1. What is the projected Compound Annual Growth Rate (CAGR) of the Built-in Roller Shutter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Built-in Roller Shutter

Built-in Roller ShutterBuilt-in Roller Shutter by Type (Aluminum Roller Shutters, Steel Roller Shutters, PVC Roller Shutters, Others), by Application (Stores and Shops, Garage, Warehouse, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

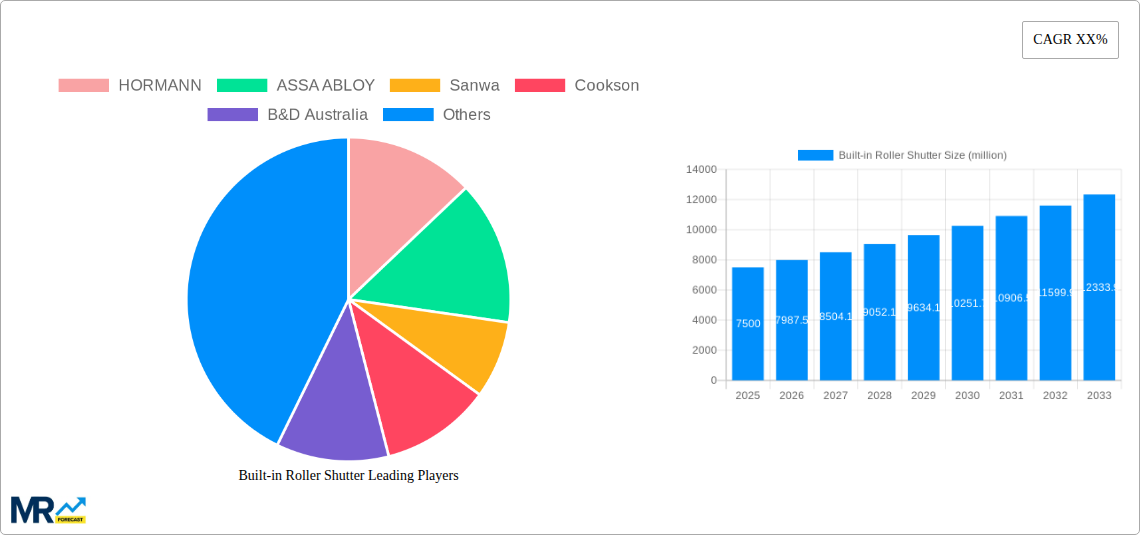

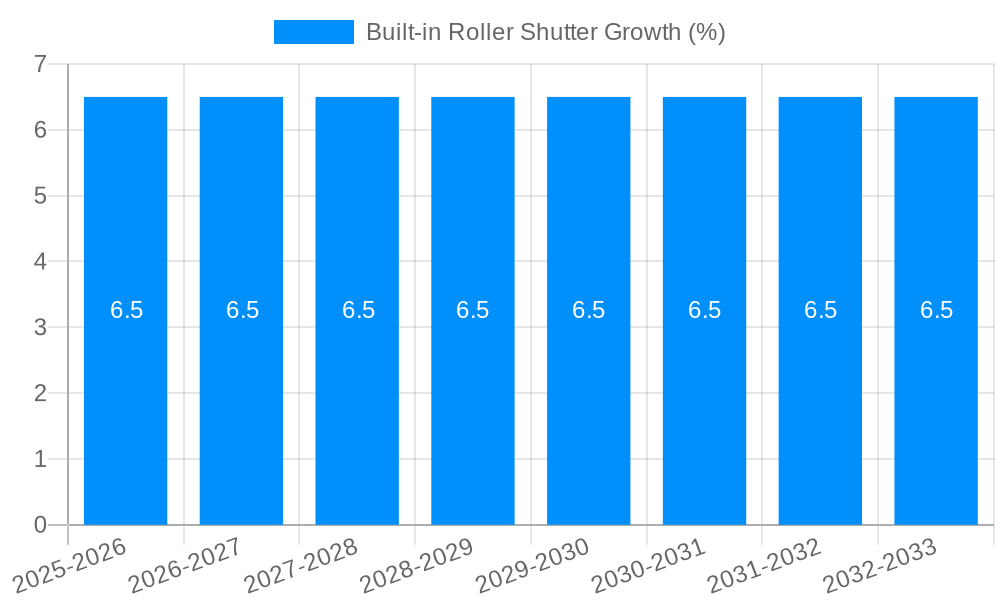

The global Built-in Roller Shutter market is poised for substantial expansion, driven by increasing demand for enhanced security, energy efficiency, and aesthetic appeal in residential and commercial buildings. With an estimated market size of approximately USD 7,500 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% from 2019 to 2033. This robust growth trajectory is fueled by a confluence of factors, including rising urbanization, a surge in new construction projects, and growing homeowner awareness regarding the benefits of integrated roller shutter systems. These systems offer not only protection against intruders but also contribute to thermal insulation, noise reduction, and protection from harsh weather conditions, making them an increasingly attractive investment. The market is witnessing a dynamic shift with key players like HORMANN, ASSA ABLOY, and Sanwa investing in innovative product development and strategic partnerships to capture market share. The adoption of smart home technologies is also influencing the market, with a growing demand for automated and app-controlled roller shutters.

