1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Instrument Switch?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Instrument Switch

Automotive Instrument SwitchAutomotive Instrument Switch by Type (Line-to-Line Switches, Line-to-Neutral Switches, Voltmeter Switches, Ammeter Switches, Others), by Application (Passenger Cars, Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

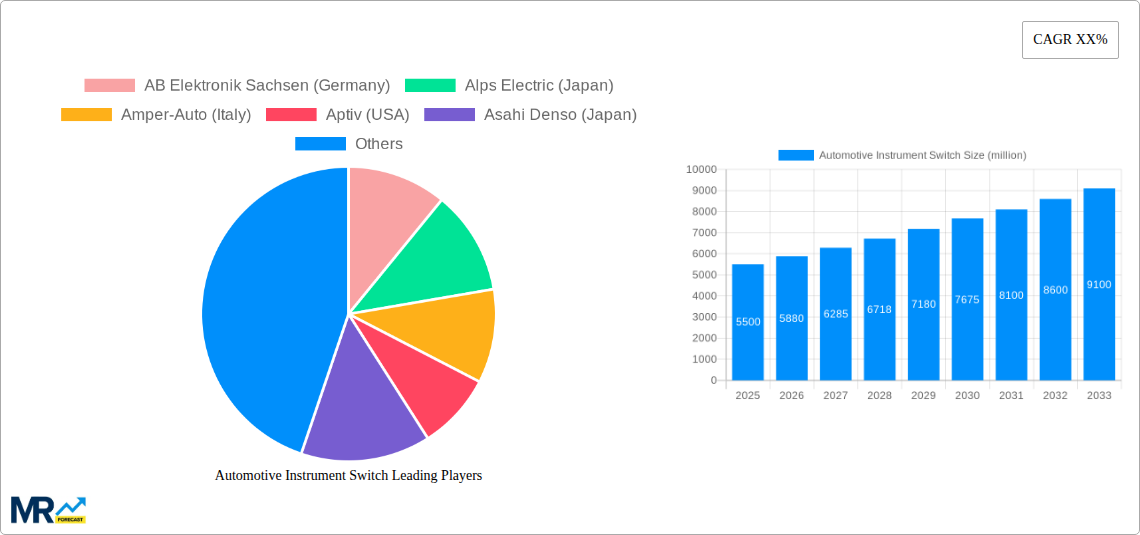

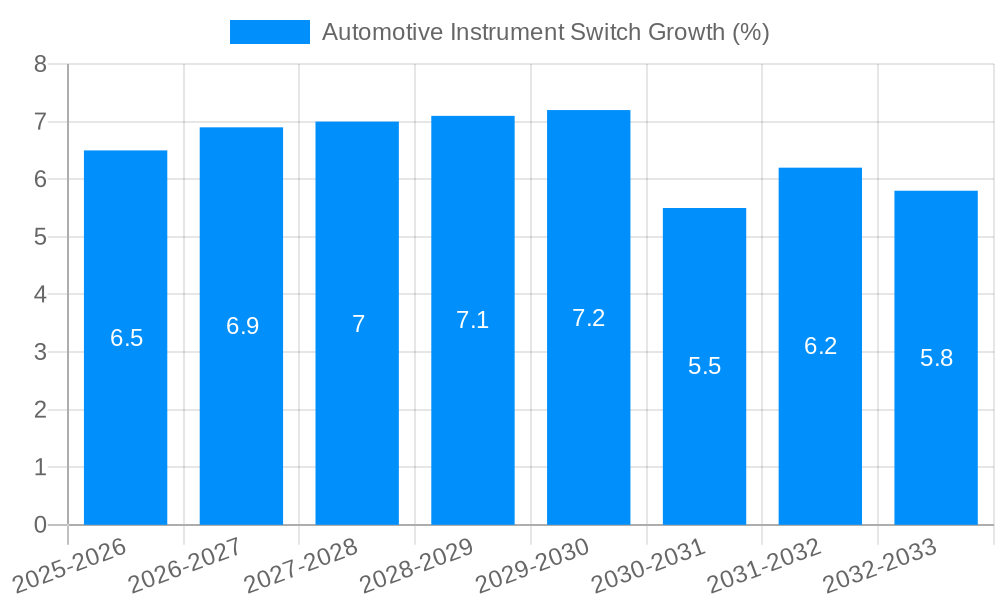

The global Automotive Instrument Switch market is poised for substantial growth, projected to reach approximately $5,500 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% anticipated through 2033. This expansion is primarily fueled by the increasing production of both passenger cars and commercial vehicles worldwide, coupled with the continuous integration of advanced electronic features and safety systems within vehicles. Key market drivers include the rising demand for sophisticated in-car infotainment systems, advanced driver-assistance systems (ADAS), and the growing trend towards vehicle electrification, all of which necessitate more complex and reliable instrument switch assemblies. Furthermore, stringent automotive safety regulations globally are compelling manufacturers to incorporate more sophisticated switch functionalities, contributing significantly to market expansion. The "Others" segment within switch types, likely encompassing specialized switches for electric vehicles and autonomous driving features, is expected to witness particularly dynamic growth as technological innovation accelerates.

