1. What is the projected Compound Annual Growth Rate (CAGR) of the Biopharmaceutical and Vaccine Production?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biopharmaceutical and Vaccine Production

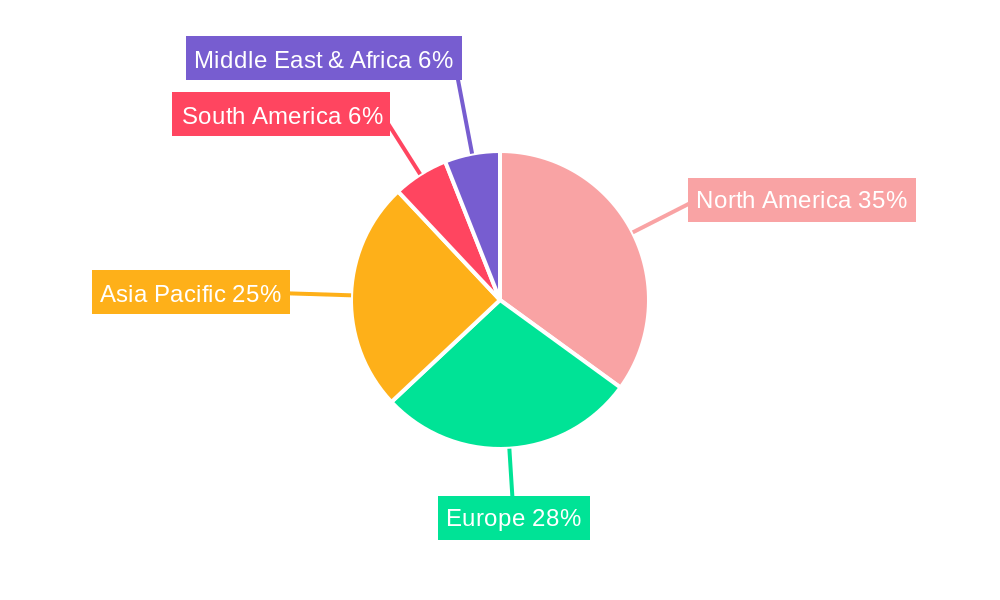

Biopharmaceutical and Vaccine ProductionBiopharmaceutical and Vaccine Production by Type (/> Biopharmaceutical, Vaccine Production), by Application (/> Pharmaceutical, Biotechnology, Academic and Research Institutes, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

