1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Navigation Infotainment System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Navigation Infotainment System

Automotive Navigation Infotainment SystemAutomotive Navigation Infotainment System by Type (/> Hardware, Software), by Application (/> Assisted Driving, Troubleshooting, Vehicle Information, Online Entertainment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

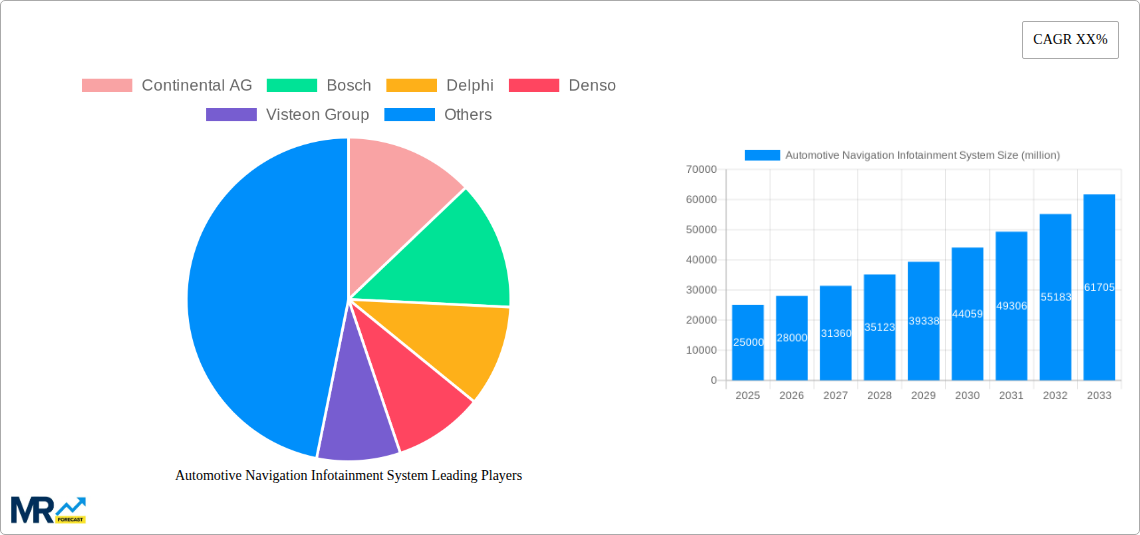

The Automotive Navigation Infotainment System market is poised for substantial expansion, projected to reach approximately $25,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 12% anticipated to drive its value to an estimated $40,000 million by 2033. This growth is fundamentally fueled by the escalating demand for enhanced in-vehicle experiences, driven by advancements in connectivity, artificial intelligence, and the increasing integration of smart technologies into automobiles. Consumers are increasingly seeking sophisticated infotainment systems that offer seamless navigation, real-time traffic updates, personalized entertainment options, and advanced driver-assistance features, transforming the car into a connected digital hub. The proliferation of connected vehicles, the rise of autonomous driving technologies, and the growing adoption of over-the-air (OTA) updates are further propelling market dynamics. Hardware advancements, including larger, higher-resolution displays and more powerful processors, coupled with sophisticated software platforms and a growing array of applications like advanced assisted driving, predictive troubleshooting, and immersive online entertainment, are collectively shaping the future of automotive interiors.

