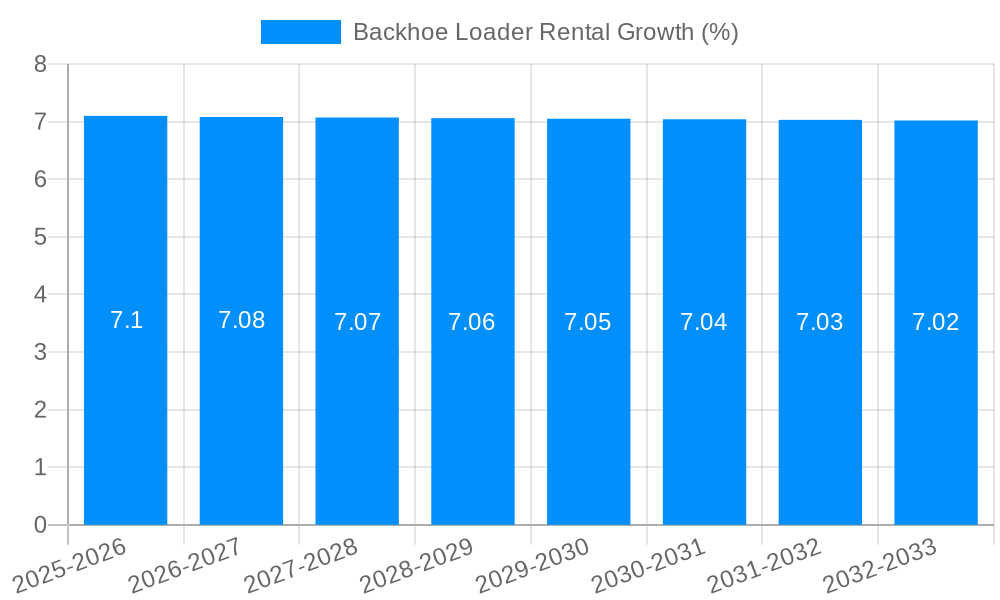

1. What is the projected Compound Annual Growth Rate (CAGR) of the Backhoe Loader Rental?

The projected CAGR is approximately 7.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Backhoe Loader Rental

Backhoe Loader RentalBackhoe Loader Rental by Type (Articulated Backhoe Loader, Rigidity Backhoe Loader), by Application (Highway Construction, Public Facilities, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

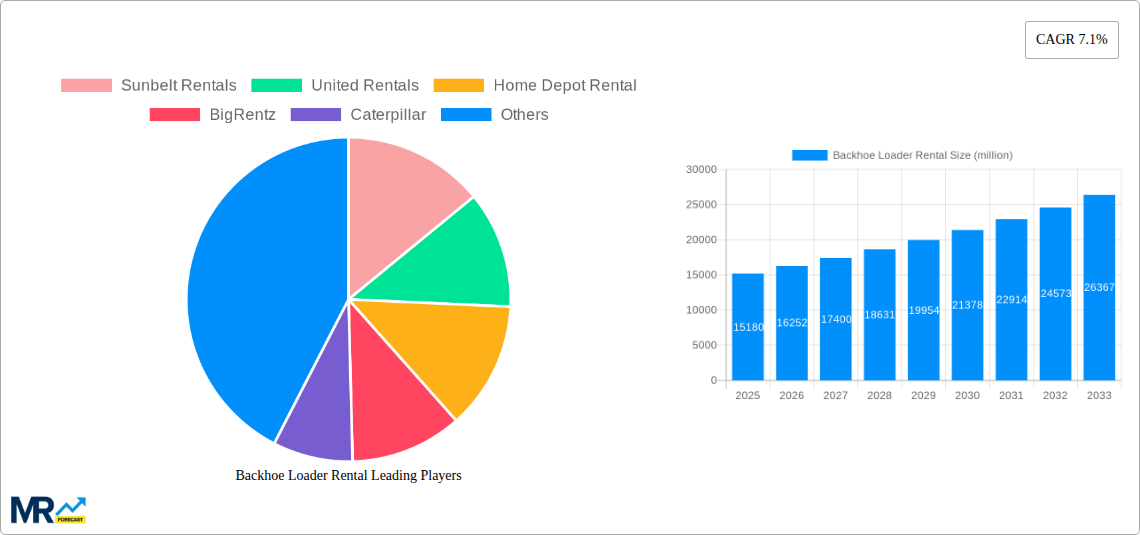

The global Backhoe Loader Rental market is poised for significant expansion, with an estimated market size of $15,180 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% through 2033. This robust growth trajectory is fueled by escalating infrastructure development worldwide, particularly in emerging economies and established markets undergoing modernization. The demand for backhoe loaders is intrinsically linked to construction activities, ranging from extensive highway construction projects and the development of public facilities like schools, hospitals, and utilities, to smaller-scale residential and commercial building. Rental services offer a cost-effective and flexible solution for contractors, eliminating the substantial capital expenditure associated with purchasing these heavy-duty machines and catering to project-specific needs. The market is segmented by type into Articulated Backhoe Loaders and Rigidity Backhoe Loaders, with articulated variants often preferred for their enhanced maneuverability in confined spaces.