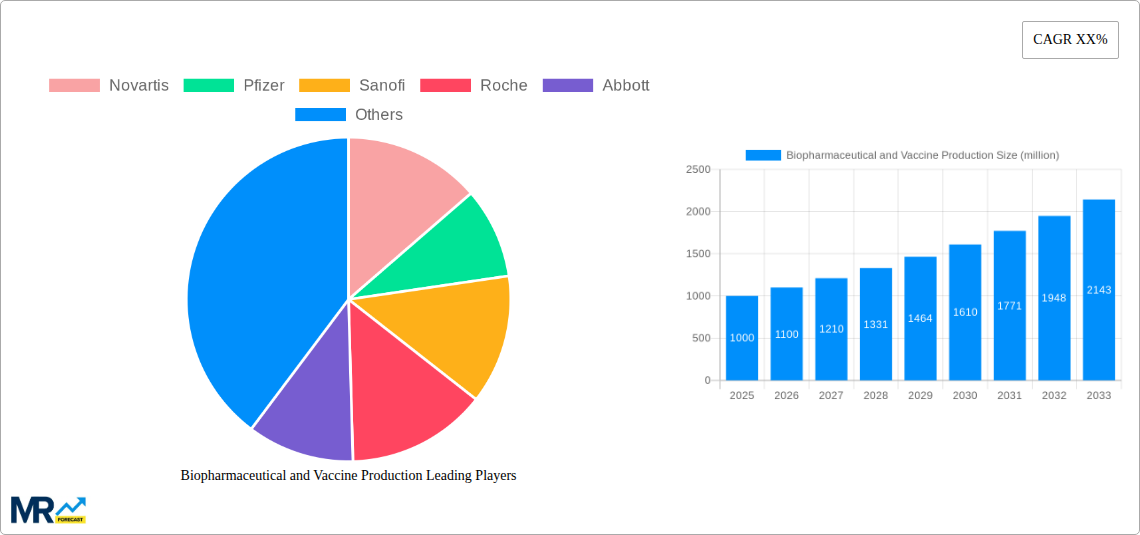

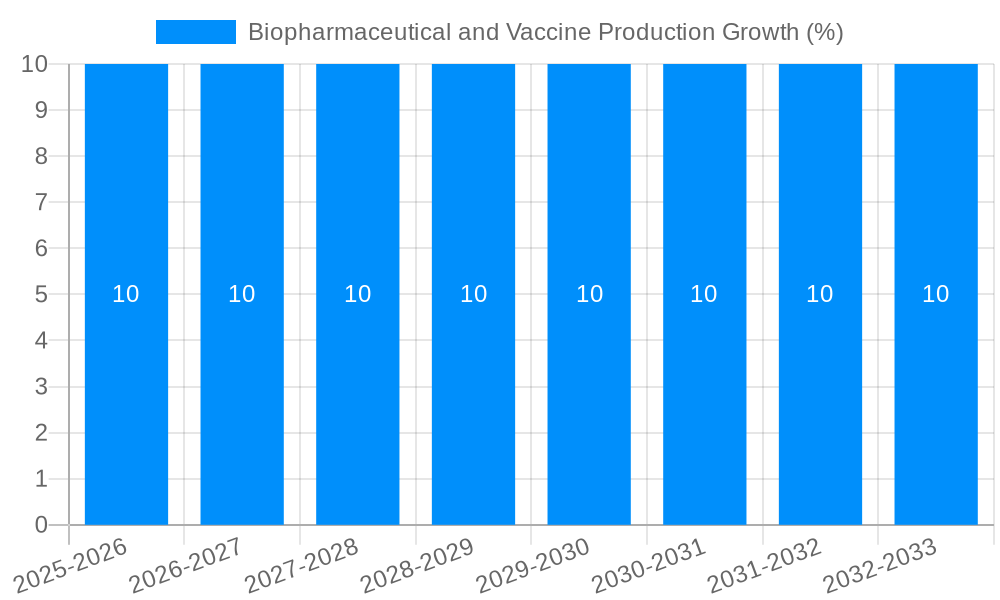

The global Biopharmaceutical and Vaccine Production market is poised for robust expansion, projected to reach a substantial market size of approximately USD 1,000 million by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of roughly 10% during the forecast period of 2025-2033. This significant upward trajectory is primarily fueled by escalating global healthcare expenditures, a burgeoning demand for innovative biologics and advanced therapeutics to combat chronic diseases, and the continuous advancements in biotechnology. The increasing prevalence of infectious diseases, coupled with the critical role of vaccines in public health initiatives, further underscores the market's growth potential. Key drivers include the expanding pipeline of biopharmaceutical drugs targeting unmet medical needs, particularly in oncology, autoimmune disorders, and rare diseases, alongside the ongoing development and manufacturing of novel vaccines for emerging and re-emerging pathogens.

The market's growth is further propelled by several critical trends, including the rise of personalized medicine, the increasing adoption of single-use technologies for bioprocessing, and the growing trend of outsourcing biopharmaceutical manufacturing to Contract Development and Manufacturing Organizations (CDMOs). These trends enhance efficiency, reduce costs, and accelerate time-to-market for life-saving treatments. Despite the promising outlook, the market faces certain restraints, such as the high cost of research and development, stringent regulatory hurdles, and the complex supply chain management inherent in biopharmaceutical production. However, strategic collaborations between pharmaceutical giants and emerging biotech firms, alongside significant investments in research and technological innovation by leading companies like Novartis, Pfizer, and Sanofi, are expected to mitigate these challenges and sustain the market's dynamic growth.

This report offers a deep dive into the dynamic global market for biopharmaceutical and vaccine production, providing actionable insights and comprehensive analysis for the period spanning 2019 to 2033. With a base year of 2025, the study meticulously examines historical trends from 2019-2024 and projects future growth through a robust forecast period of 2025-2033. We quantify market opportunities, identify key growth drivers and challenges, and spotlight dominant regions and market segments. Our analysis is grounded in real-world data and expert interpretation, making it an indispensable resource for stakeholders navigating this vital sector.

The biopharmaceutical and vaccine production market is experiencing an unprecedented surge, driven by a confluence of scientific advancements, evolving global health needs, and strategic investments. XXX, the global biopharmaceutical and vaccine production market has witnessed a remarkable transformation. During the historical period (2019-2024), the sector was significantly shaped by the urgent demand for COVID-19 vaccines, leading to an exponential increase in production capacity and a heightened focus on rapid development and deployment. This period saw established players like Pfizer, Moderna, and AstraZeneca, alongside emergent biotechs, scaling up manufacturing to an unprecedented degree. Beyond the pandemic's direct influence, a steady underlying trend of increasing demand for biotherapeutics, including monoclonal antibodies, gene therapies, and cell therapies, has consistently propelled market growth. These advanced treatments are revolutionizing healthcare for chronic diseases, cancers, and rare genetic disorders, creating a robust and expanding market. The pharmaceutical and biotechnology segments are the primary beneficiaries of this expansion, with substantial investments being channeled into research and development, as well as the scaling of manufacturing processes to meet the growing patient populations requiring these innovative medicines. Furthermore, academic and research institutes play a crucial role, often serving as the genesis for novel therapeutic discoveries that subsequently fuel the production pipeline. The “Others” segment, encompassing contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), is also exhibiting substantial growth as pharmaceutical and biotech companies increasingly outsource production to leverage specialized expertise and manufacturing capabilities. The market's trajectory is characterized by an accelerated pace of innovation, a greater emphasis on personalized medicine, and a growing recognition of the critical role of robust and agile manufacturing infrastructure. The base year of 2025 represents a pivotal point, where the market is consolidating the lessons learned from recent rapid expansion while continuing to invest in future capacity and technological advancements. The forecast period (2025-2033) is expected to see sustained high growth, driven by the ongoing development of novel biologics and the continuous need for established vaccines. The market is projected to reach significant milestones, with production volumes in the hundreds of millions of units for key therapeutic areas and vaccines.