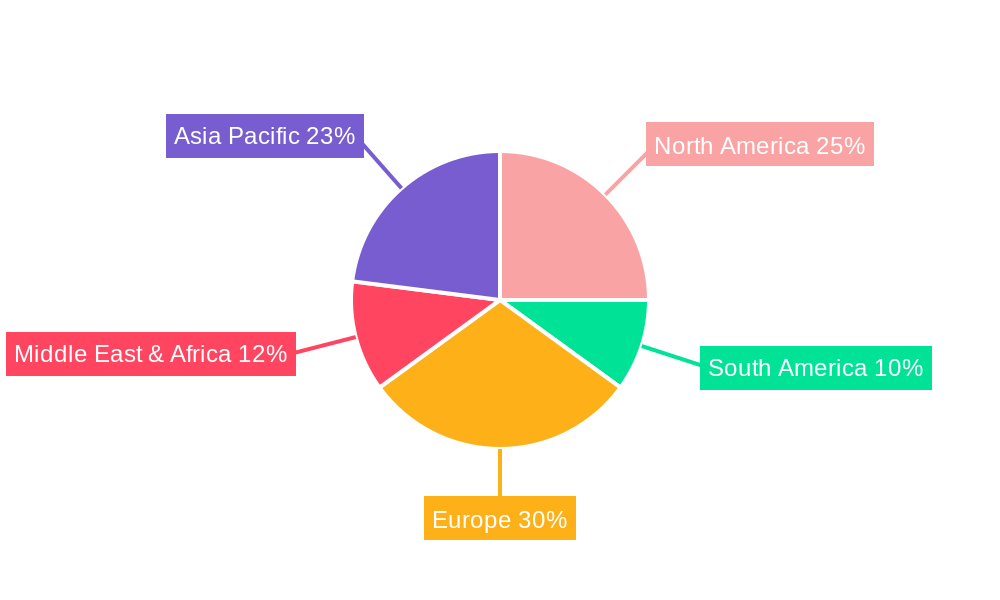

The market segmentation reveals a balanced demand across various applications, with Stores and Shops, Garage, and Warehouse sectors being significant contributors. However, the residential segment is expected to witness the fastest growth, driven by the trend towards modern home designs and enhanced security features. Aluminum roller shutters currently dominate the market due to their durability and resistance to corrosion, but PVC roller shutters are gaining traction owing to their cost-effectiveness and ease of installation. Geographically, Asia Pacific, led by China and India, is emerging as a key growth engine, owing to rapid industrialization and infrastructure development. North America and Europe, with their established markets and high disposable incomes, continue to represent significant revenue streams. Despite the positive outlook, factors such as the high initial cost of installation and the availability of alternative security solutions could pose minor restraints. Nevertheless, the overall market sentiment remains overwhelmingly positive, indicating a promising future for the built-in roller shutter industry.

Here is a report description for "Built-in Roller Shutters," incorporating your specified values, companies, segments, and headings.

The global built-in roller shutter market is poised for substantial growth, driven by increasing demand for security, energy efficiency, and aesthetic enhancement across residential, commercial, and industrial sectors. During the Historical Period (2019-2024), the market witnessed steady expansion, fueled by rising urbanization and a greater awareness of property protection solutions. The Base Year (2025) is expected to see the market value in the hundreds of millions, laying the groundwork for a more dynamic trajectory. Projections for the Forecast Period (2025-2033) indicate a compound annual growth rate (CAGR) that will push market valuations into the billions of dollars. A key insight from the Study Period (2019-2033) is the accelerating shift towards integrated solutions, where roller shutters are seamlessly incorporated into building designs from the outset, rather than being retrofitted. This trend is particularly evident in new construction projects, where architects and developers are prioritizing comprehensive security and insulation features. The market's evolution also points to a growing preference for advanced materials, such as reinforced aluminum alloys and high-density PVC, offering superior durability, weather resistance, and insulation properties. Furthermore, the integration of smart technology, including automated controls and remote access via mobile applications, is emerging as a significant differentiator, catering to the convenience-seeking consumer. The increasing adoption of energy-saving building codes worldwide is also contributing to the demand for roller shutters that offer effective thermal insulation, reducing heating and cooling costs. This multi-faceted demand underscores the built-in roller shutter's transformation from a purely functional security device to a sophisticated building component that enhances property value and occupant comfort. The market's robust performance in the Estimated Year (2025) will reflect these prevailing trends, with continued innovation expected to further shape its landscape through the Forecast Period (2025-2033).

