1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Food Packaging Bag?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Baby Food Packaging Bag

Baby Food Packaging BagBaby Food Packaging Bag by Application (Infant Formula, Baby Cereals, Baby Snacks, Others, World Baby Food Packaging Bag Production ), by Type (Plastic Packaging Bag, Aluminum Foil Packaging Bag, World Baby Food Packaging Bag Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

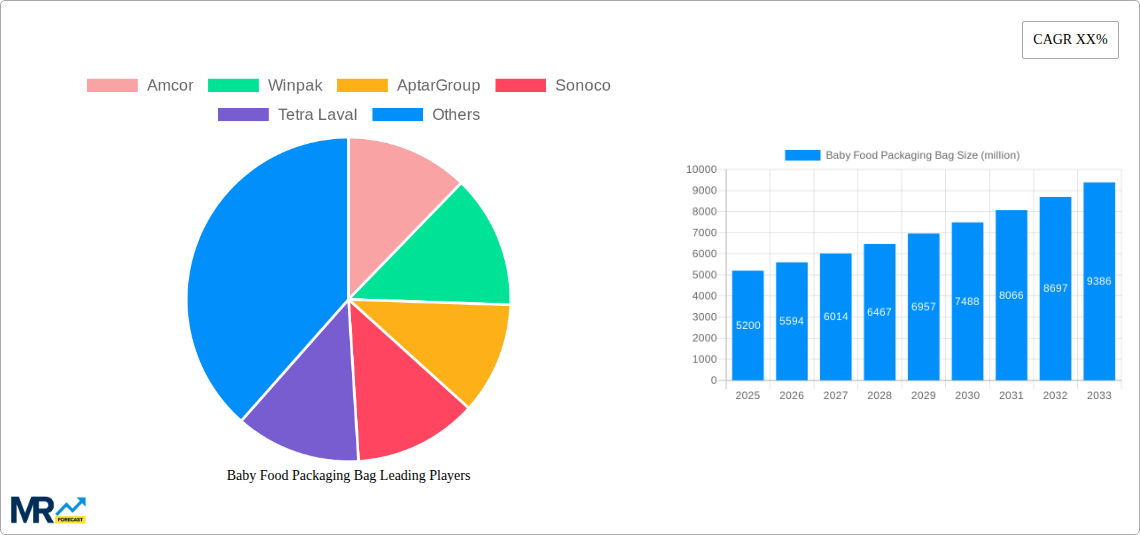

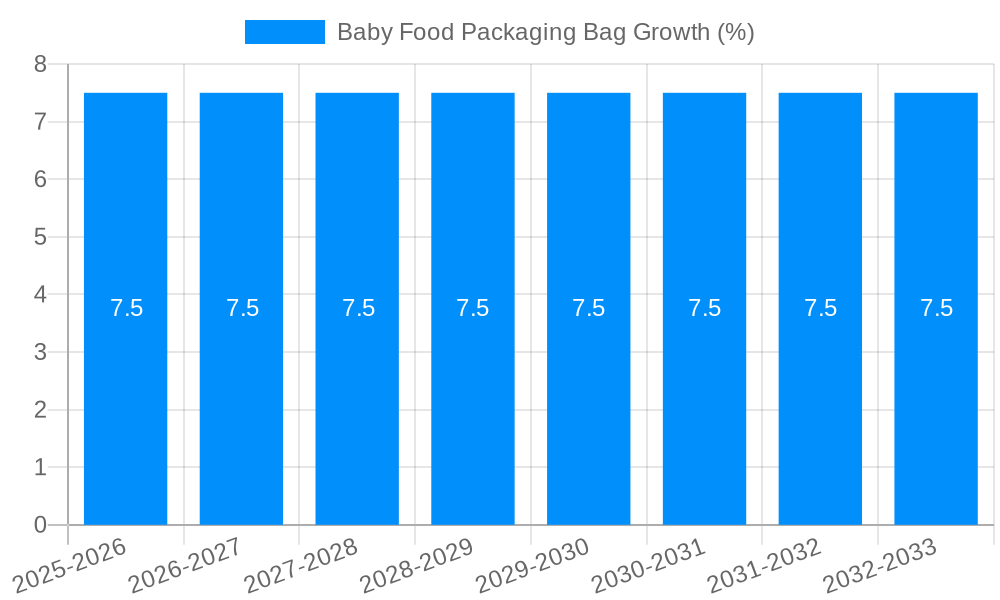

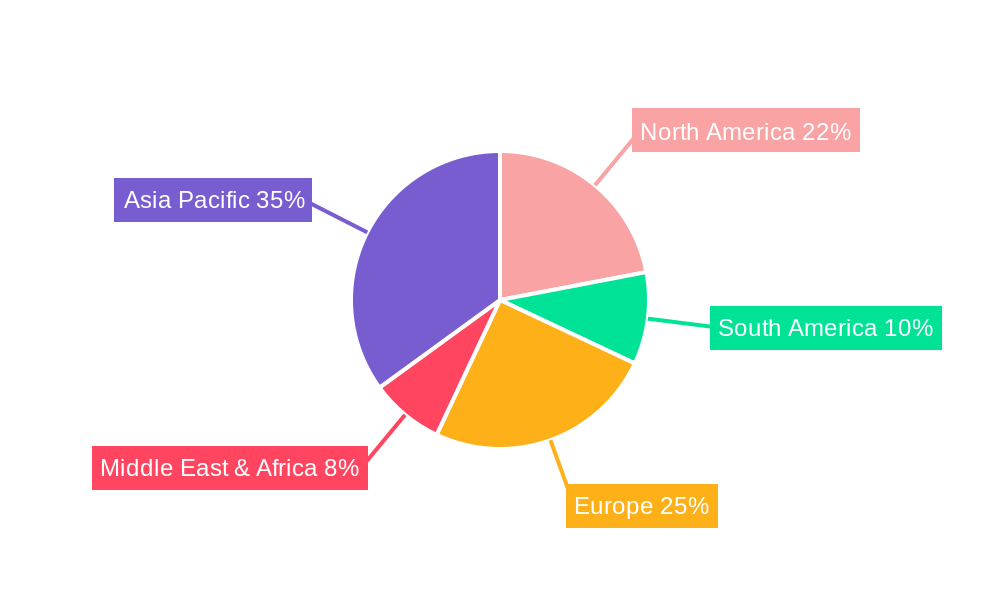

The global baby food packaging bag market is poised for significant expansion, projected to reach approximately \$5,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% expected throughout the forecast period of 2025-2033. This dynamic growth is primarily fueled by a confluence of factors, including the increasing global birth rate, a rising parental focus on premium and organic baby food options, and a growing awareness of the importance of safe and convenient packaging solutions. The Asia Pacific region, particularly China and India, is emerging as a dominant force, driven by a burgeoning middle class with increased disposable income and a growing demand for convenient, single-serve baby food formats. This surge is further amplified by an expanding retail infrastructure and a greater adoption of modern packaging technologies.

Key market drivers include the escalating demand for infant formula and baby cereals, which constitute the largest segments due to their staple nature in infant nutrition. Innovations in packaging materials, such as the development of lighter, more sustainable, and highly protective plastic and aluminum foil packaging bags, are also playing a crucial role in market expansion. These advancements ensure product freshness, extend shelf life, and offer enhanced convenience for busy parents. However, the market also faces certain restraints, including the fluctuating costs of raw materials, stringent regulatory requirements for food packaging safety, and a growing consumer preference for reusable or eco-friendly packaging alternatives, which could pose challenges for traditional single-use packaging solutions. Despite these challenges, the overarching trend towards premiumization and convenience in the baby food sector, coupled with continuous innovation in packaging technology, is expected to sustain a healthy growth trajectory for the baby food packaging bag market.

