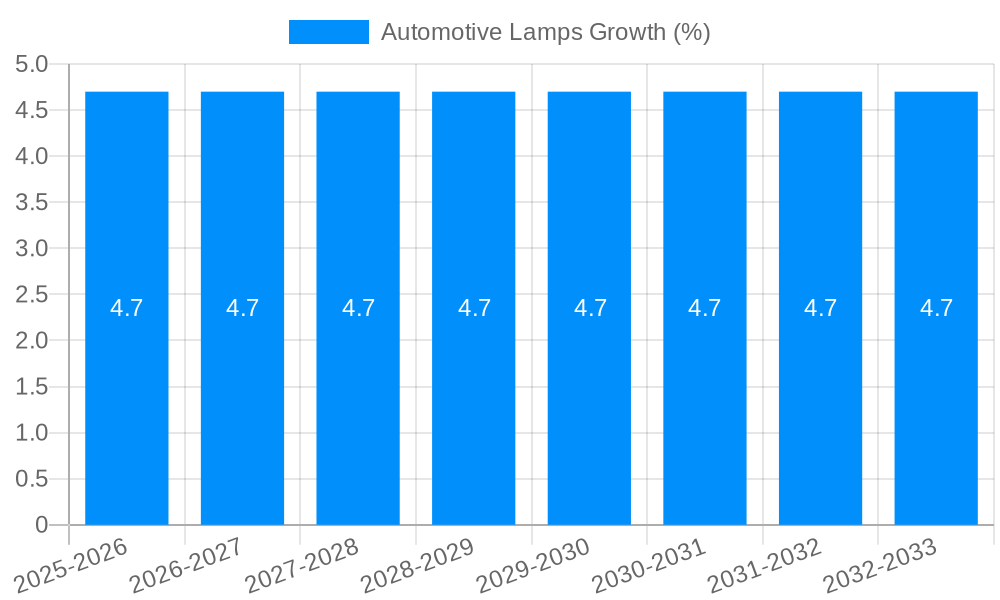

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Lamps?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Lamps

Automotive LampsAutomotive Lamps by Type (Halogen Lighting, Xenon lLighting, LED Lighting, World Automotive Lamps Production ), by Application (Passenger Vehicle, Commercial Vehicle, World Automotive Lamps Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

