1. What is the projected Compound Annual Growth Rate (CAGR) of the Braille Cartons Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Braille Cartons Packaging

Braille Cartons PackagingBraille Cartons Packaging by Type (Embossing, Screen Printing), by Application (Pharmaceutical, Food and Beverages, Health Care, Cosmetics and Beauty Care, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

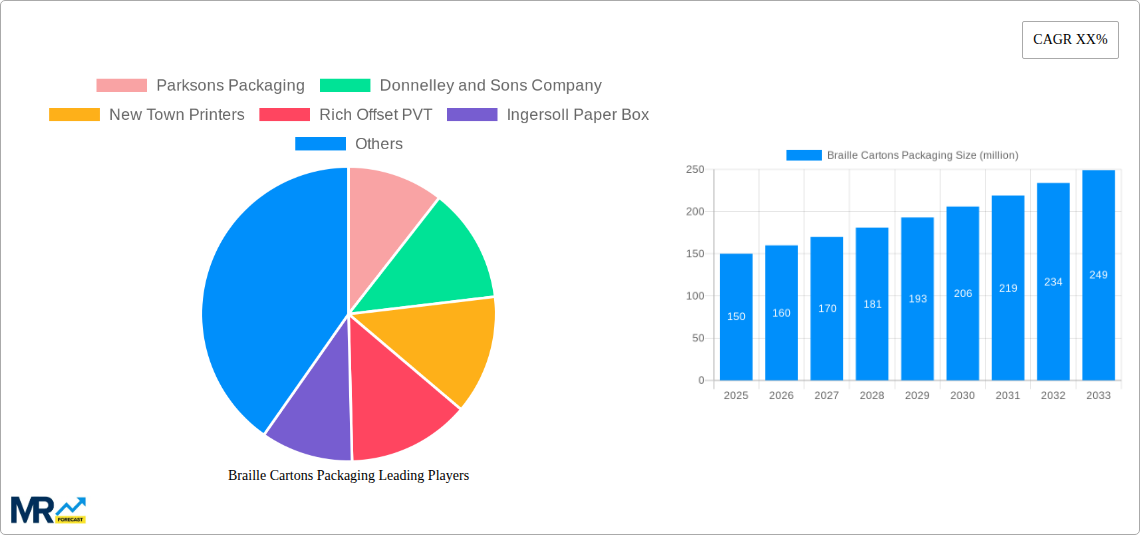

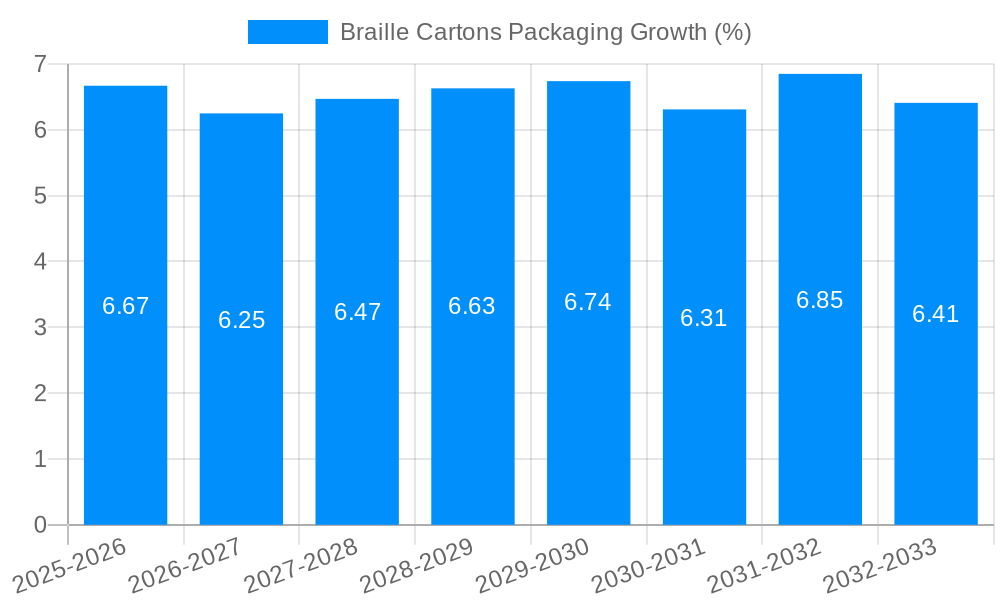

The Braille Cartons Packaging market is poised for significant expansion, projected to reach an estimated market size of approximately $150 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% expected throughout the forecast period of 2025-2033. This growth is primarily fueled by increasing global awareness and legislative mandates surrounding accessibility for visually impaired individuals across various consumer-facing industries. The pharmaceutical sector, in particular, is a major driver, as regulatory bodies worldwide are increasingly enforcing the inclusion of braille on medication packaging to ensure patient safety and adherence. Similarly, the food and beverage industry is recognizing the ethical and commercial imperative to cater to visually impaired consumers, leading to a greater adoption of braille