1. What is the projected Compound Annual Growth Rate (CAGR) of the Biological Dura Substitute?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biological Dura Substitute

Biological Dura SubstituteBiological Dura Substitute by Type (Porcine Small Intestinal, Bovine Calcaneal, Others), by Application (Hospital, Clinic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

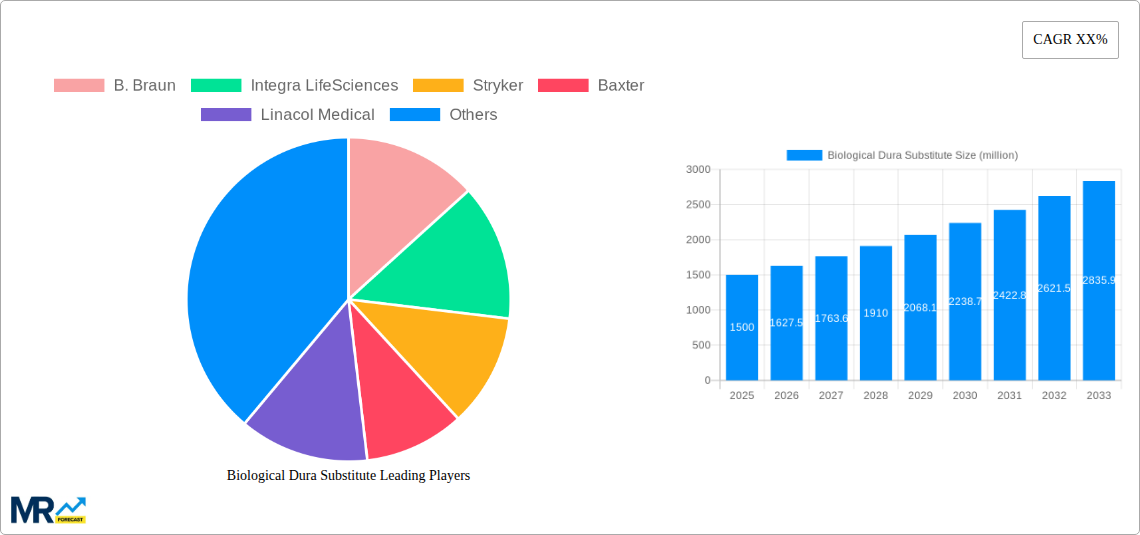

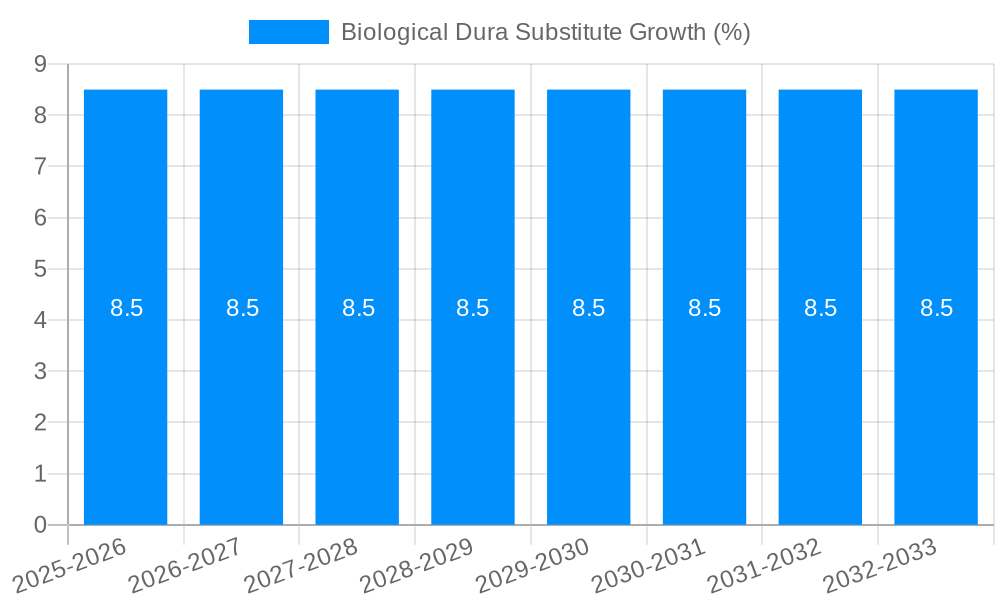

The global Biological Dura Substitute market is poised for significant expansion, projected to reach an estimated market size of $1.5 billion by 2025, growing at a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This upward trajectory is primarily fueled by the increasing incidence of neurosurgical procedures necessitated by a surge in traumatic brain injuries, brain tumors, and degenerative neurological conditions. The demand for advanced regenerative medicine solutions that offer superior biocompatibility and promote natural tissue integration is driving innovation and market adoption. Key market drivers include advancements in biomaterial science, leading to the development of more effective and safer dura substitutes, as well as a growing preference for less invasive surgical techniques. Furthermore, heightened awareness among healthcare professionals and patients regarding the benefits of biological grafts over synthetic alternatives is playing a crucial role in shaping market dynamics.

