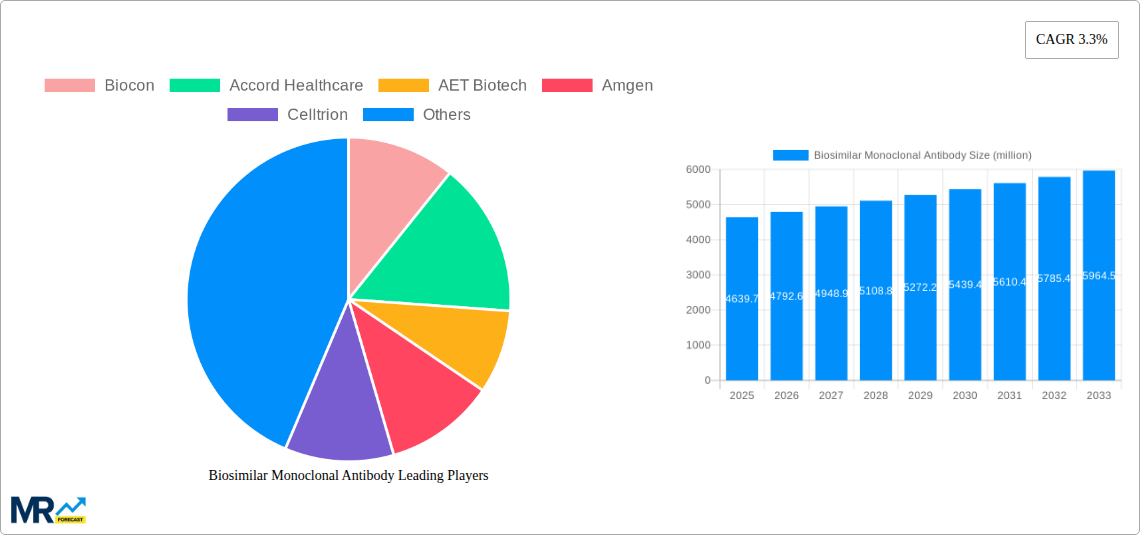

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biosimilar Monoclonal Antibody?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biosimilar Monoclonal Antibody

Biosimilar Monoclonal AntibodyBiosimilar Monoclonal Antibody by Type (Limited Dilution Method, Micromanipulation, Soft Agar Plate Method, Others), by Application (Chronic & Autoimmune Diseases, Oncology, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

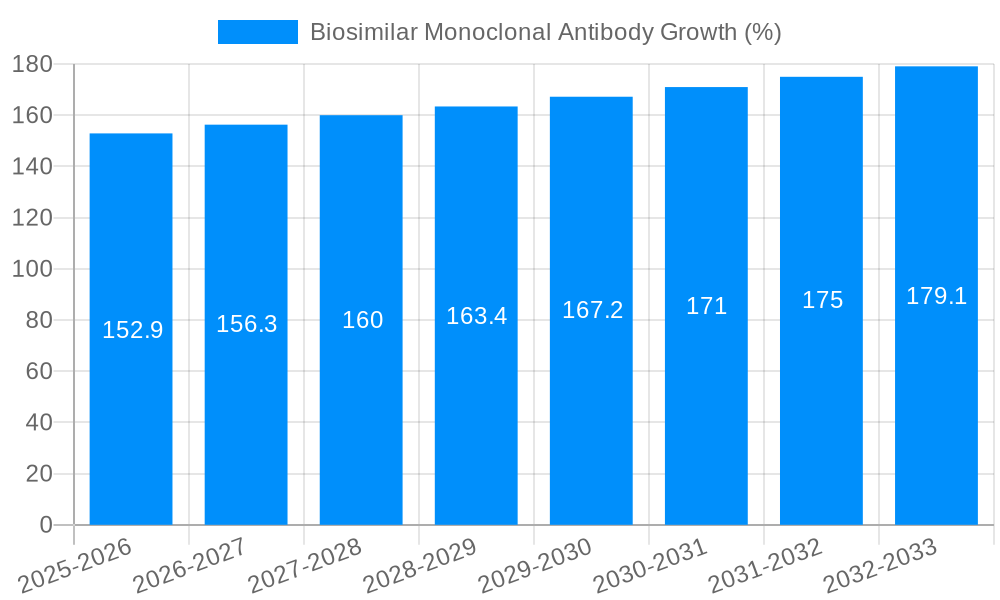

The biosimilar monoclonal antibody market exhibits substantial growth potential, projected to reach a market size of $4639.7 million in 2025 and continue expanding over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 3.3% suggests a steady, albeit moderate, expansion. This growth is driven by several factors, including increasing prevalence of chronic diseases requiring antibody therapies, rising healthcare expenditure globally, and a growing emphasis on cost-effective healthcare solutions. Biosimilars offer a significant price advantage compared to their originator counterparts, making them attractive to both healthcare providers and patients. Furthermore, the increasing pipeline of biosimilar monoclonal antibodies entering the market fuels competition and contributes to market expansion. However, regulatory hurdles and complexities in the biosimilar approval process, as well as potential challenges related to biosimilarity demonstration and market acceptance, could act as restraints to market growth. The market is segmented by various factors including therapeutic area (e.g., oncology, autoimmune diseases), and geography. Key players such as Biocon, Accord Healthcare, Amgen, and Celltrion are strategically positioned to capitalize on this growth, driving innovation and expanding their market share through robust R&D efforts and strategic partnerships.

