1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Wheel?

The projected CAGR is approximately 6.24%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Wheel

Automotive WheelAutomotive Wheel by Type (Aluminum Alloy, Steel, Carbon Fiber, World Automotive Wheel Production ), by Application (Original Equipment Manufacturer (OEM), Aftermarket, World Automotive Wheel Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

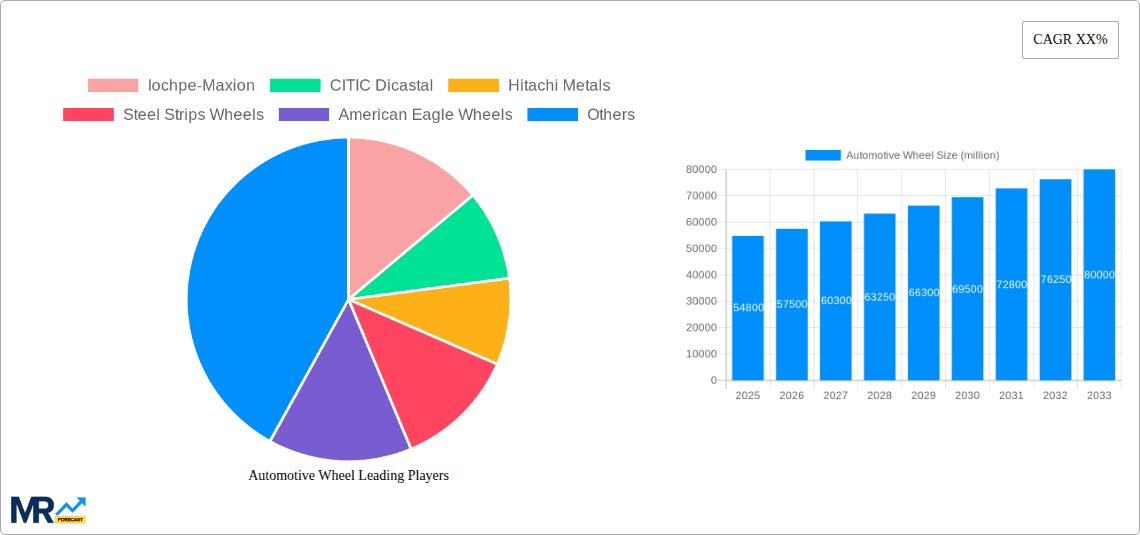

The global automotive wheel market is projected to reach $51.8 billion by 2025, with a compound annual growth rate (CAGR) of 6.24% from 2025 to 2033. This expansion is propelled by escalating demand for passenger vehicles worldwide, especially in emerging economies, and a growing consumer preference for lightweight, aesthetically pleasing wheels that improve vehicle performance and fuel efficiency. Technological innovations, including the integration of advanced materials like aluminum alloys and carbon fiber, alongside sophisticated manufacturing processes, are key contributors to this upward trend. The market is segmented by material (steel, aluminum, others), vehicle type (passenger cars, commercial vehicles), and sales channel (OEM, aftermarket). Prominent players such as Iochpe-Maxion, CITIC Dicastal, and Hitachi Metals are actively influencing the market through strategic collaborations, product development, and global expansion.

