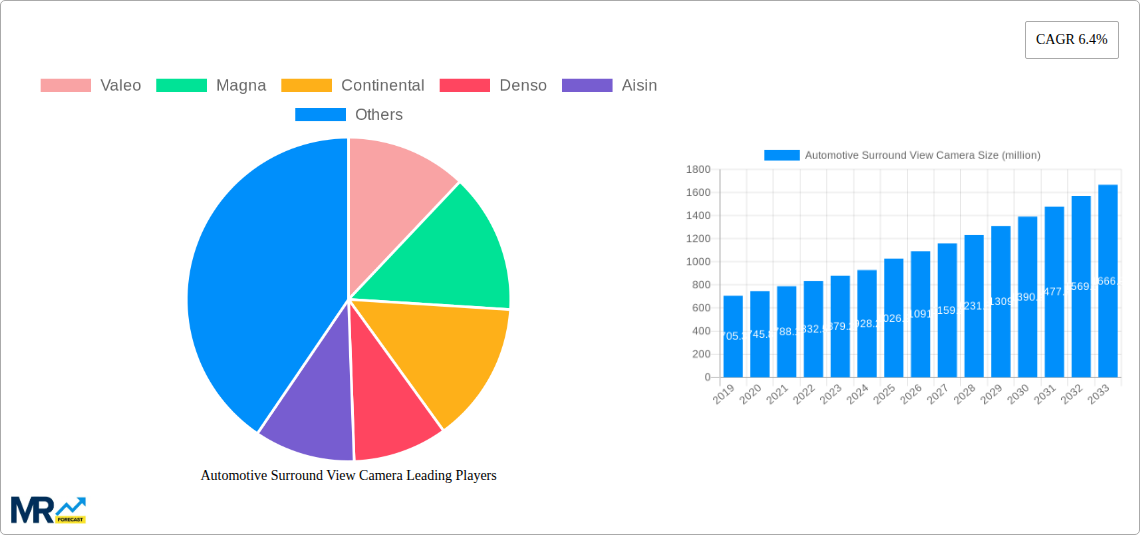

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Surround View Camera?

The projected CAGR is approximately 6.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Surround View Camera

Automotive Surround View CameraAutomotive Surround View Camera by Type (4 Cameras Type, 6 Cameras Type, Other), by Application (OEM, Aftermarket), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Automotive Surround View Camera market is poised for substantial expansion, projected to reach an impressive market size of $1026.9 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This robust growth is fundamentally driven by the escalating demand for enhanced vehicle safety features and the increasing adoption of advanced driver-assistance systems (ADAS) across all vehicle segments. As regulatory bodies worldwide continue to emphasize pedestrian detection and collision avoidance technologies, the integration of surround view camera systems becomes a critical component for automakers. The market is segmented into different camera types, with 4-camera and 6-camera systems leading in adoption due to their comprehensive visual coverage, catering to both the Original Equipment Manufacturer (OEM) and aftermarket sectors. The increasing consumer awareness regarding the benefits of these systems, such as improved parking assistance and blind-spot monitoring, is further fueling market penetration.

Emerging trends in the automotive industry, including the drive towards autonomous driving and the increasing complexity of vehicle environments, are acting as significant accelerators for the surround view camera market. Manufacturers are continuously innovating, developing higher resolution cameras, wider field-of-view lenses, and sophisticated image processing algorithms to provide a more immersive and accurate 360-degree view. The integration of AI and machine learning capabilities within these systems to enable advanced object recognition and predictive safety measures is a key area of development. While the market demonstrates strong upward momentum, potential restraints include the initial cost of these advanced systems, which can impact adoption in budget-conscious segments, and the ongoing challenges related to technological standardization and data integration across different automotive platforms. However, the overwhelming benefits in terms of safety and convenience are expected to outweigh these challenges, solidifying the market's growth trajectory.