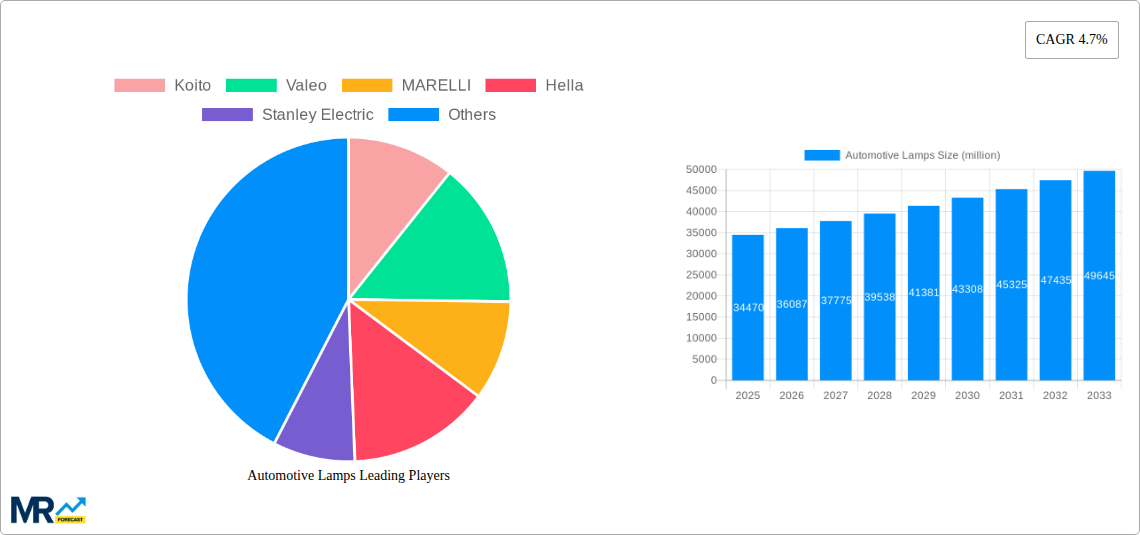

The global automotive lamps market, valued at $47,570 million in 2025, is poised for significant growth driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for enhanced vehicle safety and aesthetics. The shift towards LED lighting technology is a major trend, fueled by its superior energy efficiency, longer lifespan, and brighter illumination compared to traditional halogen and xenon lamps. This transition is expected to significantly impact market dynamics over the forecast period (2025-2033). Furthermore, the burgeoning automotive industry in developing economies like India and China presents substantial growth opportunities. However, factors like stringent regulatory compliance requirements and the relatively high initial cost of LED technology pose challenges to market expansion. The passenger vehicle segment currently dominates the market, but the commercial vehicle segment is projected to witness faster growth due to increasing demand for enhanced safety features in commercial fleets. Leading players like Koito, Valeo, and Osram are actively engaged in research and development to introduce innovative lighting technologies, while also focusing on expanding their geographical reach to capitalize on emerging markets. The competitive landscape is characterized by intense rivalry, with companies focusing on strategic partnerships, acquisitions, and product differentiation to maintain their market positions.

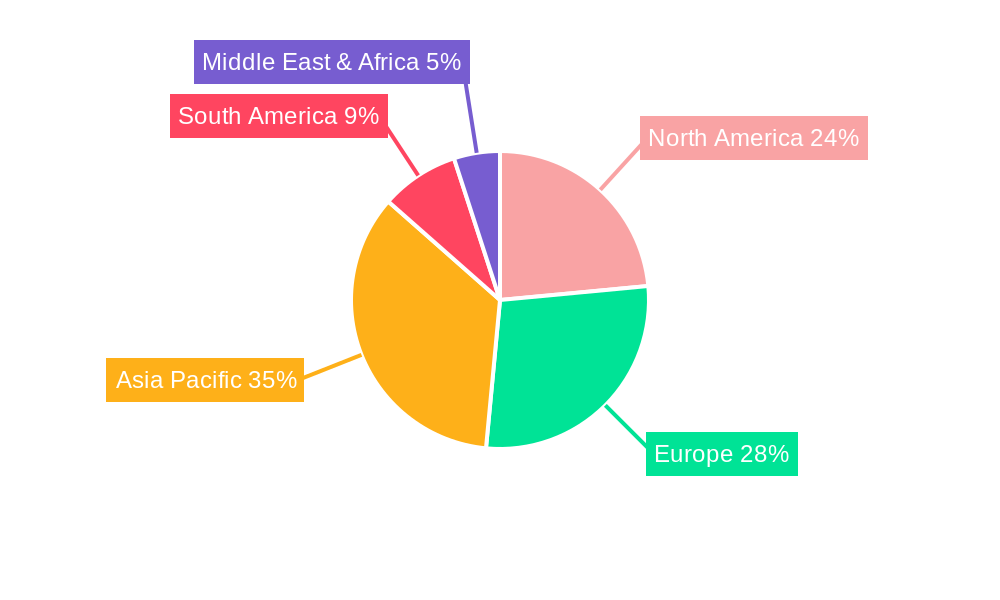

Considering the provided data and the market trends in the automotive lighting sector, a realistic CAGR for the period 2025-2033 could be estimated at 5-7%. This estimation accounts for the expected growth driven by LED adoption, emerging markets, and ADAS integration, while also acknowledging the potential restraints imposed by regulations and initial investment costs. This implies a significant market expansion, reaching a value well exceeding $70,000 million by 2033. The regional distribution will likely see continued dominance from North America and Europe, while the Asia-Pacific region is anticipated to experience the most rapid growth due to its high automotive production volumes and expanding middle class.

The global automotive lamps market, valued at several billion units annually, is undergoing a significant transformation driven by technological advancements and evolving consumer preferences. The historical period (2019-2024) witnessed a steady growth trajectory, primarily fueled by the increasing adoption of LED lighting in both passenger and commercial vehicles. This trend is expected to continue and accelerate throughout the forecast period (2025-2033), with LED technology projected to dominate the market share. The transition from traditional halogen and xenon lighting systems to LEDs is being driven by factors such as improved energy efficiency, longer lifespan, enhanced brightness and design flexibility. This shift is not just about improved illumination; it's about integrating advanced features like adaptive headlights, intelligent lighting systems, and advanced driver-assistance systems (ADAS). The base year 2025 marks a crucial point where the market is expected to see a substantial surge in LED adoption, with production exceeding several hundred million units. Major players like Koito, Valeo, and Hella are investing heavily in R&D to develop innovative LED lighting solutions, incorporating features like laser technology and matrix beam systems for improved visibility and safety. The market is also seeing a rise in the demand for aesthetically pleasing lighting designs, further fueling the growth of LED technology due to its design versatility. The commercial vehicle segment, while smaller than passenger vehicles, is experiencing a significant uptake of LED lighting due to the demand for improved safety and durability in demanding operating conditions. The global production of automotive lamps is poised for substantial expansion, exceeding a billion units annually by the end of the forecast period, driven primarily by the growth in vehicle production and the increasing penetration of advanced lighting technologies. The competition among manufacturers is fierce, with companies continually striving to improve efficiency, performance, and aesthetics to cater to a discerning market. Further market growth will be largely shaped by regulations mandating advanced lighting technologies, increasing consumer awareness about safety features, and the continuous technological progress in the field.

