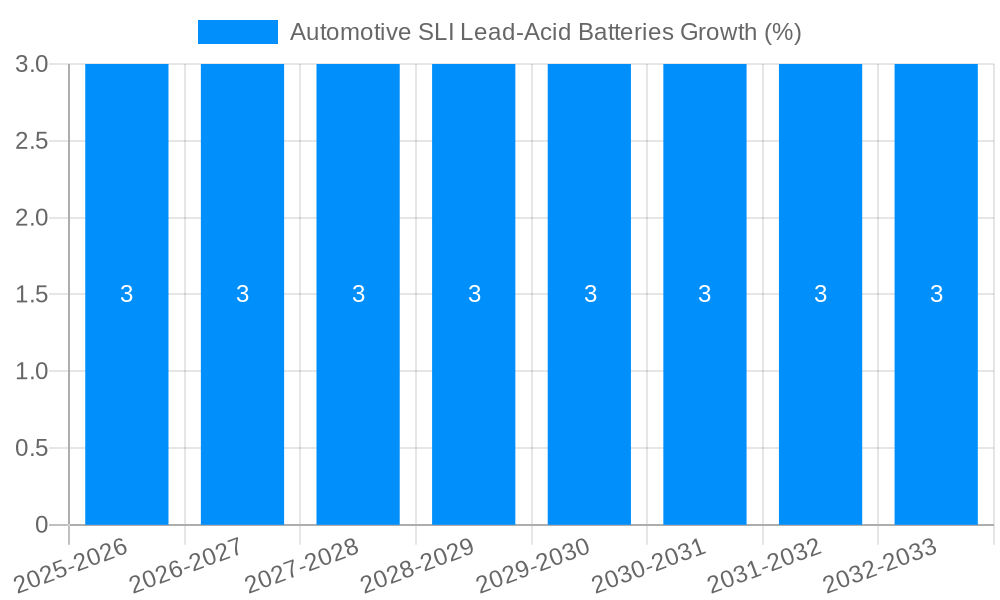

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive SLI Lead-Acid Batteries?

The projected CAGR is approximately 3.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive SLI Lead-Acid Batteries

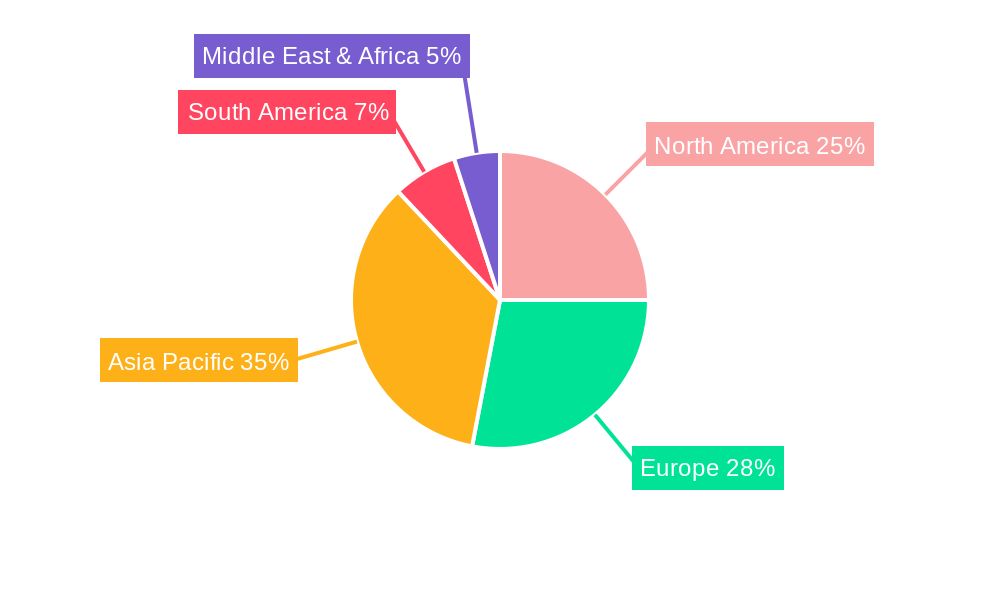

Automotive SLI Lead-Acid BatteriesAutomotive SLI Lead-Acid Batteries by Type (Gasoline & Diesel Engine, Electric & Hybrid Cars), by Application (Sedan, SUVs, Pickup Trucks, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