The automotive surround view camera market is experiencing a transformative period, driven by an escalating demand for enhanced vehicle safety, improved driver assistance features, and the burgeoning trend towards autonomous driving. This report provides a comprehensive analysis of the market dynamics, segmentations, and future trajectory of automotive surround view camera systems, meticulously examining the period from 2019 to 2033, with a deep dive into the base year of 2025 and a robust forecast period from 2025 to 2033. The historical performance from 2019 to 2024 has laid the groundwork for this dynamic growth.

XXX The automotive surround view camera market is poised for exponential growth, projected to reach tens of millions of units by the end of the forecast period. This surge is intrinsically linked to the global automotive industry's relentless pursuit of enhanced safety and convenience features. Consumers are increasingly prioritizing vehicles equipped with advanced driver-assistance systems (ADAS), and surround view cameras are emerging as a cornerstone technology in this evolution. The ability of these systems to provide a 360-degree view around the vehicle, effectively eliminating blind spots and facilitating precise maneuvering, is a key selling proposition.

The market's expansion is further fueled by stringent government regulations mandating the inclusion of advanced safety features in new vehicles across various regions. This regulatory push, coupled with automakers' proactive approach to integrating sophisticated technologies to meet evolving consumer expectations, is creating a fertile ground for surround view camera adoption. The increasing affordability of camera hardware and processing power is also playing a crucial role, making these advanced systems accessible to a wider range of vehicle segments, from premium sedans to mass-market hatchbacks.

Furthermore, the integration of surround view cameras with other ADAS technologies, such as parking assist systems, blind-spot monitoring, and even rudimentary forms of autonomous driving, is a significant trend. This synergistic integration allows for more intelligent and comprehensive driver support, enhancing both safety and the overall driving experience. As vehicle connectivity advances and the concept of the "smart car" gains traction, surround view cameras are becoming an indispensable component in the automotive ecosystem, contributing to a more secure and convenient mobility future. The market is also witnessing a diversification in camera types, with advancements in image processing and sensor technology leading to improved resolution, low-light performance, and wider field-of-view capabilities, further solidifying their importance. The shift towards more integrated and sophisticated camera modules, designed for seamless integration into vehicle aesthetics, is also a noteworthy trend.

The automotive surround view camera market is experiencing a significant upswing driven by a confluence of powerful factors. Foremost among these is the escalating consumer demand for enhanced safety and security features in vehicles. In an era where driver distraction is a major concern and parking in congested urban environments can be challenging, the 360-degree visibility offered by surround view camera systems provides an invaluable layer of protection, significantly reducing the risk of minor collisions and pedestrian incidents. This enhanced situational awareness is a powerful draw for car buyers across all demographics and vehicle types.

Beyond safety, the proliferation of sophisticated infotainment and driver assistance systems is another key propellant. As vehicles become more connected and technologically advanced, surround view cameras are increasingly being integrated as a central component of these systems. Their ability to provide real-time visual feedback for parking maneuvers, lane changes, and obstacle detection seamlessly complements other ADAS functions, creating a more holistic and intuitive driver experience. Automakers are recognizing the competitive advantage offered by these advanced camera systems, positioning them as a premium feature that appeals to a discerning customer base. The ongoing advancements in AI and machine learning are also enabling more intelligent interpretation of camera feeds, leading to features like object recognition and trajectory prediction, further increasing the perceived value of surround view camera technology.

Despite the robust growth trajectory, the automotive surround view camera market is not without its impediments. A primary challenge revolves around the cost of integration. While camera hardware costs are decreasing, the overall system – encompassing multiple cameras, sophisticated image processing units, and complex software algorithms – can still represent a significant investment for some automakers, particularly for entry-level or budget-conscious vehicle models. This can limit widespread adoption in price-sensitive segments of the market.

