1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioinformatics Platforms?

The projected CAGR is approximately 6.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bioinformatics Platforms

Bioinformatics PlatformsBioinformatics Platforms by Type (Sequence Analysis Platforms, Sequence Alignment Platforms, Sequence Manipulation Platforms, Structural & Functional Analysis Platforms, Others), by Application (Drug Development, Molecular Genomics, Personalized Medicine, Gene Therapy, Protein Function Analysis, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

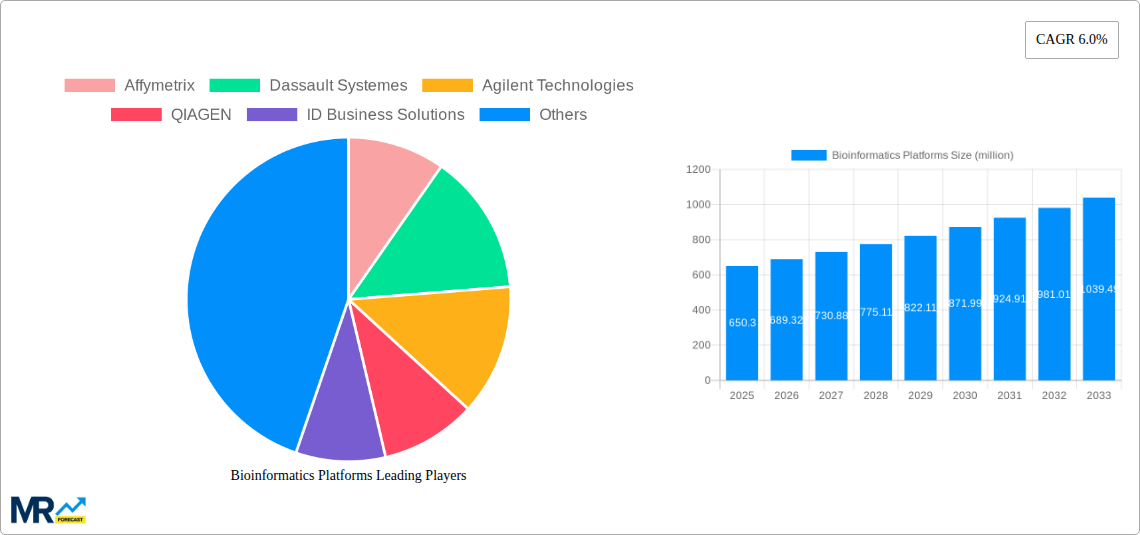

The global bioinformatics platforms market is poised for robust expansion, projected to reach an impressive USD 650.3 million by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 6.0% during the forecast period of 2025-2033. This growth is fundamentally driven by the escalating volume of biological data generated through advanced sequencing technologies, coupled with an increasing demand for sophisticated analytical tools across various life science disciplines. Key applications fueling this market surge include drug development, where bioinformatics platforms are indispensable for target identification, lead optimization, and clinical trial analysis; molecular genomics, which relies heavily on these platforms for gene sequencing, variant analysis, and understanding complex genomic interactions; and personalized medicine, a rapidly evolving field that leverages bioinformatics to tailor treatments based on an individual's genetic makeup. Furthermore, the burgeoning field of gene therapy, alongside intricate protein function analysis, is creating significant new avenues for growth. The market is segmented into specialized platforms such as Sequence Analysis, Sequence Alignment, Sequence Manipulation, and Structural & Functional Analysis, each catering to distinct research and development needs.