The market's dynamism is further shaped by several key drivers. Increased government spending on infrastructure projects, driven by initiatives aimed at improving transportation networks, urban development, and utility expansion, is a primary catalyst. The growing trend of outsourcing equipment needs by construction companies, coupled with the cost benefits of renting over owning, including reduced maintenance, storage, and transportation expenses, significantly bolsters rental demand. Furthermore, the increasing adoption of advanced backhoe loader technologies, such as GPS integration and enhanced fuel efficiency, is also contributing to market growth as rental companies update their fleets. While the market experiences strong tailwinds, potential restraints include fluctuating construction project timelines, intense price competition among rental providers, and the availability of skilled operators for operating these complex machines. Nevertheless, the overall outlook remains highly positive, driven by the indispensable role of backhoe loaders in construction and the inherent advantages of the rental model.

This report offers an in-depth examination of the global Backhoe Loader Rental market, providing a detailed analysis of its trends, driving forces, challenges, key regional and segmental dominance, growth catalysts, leading players, and significant developments. The study encompasses a comprehensive Study Period: 2019-2033, with a Base Year: 2025, and utilizes the Estimated Year: 2025 for initial projections. The Forecast Period: 2025-2033 allows for a forward-looking perspective, building upon the insights gained from the Historical Period: 2019-2024. The market size is evaluated in million units, offering a quantifiable understanding of its scale and growth trajectory.

The backhoe loader rental market is experiencing a dynamic evolution driven by a confluence of economic, technological, and industry-specific factors. A significant trend observed during the historical period of 2019-2024 and projected to continue through the forecast period of 2025-2033 is the increasing preference for flexible rental agreements over outright ownership. This shift is particularly pronounced in sectors with fluctuating project demands, allowing businesses to optimize their capital expenditure and avoid the long-term costs associated with equipment maintenance and depreciation. The market size, projected to be in the million units, reflects this growing demand for accessible and cost-effective machinery. Furthermore, there's a discernible trend towards the adoption of advanced backhoe loader models equipped with enhanced features such as GPS tracking, fuel efficiency monitoring, and improved operator ergonomics. This technological integration is not only boosting operational efficiency but also contributing to a safer working environment, aligning with global trends in smart construction and industrial automation. The market is witnessing a segmentation based on the type of backhoe loader, with articulated models gaining traction due to their superior maneuverability in confined spaces, a crucial advantage in urban infrastructure projects. Conversely, rigidity backhoe loaders continue to be a staple for heavy-duty applications requiring immense stability and lifting capacity. The application segment of highway construction and public facilities are significant contributors to the rental demand, driven by ongoing government investments in infrastructure development across various regions. The overall market sentiment indicates a steady upward trajectory, supported by consistent demand from construction, mining, and agricultural sectors, with the Base Year: 2025 serving as a crucial benchmark for understanding the current market landscape. The Study Period: 2019-2033 encompasses a period of significant global economic shifts, and the rental market's resilience and adaptability highlight its intrinsic value proposition. The increasing focus on sustainability is also influencing rental trends, with a growing demand for fuel-efficient and environmentally friendly backhoe loader options. This will likely shape the future offerings from rental companies and influence purchasing decisions of end-users. The adaptability of rental services to cater to short-term project needs and emergency repairs further solidifies its position as a critical component of the construction and infrastructure ecosystem.

