1. What is the projected Compound Annual Growth Rate (CAGR) of the Avian Influenza Test?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Avian Influenza Test

Avian Influenza TestAvian Influenza Test by Type (/> PCR Avian Influenza Test, ELISA Avian Influenza Test), by Application (/> Duck, Goose, Chickens, Turkeys, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

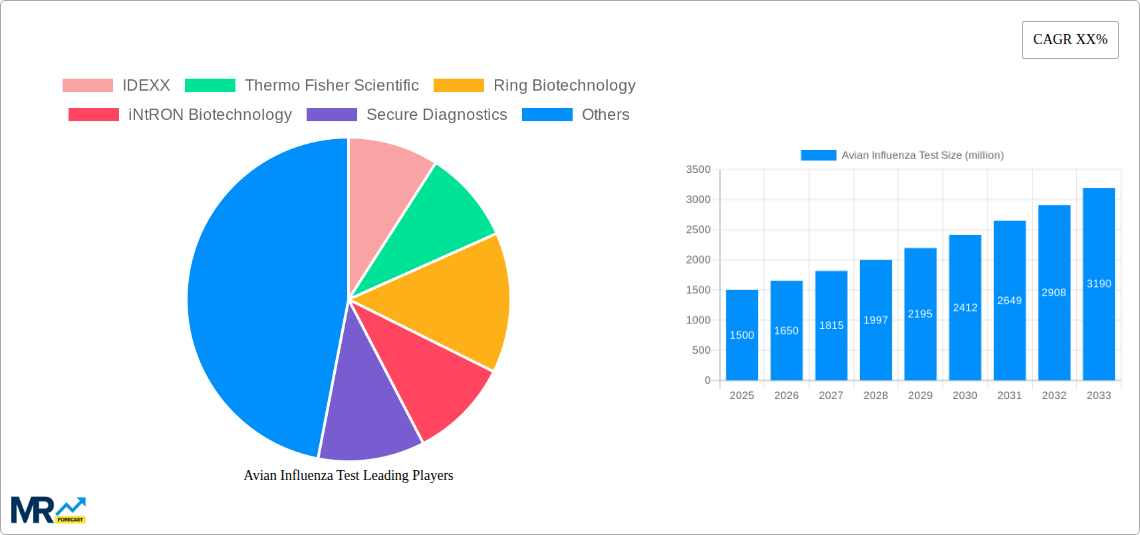

The global Avian Influenza (AI) Test market is experiencing robust growth, driven by the increasing prevalence of avian influenza outbreaks worldwide and stringent government regulations mandating rapid and accurate disease detection. The market's expansion is fueled by advancements in diagnostic technologies, such as real-time PCR and ELISA tests, offering faster and more sensitive results compared to traditional methods. Furthermore, the rising demand for efficient surveillance programs in poultry farming and wildlife monitoring contributes significantly to market growth. The increasing adoption of point-of-care diagnostics is also expected to fuel market expansion, particularly in regions with limited access to advanced laboratory facilities. However, the market faces certain restraints, including the high cost of advanced diagnostic technologies, the need for skilled personnel to operate these tests, and the potential for false-negative or false-positive results, depending on the test's sensitivity and specificity. Competitive landscape analysis reveals key players like IDEXX, Thermo Fisher Scientific, and Zoetis, contributing significantly to innovation and market penetration. These companies are actively engaged in research and development, aiming to develop more accurate, rapid, and cost-effective AI diagnostic tools.