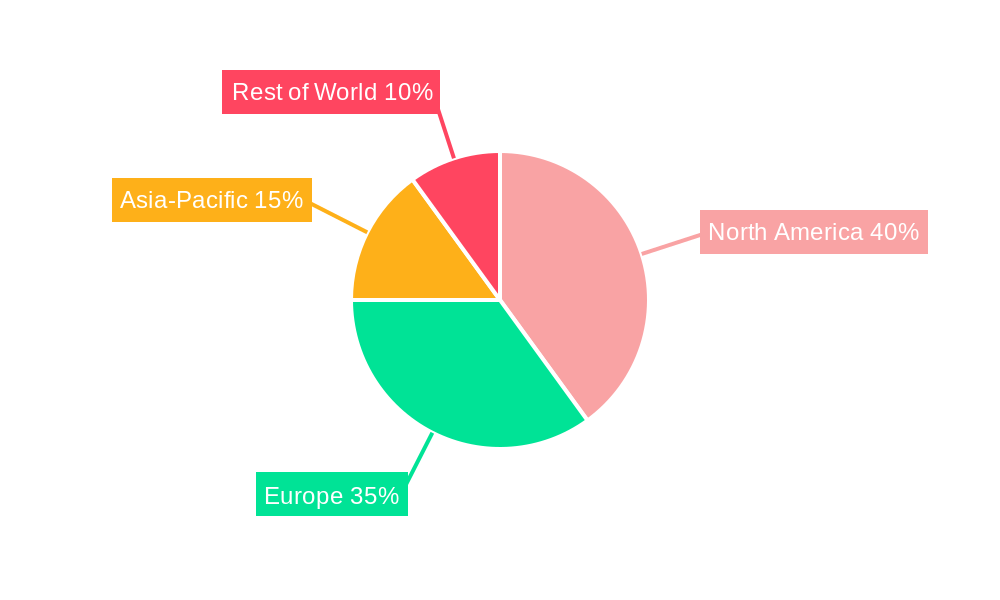

The competitive landscape is dynamic, with existing players expanding their portfolios and new entrants emerging. Successful market penetration requires a strong focus on demonstrating biosimilarity, effectively communicating the safety and efficacy of biosimilars, and managing supply chain challenges. The regional distribution of the market likely reflects the varying healthcare infrastructure and regulatory landscapes across different regions. North America and Europe are expected to retain significant market share due to their well-established healthcare systems and high prevalence of target diseases. However, emerging economies in Asia-Pacific and Latin America are also expected to witness notable growth due to rising healthcare spending and increasing awareness of biosimilar therapies. This expanding market will continue to attract investment and innovation, leading to the development of novel biosimilar monoclonal antibodies with improved efficacy and safety profiles.

The biosimilar monoclonal antibody market is experiencing robust growth, driven by several converging factors. The market size, estimated at USD XXX million in 2025, is projected to reach USD XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This surge is fueled by the increasing prevalence of chronic diseases requiring monoclonal antibody therapies, coupled with the rising demand for cost-effective alternatives to expensive originator biologics. The historical period (2019-2024) witnessed a significant increase in biosimilar approvals and market entry, laying the foundation for this accelerated growth. However, the path to market penetration isn't always smooth. Regulatory hurdles, including rigorous biosimilarity demonstration requirements, and the complexities involved in establishing bioequivalence, continue to pose challenges. Furthermore, the market dynamics are significantly shaped by patent expirations of blockbuster monoclonal antibodies. As these patents expire, the floodgates open for biosimilar entrants, leading to intensified competition and price pressure. This competition isn't just between biosimilar manufacturers; it also involves intense strategic maneuvering against originator companies actively trying to defend their market share. The intense focus on research and development is also a key trend, with companies continually striving to improve manufacturing processes, reduce costs, and expand the biosimilar portfolio to cover a broader range of therapeutic areas. This includes innovation in delivery systems and formulation to improve patient compliance and efficacy. The increasing acceptance of biosimilars by healthcare providers and payers further contributes to market expansion. A notable shift is seen in the growing confidence of healthcare professionals and patients regarding the efficacy and safety of these biosimilars, significantly impacting market adoption rates. This is further propelled by positive clinical trial data and growing evidence supporting their interchangeability with originator biologics. The overall market landscape is thus a complex interplay of scientific advancements, regulatory landscapes, market competition, and evolving patient and provider attitudes.

