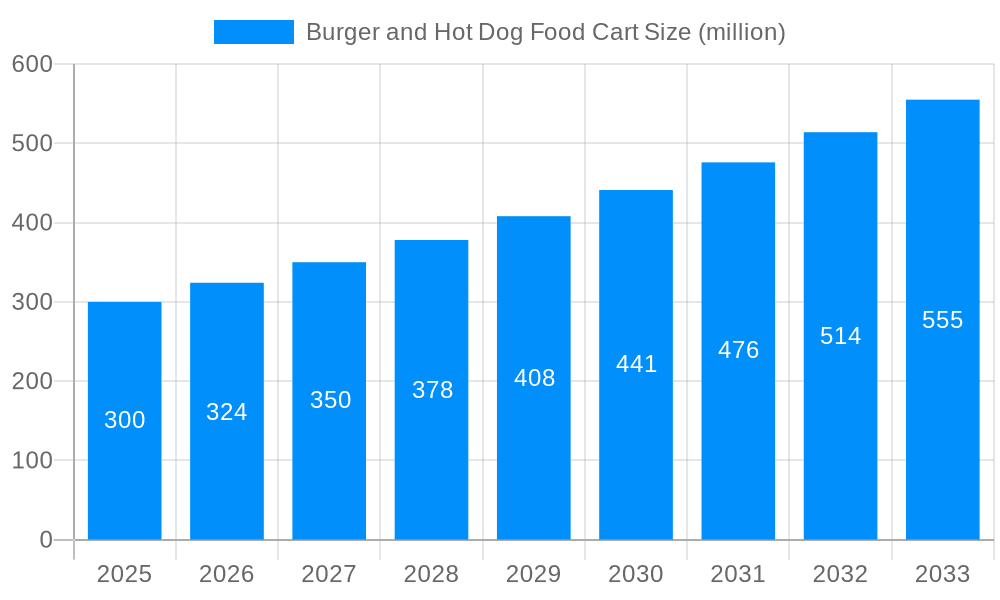

1. What is the projected Compound Annual Growth Rate (CAGR) of the Burger and Hot Dog Food Cart?

The projected CAGR is approximately 7.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Burger and Hot Dog Food Cart