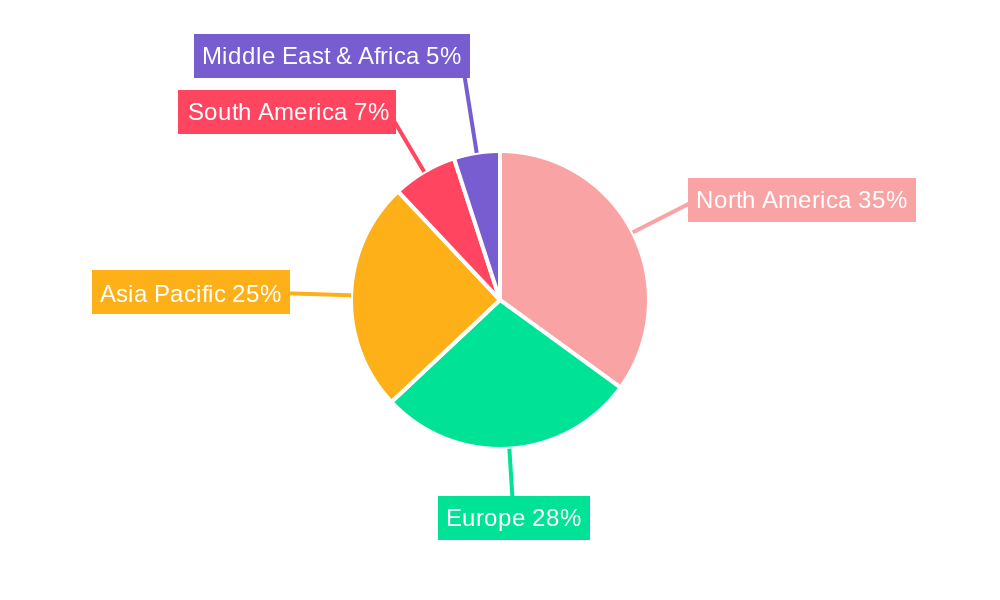

The competitive landscape is characterized by the presence of established players like Illumina, QIAGEN, and Agilent Technologies, alongside innovative companies focusing on specific niches. Geographically, North America, particularly the United States, is expected to lead the market due to its advanced research infrastructure and substantial investments in biotechnology and pharmaceutical R&D. Europe and Asia Pacific are also significant markets, with China and India emerging as major contributors due to their rapidly growing research sectors and increasing adoption of advanced bioinformatics solutions. While the market presents significant opportunities, certain factors could influence its trajectory. The need for skilled bioinformaticians, the cost of implementing and maintaining sophisticated platforms, and data security concerns are potential challenges. However, ongoing advancements in AI and machine learning are expected to enhance platform capabilities, automate complex analyses, and ultimately drive greater efficiency and accuracy in biological research, further solidifying the market's upward trend.

This report provides an in-depth analysis of the global Bioinformatics Platforms market, offering a comprehensive overview of its present landscape and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, the report meticulously examines historical trends from 2019-2024. Our estimation for 2025 stands at a robust $15,500 million. The report delves into the intricate dynamics of this rapidly evolving sector, dissecting key market insights, driving forces, inherent challenges, and dominant segments. Through a detailed exploration of industry developments and leading players, this report aims to equip stakeholders with actionable intelligence to navigate and capitalize on opportunities within the bioinformatics platforms ecosystem.

The global bioinformatics platforms market is poised for substantial growth, driven by an escalating volume of genomic and proteomic data, coupled with an increasing demand for advanced analytical tools across diverse life science applications. The market is projected to reach an estimated $38,200 million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.8% from the base year of 2025. Key market insights indicate a significant shift towards cloud-based bioinformatics solutions, which offer enhanced scalability, accessibility, and cost-effectiveness for researchers and institutions worldwide. The increasing adoption of next-generation sequencing (NGS) technologies has been a primary catalyst, generating vast datasets that necessitate sophisticated platforms for effective analysis. Furthermore, the burgeoning field of personalized medicine, propelled by breakthroughs in genomics and a growing understanding of disease at a molecular level, is creating a persistent demand for specialized bioinformatics tools capable of deciphering individual genetic variations and their implications for treatment. The report highlights the growing influence of artificial intelligence (AI) and machine learning (ML) algorithms integrated into these platforms, enabling more accurate predictive modeling, faster discovery cycles, and the identification of complex biological patterns previously undetectable. This integration is not merely an incremental improvement but a transformative force, pushing the boundaries of what is achievable in biological research and drug discovery. The expansion of gene therapy research and development also significantly contributes to market growth, as the precise manipulation and analysis of genetic material require highly specialized bioinformatics capabilities. Moreover, the increasing focus on precision oncology and the development of targeted therapies underscore the critical role of bioinformatics platforms in understanding tumor heterogeneity and designing effective treatment strategies. The landscape is further shaped by a growing emphasis on data standardization and interoperability, enabling seamless data exchange and collaborative research efforts, which are essential for tackling complex biological questions and accelerating scientific progress. The market is characterized by continuous innovation, with companies consistently introducing new features and functionalities to address the evolving needs of the scientific community.