packaging for product identification and differentiation. The cosmetics and beauty care sector also presents substantial opportunities, driven by brands aiming to enhance inclusivity and customer experience for a broader demographic.

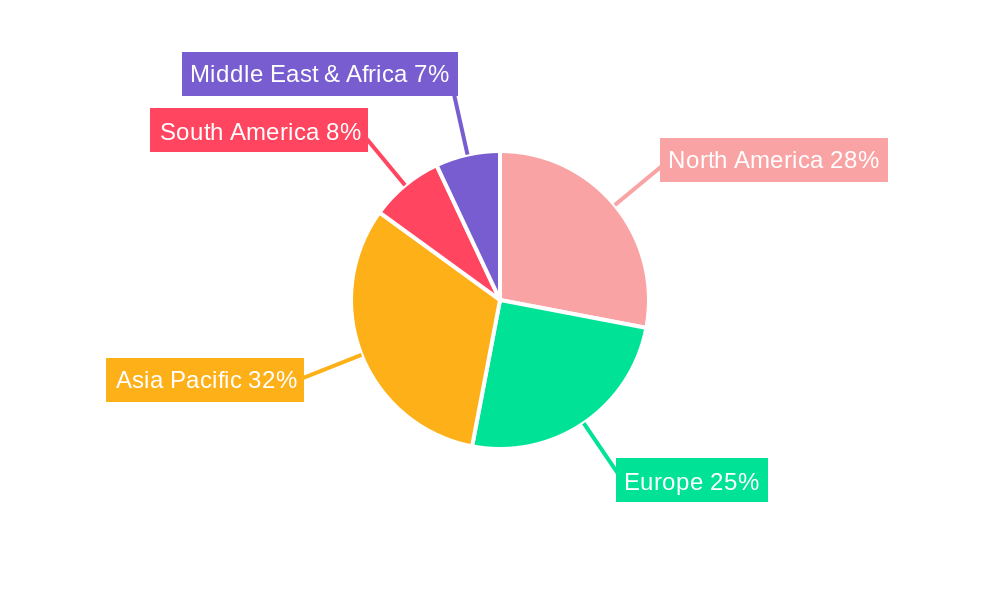

The market's trajectory is further supported by advancements in printing technologies, making the application of braille more efficient and cost-effective for a wider range of packaging materials. Emerging trends indicate a move towards more sophisticated braille integration, including tactile graphics and multi-language braille, enhancing user comprehension. However, the market is not without its challenges. High initial setup costs for specialized braille printing equipment and a lack of standardized braille specifications across different regions can act as restraints. Despite these hurdles, the continuous push for universal design and inclusive practices across industries, coupled with growing consumer demand for accessible products, are expected to propel the Braille Cartons Packaging market to new heights. Key regions like Asia Pacific, with its rapidly growing economies and increasing focus on consumer welfare, alongside established markets in North America and Europe, are expected to witness substantial growth.

