1. What is the projected Compound Annual Growth Rate (CAGR) of the Buy Now Pay Later Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Buy Now Pay Later Software

Buy Now Pay Later SoftwareBuy Now Pay Later Software by Type (Android System, IOS System), by Application (Online Retailer, Fintech Platform, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

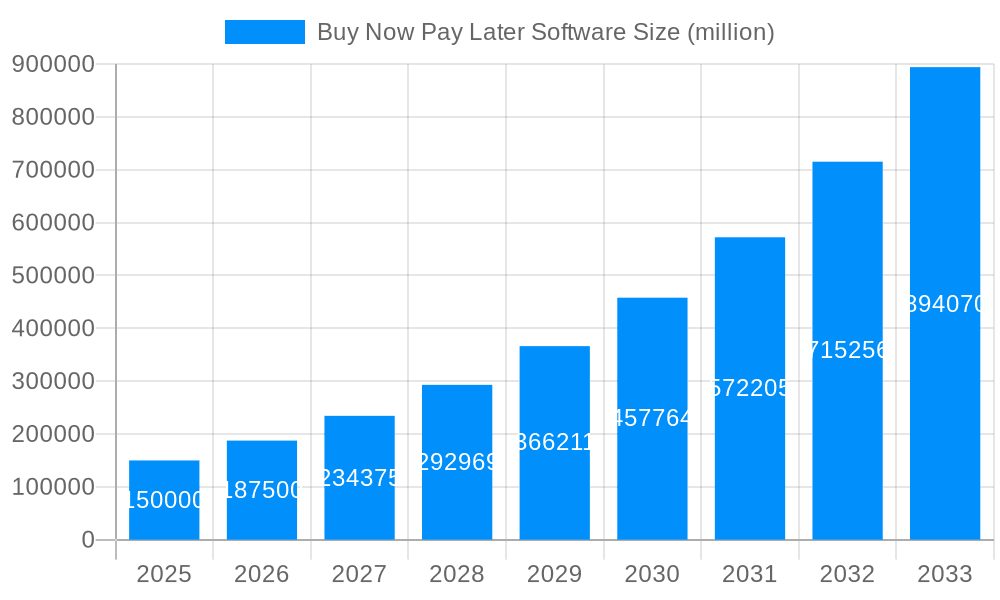

The Buy Now Pay Later (BNPL) software market is experiencing explosive growth, fueled by the increasing popularity of e-commerce and a shift in consumer spending habits. The market's expansion is driven by several factors, including the convenience and accessibility offered by BNPL services, particularly to younger demographics. The ease of integration with online retailers and fintech platforms, coupled with the ability to process transactions quickly and efficiently, further enhances adoption. While precise market sizing data isn't provided, considering the numerous players and their global reach, we can reasonably estimate the 2025 market size to be around $150 billion USD, based on reported funding rounds and market analyses of similar fintech sectors. A conservative Compound Annual Growth Rate (CAGR) of 25% is projected for the forecast period (2025-2033), reflecting a maturing market with increasing competition and regulatory scrutiny. This growth is underpinned by continued e-commerce expansion in developing economies and innovations within the BNPL ecosystem itself, such as improved risk management and fraud detection capabilities.

However, the market is not without its challenges. Regulatory hurdles, varying across different jurisdictions, present a significant restraint to growth. Concerns regarding consumer debt and potential for financial instability are also impacting the market. The market segmentation shows significant strength in both the Android and iOS systems, indicating a broad reach across mobile devices. Online retailers are major adopters, with Fintech platforms also representing a considerable segment, suggesting potential future growth through partnerships and financial integrations. The competitive landscape is fiercely contested, with numerous established players vying for market share. Successful companies will differentiate themselves through superior risk management, innovative features, and strategic partnerships across diverse platforms and geographies. The continued evolution of this market will depend heavily on balancing financial inclusion and consumer protection with innovation and economic growth.

The Buy Now Pay Later (BNPL) software market experienced explosive growth between 2019 and 2024, fueled by the increasing popularity of e-commerce and a growing preference for flexible payment options among consumers. The global market value soared into the multi-billion dollar range during this period, with key players like PayPal, Affirm, and Klarna establishing significant market share. The historical period (2019-2024) saw a surge in adoption across various segments, including online retailers, fintech platforms, and other applications. The convenience and accessibility of BNPL services, often integrated directly into online checkout processes, significantly contributed to this growth. However, the rapid expansion also brought regulatory scrutiny and concerns about potential consumer debt. The base year 2025 marks a point of consolidation and strategic adjustment for many companies, with a focus on refining risk management strategies and enhancing user experience. The estimated market value for 2025 reflects this transitional phase, showing a growth rate that, while still significant, is more moderated compared to the preceding years. The forecast period (2025-2033) anticipates continued growth, but at a pace influenced by regulatory changes, evolving consumer behavior, and competition from traditional financial institutions offering similar services. The market is expected to reach tens of billions of dollars by 2033, showcasing the enduring appeal of BNPL as a payment solution. This growth will be driven by factors such as improved integration with existing e-commerce platforms, expansion into new markets and demographics, and the increasing sophistication of risk assessment and fraud prevention technologies. However, challenges remain, particularly around responsible lending practices and the need for increased financial literacy among consumers.