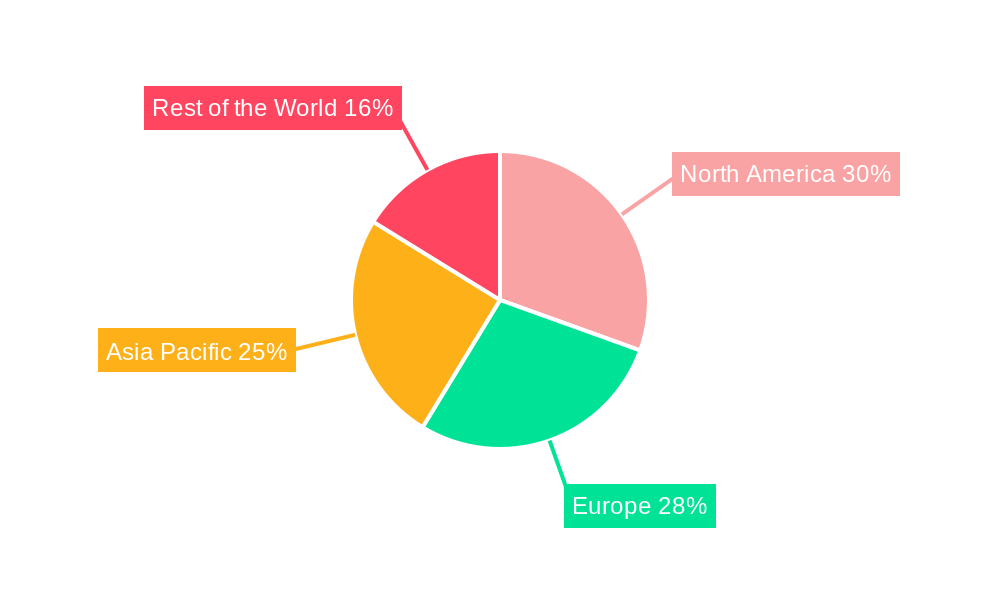

The market landscape is characterized by a diverse range of product types, with Porcine Small Intestinal and Bovine Calcaneal dura substitutes holding significant shares, catering to a wide spectrum of surgical needs. Applications in hospitals and specialized clinics dominate, reflecting the centralized nature of advanced neurosurgical interventions. While the market benefits from strong growth drivers, certain restraints, such as the high cost of some advanced biological substitutes and regulatory hurdles for new product approvals, may temper the growth rate in specific segments. However, strategic collaborations between key players like B. Braun, Integra LifeSciences, and Stryker, coupled with ongoing research and development efforts focused on enhancing graft efficacy and reducing patient recovery times, are expected to overcome these challenges and solidify the market's strong growth outlook. The Asia Pacific region, particularly China and India, is emerging as a significant growth engine due to a rapidly expanding healthcare infrastructure and increasing patient access to sophisticated neurosurgical treatments.

Here's a unique report description on Biological Dura Substitutes, incorporating your specified elements:

The global Biological Dura Substitute market, projected to reach a significant \$1,150 million by 2033, is on an upward trajectory, driven by increasing incidences of neurosurgical procedures and a growing demand for advanced regenerative medical solutions. During the Study Period of 2019-2033, the market has witnessed consistent expansion, with the Base Year of 2025 serving as a pivotal point for current market valuation and future projections. The Estimated Year of 2025 solidifies the foundational understanding of prevailing market dynamics, while the Forecast Period of 2025-2033 outlines the anticipated growth trajectory. The Historical Period of 2019-2024 lays the groundwork, demonstrating the market's evolution from its nascent stages to its current robust standing. Innovations in biomaterials and tissue engineering have been paramount, leading to the development of safer and more effective dura substitutes. The market is characterized by a shift towards naturally derived materials that promote optimal tissue integration and reduce the risk of complications such as infections and adhesions. The increasing adoption of minimally invasive surgical techniques also necessitates the use of specialized graft materials like biological dura substitutes, further bolstering market growth. Furthermore, the growing awareness and acceptance of biological solutions over synthetic alternatives, owing to their superior biocompatibility and regenerative potential, are key trends shaping the market landscape. The development of advanced processing techniques to enhance the structural integrity and bioactivity of these substitutes is also a significant trend. The market is segmented by type, application, and region, each contributing to the overall growth narrative. The rising prevalence of neurological disorders, traumatic brain injuries, and spinal conditions requiring surgical intervention directly translates into a higher demand for effective dura repair solutions. This sustained demand, coupled with continuous technological advancements and increasing investment in R&D, positions the biological dura substitute market for substantial and sustained growth in the coming years. The intricate interplay of these factors underscores the dynamic and promising nature of this specialized segment within the broader medical devices industry, with a clear focus on patient outcomes and long-term efficacy.