The rapid expansion of the bioinformatics platforms market is primarily fueled by the exponential growth in biological data generation, particularly from high-throughput sequencing technologies like Next-Generation Sequencing (NGS). This data deluge necessitates robust and sophisticated analytical tools to extract meaningful insights, driving the demand for advanced bioinformatics platforms. Another significant propellant is the escalating investment in drug development and discovery. Pharmaceutical and biotechnology companies are increasingly leveraging bioinformatics to accelerate target identification, lead optimization, and clinical trial analysis, aiming to bring novel therapeutics to market faster and more cost-effectively. The growing emphasis on personalized medicine represents a pivotal driving force. As researchers gain a deeper understanding of individual genetic variations and their impact on disease susceptibility and treatment response, the demand for platforms that can analyze complex genomic, proteomic, and transcriptomic data for tailored healthcare solutions is soaring. Furthermore, advancements in computational power and cloud computing infrastructure have made sophisticated bioinformatics analyses more accessible and affordable, empowering a wider range of research institutions and smaller biotech firms to engage in cutting-edge research. The increasing prevalence of chronic diseases and the need for better diagnostic and prognostic tools are also contributing to the market's growth, as bioinformatics plays a crucial role in identifying disease biomarkers and understanding disease mechanisms. The expanding applications of bioinformatics in fields like gene therapy, agricultural biotechnology, and synthetic biology are further broadening the market's scope and creating new avenues for growth.

Despite the robust growth, the bioinformatics platforms market faces several challenges and restraints that could impede its full potential. A primary concern is the high cost associated with acquiring, implementing, and maintaining sophisticated bioinformatics platforms, particularly for academic institutions and smaller research organizations. The substantial computational resources and specialized expertise required can act as a significant barrier to entry. The ever-increasing volume and complexity of biological data also present a considerable challenge. Managing, storing, and analyzing these massive datasets efficiently requires powerful infrastructure and advanced algorithms, which can be difficult and expensive to implement. Data security and privacy concerns are another critical restraint, especially with the rise of personalized medicine and the handling of sensitive patient genomic data. Ensuring compliance with stringent regulations like GDPR and HIPAA requires robust security measures and can add to the operational complexity and cost of these platforms. The lack of skilled bioinformatics professionals is also a growing concern. There is a significant gap between the demand for individuals with expertise in bioinformatics, data science, and computational biology and the available talent pool, which can slow down the adoption and effective utilization of these platforms. Furthermore, the interoperability and standardization of data formats across different platforms and research settings remain a persistent challenge, hindering seamless data sharing and collaborative research efforts. The continuous need for platform updates and the rapid pace of technological advancements also necessitate ongoing investment and training, which can strain the resources of many organizations. Finally, the validation and regulatory approval process for bioinformatics tools used in clinical settings can be lengthy and complex, potentially delaying their widespread adoption.

The global bioinformatics platforms market is characterized by the dominance of North America and Europe, driven by their well-established research infrastructure, significant investments in life sciences, and a strong presence of leading pharmaceutical and biotechnology companies. The United States, in particular, is a powerhouse, consistently investing billions in research and development, fostering a vibrant ecosystem for bioinformatics innovation and adoption.

North America (United States & Canada):

Europe:

Dominant Segments:

The synergy between advanced sequencing technologies, computational power, and a growing understanding of biological complexity ensures that these regions and segments will continue to lead the bioinformatics platforms market's expansion in the coming years.

Several factors are acting as significant growth catalysts for the bioinformatics platforms industry. The relentless advancement and cost reduction of Next-Generation Sequencing (NGS) technologies continue to fuel an unprecedented surge in biological data generation, creating an insatiable demand for robust analytical platforms. The increasing global investment in genomics research, driven by government initiatives and private sector R&D, further propels market expansion. The burgeoning field of personalized medicine, focused on tailoring treatments based on individual genetic makeup, is a major catalyst, requiring sophisticated platforms for patient data analysis. Furthermore, the growing applications of AI and machine learning in deciphering complex biological patterns and accelerating drug discovery are opening new avenues for growth and innovation within the bioinformatics platform sector.

This report offers an all-encompassing examination of the global Bioinformatics Platforms market, detailing its projected trajectory from $15,500 million in 2025 to an impressive $38,200 million by 2033, with a notable CAGR of 7.8%. It provides critical insights into market trends, the forces propelling its growth, and the challenges that shape its landscape. The report meticulously identifies key regions and segments poised for dominance, with a particular focus on Sequence Analysis Platforms and the Personalized Medicine application. Furthermore, it highlights the leading companies driving innovation and chronicles significant developments within the sector. This comprehensive coverage ensures that stakeholders gain a deep understanding of the market's complexities and are well-equipped to leverage emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.0%.

Key companies in the market include Affymetrix, Dassault Systemes, Agilent Technologies, QIAGEN, ID Business Solutions, GenoLogics Life Sciences, Illumina, .

The market segments include Type, Application.

The market size is estimated to be USD 650.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Bioinformatics Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bioinformatics Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.