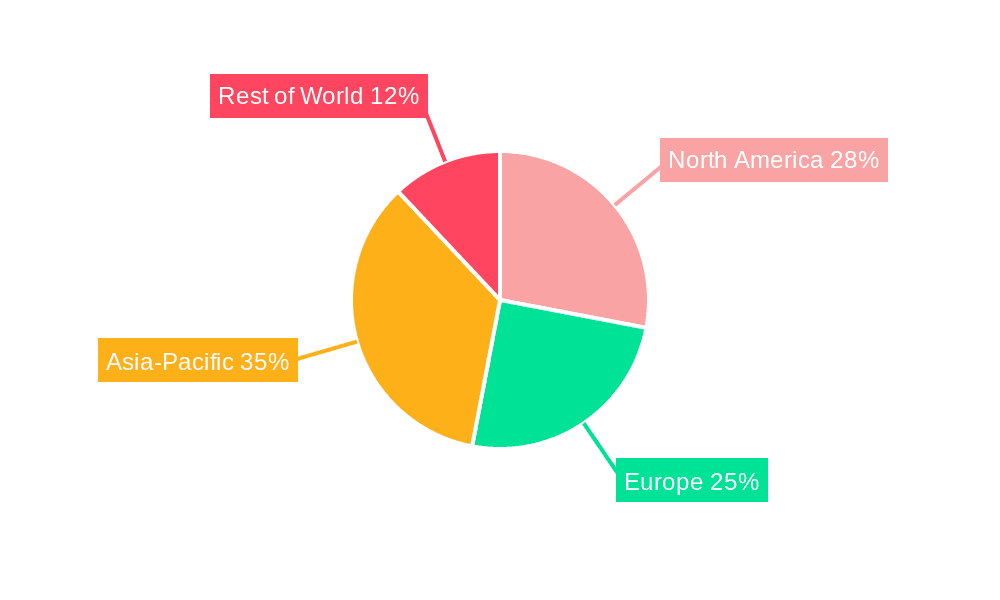

Despite positive growth prospects, the market encounters several challenges. Volatile raw material prices for steel and aluminum, exacerbated by global supply chain disruptions, can significantly affect manufacturing costs and profitability. Stringent environmental regulations and a growing emphasis on sustainable production methods require manufacturers to invest in adaptation and innovation. Moreover, intense market competition necessitates continuous investment in research and development (R&D) and operational optimization to sustain a competitive advantage. Nevertheless, the long-term outlook for the automotive wheel market remains robust, driven by the sustained growth of the automotive industry and ongoing technological advancements. North America and Asia-Pacific are anticipated to be primary growth regions.

The global automotive wheel market, valued at over 1000 million units in 2024, is poised for significant growth throughout the forecast period (2025-2033). Key market insights reveal a strong correlation between automotive production and wheel demand, with the rising sales of passenger cars and light commercial vehicles acting as a primary driver. The shift towards lightweight materials, driven by the increasing focus on fuel efficiency and vehicle performance, is significantly impacting the market. Aluminum alloy wheels are experiencing substantial growth, surpassing steel wheels in certain segments, particularly in high-end vehicles and electric vehicles (EVs). This preference for aluminum is further fueled by advancements in casting and forging technologies that allow for more complex designs and improved durability. Furthermore, the market is witnessing increased customization and personalization, with consumers demanding aesthetically pleasing and performance-enhancing wheels. This trend is pushing manufacturers to innovate in design, materials, and finishes. The growing adoption of advanced driver-assistance systems (ADAS) and the increasing prevalence of connected cars are also indirectly influencing the market, as these technological advancements often require specific wheel designs and integration capabilities. Finally, stringent safety regulations and emission standards worldwide are prompting the development of wheels that meet and exceed these requirements, driving innovation in areas like wheel strength, durability, and noise reduction. The market is witnessing a growing trend toward sustainable manufacturing practices, as companies strive to reduce their environmental impact.

Several factors contribute to the robust growth of the automotive wheel market. The expanding global automotive industry, particularly in developing economies like India and China, fuels the demand for millions of wheels annually. Rising disposable incomes and a growing middle class in these regions lead to increased car ownership, directly translating into higher demand. The aforementioned shift toward lighter-weight materials, particularly aluminum alloys, represents a key driving force. These lighter wheels improve fuel efficiency, reducing carbon emissions and appealing to environmentally conscious consumers. Moreover, advancements in manufacturing technologies, such as automated casting and forging processes, contribute to increased production efficiency and lower costs. This makes the wheels more affordable and accessible to a wider range of consumers. Technological advancements also play a crucial role. Innovations in wheel design, material science, and surface treatments enhance durability, aesthetics, and performance. The rise of the electric vehicle (EV) market presents a significant opportunity, as EVs often require specialized wheels to accommodate their unique powertrain and performance characteristics. Finally, the increasing demand for aftermarket customization, where consumers replace factory-fitted wheels with aftermarket options, adds another dimension to market growth.