This comprehensive report delves into the intricate world of Baby Food Packaging Bags, analyzing its evolving landscape from 2019 to 2033, with a specific focus on the base year 2025 and a detailed forecast from 2025-2033. The study meticulously examines market dynamics, technological advancements, and consumer preferences that are shaping the production and consumption of these critical packaging solutions for infants and toddlers. With an estimated global baby food packaging bag production reaching XXX million units by 2025, this report provides an invaluable resource for stakeholders seeking to understand market opportunities and navigate its complexities.

The global baby food packaging bag market is undergoing a significant transformation, driven by a confluence of evolving consumer expectations, regulatory shifts, and technological innovations. XXX indicates a pronounced trend towards enhanced convenience and portability. Parents today lead increasingly busy lives, necessitating packaging solutions that are easy to open, reseal, and transport. This has led to a surge in the adoption of stand-up pouches with reclosable zippers and spouts, particularly for purees and snacks. Furthermore, the "on-the-go" consumption pattern is a dominant force, influencing the design and format of packaging to cater to busy schedules. Sustainability is no longer a niche concern but a central tenet of consumer choice. There is a palpable demand for eco-friendly packaging materials, including recyclable plastics, biodegradable options, and those with a reduced environmental footprint. Manufacturers are actively investing in research and development to incorporate post-consumer recycled (PCR) content and explore innovative bio-based materials. The pursuit of extended shelf life and improved product safety remains paramount. Advanced barrier properties, such as those offered by multi-layer plastic films and aluminum foil laminates, are crucial for preserving the nutritional integrity and freshness of baby food. This extends to innovative sealing technologies and tamper-evident features that provide consumers with a visual assurance of product integrity, a factor of immense importance in the baby food sector. The rise of personalized nutrition and specialized dietary needs is also subtly influencing packaging design. While not yet a mainstream driver for bags, the potential for smaller, single-serving pouches that cater to specific caloric or allergen-free requirements is an emerging trend. The aesthetic appeal and branding of baby food packaging are also gaining traction. Attractive, vibrant designs with clear nutritional information and engaging characters appeal to both parents and, increasingly, to discerning young consumers, contributing to brand loyalty and product differentiation in a competitive market. The integration of smart packaging features, though still nascent, represents a future trend, with the potential for QR codes linking to nutritional information, origin traceability, or even interactive content for parents.