The backhoe loader rental market is propelled by a robust set of driving forces that ensure its sustained growth and increasing relevance. A primary driver is the inherent cost-effectiveness and flexibility that rental services offer to businesses of all sizes. For small to medium-sized enterprises (SMEs) and even larger contractors undertaking projects with variable timelines, renting a backhoe loader eliminates the substantial upfront capital investment required for outright purchase, along with associated costs like maintenance, insurance, and depreciation. This financial agility allows companies to allocate their resources more strategically towards core business operations and project execution. The burgeoning global infrastructure development is another colossal driver. Governments worldwide are investing billions in public works projects, including the construction and upgrading of roads, bridges, utilities, and public facilities. These large-scale endeavors necessitate the consistent availability of heavy machinery, and backhoe loaders are indispensable for tasks ranging from excavation and material handling to trenching and backfilling. The rental model perfectly aligns with the project-based nature of such developments, enabling contractors to secure the required equipment for the duration of their contracts without long-term commitments. Furthermore, the increasing trend of urbanization is contributing significantly to the demand for backhoe loader rentals. As cities expand and redevelop, there's a constant need for construction and excavation activities in both new developments and existing urban landscapes. The maneuverability and versatility of backhoe loaders make them ideal for navigating often congested urban environments. Technological advancements in backhoe loader design, leading to more fuel-efficient, powerful, and operator-friendly machines, also indirectly fuel the rental market by making these machines more desirable and efficient for a wider range of applications. The need for specialized equipment for specific project phases also drives rental demand, as companies may not possess the full spectrum of machinery required for every job.

Despite its robust growth trajectory, the backhoe loader rental market faces several challenges and restraints that can impede its full potential. One of the most significant hurdles is the intense competition within the rental sector. With numerous established players and new entrants vying for market share, rental companies often face pressure to lower prices, which can impact profit margins. This competitive landscape necessitates a focus on differentiation through service quality, fleet availability, and technological integration. Another considerable restraint is the fluctuating economic conditions and their impact on the construction industry. Economic downturns, rising interest rates, and inflation can lead to a slowdown in construction projects, directly reducing the demand for backhoe loader rentals. Uncertainty in project timelines and potential project cancellations due to economic volatility also pose a risk for rental companies, as it can lead to idle equipment and decreased revenue. The availability and cost of skilled operators represent another challenge. Operating a backhoe loader requires trained personnel, and a shortage of qualified operators can limit the utilization of rented equipment and increase labor costs for end-users, potentially diverting them towards alternative solutions. Furthermore, the maintenance and upkeep of rental fleets can be a substantial operational challenge and expense. Backhoe loaders are complex pieces of machinery that require regular servicing and repairs to ensure optimal performance and safety. Unexpected breakdowns can lead to customer dissatisfaction and lost revenue. The capital investment required to maintain and upgrade a modern and diverse fleet of backhoe loaders can also be a significant barrier, especially for smaller rental companies. Regulatory changes and environmental compliance requirements can also add to the operational costs and complexity for rental providers. Finally, the increasing availability of used equipment for sale can present a substitute option for some businesses, diverting demand away from the rental market, particularly for longer-term projects where the cost of ownership might become more appealing.

The backhoe loader rental market's dominance is multifaceted, with specific regions and segments exhibiting particularly strong performance. Among the key segments driving this market, Highway Construction stands out as a major contributor, projected to significantly influence market dynamics throughout the forecast period of 2025-2033. The ongoing global emphasis on infrastructure development, including the expansion and modernization of road networks, directly fuels the demand for backhoe loaders. Governments worldwide are investing heavily in transportation infrastructure to enhance connectivity, facilitate trade, and boost economic growth. These projects typically involve extensive excavation, earthmoving, and material handling, tasks for which backhoe loaders are indispensable. The sheer scale and duration of highway construction projects necessitate a consistent and reliable supply of rental equipment, making it a cornerstone of the backhoe loader rental market.

Furthermore, the Public Facilities segment also plays a pivotal role in market dominance. This encompasses the construction and maintenance of essential community infrastructure such as schools, hospitals, public parks, water and sewage systems, and waste management facilities. The expansion of urban populations and the need for improved public amenities consistently drive demand for backhoe loader rentals within this segment. Municipalities and government bodies often partner with private contractors for these projects, who in turn rely on rental services to access the necessary machinery. The repetitive nature of utility work and the localized needs within public facility development ensure a steady rental demand.