Despite the positive growth trajectory, several challenges and restraints impact the automotive wheel market. Fluctuations in raw material prices, particularly steel and aluminum, pose a significant risk, affecting production costs and profitability. Global economic downturns or regional recessions can drastically reduce automotive production, consequently impacting wheel demand. Intense competition among numerous wheel manufacturers necessitates continuous innovation and cost-effective production strategies to maintain market share. The industry is also subject to stringent environmental regulations regarding emissions and waste management, requiring manufacturers to invest in sustainable manufacturing practices, which can increase upfront costs. Supply chain disruptions and logistical challenges, particularly evident in recent years, can cause production delays and increase costs. Furthermore, technological advancements in wheel design and manufacturing require significant research and development investment, placing pressure on companies to maintain a competitive edge. Finally, consumer preferences are dynamic, with trends changing frequently, requiring manufacturers to be responsive and adaptive to evolving market needs.

Asia-Pacific: This region is projected to dominate the market due to the rapid growth of the automotive industry in countries like China and India. The large-scale automotive production in these nations necessitates a huge supply of wheels, driving significant market expansion. The increasing demand for passenger cars, commercial vehicles, and two-wheelers continues to fuel this growth. Furthermore, the region's expanding middle class and rising disposable incomes further contribute to the increased demand for automobiles and related components. Government initiatives promoting electric vehicle adoption in several Asian-Pacific countries also present a strong catalyst for the market's growth. The region's robust manufacturing infrastructure and relatively lower production costs further enhance its dominance in the automotive wheel market.

Aluminum Alloy Wheels Segment: This segment is expected to experience the highest growth rate due to the increasing preference for lightweight, fuel-efficient vehicles. The superior performance characteristics of aluminum alloy wheels compared to steel wheels, including lighter weight, improved fuel economy, enhanced aesthetics, and greater durability, make them highly sought after in the premium and luxury vehicle segments. Technological advancements in manufacturing processes allow for more complex designs and cost-effective production of these high-performance wheels. The rise of electric vehicles (EVs) is further boosting this segment's growth, as aluminum alloy wheels are ideal for EVs due to their lightweight nature and contribution to extended range.

Aftermarket Segment: While the original equipment manufacturer (OEM) segment is substantial, the aftermarket segment presents a lucrative opportunity for growth. Consumers are increasingly customizing their vehicles, including replacing standard wheels with aftermarket options that offer improved aesthetics, performance, or both. This trend is driving significant demand for aftermarket wheels, fueling the expansion of the automotive wheel market.

The automotive wheel industry is witnessing significant growth propelled by factors like increasing vehicle production, rising demand for fuel-efficient and lightweight vehicles, technological advancements in wheel manufacturing, and the expanding aftermarket segment. The growing preference for aluminum alloy wheels over steel wheels due to their superior performance and aesthetic qualities further accelerates market expansion. Furthermore, government regulations promoting fuel efficiency and emission reduction are indirectly driving the demand for lightweight wheels.

This report offers a comprehensive overview of the automotive wheel market, covering market size, segmentation, key players, and growth trends from 2019 to 2033. It provides detailed insights into market dynamics, driving factors, and challenges. The report analyzes regional and segment-specific market opportunities and forecasts future market growth, offering invaluable information for stakeholders in the automotive industry. The data presented is based on rigorous analysis and extensive research, ensuring its accuracy and reliability.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.24%.

Key companies in the market include Iochpe-Maxion, CITIC Dicastal, Hitachi Metals, Steel Strips Wheels, American Eagle Wheels, United Wheels Group, .

The market segments include Type, Application.

The market size is estimated to be USD 51.8 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Wheel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Wheel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.