Several key factors are propelling the growth of the automotive lamps market. The foremost driver is the increasing adoption of advanced driver-assistance systems (ADAS). ADAS features, such as adaptive headlights, automatic high beam, and lane-keeping assist, rely heavily on sophisticated lighting systems for optimal performance. The global push towards improved road safety is also a major catalyst, with governments worldwide implementing stricter regulations regarding vehicle lighting standards. This mandates the adoption of brighter, more efficient, and safer lighting technologies like LEDs. The growing popularity of luxury and premium vehicles further fuels the demand for advanced automotive lighting features. Consumers are increasingly willing to pay a premium for enhanced safety and aesthetic appeal, resulting in higher adoption rates of high-end lighting technologies. Furthermore, the increasing demand for energy-efficient vehicles is driving the adoption of LED lighting due to its significantly lower energy consumption compared to traditional halogen and xenon systems. The automotive industry's continuous innovation in lighting technology, incorporating features like laser headlights and matrix beam systems, contributes to market expansion. Finally, the growth in the global automotive sector itself, particularly in developing economies, is directly linked to the increased demand for automotive lamps.

Despite the promising growth trajectory, the automotive lamps market faces several challenges. The high initial investment costs associated with developing and manufacturing advanced lighting systems, such as LEDs and laser headlights, can be a significant barrier to entry for smaller manufacturers. The stringent regulatory compliance requirements related to safety and emissions in different regions pose another hurdle. Manufacturers must invest heavily in meeting these diverse and evolving standards across various markets. Intense competition among established players and the emergence of new entrants also contributes to the challenges. This competitive landscape puts pressure on pricing and profit margins. Fluctuations in the prices of raw materials, particularly semiconductors, significantly impact production costs and profitability. Technological advancements are rapid, meaning that products can quickly become obsolete, requiring continuous investment in R&D to remain competitive. The dependence on global supply chains for components and materials creates vulnerability to geopolitical instability and disruptions in the supply chain. Lastly, the complex integration of lighting systems with other vehicle systems, especially within ADAS functionalities, can present engineering and manufacturing challenges.

The LED lighting segment is poised to dominate the automotive lamps market. This dominance is rooted in several key factors:

While the passenger vehicle segment remains the largest application area, the commercial vehicle segment is demonstrating rapid growth in LED adoption, driven by increased safety and durability requirements for heavy-duty vehicles. Geographically, Asia-Pacific, particularly China, is expected to lead the market due to its large and rapidly growing automotive industry. The region's rising disposable incomes, coupled with increasing awareness regarding road safety, fuels the demand for high-quality automotive lamps, including advanced LED systems. Europe and North America also represent significant markets, but the Asia-Pacific region demonstrates a higher growth potential.

The automotive lamps market's future growth is driven by several key catalysts. The increasing integration of advanced driver-assistance systems (ADAS) requiring sophisticated lighting functionalities is a major driver. Growing demand for energy-efficient vehicles directly boosts the adoption of energy-saving LED technology. Stringent government regulations mandating advanced safety features also propel the market. Lastly, the continuous innovation in lighting technology, with advancements like laser headlights and matrix beam systems, ensures a long-term growth outlook.

This report provides an in-depth analysis of the automotive lamps market, covering historical data, current market dynamics, and future projections. It includes a detailed examination of key market segments, leading players, and significant technological advancements. The report offers valuable insights into market trends, driving forces, challenges, and opportunities, making it a crucial resource for stakeholders in the automotive lighting industry. The report's projections for market growth, based on rigorous data analysis, provide a clear roadmap for businesses seeking to navigate the evolving landscape of automotive lighting.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Koito, Valeo, MARELLI, Hella, Stanley Electric, SL Courporation, OSRAM, HASCO, ZKW Group, Varroc, Xingyu, Lumileds, Hyundai IHL, TYC, DEPO, .

The market segments include Type, Application.

The market size is estimated to be USD 47570 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Lamps," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Lamps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.