1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Summer Tire?

The projected CAGR is approximately 6.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Summer Tire

Automotive Summer TireAutomotive Summer Tire by Type (Replacement, OEM), by Application (Passenger Car, Commecial Car), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

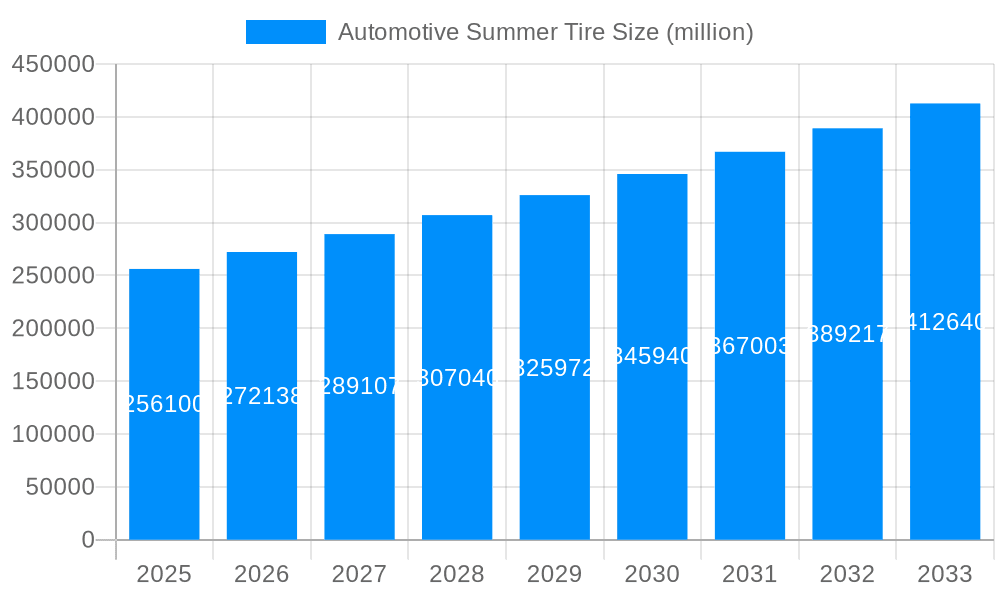

The global Automotive Summer Tire market is experiencing robust growth, projected to reach approximately USD 256.1 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.3% anticipated from 2025 to 2033. This expansion is fueled by several key drivers, including the increasing global vehicle parc and the continuous demand for tire replacements. As vehicle ownership rises across both developed and emerging economies, the need for reliable and performance-oriented summer tires becomes paramount. Furthermore, advancements in tire technology, leading to improved fuel efficiency, enhanced safety features, and extended tire life, are also contributing significantly to market momentum. The OEM segment is expected to remain a dominant force, driven by new vehicle production, while the replacement segment offers substantial opportunities due to the natural wear and tear of existing tires. The market's trajectory indicates a sustained period of growth, reflecting the essential role of summer tires in ensuring optimal vehicle performance and safety during warmer months.

The market is characterized by evolving trends that are shaping consumer preferences and manufacturer strategies. There's a growing emphasis on high-performance summer tires designed for sporty and luxury vehicles, catering to a segment of consumers seeking superior handling and responsiveness. Simultaneously, the development of eco-friendly summer tires, incorporating sustainable materials and manufacturing processes, is gaining traction, aligning with increasing environmental consciousness. While growth is strong, the market is not without its restraints. Fluctuations in raw material prices, particularly for natural and synthetic rubber, can impact manufacturing costs and profitability. Intense competition among established players and the emergence of new entrants also present a challenge, necessitating continuous innovation and competitive pricing strategies. Geographically, Asia Pacific, led by China and India, is poised to be a significant growth engine, owing to its burgeoning automotive industry and expanding middle class. North America and Europe will continue to be mature yet substantial markets, with a strong focus on premium and replacement segments.

Here's a unique report description for an Automotive Summer Tire market analysis, incorporating your specified elements:

The global automotive summer tire market is a dynamic and evolving landscape, projected to witness substantial growth over the coming decade. With an estimated market size reaching upwards of \$65 billion by 2025, and a robust forecast to surpass \$100 billion by 2033, the demand for specialized summer tires is being redefined by several key trends. The historical period of 2019-2024 laid the groundwork, characterized by increasing automotive production and a gradual shift towards performance-oriented tires, even in traditionally less specialized markets. As we enter the base year of 2025, the market is poised for accelerated expansion, driven by a confluence of technological advancements, changing consumer preferences, and regulatory influences.