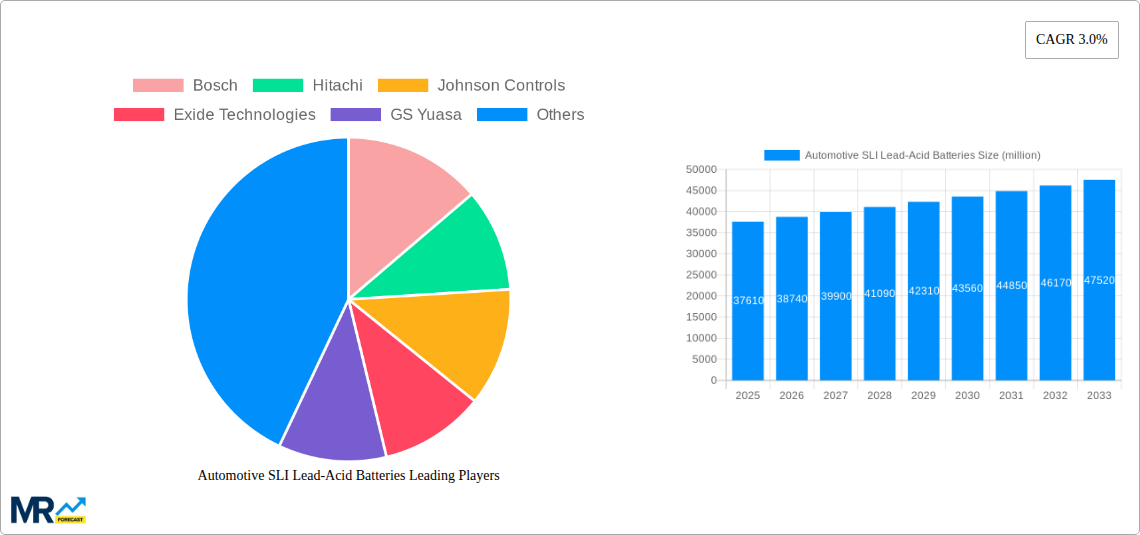

The global Automotive SLI (Starting, Lighting, and Ignition) lead-acid battery market is a substantial and established segment within the automotive aftermarket, estimated at USD 37,610 million in 2025. This market is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.0% anticipated between 2025 and 2033. This sustained expansion is primarily driven by the sheer volume of the existing internal combustion engine (ICE) vehicle parc, which continues to be the dominant mode of transportation globally. Despite the rise of electric vehicles (EVs), lead-acid batteries remain the standard for SLI applications in traditional gasoline and diesel-powered cars, sedans, SUVs, and pickup trucks. The ongoing demand for these vehicles, particularly in emerging economies where fleet replacement cycles are longer and EV adoption is still gaining traction, underpins the resilience of this market. Furthermore, the relatively lower cost and established recycling infrastructure of lead-acid batteries contribute to their continued market relevance.

While the market demonstrates consistent growth, it is also navigating evolving industry dynamics. Key trends include advancements in lead-acid battery technology aimed at improving performance, lifespan, and reliability to meet the increasing electrical demands of modern vehicles, such as advanced driver-assistance systems (ADAS) and sophisticated infotainment units. Innovations like enhanced plate designs and improved electrolyte management are contributing factors. The market is also influenced by stringent emission regulations and the push for electrification, which represent a long-term restraint as EV penetration increases. However, the significant installed base of ICE vehicles, coupled with the necessity for affordable and reliable battery solutions for their maintenance and replacement, will ensure the continued importance of the Automotive SLI Lead-Acid Batteries market for the foreseeable future. Companies like Bosch, Hitachi, and Exide Technologies are key players in this competitive landscape, focusing on product innovation and efficient distribution networks to maintain their market positions.

This report provides an in-depth analysis of the global Automotive SLI (Starting, Lighting, and Ignition) Lead-Acid Battery market, encompassing a study period from 2019 to 2033. It leverages a base year of 2025 for estimations, with a forecast period from 2025 to 2033 and a historical period covering 2019 to 2024. The report offers critical market insights, identifies driving forces and challenges, highlights key regional and segmental dominance, and outlines growth catalysts, all while profiling leading players and significant industry developments.

XXX The global Automotive SLI Lead-Acid Battery market is poised for a complex evolutionary trajectory over the forecast period (2025-2033). While the proliferation of electric and hybrid vehicles (EV/HEVs) presents a long-term challenge to traditional SLI battery dominance, the sheer volume of the existing internal combustion engine (ICE) vehicle fleet ensures a sustained demand for lead-acid batteries, particularly in emerging economies and for older vehicle models. The market is expected to witness a gradual shift in focus towards enhanced performance, durability, and improved energy density within lead-acid technology, aiming to bridge the gap with newer battery chemistries. Advancements in manufacturing processes and materials science will be crucial in optimizing the efficiency and lifespan of these batteries, allowing them to remain competitive. Furthermore, the increasing stringency of environmental regulations regarding battery recycling and disposal will drive innovation in sustainable manufacturing practices and end-of-life management for lead-acid batteries. We anticipate a market size that, while potentially experiencing a plateau or slight decline in certain developed regions, will continue to hold substantial value globally due to the vast installed base of ICE vehicles. The report will delve into regional nuances, where developing nations with a strong reliance on ICE technology will likely exhibit more resilient demand patterns for lead-acid SLI batteries, while mature markets may see a more pronounced impact from EV adoption. Innovations aimed at reducing weight and increasing cold-cranking performance will be key differentiators. The ongoing competition between established lead-acid manufacturers and emerging battery technologies will shape pricing strategies and product development, with a growing emphasis on cost-effectiveness and reliability. The year 2025 is projected to be a pivotal year, reflecting the current market equilibrium before the projected acceleration of EV adoption in the latter half of the forecast period. The study will provide detailed market volume projections in millions of units, segmented by vehicle type and application, offering a granular view of this dynamic market.