The growth of the built-in roller shutter market is primarily propelled by an escalating global emphasis on enhanced security and safety for properties. In an era characterized by rising concerns over burglary and vandalism, homeowners and businesses alike are actively seeking robust solutions to protect their assets. Built-in roller shutters offer a formidable physical barrier that deters potential intruders, significantly reducing the risk of unauthorized access. Beyond security, the increasing awareness of energy efficiency in buildings is another major catalyst. Roller shutters, when properly installed, provide an additional layer of insulation, helping to regulate indoor temperatures and reduce reliance on heating and cooling systems. This contributes to lower energy bills and a reduced carbon footprint, aligning with growing environmental consciousness and government mandates for sustainable construction. The aesthetic appeal and architectural integration capabilities of modern built-in roller shutters are also playing a crucial role. Unlike traditional external shutters, built-in options can be seamlessly incorporated into the building facade, enhancing the overall architectural design and contributing to a cleaner, more streamlined appearance. This is particularly attractive in the context of new construction projects and modern renovations where aesthetics are a key consideration. Furthermore, the increasing disposable income in many developing economies translates into higher consumer spending on home improvement and property upgrades, creating a larger addressable market for these sophisticated security and insulation solutions.

Despite the promising growth trajectory, the built-in roller shutter market encounters several challenges and restraints that could moderate its expansion. A significant hurdle is the higher upfront cost associated with built-in roller shutters compared to their externally mounted counterparts or simpler window security solutions. The integration process during construction requires specialized planning and installation, which can add to the overall building expenses, making them a less accessible option for budget-conscious consumers or in regions with lower average incomes. Fluctuations in raw material prices, particularly for aluminum and steel, can also impact manufacturing costs and subsequently the retail price of roller shutters. Supply chain disruptions, as observed in recent years, can further exacerbate these cost pressures and lead to production delays. Another restraint is the complexity of installation and maintenance, especially for advanced automated or smart systems. While offering convenience, these systems can require specialized technicians for installation and repair, potentially leading to higher service costs and longer downtime in case of malfunctions. Furthermore, in certain established urban areas, aesthetic regulations or architectural preservation guidelines might limit the widespread adoption of roller shutters, especially if they are perceived to detract from the historical character of buildings. The availability of alternative security solutions, such as advanced alarm systems, reinforced glass, and modern grilles, also presents a competitive landscape, requiring roller shutter manufacturers to continually innovate and demonstrate superior value.

The Aluminum Roller Shutters segment is projected to dominate the global built-in roller shutter market due to its advantageous combination of durability, lightweight properties, corrosion resistance, and aesthetic versatility. Aluminum's inherent strength ensures robust security, while its malleability allows for a wide range of designs and finishes that can seamlessly integrate with various architectural styles. This makes it a preferred choice for both residential and commercial applications where security and visual appeal are paramount.

In terms of regional dominance, Europe is expected to lead the market, driven by a confluence of factors that favor the adoption of built-in roller shutters.

Within Europe, countries like Germany, France, the United Kingdom, and the Netherlands are expected to be significant contributors to this dominance, owing to their robust construction industries, high property values, and proactive approach to security and sustainability. The Stores and Shops application segment, particularly in urban centers, is also anticipated to witness substantial growth within these regions, as businesses prioritize the protection of their retail spaces and inventory.

The built-in roller shutter industry is experiencing significant growth catalysts, with the increasing demand for enhanced property security being a primary driver. As urban populations grow and concerns about crime persist, consumers are actively seeking robust solutions to protect their homes and businesses. Furthermore, the escalating emphasis on energy efficiency in building design, driven by environmental regulations and rising energy costs, is propelling the adoption of roller shutters for their thermal insulation properties. The aesthetic integration capabilities of built-in shutters, offering a cleaner and more modern look, also contribute to their appeal in new construction and renovation projects.

This comprehensive report on the built-in roller shutter market offers an in-depth analysis of trends, drivers, challenges, and future outlook. It delves into the segmentation of the market by type (Aluminum, Steel, PVC, Others) and application (Stores and Shops, Garage, Warehouse, Others), providing detailed insights into the performance and growth potential of each. The report utilizes a robust research methodology, covering the Historical Period (2019-2024), a detailed analysis of the Base Year (2025), and a thorough Forecast Period (2025-2033), spanning a total Study Period (2019-2033). Key market intelligence, including regional dominance, competitive landscape, and significant developments, is presented to provide stakeholders with actionable information for strategic decision-making. The report aims to equip industry participants with the necessary understanding to navigate the evolving market dynamics and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include HORMANN, ASSA ABLOY, Sanwa, Cookson, B&D Australia, Alpine, Lawrence, Best Roll-Up Door, Aluroll, Gliderol Garage Doors, Roller Doors, Shutter Victech Industry, Xufeng Door, Superlift.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Built-in Roller Shutter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Built-in Roller Shutter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.