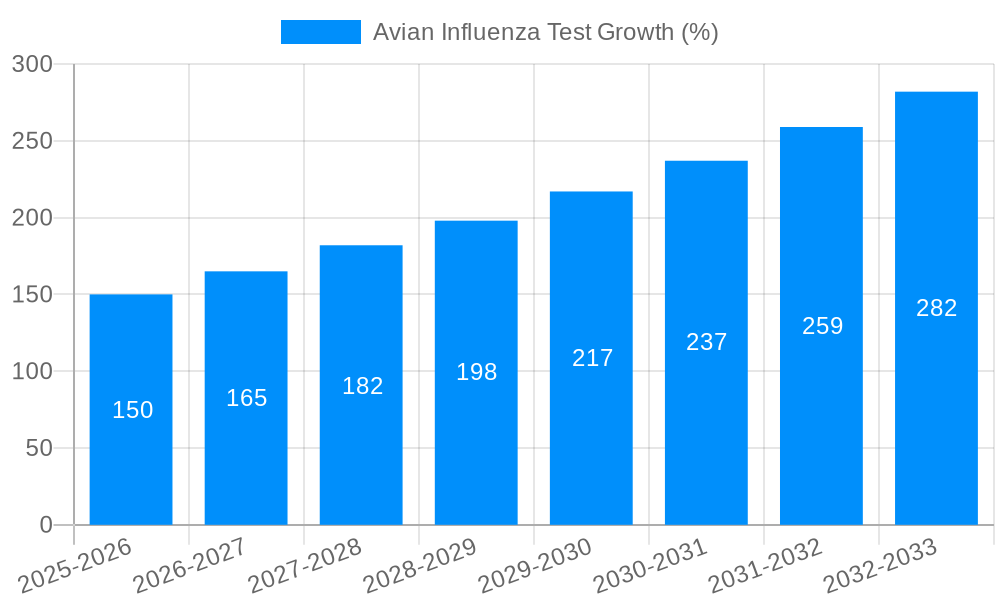

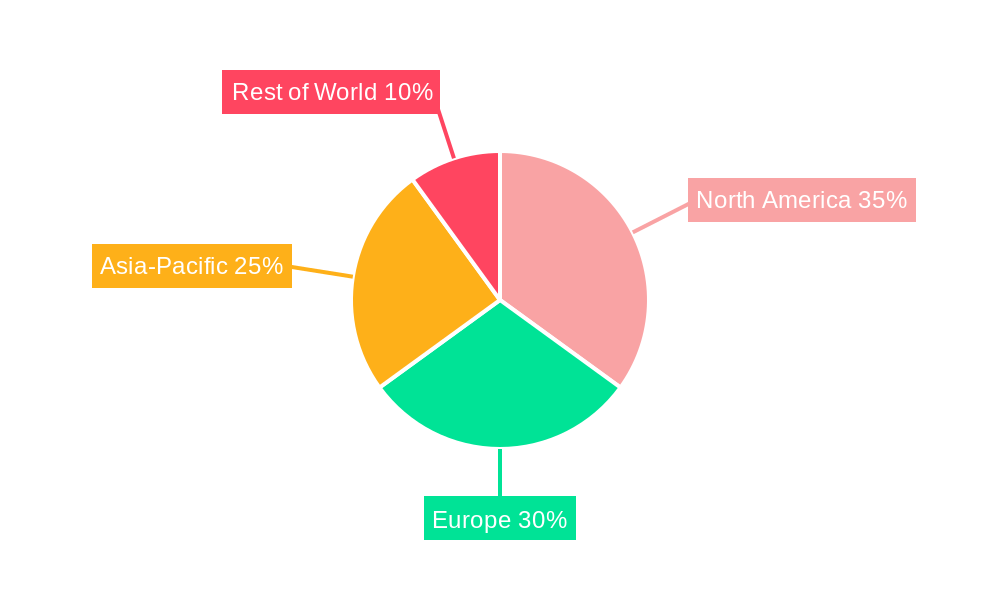

Segment-wise, the market is categorized by test type (e.g., PCR, ELISA, etc.), end-user (e.g., research laboratories, veterinary clinics, government agencies), and geographic region. The PCR segment currently dominates, owing to its high sensitivity and specificity. However, other techniques are also rapidly evolving, offering competitive alternatives. North America and Europe are major markets due to established healthcare infrastructure and stringent animal health regulations. However, the Asia-Pacific region is expected to witness significant growth in the coming years, driven by increasing poultry production and rising awareness about AI prevention and control. Considering the projected CAGR and current market size estimations based on available data from similar markets in the veterinary diagnostics field, the market is poised for considerable growth throughout the forecast period (2025-2033), with significant potential for expansion in emerging economies.

The global avian influenza (AI) test market is experiencing substantial growth, projected to reach multi-million unit sales by 2033. Driven by increasing poultry production, the expanding global reach of AI outbreaks, and heightened surveillance efforts, the market demonstrates strong potential. The historical period (2019-2024) saw significant fluctuations influenced by the severity and geographical spread of AI outbreaks. The estimated market value for 2025 is substantial, setting the stage for a robust forecast period (2025-2033). This growth is fueled by advancements in diagnostic technologies, a move towards rapid and point-of-care testing, and increased governmental investment in disease surveillance and control programs. The market is witnessing a shift towards more sensitive and specific detection methods, with companies actively developing and launching next-generation sequencing (NGS) based tests and multiplex assays that can detect multiple pathogens simultaneously. This improves efficiency and reduces diagnostic costs. Furthermore, the increasing demand for accurate and timely diagnostic solutions from both government agencies and private poultry farms is pushing the market forward. The rise of AI-powered diagnostic tools also promises enhanced accuracy and speed, attracting investments in this burgeoning field. However, challenges such as the high cost of advanced diagnostic technologies, the need for skilled personnel to operate sophisticated equipment, and the potential for false-positive or false-negative results remain. Overall, the market’s trajectory indicates significant expansion fueled by both technological advancements and increasing global need.