Another considerable restraint is the complexity of calibration and maintenance. Ensuring the accurate stitching of images from multiple cameras to create a seamless 360-degree view requires precise calibration during manufacturing. Any miscalibration can lead to distorted or inaccurate visual representations, compromising the system's effectiveness. Furthermore, post-installation, any physical damage to a camera or its housing can necessitate recalibration, adding to the ownership cost and potential inconvenience for the end-user. The need for robust and reliable performance in diverse environmental conditions – including extreme temperatures, heavy rain, snow, and dust – also presents engineering challenges and can impact long-term durability and functionality. Finally, data privacy concerns related to continuous video recording and processing, while less prominent than other restraints, could also emerge as a consideration in the future.

The OEM (Original Equipment Manufacturer) application segment is poised to dominate the automotive surround view camera market, projected to account for a significant majority of unit sales throughout the forecast period. This dominance stems from the inherent strategy of automakers to integrate advanced safety and convenience features directly into new vehicles as standard or optional equipment. The primary driver for this is the increasing consumer expectation for sophisticated technology, coupled with regulatory mandates in many key automotive markets pushing for higher safety standards.

OEM Dominance: Automakers are increasingly viewing surround view camera systems not as a mere add-on but as an integral part of the modern driving experience. The seamless integration into the vehicle's architecture, from the aesthetics of the camera placement to the user interface on the infotainment display, is best achieved at the OEM level. This allows for optimized performance, superior user experience, and the ability to bundle these features with other advanced driver-assistance systems (ADAS). As new vehicle sales, particularly in major automotive hubs, continue to grow, the OEM channel will naturally represent the largest volume of surround view camera deployments. The base year of 2025 is expected to see a strong showing in this segment, with continued expansion through to 2033.

4 Cameras Type Segment: Within the Type segmentation, the 4 Cameras Type is anticipated to lead the market and capture the largest share. This is due to its optimal balance of comprehensive coverage and cost-effectiveness. A system with four cameras strategically placed at the front, rear, and sides of the vehicle provides the necessary 360-degree view for effective parking assistance and obstacle detection in most everyday driving scenarios. While more advanced systems with 6 cameras or other configurations exist, the 4-camera setup offers a compelling value proposition for a broad spectrum of vehicle models, making it the most widely adopted solution across various price points. The widespread adoption in the OEM segment further solidifies the dominance of the 4-camera configuration.

Geographical Considerations for Market Dominance:

The automotive surround view camera industry is experiencing robust growth fueled by several key catalysts. The escalating focus on vehicle safety and the desire to reduce accidents are paramount, with governments worldwide implementing stricter safety regulations that often mandate or incentivize the adoption of ADAS. Furthermore, consumer demand for convenience and enhanced driving experiences, particularly in urban environments, is a significant driver. The continuous technological advancements in camera resolution, image processing, and AI-powered analytics are making these systems more effective and feature-rich, thereby increasing their appeal to both automakers and end-users. As the cost of these components continues to decline, their accessibility across a wider range of vehicle segments is improving, leading to broader market penetration.

This comprehensive report provides an in-depth analysis of the automotive surround view camera market from 2019 to 2033. It delves into the intricate market dynamics, meticulously dissecting trends, driving forces, and challenges that shape the industry's trajectory. The report offers a granular segmentation of the market by type (4 Cameras Type, 6 Cameras Type, Other) and application (OEM, Aftermarket), providing valuable insights into the performance and growth potential of each segment. Key regions and countries are analyzed for their market dominance, with a focus on the critical role of the OEM segment and the widely adopted 4-camera type. The report also highlights significant industry developments and identifies the leading players, offering a holistic view of the competitive landscape. The detailed forecast period (2025-2033) alongside the base year (2025) and historical performance (2019-2024) ensures a robust understanding of past, present, and future market opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.4%.

Key companies in the market include Valeo, Magna, Continental, Denso, Aisin, Mobis, Fujitsu, Clarion, SL, Good Driver, Percherry, .

The market segments include Type, Application.

The market size is estimated to be USD 1026.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Surround View Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Surround View Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.