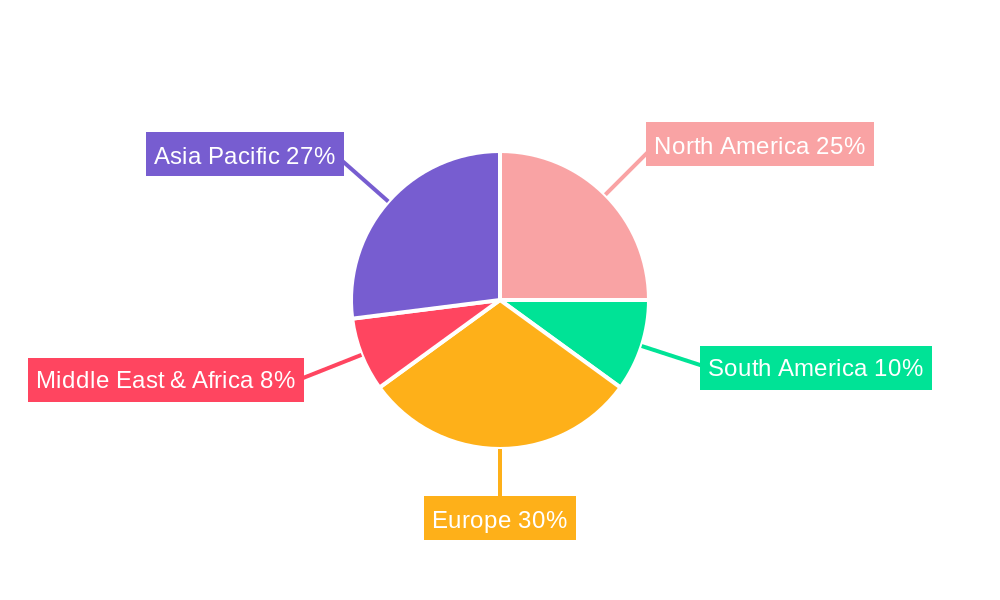

Key market restraints, such as the high cost of advanced systems and cybersecurity concerns, are being systematically addressed through technological innovation and evolving industry standards. The market is segmented into Hardware and Software, with Applications encompassing Assisted Driving, Troubleshooting, Vehicle Information, Online Entertainment, and Others. Leading players like Continental AG, Bosch, Delphi, and Denso are at the forefront, investing heavily in research and development to offer integrated solutions that meet the evolving needs of automotive manufacturers and end-users. The Asia Pacific region, particularly China, is expected to dominate the market share due to its vast automotive production and a rapidly growing consumer base with a strong appetite for advanced vehicle technologies. North America and Europe are also significant contributors, driven by stringent safety regulations and a mature market for premium and technologically advanced vehicles. The continuous evolution of vehicle architecture towards centralized computing and software-defined vehicles will further accelerate the adoption of advanced infotainment and navigation systems.

Here's a unique report description for the Automotive Navigation Infotainment System market, incorporating your specified details:

The Automotive Navigation Infotainment (ANI) System market is experiencing a transformative period, moving beyond basic navigation to become the central nervous system of the connected vehicle. Throughout the study period of 2019-2033, with a strong focus on the base and estimated year of 2025, the market has witnessed an exponential growth trajectory. Historically, from 2019-2024, the ANI systems were primarily characterized by integrated GPS functionalities, basic multimedia playback, and rudimentary connectivity options. However, the market has rapidly evolved to embrace advanced features, driven by increasing consumer demand for seamless digital experiences within their vehicles. The estimated market size for 2025 is poised to reach well over 500 million units, a significant leap from previous years. This growth is fueled by the proliferation of smartphones and the subsequent expectation of similar intuitive and feature-rich interfaces in automotive settings. The trend towards larger, higher-resolution displays, integrated voice control powered by advanced AI, and over-the-air (OTA) updates for software and navigation data are becoming standard. Furthermore, the integration of ANI systems with Advanced Driver-Assistance Systems (ADAS) is creating a synergistic effect, where navigation data enhances functionalities like adaptive cruise control and predictive routing based on traffic conditions. The software segment is rapidly gaining prominence, accounting for a substantial portion of the total market value and demonstrating the increasing complexity and intelligence embedded within these systems. Application-wise, while navigation remains core, the demand for online entertainment, vehicle diagnostics, and assisted driving features is surging, pushing the boundaries of what ANI systems can offer. The forecast period of 2025-2033 is expected to witness even more sophisticated integrations, including augmented reality navigation, personalized driver profiles, and deeper connectivity with smart home ecosystems. The market is no longer just about getting from point A to point B; it's about creating an immersive, safe, and personalized mobility experience.

Several powerful forces are propelling the automotive navigation infotainment system market forward. Foremost among these is the escalating consumer expectation for connected and feature-rich in-car experiences, mirroring the seamless digital integration they enjoy in their daily lives. This demand is further amplified by the rapid advancements in smartphone technology, which has set a high bar for user interface intuitiveness, processing power, and access to a vast array of applications. Automakers are increasingly recognizing ANI systems as a key differentiator, a crucial element for enhancing brand perception and customer loyalty. The integration of these systems with advanced driver-assistance systems (ADAS) is another significant driver. Navigation data, combined with real-time sensor information, enables more sophisticated safety and convenience features like predictive navigation for traffic jams, intelligent route planning that considers charging needs for electric vehicles, and enhanced situational awareness for the driver. The growing adoption of electric vehicles (EVs) also plays a pivotal role, as ANI systems are essential for managing charging infrastructure, optimizing range, and providing charging station recommendations, thus easing range anxiety and promoting EV adoption. Furthermore, the increasing sophistication of AI and machine learning algorithms is enabling more personalized and context-aware infotainment experiences, including advanced voice assistants that can understand natural language commands and proactively offer suggestions. The expansion of 5G connectivity is set to revolutionize the capabilities of ANI systems, enabling faster data transmission for real-time traffic updates, richer online content streaming, and more robust cloud-based services.