The baby food packaging bag market is experiencing robust growth, propelled by a confluence of powerful demographic and socio-economic factors. The most significant driver remains the steadily growing global infant population. As birth rates, particularly in emerging economies, continue to climb, the demand for baby food, and consequently its packaging, expands proportionally. This demographic uplift provides a fundamental and consistent impetus for market expansion. Alongside population growth, the increasing disposable income and rising living standards in developing nations are playing a crucial role. As more families gain access to improved economic resources, they are increasingly opting for commercially prepared baby food over traditional home preparation, thereby boosting the demand for packaged products. This shift is particularly evident in Asia-Pacific and parts of Africa. Furthermore, the growing awareness and emphasis on infant nutrition and health among parents globally are driving the preference for convenient, safe, and nutritionally complete baby food options. This necessitates packaging that not only preserves the product's quality but also conveys essential information clearly and effectively. The desire for convenience, a defining characteristic of modern lifestyles, is another major propeller. Parents are seeking packaging solutions that are easy to use, resealable, and portable, allowing for feeding on-the-go. This has spurred the demand for innovations like stand-up pouches with spouts and zippers, which offer unparalleled user-friendliness. The evolving retail landscape, with the dominance of modern trade channels like supermarkets and hypermarkets, also influences packaging choices. These channels often favor standardized and aesthetically appealing packaging that can be easily displayed and managed on shelves, further contributing to the demand for bags and pouches.

Despite the positive growth trajectory, the baby food packaging bag market faces several significant challenges and restraints that warrant careful consideration. A primary concern revolves around environmental sustainability and the increasing scrutiny of single-use plastics. Growing public and regulatory pressure to reduce plastic waste is leading to calls for more sustainable packaging alternatives. While manufacturers are exploring recyclable and biodegradable options, the cost and performance limitations of these materials can act as a restraint. The volatility in raw material prices, particularly for plastics and aluminum foil, can significantly impact production costs and profit margins for packaging manufacturers. Fluctuations in crude oil prices, for instance, directly affect the cost of producing plastic resins, making it challenging to maintain stable pricing for end-products. Stringent regulatory requirements and evolving food safety standards across different regions present another hurdle. Compliance with these regulations, which often involve rigorous testing and certification processes, can be time-consuming and expensive, potentially slowing down product innovation and market entry. The high cost of specialized packaging machinery and infrastructure required for advanced packaging solutions, such as those with sophisticated barrier properties or smart features, can be a barrier to entry for smaller players and limit widespread adoption, especially in price-sensitive markets. Furthermore, consumer perception and preference for traditional packaging formats in certain regions, where glass jars or cans might still be favored due to established trust or perceived safety, can limit the market penetration of flexible packaging solutions. Finally, the risk of counterfeiting and product tampering in the baby food sector necessitates robust security features in packaging, which can add to the complexity and cost of production, acting as a subtle restraint on overly simplified packaging designs.

The global baby food packaging bag market is poised for significant regional and segment-driven dominance. Based on the analysis for the Study Period: 2019-2033, with a Base Year of 2025, the following insights are crucial:

Key Dominating Segments:

Application: Infant Formula: This segment is projected to be a major driver of market growth.

Type: Plastic Packaging Bag: This type of packaging is expected to hold a dominant share.

Key Dominating Regions/Countries:

Asia-Pacific: This region is expected to emerge as the largest and fastest-growing market for baby food packaging bags.

North America: This region is expected to maintain a significant market share, driven by mature markets and high consumer spending.

The baby food packaging bag industry is fueled by several key growth catalysts. The escalating global birth rate consistently provides a foundational demand. Concurrently, rising disposable incomes and increasing urbanization in emerging economies are expanding the consumer base for convenient, commercially prepared baby food. Furthermore, heightened parental awareness regarding infant nutrition and safety drives the demand for high-quality packaging that ensures product integrity. The persistent need for convenience and portability in modern lifestyles directly translates to a preference for easy-to-use and on-the-go packaging formats. Finally, technological advancements in materials science and manufacturing processes are enabling the development of more sustainable, functional, and cost-effective packaging solutions, further stimulating market expansion.

This report offers an exhaustive examination of the baby food packaging bag market, providing a holistic view for stakeholders. It meticulously analyzes market size and growth projections, segmented by application (Infant Formula, Baby Cereals, Baby Snacks, Others) and type (Plastic Packaging Bag, Aluminum Foil Packaging Bag). The study delves into the intricate interplay of driving forces and challenges, shedding light on the key factors shaping the industry's trajectory. Furthermore, it identifies and elaborates on the dominant regions and countries, offering specific insights into market dynamics in these areas. The report also highlights significant developments and technological innovations, alongside a comprehensive overview of the leading industry players. This in-depth analysis ensures that readers gain a profound understanding of the current market landscape and future opportunities within the global baby food packaging bag sector, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor, Winpak, AptarGroup, Sonoco, Tetra Laval, Mondi Group, Sealed Air, Ampac Holding LLC, Berry Global, Nestle, Bericap, Carepac, Beapak Packaging, Auspouch, Lanker Pack.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Baby Food Packaging Bag," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Baby Food Packaging Bag, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.