The burgeoning biological dura substitute market is propelled by a confluence of compelling factors, primarily centered around the escalating need for advanced neurosurgical interventions. The increasing global incidence of traumatic brain injuries, stroke-related neurological deficits, and complex spinal surgeries necessitates robust and reliable methods for dura mater reconstruction. Biological dura substitutes offer a compelling alternative to traditional synthetic grafts, boasting superior biocompatibility, reduced immunogenicity, and a natural ability to integrate with host tissues, thereby promoting faster and more complete healing. This inherent regenerative capacity is a significant draw for neurosurgeons and patients alike, minimizing the risk of long-term complications such as cerebrospinal fluid (CSF) leaks and dural adhesions, which can lead to chronic pain and neurological dysfunction. Furthermore, advancements in biomaterial science and tissue engineering have led to the development of more sophisticated and effective biological grafts. These innovations are not only improving the mechanical properties of the substitutes, ensuring better wound closure and structural support, but also enhancing their ability to stimulate cellular regeneration. The growing preference for minimally invasive surgical techniques, which often require highly adaptable and well-integrating graft materials, further fuels the demand for biological dura substitutes. As healthcare systems worldwide prioritize patient outcomes and aim to reduce hospital stays and recovery times, the inherent advantages of biological solutions are becoming increasingly evident, creating a powerful impetus for market expansion.

Despite the promising growth trajectory, the biological dura substitute market faces several inherent challenges and restraints that could temper its expansion. A primary concern revolves around the cost of these advanced biological materials. The complex sourcing, processing, and sterilization techniques involved in producing high-quality biological grafts can result in significantly higher price points compared to conventional synthetic alternatives. This cost differential can be a major barrier to widespread adoption, particularly in healthcare systems with budget constraints or in regions with limited access to advanced medical technologies. Furthermore, the variability inherent in biological materials, stemming from animal sourcing and donor-to-donor inconsistencies, can sometimes lead to unpredictable performance and efficacy. While regulatory bodies have stringent quality control measures, the risk of immune reactions or allergic responses, though low, cannot be entirely eliminated. The availability and accessibility of these specialized grafts can also be a limiting factor, with certain types or brands being less readily available in specific geographic markets. The learning curve associated with the implantation of novel biological dura substitutes, requiring specialized surgical expertise and techniques, can also slow down their widespread adoption. Finally, ongoing research and development are crucial to overcome limitations such as potential bioburden and the need for improved handling characteristics, which represent continuous challenges for manufacturers striving to innovate and expand the market.

The Porcine Small Intestinal Submucosa (SIS) segment, within the Hospital application, is poised to dominate the global Biological Dura Substitute market, driven by its established efficacy, growing clinical acceptance, and the robust infrastructure of healthcare facilities. The United States is anticipated to be a leading region, owing to its advanced healthcare system, high per capita healthcare expenditure, and a significant volume of neurosurgical procedures.

Segment Dominance - Porcine Small Intestinal Submucosa (SIS):

Application Dominance - Hospital:

Regional Dominance - United States:

The synergy between the highly adopted Porcine SIS segment and its primary application in hospitals, particularly within the technologically advanced and medically sophisticated landscape of the United States, will collectively propel this segment and region to the forefront of the global biological dura substitute market throughout the forecast period.

The biological dura substitute industry is experiencing robust growth catalyzed by several key factors. The rising global prevalence of neurological disorders, traumatic brain injuries, and spinal conditions necessitating surgical intervention creates a sustained demand for effective dural repair solutions. Advancements in biomaterial science and tissue engineering are continuously yielding more biocompatible, bioresorbable, and regenerative dura substitutes, enhancing their clinical efficacy and patient outcomes. Furthermore, the increasing preference for minimally invasive surgical techniques, which demand flexible and highly adaptable graft materials, further propels the adoption of biological options.

This comprehensive report offers an in-depth analysis of the global Biological Dura Substitute market, spanning the Study Period of 2019-2033. With the Base Year of 2025 establishing a concrete market valuation, the report meticulously forecasts market growth through the Forecast Period of 2025-2033, building upon the insights from the Historical Period of 2019-2024. It delves into market trends, identifying key drivers such as the increasing incidence of neurosurgical procedures and advancements in regenerative medicine. The report also addresses the challenges and restraints, including cost barriers and material variability, that influence market dynamics. A significant portion is dedicated to identifying the dominant regions and segments, with a particular focus on the projected leadership of Porcine Small Intestinal Submucosa (SIS) in hospital applications within the United States. Furthermore, the report highlights critical growth catalysts, provides a detailed overview of leading industry players, and chronicles significant developments within the sector. This comprehensive coverage equips stakeholders with the strategic intelligence needed to navigate and capitalize on the evolving Biological Dura Substitute market, estimated to reach \$1,150 million by 2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include B. Braun, Integra LifeSciences, Stryker, Baxter, Linacol Medical, Biosis Healing, COOK Medical, Vostra, TianXinFu Medical, Bioimplon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Biological Dura Substitute," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biological Dura Substitute, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.