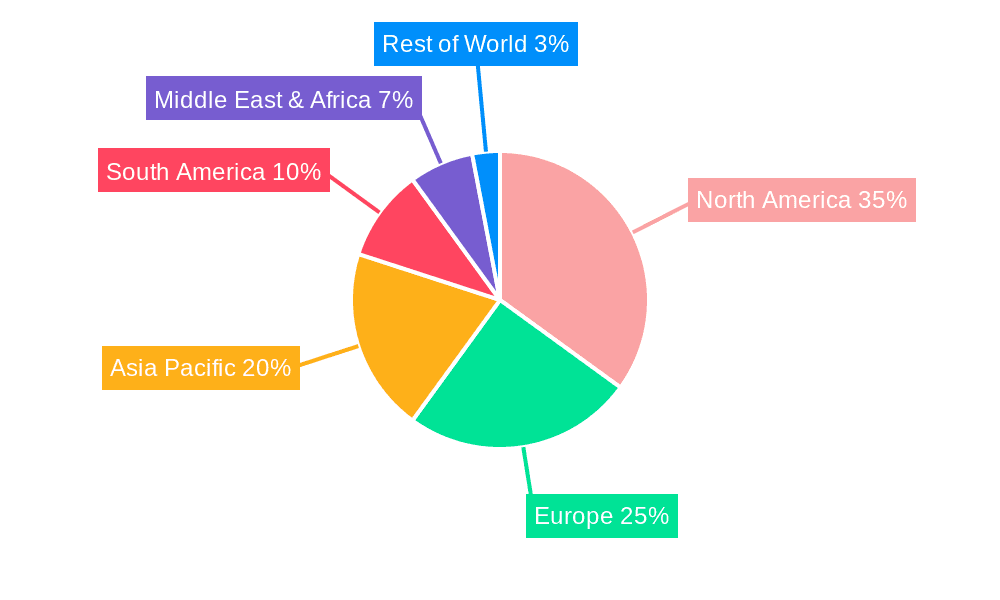

Burger and Hot Dog Food CartBurger and Hot Dog Food Cart by Type (Fixed Dining Car, Mobile Dining Car, World Burger and Hot Dog Food Cart Production ), by Application (Catering, Individual Merchants, Others, World Burger and Hot Dog Food Cart Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global burger and hot dog food cart market, a vibrant segment of the quick-service restaurant (QSR) industry, is defined by its accessibility, portability, and low entry barriers. Projecting a global market size of $1.5 billion in the base year 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 7.5%, this sector demonstrates significant potential. This growth is fueled by escalating consumer demand for convenient and affordable culinary experiences, particularly among younger demographics and in urban environments. Key growth drivers encompass the surging popularity of food trucks and street food culture, increasing disposable incomes in emerging economies, and the inherent operational flexibility of mobile food ventures. Emerging trends highlight a shift towards menu customization and healthier alternatives, with food carts increasingly utilizing local ingredients and accommodating diverse dietary needs. Nevertheless, the market faces challenges including rigorous food safety and permit regulations, intense competition from established QSR brands, and economic sensitivities influencing consumer spending.

Strategic foresight is essential for businesses operating within this evolving market. Businesses must prioritize adaptability to cater to changing consumer preferences, effectively manage regulatory landscapes, and optimize operational expenditures. Menu innovation, strategic alliances with food delivery platforms, and robust marketing initiatives are crucial for sustained success. Opportunities for expansion are abundant, particularly in rapidly urbanizing regions with growing disposable incomes. The competitive arena is expected to intensify, underscoring the need for operational efficiency, unwavering quality, and a distinctive brand presence to secure market share. The outlook for the coming decade is positive, anticipating continued expansion as the food cart market matures.

The burger and hot dog food cart industry, while seemingly simple, is a dynamic market exhibiting significant growth potential. Over the study period (2019-2033), we project a market value exceeding several million units, with substantial increases anticipated throughout the forecast period (2025-2033). The base year of 2025 serves as a crucial benchmark, indicating a robust market foundation built upon several key factors. Consumer preferences are shifting towards convenient, affordable, and customizable food options, a trend perfectly aligned with the mobile nature of food carts. This allows for strategic placement in high-traffic areas, maximizing exposure and sales opportunities. Furthermore, the relatively low start-up costs and operational flexibility associated with food carts attract entrepreneurs and investors seeking diverse revenue streams. The increasing popularity of food truck festivals and events further contributes to the industry's visibility and profitability. The estimated year 2025 shows a significant leap in market value compared to the historical period (2019-2024), driven by these aforementioned factors and strategic marketing and branding efforts by established players as well as numerous new entrants. The industry demonstrates resilience even amidst economic fluctuations, showcasing its adaptability and enduring appeal. The increasing use of technology, such as online ordering and delivery platforms, is revolutionizing the customer experience and expands the market reach beyond physical locations. This blend of traditional convenience and modern technological integration positions the burger and hot dog food cart industry for continued expansion in the coming years. The market is also segmented by geographic location, with certain urban centers experiencing faster growth than others due to factors such as population density, tourism, and local regulations.

Several key factors are fueling the impressive growth trajectory of the burger and hot dog food cart industry. The increasing demand for quick and affordable meals, particularly amongst busy professionals and students, forms a strong foundation for market expansion. The inherent portability and flexibility of food carts allow operators to reach a wider customer base compared to traditional brick-and-mortar establishments. This mobility allows for strategic positioning in high-traffic areas, including business districts, tourist hotspots, and entertainment venues, maximizing visibility and sales opportunities. Furthermore, the relatively low start-up costs and operational overhead compared to restaurants significantly reduce the financial risk for entrepreneurs, fostering a competitive and dynamic market. The ability to adapt menus and offerings to local tastes and preferences contributes to the sustained popularity of food carts. This can range from incorporating local ingredients to offering unique flavor combinations, keeping the offerings fresh and engaging. Finally, the burgeoning popularity of food truck rallies and festivals has become a crucial marketing platform, raising industry awareness and attracting new customers. This creates a synergistic effect, boosting both individual businesses and the overall industry growth.