Here's a comprehensive report description on Braille Cartons Packaging, incorporating the requested information and structure:

The global Braille Cartons Packaging market is poised for substantial growth, projecting a compound annual growth rate (CAGR) that reflects increasing demand for accessibility and regulatory compliance. During the Study Period of 2019-2033, with a specific focus on the Base Year of 2025, the market is expected to witness significant expansion. Current trends indicate a rising awareness among manufacturers regarding the importance of inclusive packaging solutions. This heightened consciousness is not merely philanthropic; it's increasingly driven by legislative mandates and a desire to cater to a broader consumer base. The adoption of Braille on product packaging is transitioning from a niche requirement to a standard expectation, particularly in sectors where consumer safety and clear identification are paramount. The Forecast Period of 2025-2033 is anticipated to be characterized by technological advancements in printing and embossing techniques, enabling more cost-effective and durable Braille application. Furthermore, the Historical Period of 2019-2024 laid the groundwork for this growth, with early adopters demonstrating the commercial viability and positive consumer reception of Braille-enabled packaging. Innovations in material science are also playing a crucial role, allowing for Braille to be applied to a wider range of carton substrates without compromising structural integrity. The market is also seeing a trend towards integrated Braille solutions, where the tactile markings are designed seamlessly into the overall packaging artwork, enhancing both functionality and aesthetics. This evolution signifies a maturation of the market, moving beyond basic compliance to proactive consumer engagement and brand differentiation through inclusive design. The estimated unit volume is projected to reach the millions, underscoring the scale of this evolving industry. The emphasis on sustainability is also subtly influencing Braille carton packaging, with a growing preference for eco-friendly inks and recycled materials that can accommodate tactile printing. This confluence of regulatory pressure, consumer demand for inclusivity, and technological innovation is shaping a dynamic and expanding market landscape for Braille cartons.

Several compelling factors are driving the significant growth trajectory of the Braille Cartons Packaging market. Foremost among these is the intensifying global focus on accessibility and the rights of visually impaired individuals. Regulatory bodies worldwide are increasingly implementing and enforcing legislation that mandates the inclusion of Braille on product packaging, particularly for pharmaceuticals, healthcare products, and consumer goods where clear identification is critical for safety and usability. This legislative push is a primary revenue driver, compelling manufacturers to integrate Braille into their packaging designs. Beyond compliance, there's a growing recognition among brands of the significant purchasing power of the visually impaired community. Companies are realizing that providing accessible packaging is not just a legal obligation but a strategic opportunity to build brand loyalty and tap into an underserved market segment. This consumer-centric approach is leading to proactive adoption of Braille, moving it from a mere compliance checkbox to a key element of customer experience. Furthermore, technological advancements in printing and embossing have made the application of Braille more efficient, cost-effective, and adaptable to various packaging materials. Innovations in digital printing, laser etching, and specialized embossing techniques allow for precise and durable Braille markings without significantly increasing production costs. The Estimated Year of 2025 highlights this phase of accelerated adoption, where these driving forces are converging to create a robust market environment. The increasing globalization of brands also means that companies are adopting universal packaging standards, including Braille, to ensure compliance and accessibility across diverse international markets. This confluence of ethical considerations, regulatory mandates, and technological advancements creates a powerful impetus for the Braille cartons packaging sector.

Despite the burgeoning growth, the Braille Cartons Packaging market is not without its challenges and restraints. One of the primary hurdles is the cost of implementation. While advancements have been made, incorporating Braille often involves additional printing or embossing processes, which can lead to increased manufacturing costs. This can be a significant deterrent for smaller businesses or those operating on tight margins, particularly when competing in price-sensitive markets. Technical complexities and variability in Braille standards across different regions can also pose challenges. Ensuring accurate and legible Braille that conforms to all relevant international and national standards requires meticulous attention to detail and specialized expertise, which might not be readily available to all manufacturers. Durability and legibility of the Braille markings over the product's lifecycle are another concern. Cartons are often subjected to various handling and environmental conditions, and there's a risk of Braille becoming worn out, smudged, or illegible, thereby defeating its purpose. Consumer awareness and education regarding Braille packaging also remain an area for development. While the visually impaired community understands its importance, a broader consumer base may not be fully aware of the benefits or the necessity of Braille, which can impact market acceptance and demand from a non-impaired consumer perspective. The availability of specialized printing equipment and skilled labor can also be a bottleneck, particularly in emerging markets. Setting up or adapting production lines to accommodate Braille printing requires investment and training, which can limit the speed of adoption. Finally, the potential for design interference with the overall aesthetic appeal of the packaging can be a concern for some brands, although modern techniques are increasingly integrating Braille seamlessly.