Despite the robust growth, the automotive navigation infotainment system market faces notable challenges and restraints. A primary concern revolves around the high cost of development and integration for these sophisticated systems. The continuous need for hardware upgrades, software development, and extensive testing to ensure safety and reliability places a significant financial burden on automakers and component suppliers. Cybersecurity threats are also a major impediment; as ANI systems become more connected and data-intensive, they become more vulnerable to hacking, which could compromise vehicle control, driver privacy, and sensitive personal data. Ensuring the security of these complex interconnected systems requires constant vigilance and substantial investment in robust cybersecurity measures. Furthermore, the rapid pace of technological evolution presents a challenge for product lifecycle management. Keeping ANI systems up-to-date with the latest software and hardware advancements while ensuring backward compatibility and long-term support can be a complex undertaking. The fragmentation of the automotive market, with a diverse range of vehicle models and regional specifications, necessitates customized solutions, adding to development complexity and cost. User interface (UI) and user experience (UX) design also remain critical challenges; creating intuitive and distraction-free interfaces that are safe for drivers to operate while on the road requires meticulous design and rigorous testing. Regulatory compliance, particularly concerning data privacy and in-car device usage, can also introduce complexities and potential limitations on system functionalities. Finally, the integration of third-party applications and services needs careful management to ensure seamless operation and avoid performance degradation or security vulnerabilities.

The Asia-Pacific region is projected to dominate the Automotive Navigation Infotainment System market, driven by the sheer volume of automotive production and a burgeoning middle class with increasing disposable income. Countries like China, Japan, and South Korea are at the forefront of this dominance, owing to their established automotive manufacturing prowess and rapid adoption of new technologies. China, in particular, stands out as a key market, not only as a major producer but also as a massive consumer base for vehicles equipped with advanced ANI systems. The rapid urbanization and the growing demand for connected vehicles in emerging economies within Asia-Pacific are significant contributors to this regional supremacy. The government's focus on developing smart cities and promoting electric vehicle adoption further bolsters the demand for sophisticated infotainment and navigation solutions.

Within the market segments, the Software segment is poised for significant growth and is expected to be a key driver of market value. This surge is attributed to the increasing complexity and intelligence being embedded within ANI systems.

The automotive navigation infotainment system industry is experiencing robust growth, catalyzed by several key factors. The burgeoning demand for personalized in-car experiences, mirroring smartphone functionalities, is a primary driver. Advancements in AI and machine learning are enabling more intuitive voice control and predictive assistance, enhancing user engagement. Furthermore, the increasing adoption of electric vehicles (EVs) necessitates sophisticated navigation and charging management features, boosting demand for advanced ANI systems. The continuous evolution of connectivity standards, particularly the rollout of 5G, is unlocking new possibilities for real-time data streaming, cloud-based services, and enhanced over-the-air updates, further accelerating market expansion.

This comprehensive report delves deep into the multifaceted automotive navigation infotainment system market, providing an in-depth analysis of its evolution and future trajectory. Covering the study period from 2019-2033, with a particular focus on the base and estimated year of 2025, it offers a detailed breakdown of market dynamics, key trends, and growth drivers. The report meticulously analyzes the impact of technological advancements, shifting consumer preferences, and regulatory landscapes on the market. It provides insights into the strategic initiatives of leading players and emerging market entrants, offering a holistic view of the competitive landscape. Furthermore, the report explores the intricate interplay between hardware, software, and application segments, highlighting their respective contributions to the overall market value. The detailed forecast for the 2025-2033 period, coupled with historical data from 2019-2024, equips stakeholders with the necessary intelligence to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Continental AG, Bosch, Delphi, Denso, Visteon Group, Aisin Seiki, Mitsubishi Electric, Pioneer Corporation, Panasonic, HARMAN International, Alpine Electronics, HUIZHOU DESAY SV AUTOMOTIVE CO., LTD, ADAYO, Joyson, Soling, Road Rover, Hangsheng, FlyAudio, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Automotive Navigation Infotainment System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Navigation Infotainment System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.