Despite the considerable growth potential, the burger and hot dog food cart industry faces several challenges. Stringent health and safety regulations, varying across different jurisdictions, impose significant compliance burdens on operators. Securing permits and licenses can be complex and time-consuming, often presenting significant hurdles for new entrants. Competition within the industry is fierce, demanding continuous innovation and marketing efforts to retain and attract customers. Maintaining consistent food quality and service can be difficult, especially during peak hours or in challenging weather conditions. Finding suitable locations with high foot traffic and favorable regulatory environments is a continuous challenge, often requiring significant effort and negotiation. Fluctuations in the cost of raw materials, particularly meat and produce, directly impact profitability, requiring careful cost management and menu adjustments. Seasonal variations in customer demand can also create periods of lower revenue, necessitating proactive strategies for mitigating these fluctuations. Finally, negative publicity or food safety incidents can have severe repercussions on a business's reputation, highlighting the crucial importance of maintaining high hygiene standards.

Several regions and segments are expected to dominate the burger and hot dog food cart market during the forecast period.

Urban Centers: High population density and significant tourist traffic in major cities create ideal conditions for thriving food cart businesses. Areas with robust public transportation systems further enhance accessibility and customer reach.

Tourist Destinations: Popular tourist attractions and vacation spots offer substantial revenue potential, as visitors often seek quick and convenient meal options.

College Campuses and Business Districts: These locations boast large concentrations of potential customers with limited time and disposable income.

Customized Options/Specialty Items: Consumers increasingly demand unique and personalized food experiences. Carts offering gourmet burgers, artisan hot dogs, or creative combinations are likely to attract more customers.

Mobile Ordering and Delivery: The integration of technology into the customer experience can improve efficiency and expand market reach. Carts leveraging mobile ordering apps or delivery services gain a competitive edge.

The paragraphs above showcase the dominance of urban settings and tourist destinations, highlighting the importance of targeting consumers with limited time and a demand for readily available food choices. The ability to cater to a wide array of preferences through customized menu options and leveraging technological advancements in mobile ordering and delivery further supports the growth trajectory of these segments. The success within these areas is directly linked to effectively navigating the inherent challenges, such as regulatory compliance, maintaining consistent quality in a mobile setting, and adapting to fluctuations in demand.

The burger and hot dog food cart industry's growth is fueled by the convergence of several factors: increasing demand for convenient and affordable meals, the flexibility and low overhead of mobile operations, and the growing popularity of food truck festivals and events that boost brand visibility. The integration of technology, such as mobile ordering and delivery apps, further expands market reach and efficiency. Strategic location selection in high-traffic areas ensures maximum customer exposure and sales potential. Finally, continuous menu innovation, focusing on customized options and unique flavor combinations, helps to sustain consumer interest and market competitiveness.

Note: Many of the listed companies are not primarily food cart businesses, but may be involved in related services such as catering or logistics. A comprehensive list of leading pure-play food cart operators would require additional research.

This report provides a thorough analysis of the burger and hot dog food cart industry, covering market trends, driving forces, challenges, key segments and regions, and leading players. It presents valuable insights for entrepreneurs, investors, and industry stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed decisions about future opportunities. The report utilizes extensive data analysis to project market growth over the forecast period, providing a comprehensive overview of the current landscape and future prospects.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.5%.

Key companies in the market include Cousins Maine Lobster, Luke’s Lobster, Lobsterdamus, Bite into Maine, Freshies Lobster, Red Hook Lobster Pound, Aspen Crossing, Amtrak, Rovos Rail, MAV-csoport, Groupon, ELDCPS Home, VIA Rail, .

The market segments include Type, Application.

The market size is estimated to be USD 1.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Burger and Hot Dog Food Cart," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Burger and Hot Dog Food Cart, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.