One of the most significant trends is the increasing emphasis on fuel efficiency and reduced rolling resistance. As global emissions regulations tighten and fuel prices remain a concern for consumers, manufacturers are investing heavily in research and development to create summer tires that minimize energy loss without compromising grip and handling. This has led to the adoption of innovative rubber compounds, advanced tread designs, and lightweight construction techniques. Furthermore, the rise of electric vehicles (EVs) is creating a new sub-segment within the summer tire market. EVs, with their instant torque and often heavier battery packs, require tires that can withstand higher stress levels, offer superior grip for acceleration and braking, and crucially, contribute to maximizing range through low rolling resistance. This necessitates the development of specialized summer tires for EVs, often featuring specific tread patterns and construction to manage these unique demands.

The growing demand for enhanced safety and performance, particularly in regions with distinct summer seasons, is another powerful driver. Consumers are increasingly aware of the benefits of using tires specifically designed for warm weather conditions, which offer superior braking distances, better handling on dry and wet surfaces, and improved cornering stability compared to all-season or winter tires. This awareness is being amplified by automotive manufacturers who are equipping new vehicles with performance-oriented summer tires as standard, further educating the consumer. The aftermarket segment is also witnessing a surge in demand for premium summer tires, as car enthusiasts and discerning drivers seek to optimize their vehicle's performance and driving experience. This trend is further supported by the increasing average age of vehicles on the road in many developed economies, leading to a consistent replacement market for high-quality summer tires.

Geographically, North America and Europe are anticipated to continue their dominance in the summer tire market, owing to high vehicle penetration rates, a strong aftermarket culture, and a significant proportion of the year experiencing warm weather conducive to summer tire usage. However, the Asia-Pacific region is emerging as a significant growth engine, driven by rapid economic development, a burgeoning middle class, and an expanding automotive industry, particularly in countries like China and India. The aftermarket segment is expected to remain the largest revenue contributor, driven by the sheer volume of vehicles requiring tire replacements. The OEM segment, while smaller, is crucial for setting market trends and introducing new tire technologies, as manufacturers increasingly integrate specialized summer tires into their vehicle offerings. The shift towards connected and autonomous vehicles also presents an interesting future trend, potentially influencing tire design to accommodate sensors and communicate performance data.

The automotive summer tire market is experiencing a robust upswing, propelled by a multifaceted array of driving forces that are fundamentally reshaping demand and innovation. At its core, the increasing global vehicle parc, especially in emerging economies, forms a foundational element of this growth. As more individuals acquire personal transportation, the inherent need for tire replacements, including seasonal options like summer tires, naturally escalates. This fundamental demographic shift, coupled with rising disposable incomes in many regions, empowers consumers to invest in specialized tires that enhance vehicle performance and safety.

Furthermore, the escalating consumer awareness regarding the distinct advantages of summer tires over more generalized options is a critical propellant. Unlike all-season tires, summer tires are engineered with specific rubber compounds and tread patterns that optimize grip, handling, and braking in warmer temperatures and on dry or wet surfaces. This heightened understanding of performance benefits, coupled with the influence of automotive media, reviews, and the increasing inclusion of performance-oriented summer tires as OEM fitments on new vehicles, is actively educating and motivating consumers to opt for these specialized products. The pursuit of an enhanced driving experience, characterized by superior responsiveness and control, is a significant emotional and practical driver for consumers, particularly in performance-oriented vehicle segments.

Despite the generally optimistic outlook, the automotive summer tire market is not without its hurdles and restraints that could temper its growth trajectory. One of the primary challenges stems from the increasing popularity and technological advancements in all-season and all-weather tires. These tires are becoming increasingly sophisticated, offering a compelling compromise for consumers who may not experience extreme winter conditions but still desire a degree of adaptability across a broader range of temperatures and conditions. The convenience of a single tire set for a significant portion of the year can be a powerful deterrent for consumers considering the purchase of dedicated summer tires, especially in regions with milder climates.

