on factors such as evolving regulatory frameworks, consumer debt levels, and the ability of existing and emerging players to adapt to the changing market dynamics.

Several key factors are driving the remarkable growth of the BNPL platform market. Firstly, the inherent convenience and accessibility offered by these platforms are major draws for consumers. The seamless integration into online checkout processes eliminates the complexities often associated with traditional financing options, making purchases quick and straightforward. Secondly, the appeal of interest-free periods is a powerful incentive, particularly for smaller purchases where the benefit of immediate gratification outweighs the potential cost of deferred payments. This is especially true for younger demographics who are more comfortable with digital financial transactions. Thirdly, the strategic partnerships forged between BNPL providers and major players in the financial and retail sectors have expanded the reach and acceptance of these platforms dramatically. The integration with established payment processors and retailers enhances brand credibility and broadens consumer access. Finally, continuous innovation within the BNPL space, such as personalized repayment options and improved risk management techniques, further enhances the customer experience and mitigates potential risks for both consumers and providers. These combined factors are creating a virtuous cycle of growth and adoption, propelling the BNPL market to new heights.

Despite its rapid growth, the BNPL industry faces several significant challenges and restraints. One primary concern is the potential for increased consumer debt. While interest-free periods are attractive, late or missed payments can lead to substantial fees and negatively impact credit scores. The rise in BNPL usage necessitates careful consumer education and responsible borrowing practices to mitigate this risk. Another challenge is the increasing regulatory scrutiny from governments worldwide. Concerns surrounding consumer protection, data privacy, and the potential for financial instability are leading to stricter regulations and oversight, potentially slowing the market's expansion. The competitive landscape is also highly intense, with numerous established and emerging players vying for market share. This pressure requires companies to constantly innovate and enhance their offerings to attract and retain customers. Furthermore, managing fraud and security risks associated with online transactions and handling a large volume of repayment schedules remains a significant operational challenge for BNPL providers. Addressing these challenges effectively will be crucial for the sustainable growth and long-term success of the BNPL market.

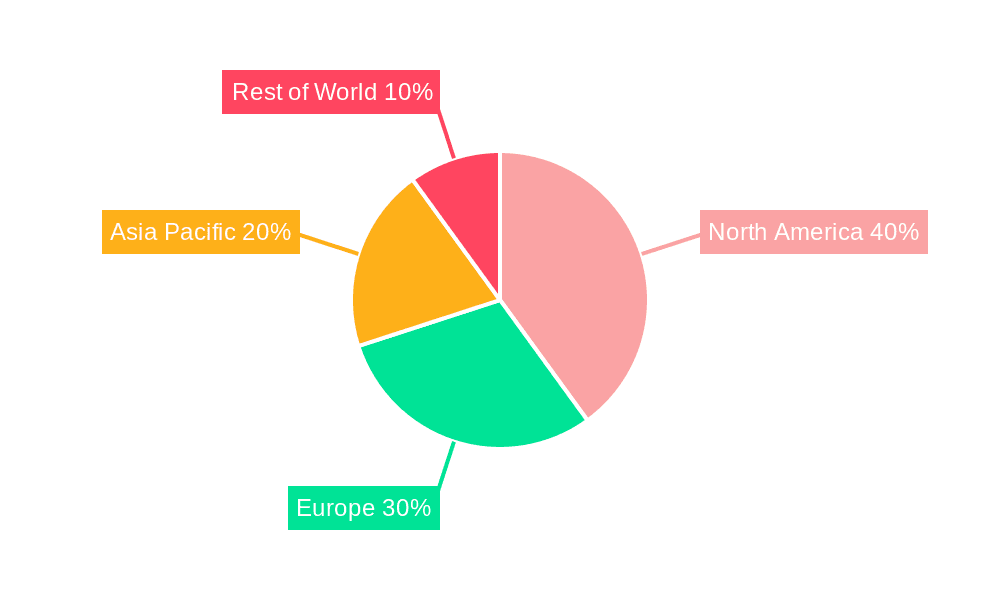

The BNPL market is experiencing significant growth globally, but certain regions and segments are showing particularly strong dominance.

North America: The US and Canada have emerged as leading markets due to high e-commerce penetration, a large consumer base, and early adoption of BNPL services. The established presence of major players like Affirm and Afterpay has further solidified this region's position. The market value here is estimated to be in the tens of billions of dollars by 2025.

Europe: Countries like the UK, Germany, and Sweden are exhibiting substantial growth due to increasing online shopping and a favourable regulatory environment (although this is evolving). Klarna, a European giant, significantly contributes to this growth, along with other regional players. The market is expected to reach several billion dollars by 2025.

Asia-Pacific: While still developing, the Asia-Pacific region displays high potential for BNPL adoption, driven by rising disposable incomes and increasing smartphone penetration. Markets in Australia, China, India and Japan show significant promise. Growth is projected to be substantial, though varied across nations due to diverse regulatory landscapes and consumer behaviors.

Dominant Segment: 4-month Interest-Free: This segment demonstrates high market penetration due to its appealing balance between immediate gratification and manageable repayment schedules. The short repayment term minimizes the potential for significant interest accrual and makes the option more attractive to budget-conscious consumers. This segment is projected to account for a substantial portion of the overall market value by 2025, in the multi-billion dollar range globally.

Fashion & Garment Industry: This application sector has experienced exceptional growth because it aligns perfectly with the impulsive nature of online fashion purchases. The ability to spread the cost of apparel over several payments makes it highly appealing to consumers, driving significant adoption within this vertical. Its market value is estimated to be in the billions by 2025.

The forecast period (2025-2033) suggests that these regions and segments will continue to drive the overall market growth, though the relative market shares may shift as the market matures and new competitors emerge. The continued expansion of BNPL services into emerging markets and new retail sectors will also be a significant factor shaping future market dynamics.

The BNPL industry's growth is fueled by several key catalysts. Increasing e-commerce adoption globally creates a vast addressable market, while technological advancements, such as improved risk assessment models and streamlined integrations, enhance efficiency and accessibility. Furthermore, strategic partnerships between BNPL providers and major retailers expand market reach and increase consumer trust, further boosting adoption rates. Finally, the ongoing innovation in product offerings, including personalized repayment plans and flexible payment options, caters to diverse consumer needs and strengthens market competitiveness. These combined factors create a positive feedback loop, driving further expansion of the BNPL industry.

This report provides a comprehensive overview of the Buy Now Pay Later platform market, analyzing historical trends, current market dynamics, and future growth projections. It delves into key drivers, challenges, and opportunities, offering valuable insights into the dominant players, key segments, and geographical regions. The report provides a detailed analysis of the market segmentation, covering different interest-free periods and application industries, and projects future market growth based on meticulous data analysis and expert forecasts, offering valuable insights for stakeholders across the BNPL ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Afterpay, Zippay, VISA, Sezzle, Affirm, Paypal, Splitit, Latitude Financial Services, Klarna, Humm, Openpay.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Buy Now Pay Later Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Buy Now Pay Later Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.