Several key factors contribute to the continued growth of the BNPL software market. Firstly, the rising popularity of e-commerce and online shopping provides a fertile ground for BNPL integration. Consumers increasingly prefer the convenience of online shopping, and BNPL offers an attractive payment option that removes immediate financial barriers, encouraging larger purchases. Secondly, the increasing adoption of mobile commerce further accelerates the trend, as mobile apps provide seamless access to BNPL services. Thirdly, the younger generation's preference for flexible payment options and their comfort with digital financial tools significantly drives the market. This demographic is more inclined to utilize BNPL services due to their familiarity with digital technologies and a preference for managing their finances through mobile apps. Furthermore, the competitive landscape within the BNPL industry fosters innovation and the development of improved features, enhancing user experience and attracting new customers. This includes advancements in risk management technologies to mitigate potential losses and fraud, enhancing the stability and attractiveness of BNPL solutions for both consumers and merchants. Finally, the global reach of the internet and the increasing penetration of smartphones in emerging markets create substantial growth opportunities. This expansion into new markets with large and growing populations of digitally savvy consumers fuels the expansion of the BNPL market internationally.

Despite its impressive growth, the BNPL software market faces significant challenges. Regulatory scrutiny is a major concern, with governments worldwide examining the potential for increased consumer debt and the need for better consumer protection measures. This includes concerns about responsible lending practices, transparency of fees and interest rates, and the potential for consumers to accumulate excessive debt. Furthermore, the high rate of charge-offs and defaults represents a significant risk to BNPL providers, particularly during economic downturns or when unemployment increases. This necessitates sophisticated risk assessment and fraud prevention technologies to mitigate losses. Competition is another factor; the market is becoming increasingly crowded with established players and new entrants, putting pressure on profit margins and forcing companies to innovate to maintain a competitive edge. Maintaining a delicate balance between attracting new customers and managing risk effectively is crucial for the long-term success of BNPL providers. Finally, educating consumers about responsible BNPL usage and the potential financial implications is essential. Increased consumer awareness can mitigate the risk of unsustainable debt accumulation and promote more responsible use of these convenient payment options.

The Online Retailer segment is projected to dominate the BNPL software market during the forecast period (2025-2033). Several factors contribute to this dominance:

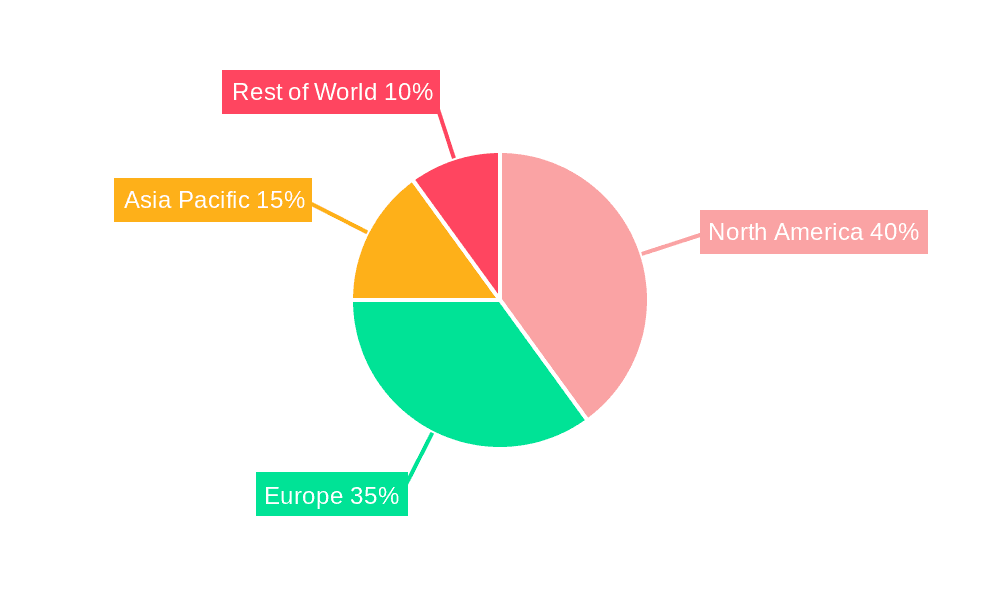

Geographic Dominance: While the market is globally dispersed, North America and Western Europe are likely to maintain significant market share due to high e-commerce penetration, established BNPL infrastructure, and regulatory environments that facilitate its growth (albeit with increasing scrutiny). Asia-Pacific will also demonstrate considerable growth, driven by increasing smartphone penetration and the expansion of e-commerce in emerging economies. However, regulatory hurdles and varying levels of financial literacy could influence the pace of growth in certain regions.

The Buy Now Pay Later software industry is experiencing robust growth fueled by several factors. The increasing penetration of smartphones and internet access globally creates a larger potential customer base readily accessible through mobile apps. The continuous evolution of e-commerce, particularly mobile commerce, provides a vast platform for BNPL integration, enhancing convenience for customers and boosting sales for retailers. Furthermore, innovative technological advancements enhance risk management capabilities and fraud prevention, resulting in a more sustainable and secure BNPL ecosystem. Finally, strategic partnerships between BNPL providers, merchants, and fintech platforms further expand market reach and solidify the position of BNPL as a preferred payment method.

This report provides a comprehensive analysis of the Buy Now Pay Later software market, covering historical data, current trends, and future projections. It offers insights into key drivers and restraints, examines leading players and their strategies, and analyzes market segments to provide a complete understanding of this rapidly evolving industry. The report will be invaluable for businesses involved in or considering entering the BNPL space, investors seeking investment opportunities, and regulatory bodies striving to establish robust and sustainable frameworks for this growing financial technology sector. The report also delves into future projections, taking into account factors such as emerging technologies, regulatory shifts and changing consumer preferences, providing a clear picture of the potential trajectory of the BNPL market over the next decade and beyond.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PayPal, Afterpay, Sezzle, EasyPay, GoCardless, Zip, Postpay, Wisetack, Sunbit, Klarna, Laterpay, Affirm, ViaBill, Splitit, Bread Financial, Credit Key, Zilla, Laybuy, FuturePay, TABBY, Alternative Payments, Tamara, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Buy Now Pay Later Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Buy Now Pay Later Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.