Several key factors contribute to the significant growth projected in the avian influenza test market. First and foremost, the ever-increasing global poultry production necessitates robust surveillance systems to prevent and control AI outbreaks. Losses due to AI outbreaks can be catastrophic for the poultry industry, creating significant economic incentives for early and accurate detection. The rising awareness of AI's zoonotic potential – its ability to transmit to humans – fuels investments in proactive testing and monitoring. Governments worldwide are implementing stringent biosecurity measures and investing heavily in AI diagnostic capabilities as part of their public health strategies. Technological advancements are another pivotal driver. The development of rapid, sensitive, and cost-effective diagnostic tools, such as PCR-based tests and lateral flow assays, greatly accelerates the testing process and improves accessibility. Moreover, the emergence of point-of-care testing (POCT) solutions allows for on-site testing, reducing turnaround times and improving disease management. The growing adoption of automated high-throughput testing systems further enhances efficiency and reduces labor costs in high-volume testing laboratories. Finally, increased collaboration between governments, research institutions, and diagnostic companies fuels innovation and market growth by facilitating the development and deployment of advanced testing solutions.

Despite the positive growth trajectory, several factors pose challenges to the avian influenza test market. The high cost of advanced diagnostic technologies, particularly NGS-based assays and sophisticated PCR equipment, can hinder access for smaller poultry farms and laboratories in developing countries. The requirement for skilled personnel to operate and interpret results from these advanced technologies creates a dependency on trained professionals, which may limit widespread adoption, especially in resource-constrained settings. Another challenge lies in maintaining the quality and reliability of test results. False-positive or false-negative results can have serious consequences, leading to unnecessary culling or delayed intervention, respectively. Strict quality control measures and robust validation protocols are crucial to mitigate these risks. The constant evolution of AI strains necessitates the continuous development and adaptation of diagnostic tests to ensure effective detection of emerging variants. This ongoing need for updated testing methodologies represents a significant investment for manufacturers and healthcare systems. Finally, the complexities of regulatory approvals and varying international standards can create barriers to market entry for new diagnostic tools and technologies.

Asia-Pacific: This region is expected to hold a significant share of the market, driven by the high density of poultry farms and frequent AI outbreaks. Countries like China and India, with their massive poultry industries, are key contributors. The high volume of poultry production necessitates continuous testing, fueling demand for rapid and cost-effective diagnostic solutions. Increased government funding for animal health initiatives and investments in advanced diagnostic technologies are also bolstering market growth.

North America: Strong regulatory frameworks and advancements in diagnostic technology contribute significantly to the market's growth in this region. The presence of large poultry producers and well-established animal health infrastructure supports the high demand for rapid and reliable avian influenza tests.

Europe: Similar to North America, Europe demonstrates strong market growth due to robust regulatory oversight and proactive disease surveillance programs. High-income countries within the region generally have better access to advanced testing technologies. However, variations in market access and testing capacity exist across different European nations.

Segments: While the market encompasses various segments, tests based on PCR technology are projected to maintain a dominant position owing to their high sensitivity and specificity. Rapid diagnostic tests (RDTs) are also witnessing increasing adoption due to their ease of use and rapid turnaround time, particularly valuable for on-site testing in remote areas or during outbreaks.

The paragraph above highlights the key regions and the PCR and RDT segments as market dominators. The combination of high poultry production, advanced testing technologies, and supportive regulatory environments drives these segments and regions to the forefront of the AI testing market.

The avian influenza test industry is propelled by several key growth catalysts. The increasing prevalence of AI outbreaks necessitates sophisticated and rapid diagnostic tools. Advancements in testing technologies, such as the development of more sensitive and specific assays, are improving detection capabilities and informing better disease management strategies. Governmental initiatives focused on biosecurity and disease surveillance are further bolstering market growth by increasing funding and support for research and development. The growing awareness among poultry producers regarding the economic impact of AI outbreaks also motivates greater investment in preventive testing measures.

This report provides a comprehensive overview of the avian influenza test market, examining historical trends, current market dynamics, and future projections. It analyzes key market drivers, restraints, and opportunities. The report also features detailed profiles of leading companies in the sector, focusing on their market share, product portfolio, and strategic initiatives. In addition to regional and segmental analyses, the report delves into regulatory landscapes and technological advancements shaping this critical area of animal health. The report's projections extend to 2033, offering valuable insights for stakeholders involved in avian influenza testing and surveillance.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IDEXX, Thermo Fisher Scientific, Ring Biotechnology, iNtRON Biotechnology, Secure Diagnostics, Bioeasy Biotechnology Inc., BioSellal, MEGACOR Diagnostik, Abbexa, Biostone Animal Health LLC, BioChek, Primerdesign, Zoetis Services, Secure Diagnostics, Shenzhen Zhenrui Biotech Co., Ltd., Quicking Biotech, Chongqing Calvin Cycle Technology Co., Shenzhen Lvshiyuan Biotechnology Co., Shanghai S&C BIOTECH, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Avian Influenza Test," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Avian Influenza Test, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.