The Braille Cartons Packaging market is experiencing a surge in demand across several key regions, with North America and Europe currently leading the charge due to robust regulatory frameworks and high consumer awareness regarding accessibility. These regions have well-established legislative bodies that actively promote and enforce the inclusion of Braille on a wide array of products. For instance, the Americans with Disabilities Act (ADA) in the United States and similar directives in European countries have been instrumental in driving the adoption of Braille packaging. The strong presence of major pharmaceutical and healthcare companies, which are mandated to comply with stringent labeling regulations, further bolsters demand in these areas.

However, the Asia Pacific region is projected to exhibit the fastest growth rate in the coming years. This expansion is attributed to several factors:

Regarding segments, the Pharmaceutical application is a dominant force and is expected to continue its leadership through the Forecast Period of 2025-2033. The critical nature of medication and the need for accurate identification by visually impaired individuals make Braille an essential component of pharmaceutical packaging. Regulations surrounding drug safety and patient adherence strongly advocate for and, in many cases, mandate Braille labeling. This ensures that patients can correctly identify their medications, dosages, and expiry dates, thereby preventing potentially dangerous errors.

The Health Care segment also plays a pivotal role, encompassing a wide range of products from medical devices to over-the-counter remedies, all of which benefit from clear, tactile identification. The intersection of pharmaceutical and healthcare applications often means that regulatory requirements and safety considerations are paramount, thus driving consistent demand for Braille cartons.

While Food and Beverages and Cosmetics and Beauty Care are growing segments, their demand for Braille is often driven by voluntary adoption and brand differentiation rather than strict mandates, although this is gradually changing with increasing awareness. The Others segment, which could include educational materials or specialized consumer goods, also contributes to the market, showcasing the broad applicability of Braille cartons. The Type of Braille application, specifically Embossing, is currently the most prevalent due to its durability and cost-effectiveness for large-scale production of cartons. Screen Printing offers more flexibility for intricate designs and shorter runs, and its adoption is expected to grow as the market matures.

The Braille Cartons Packaging industry is experiencing accelerated growth fueled by an increasing emphasis on universal design principles and a growing understanding of the rights of persons with disabilities. Regulatory mandates across various countries, particularly in the pharmaceutical and healthcare sectors, are compelling manufacturers to integrate Braille for enhanced product safety and accessibility. Furthermore, the growing purchasing power of the visually impaired demographic is recognized by brands as a valuable market segment, prompting proactive adoption of inclusive packaging solutions. Technological advancements in printing and embossing techniques are also making Braille application more cost-effective and efficient, further catalyzing market expansion.

This report offers an in-depth analysis of the Braille Cartons Packaging market, encompassing a comprehensive examination of its trends, drivers, challenges, and future outlook. It provides granular insights into regional market dynamics, segment-specific growth patterns, and the competitive landscape. The report details market sizes and growth projections, with specific data for the Study Period (2019-2033), Base Year (2025), and Forecast Period (2025-2033), leveraging historical data from 2019-2024. It identifies key players and their strategic initiatives, alongside significant technological advancements and regulatory changes shaping the industry. This extensive coverage ensures stakeholders have the necessary information to make informed strategic decisions in this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Parksons Packaging, Donnelley and Sons Company, New Town Printers, Rich Offset PVT, Ingersoll Paper Box, Eson Pac AB, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Braille Cartons Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Braille Cartons Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.