The biosimilar monoclonal antibody market's remarkable growth is primarily driven by the escalating global burden of chronic diseases like cancer, autoimmune disorders, and inflammatory conditions. These diseases necessitate expensive monoclonal antibody therapies, creating a substantial unmet need for affordable treatment options. Biosimilars effectively address this need, offering comparable efficacy and safety at significantly lower costs. The patent expirations of several high-value originator monoclonal antibodies are also a major catalyst, unlocking opportunities for biosimilar developers to enter the market. This competitive landscape fuels innovation and further drives down prices, benefiting both patients and healthcare systems. Furthermore, supportive regulatory frameworks in various regions, streamlining the biosimilar approval process, have played a crucial role in accelerating market entry. Increasing government initiatives and healthcare policies focusing on cost containment and improving access to essential medicines are also encouraging the adoption of biosimilars. The growing awareness among healthcare professionals and patients about the safety and efficacy of biosimilars, backed by robust clinical data, is progressively eroding the perception of biosimilars as inferior to their originator counterparts. This shift in perception is instrumental in enhancing market acceptance and driving sales growth. Lastly, the continuous investment in research and development by pharmaceutical companies is leading to the development of next-generation biosimilars with improved formulations and delivery systems, enhancing their market appeal and therapeutic potential.

Despite the significant market potential, several challenges impede the widespread adoption of biosimilar monoclonal antibodies. The stringent regulatory pathways for biosimilar approval pose a significant hurdle, requiring extensive preclinical and clinical data to demonstrate biosimilarity to the reference product. This rigorous process is both time-consuming and resource-intensive, hindering the swift entry of new biosimilars into the market. Moreover, misconceptions and hesitancy among healthcare professionals and patients regarding the efficacy and safety of biosimilars compared to originator products continue to pose a challenge. Overcoming this skepticism requires sustained efforts to educate stakeholders and build confidence through robust clinical evidence and transparent communication. Intense competition among biosimilar manufacturers, coupled with aggressive pricing strategies, can lead to price erosion and reduced profitability for some players in the market. Furthermore, the complexities associated with manufacturing and maintaining the consistent quality and purity of biosimilar products are significant technological challenges. Intellectual property disputes and patent litigation between originator companies and biosimilar manufacturers can further delay market entry and create uncertainty. Finally, variations in regulatory frameworks across different countries create complexities in navigating the global market, particularly for smaller biosimilar companies lacking the resources to manage multiple regulatory pathways.

The biosimilar monoclonal antibody market is geographically diverse, with significant growth anticipated across multiple regions. However, certain regions and segments are expected to show particularly strong dominance.

North America: This region is projected to hold a substantial market share due to the high prevalence of chronic diseases, a well-established healthcare infrastructure, and relatively faster biosimilar adoption rates. The large patient population and advanced healthcare systems facilitate quicker market penetration for biosimilar products.

Europe: The European Union has a robust regulatory framework for biosimilars and a history of early adoption. This, coupled with a sizable market for monoclonal antibodies, positions Europe as a key driver of market growth. The regulatory clarity and favorable reimbursement policies in several European countries actively support biosimilar adoption.

Asia-Pacific: This region is witnessing a rapid expansion of the biosimilar market, driven by factors like a rising prevalence of chronic diseases, growing healthcare expenditure, and increasing government initiatives supporting affordable healthcare. The rapidly expanding middle class and increasing awareness of treatment options are positively affecting market growth.

Segments: The oncology segment is expected to dominate due to the high prevalence of cancer and the extensive use of monoclonal antibodies in cancer treatment. Other significant segments include rheumatology and immunology, driven by the growing prevalence of autoimmune diseases. Additionally, the biosimilar infliximab segment is experiencing significant growth, fueled by the large market share of the originator drug and the availability of multiple biosimilar alternatives. The biosimilar rituximab segment is also growing, spurred by its extensive use in treating various hematological malignancies.

In summary, while the global market expands, specific regional characteristics like regulatory frameworks, healthcare infrastructure, and disease prevalence will influence the pace of adoption within each region. Similarly, therapeutic area and specific biosimilars' characteristics will dictate segmental performance.

The biosimilar monoclonal antibody industry is propelled by several key factors. Firstly, the continuous development of innovative biosimilar products with improved characteristics, such as longer half-life or novel formulations, drives market expansion. Secondly, growing healthcare spending, particularly in emerging economies, increases access to affordable therapies, fostering wider adoption of biosimilars. Finally, a positive shift in the perception of biosimilars by healthcare providers and patients, fueled by extensive clinical trial data and growing regulatory acceptance, is a crucial catalyst driving industry growth.

(Note: Specific details of approvals and launches would require access to a comprehensive industry database. The above are examples of typical developments.)

This report offers a comprehensive analysis of the biosimilar monoclonal antibody market, providing detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The study covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033), offering a long-term perspective on market evolution. The report provides valuable information for stakeholders, including manufacturers, investors, researchers, and regulatory bodies, seeking to understand and navigate the dynamic biosimilar landscape. It serves as a crucial resource for informed decision-making in this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

Key companies in the market include Biocon, Accord Healthcare, AET Biotech, Amgen, Celltrion, Reddy's Laboratories, Hospira, 3SBio, Allergan, Alvartis, .

The market segments include Type, Application.

The market size is estimated to be USD 4639.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Biosimilar Monoclonal Antibody," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biosimilar Monoclonal Antibody, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.