Another significant restraint is the inherent price sensitivity of a substantial segment of the market. While performance and safety are valued, budget considerations remain paramount for many consumers, particularly in the replacement tire segment. Specialized summer tires, often incorporating advanced materials and intricate designs, tend to command a higher price point than standard all-season tires. This price differential can make them a less accessible option for price-conscious buyers, thereby limiting market penetration. Moreover, the cyclical nature of vehicle ownership and tire replacement cycles means that demand, while consistent, is not always uniform. Economic downturns or unforeseen events that impact consumer spending power can lead to a postponement or deferral of tire purchases, thus creating periods of slower growth.

The automotive summer tire market is characterized by distinct regional leadership and segment dominance, with North America and Europe standing out as the key regions poised to continue their reign, largely driven by the overwhelming strength of the Replacement Segment and the dominance of Passenger Cars within the application landscape.

Regional Dominance: North America and Europe

Segment Dominance: Replacement and Passenger Cars

Type: Replacement Segment: The replacement segment is the undisputed champion in terms of market share and revenue generation for automotive summer tires. This segment encompasses all tires purchased by vehicle owners after their initial purchase of a vehicle, whether for routine replacement due to wear and tear, or for seasonal changes. The sheer volume of vehicles in operation globally, combined with the natural lifespan of tires, ensures a continuous and substantial demand for replacement tires. Consumers in this segment are often driven by factors such as value for money, brand reputation, and specific performance needs. The aftermarket for summer tires is particularly strong in regions with pronounced summer seasons, as drivers seek to optimize their vehicle's performance and safety during warmer months. The accessibility of a wide range of brands and price points within the replacement market caters to a broad spectrum of consumer needs and budgets.

Application: Passenger Cars: Passenger cars represent the largest application segment for automotive summer tires. The vast majority of vehicles on the road globally are passenger cars, ranging from compact hatchbacks to luxury sedans and performance coupes. These vehicles are the primary beneficiaries of the enhanced grip, precise handling, and improved braking capabilities offered by specialized summer tires. As automotive manufacturers increasingly focus on delivering refined driving experiences, summer tires are becoming a standard fitment for a wide array of passenger vehicles. The diverse needs of passenger car owners, from those prioritizing fuel efficiency to those seeking outright performance, are catered to by the wide variety of summer tire options available in this segment. The aftermarket demand from passenger car owners is consistently high, making it the most significant application driving the growth of the automotive summer tire market.

Several key factors are acting as potent growth catalysts for the automotive summer tire industry. The increasing global automotive production, particularly in emerging markets, directly translates into a larger installed base of vehicles requiring eventual tire replacements. Furthermore, the growing consumer awareness and demand for enhanced vehicle performance, safety, and driving experience are driving a shift towards specialized tires like summer tires. The significant investments in research and development by leading manufacturers, focusing on fuel efficiency and sustainability, are also creating new product innovations that appeal to environmentally conscious consumers and regulatory bodies.

This comprehensive report delves deep into the multifaceted automotive summer tire market, offering an in-depth analysis of its current standing and future trajectory from 2019 to 2033. The study meticulously examines key market insights, including the projected market value reaching upwards of \$65 billion by 2025 and a robust forecast to surpass \$100 billion by 2033. It unpacks the driving forces behind this growth, such as escalating global vehicle production, heightened consumer demand for performance and safety, and the critical influence of technological advancements in tire composition and design. Simultaneously, the report provides a balanced perspective by outlining the challenges and restraints faced by the industry, including the increasing competitiveness of all-season tires and price sensitivity among consumers. The analysis further identifies the key regions and segments set to dominate the market, with a particular focus on the significant roles of North America and Europe, and the ever-crucial replacement tire segment for passenger cars. Growth catalysts, leading industry players, and significant developmental milestones are also thoroughly explored, offering a holistic and actionable understanding of this vital automotive sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.3%.

Key companies in the market include Apollo Tyres Ltd., Bridgestone Corp., Continental AG, Cooper Tire & Rubber Co., Hankook Tire Co. Ltd., Michelin Group, Pirelli & C. Spa, Sumitomo Rubber Industries Ltd., The Goodyear Tire & Rubber Co., The Yokohama Rubber Co. Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Summer Tire," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Summer Tire, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.