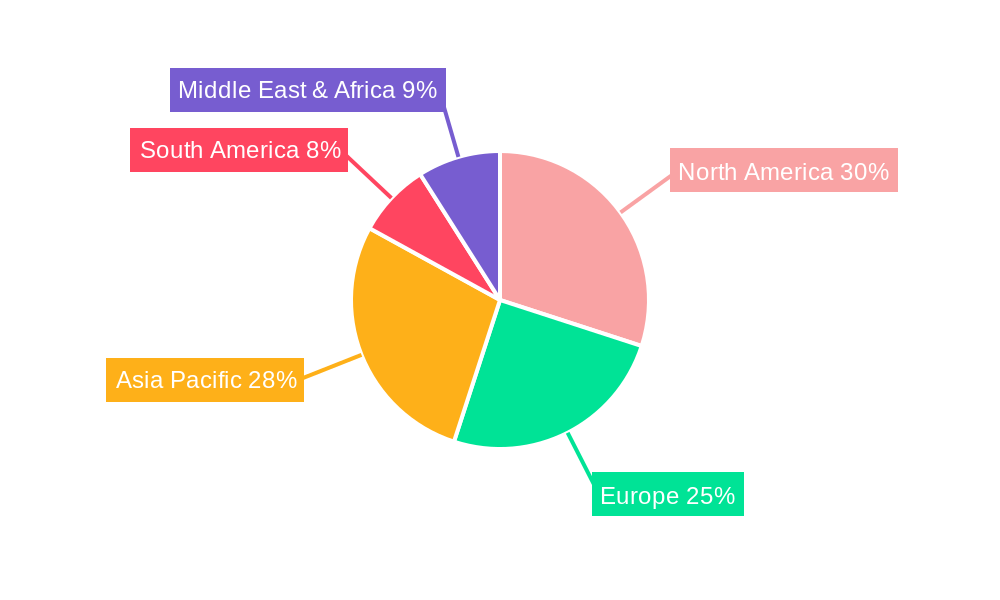

Geographically, North America, particularly the United States, is expected to remain a dominant region in the backhoe loader rental market. This dominance is underpinned by several factors:

Beyond North America, other regions like Europe and Asia-Pacific are also significant contributors and are expected to witness substantial growth. Europe’s ongoing efforts in upgrading aging infrastructure and transitioning towards sustainable energy projects will drive rental demand. In the Asia-Pacific region, rapid urbanization, burgeoning economies, and large-scale infrastructure projects in countries like China and India will continue to propel the market forward.

However, when considering the segment to dominate, the Application: Highway Construction segment, when analyzed in conjunction with the Type: Articulated Backhoe Loader, presents a particularly potent combination. Articulated backhoe loaders offer enhanced maneuverability, crucial for navigating the often tight and complex construction sites encountered during highway development and upgrades, especially in urban or semi-urban areas. Their ability to turn tighter radii and work in confined spaces makes them ideal for tasks like digging trenches alongside existing roadways, backfilling, and loading materials. The constant need for such versatile machines in the ongoing expansion and maintenance of road networks positions this specific combination as a significant market influencer. The demand for these versatile machines in large-scale highway projects, often supported by substantial government funding, ensures their continued dominance within the backhoe loader rental landscape.

The backhoe loader rental industry is primed for further growth, fueled by several key catalysts. The ongoing global surge in infrastructure development, particularly in emerging economies, is a primary growth engine, as governments prioritize the construction of roads, bridges, and public utilities. Furthermore, the increasing adoption of digitalization and telematics in construction equipment enhances operational efficiency and predictive maintenance, making rental fleets more attractive and reliable. The focus on sustainable construction practices is also a growing catalyst, driving demand for fuel-efficient and environmentally friendly backhoe loader models, which rental companies are increasingly offering to meet market needs.

The backhoe loader rental market is characterized by the presence of several prominent companies that offer extensive fleets and comprehensive rental solutions. These companies are instrumental in shaping market trends and ensuring the availability of equipment across various regions.

The backhoe loader rental sector has witnessed several key developments that have shaped its current landscape and future trajectory:

This comprehensive report provides an exhaustive analysis of the backhoe loader rental market, delving into critical aspects that influence its growth and dynamics. It offers detailed insights into the market size, segmentation by type and application, and regional variations. The report meticulously examines the driving forces, such as infrastructure development and cost-effectiveness of rentals, alongside challenges like economic volatility and intense competition. Furthermore, it highlights key growth catalysts, including technological advancements and the increasing demand for sustainable equipment. The analysis also includes a thorough overview of leading players and their contributions to the market, complemented by a timeline of significant industry developments. This all-encompassing perspective equips stakeholders with the knowledge necessary to navigate the evolving backhoe loader rental landscape and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.1%.

Key companies in the market include Sunbelt Rentals, United Rentals, Home Depot Rental, BigRentz, Caterpillar, Herc Rentals, Ohio Cat Rental Store, Blanchard Machinery, Dayim Equipment Rental, Wheeler Machinery, Carolina Cat, Green Acres Rental, Cashman Equipment, Groff Tractor Equipment, A Tool Shed Equipment Rentals, Warren CAT, Best Line Equipment, MacAllister Rentals, GP Rental, Aztec Rental Center, Cleveland Brothers, Yancey Bros, Absolute Rental, Durante Rentals, WesTrac, Jones Equipment Rental, Carter Machinery, Superior Rents & Sales, Tejas Equipment Rental, Holt of California, Rocky Hill Equipment Rentals, Green Rental.

The market segments include Type, Application.

The market size is estimated to be USD 15180 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Backhoe Loader Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Backhoe Loader Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.