Several powerful forces are collectively propelling the biopharmaceutical and vaccine production market to new heights. The most significant driver remains the unparalleled advancements in biotechnology and life sciences research. Innovations in areas like genetic engineering, monoclonal antibody development, mRNA technology, and cell and gene therapies have unlocked the potential for treating previously intractable diseases. This scientific progress directly translates into a growing pipeline of novel biopharmaceuticals, demanding sophisticated and scaled-up production capabilities. Furthermore, the increasing global prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, creates a persistent and growing demand for effective biopharmaceutical treatments. Similarly, the ongoing need for routine vaccinations and the preparedness for future pandemic threats ensure a sustained market for vaccine production. Government initiatives and funding for public health initiatives, particularly in the wake of the COVID-19 pandemic, have also played a crucial role by incentivizing research, development, and manufacturing capacity expansion. The pharmaceutical and biotechnology industries are making substantial investments, driven by the promise of significant returns from the development and commercialization of groundbreaking therapies. This investment fuels innovation and the establishment of state-of-the-art manufacturing facilities.

Despite the robust growth, the biopharmaceutical and vaccine production market faces a distinct set of challenges and restraints that can impact its trajectory. One of the most significant hurdles is the complex and lengthy regulatory approval process. Gaining approval for novel biopharmaceuticals and vaccines is a time-consuming and expensive endeavor, involving rigorous preclinical and clinical trials to ensure safety and efficacy. This can delay market entry and impact return on investment. Another substantial challenge is the high cost of research and development and manufacturing. The specialized equipment, highly skilled personnel, and stringent quality control measures required for biopharmaceutical and vaccine production represent a significant financial outlay. This cost can be a barrier to entry for smaller companies and can influence the pricing of final products. Supply chain disruptions remain a persistent concern. The global nature of biopharmaceutical and vaccine production means that reliance on a complex network of raw material suppliers, specialized components, and logistical partners can be vulnerable to geopolitical events, natural disasters, or trade restrictions. Maintaining a consistent and secure supply of critical inputs, such as cell culture media and vials, is paramount. Furthermore, the shortage of skilled labor in specialized areas like bioprocessing, analytical testing, and regulatory affairs can hinder expansion and operational efficiency. As the demand for biopharmaceuticals and vaccines grows, so too does the need for a qualified workforce, and addressing this deficit is crucial for sustained growth. Finally, evolving intellectual property landscapes and patent expirations can create uncertainty and influence investment decisions, impacting the long-term profitability of certain products.

Several regions and segments are poised to dominate the biopharmaceutical and vaccine production market, driven by a combination of factors including established infrastructure, robust research ecosystems, and strategic government support.

Dominant Regions:

Dominant Segments:

The interplay of these dominant regions and segments, supported by technological advancements and strategic investments, will shape the future landscape of biopharmaceutical and vaccine production.

The biopharmaceutical and vaccine production industry is experiencing significant growth catalysts. Key among these is the accelerating pace of scientific discovery, particularly in areas like gene editing, immunotherapy, and mRNA technology, which are enabling the development of novel and highly effective treatments. The increasing global burden of chronic diseases and the growing demand for personalized medicine are creating sustained demand for advanced biotherapeutics. Furthermore, government funding and supportive policies aimed at bolstering domestic manufacturing capabilities and addressing public health emergencies, especially post-pandemic, are significant drivers. The expansion of outsourcing to Contract Development and Manufacturing Organizations (CDMOs), leveraging their specialized expertise and capacity, also acts as a substantial growth catalyst, enabling faster and more efficient production.

This report offers a comprehensive analysis of the biopharmaceutical and vaccine production market, delving into intricate details of market dynamics, segmentation, and regional landscapes. We provide granular data on market size and growth projections, utilizing millions of units as a key metric. The report meticulously examines trends from 2019 to 2033, with a sharp focus on the base year of 2025 and the forecast period through 2033. Key segments like Biopharmaceutical Production and Vaccine Production are analyzed in depth, alongside their applications in Pharmaceutical, Biotechnology, and Academic/Research Institutes. We scrutinize the driving forces, challenges, and growth catalysts shaping the industry, offering a nuanced understanding of the market's trajectory. Furthermore, the report identifies leading players and significant developments, providing a holistic view of this critical sector. This detailed coverage ensures stakeholders are equipped with the insights necessary to make informed strategic decisions in this evolving global market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Novartis, Pfizer, Sanofi, Roche, Abbott, Regeneron Pharmaceuticals, Alexion Pharmaceuticals, Johnson and Johnson, GlaxoSmithKline, Merck, Lonza, FUJIFILM Diosynth Biotechnologies.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Biopharmaceutical and Vaccine Production," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biopharmaceutical and Vaccine Production, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.