The sustained demand for automotive SLI lead-acid batteries is primarily driven by the massive and still growing global fleet of internal combustion engine (ICE) vehicles. Despite the ascendant presence of electric and hybrid cars, the vast majority of vehicles on the road worldwide continue to rely on gasoline and diesel engines for propulsion, and consequently, on robust SLI batteries for their starting power, lighting, and essential electrical functions. This enduring installed base translates into a consistent replacement market, particularly in regions where ICE vehicle penetration remains high and the adoption of EVs is still in its nascent stages. Furthermore, the inherent cost-effectiveness and proven reliability of lead-acid technology make it the default and most economical choice for many consumers and fleet operators. The maturity of lead-acid battery manufacturing processes also contributes to a stable supply chain and competitive pricing, further solidifying its position. The continuous evolution of ICE vehicle technology, which still demands reliable starting power even with sophisticated engine management systems, also plays a role. Moreover, for older vehicle models that are not being replaced by newer, electrified alternatives, the lead-acid SLI battery remains the only viable and readily available option. The ease of availability and established recycling infrastructure for lead-acid batteries also contribute to their continued market relevance, as these factors simplify ownership and end-of-life considerations for consumers.

The automotive SLI lead-acid battery market faces significant challenges, primarily stemming from the rapid technological advancements in the automotive sector, most notably the escalating adoption of electric and hybrid vehicles. As EVs and HEVs become more prevalent, their reliance on traditional SLI lead-acid batteries diminishes, as these vehicles utilize higher-voltage battery packs for propulsion that also cater to starting and accessory functions. This trend is expected to exert downward pressure on the demand for conventional lead-acid SLI batteries in the long term, particularly in developed markets with aggressive electrification targets. Environmental regulations are also becoming more stringent, focusing on the sustainability of battery production and disposal. While lead-acid batteries have a well-established recycling infrastructure, concerns about lead toxicity and the energy-intensive nature of production can act as a restraint. Furthermore, the performance limitations of lead-acid batteries, such as lower energy density and shorter lifespan compared to emerging battery technologies like Lithium-ion, can be a disadvantage in demanding applications or for vehicles with increasingly sophisticated electrical systems. The increasing sophistication of automotive electronics also places greater demands on SLI batteries, pushing the boundaries of what lead-acid technology can efficiently deliver. Competition from advanced battery chemistries that offer superior performance, lighter weight, and longer cycle life poses a significant threat to the market share of traditional lead-acid SLI batteries.

Dominant Segment: Gasoline & Diesel Engine Vehicles

Dominant Regions/Countries: Asia Pacific and Emerging Economies

Application Dominance: Sedans and SUVs

The interplay of these segments and regions creates a robust, albeit evolving, market for Automotive SLI Lead-Acid Batteries. While the long-term outlook may see a gradual shift, the sheer inertia of the current automotive landscape ensures the continued prominence of lead-acid technology in these key areas. The forecast period will likely see a stabilization or gradual decline in demand in highly electrified regions, but this will be offset by continued strong demand from developing nations and the persistent replacement cycle in the massive ICE vehicle fleet. The report will provide detailed volume projections in millions of units, breaking down these dominant trends with granular data.

Despite the rise of EVs, several factors continue to fuel growth in the Automotive SLI Lead-Acid Batteries industry. The enduring global fleet of gasoline and diesel engine vehicles necessitates a constant replacement market for SLI batteries. Furthermore, technological advancements in lead-acid battery chemistry, such as improved performance and extended lifespan, make them a more competitive option for certain applications. The cost-effectiveness and established recycling infrastructure of lead-acid batteries remain significant advantages, particularly in emerging economies where affordability is a key driver. The increasing sophistication of automotive electronics also demands reliable and consistent power, which lead-acid batteries continue to provide.

This report provides a holistic overview of the Automotive SLI Lead-Acid Battery market, offering unparalleled depth and breadth of analysis. It encompasses detailed market segmentation by vehicle type (Gasoline & Diesel Engine, Electric & Hybrid Cars), application (Sedan, SUVs, Pickup Trucks, Others), and key regions. Projections in millions of units are provided for the study period of 2019-2033, with a focus on the base year 2025 and the forecast period 2025-2033. The report delves into the intricate market dynamics, including driving forces, critical challenges, and significant growth catalysts that shape the industry's trajectory. It also features a comprehensive list of leading players and highlights significant industry developments, providing stakeholders with actionable insights for strategic decision-making and investment planning in this vital automotive component sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.0%.

Key companies in the market include Bosch, Hitachi, Johnson Controls, Exide Technologies, GS Yuasa, Sebang, Atlasbx, East Penn, Amara Raja, FIAMM, ACDelco, Banner, MOLL, Camel, Fengfan, Ruiyu, Leoch, .

The market segments include Type, Application.

The market size is estimated to be USD 37610 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive SLI Lead-Acid Batteries," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive SLI Lead-Acid Batteries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.