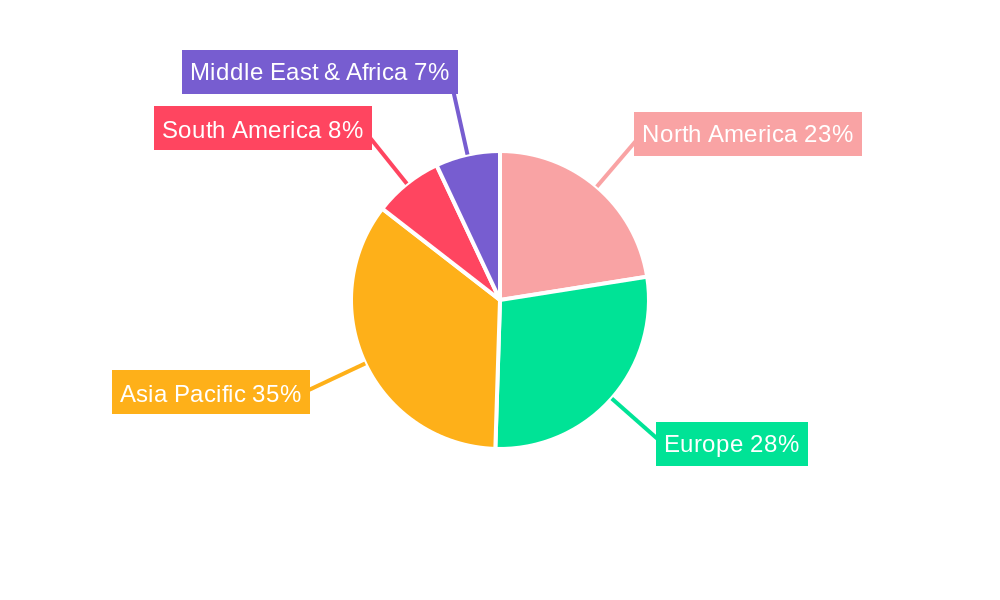

The market exhibits a strong regional concentration, with Asia Pacific currently leading in terms of market share, driven by the sheer volume of vehicle production in countries like China and India. Europe and North America follow, characterized by a higher adoption rate of premium features and a strong presence of established automotive manufacturers and suppliers. The competitive landscape is moderately fragmented, featuring a mix of large, established players and smaller, specialized manufacturers. Companies such as Aptiv, Eaton, Lear, and Stoneridge are prominent, alongside a significant number of Japanese and German component suppliers like Alps Electric and AB Elektronik Sachsen. Emerging trends include the development of smart switches with integrated sensors and digital functionalities, as well as a focus on sustainable manufacturing processes and materials to align with evolving environmental regulations and consumer preferences. While the market benefits from robust demand, potential restraints could emerge from increasing commoditization in certain switch segments and supply chain disruptions, although the overall outlook remains strongly positive.

Here's a unique report description for Automotive Instrument Switches, incorporating the provided details:

The automotive instrument switch market is experiencing a significant evolution, driven by the ever-increasing complexity and electrification of modern vehicles. During the study period of 2019-2033, with a base and estimated year of 2025, the market has witnessed a palpable shift from basic electromechanical switches to more sophisticated electronic and integrated solutions. The historical period (2019-2024) laid the groundwork for this transition, with a steady demand for traditional switches in internal combustion engine vehicles. However, the forecast period (2025-2033) is poised to be characterized by the pervasive influence of electric and hybrid vehicles, demanding more advanced switching functionalities for battery management, power distribution, and charging systems. This has led to a surge in demand for highly reliable and miniaturized switches capable of handling higher current loads and offering enhanced safety features. The integration of smart technologies, such as CAN bus communication and advanced diagnostic capabilities, is also becoming a critical trend, allowing for remote monitoring and control of various vehicle functions through intelligent instrument switches. Furthermore, the increasing focus on user experience and cabin aesthetics is pushing manufacturers towards designing aesthetically pleasing and ergonomically superior switches, often incorporating customizable backlighting and tactile feedback. The overall market trajectory points towards a continued growth driven by technological advancements and the evolving landscape of automotive manufacturing.

The automotive instrument switch market is primarily propelled by the burgeoning global automotive production, especially the rapid expansion of the electric vehicle (EV) and hybrid electric vehicle (HEV) segments. As the world transitions towards sustainable mobility, the demand for sophisticated instrument switches that manage complex power systems, battery charging, and energy regeneration in EVs and HEVs has escalated dramatically. This burgeoning EV revolution directly translates into increased production volumes for specialized switches designed for these platforms. Concurrently, advancements in vehicle safety features and the increasing adoption of advanced driver-assistance systems (ADAS) necessitate the integration of a greater number and variety of sensors and control modules, each requiring reliable switching mechanisms. The growing emphasis on vehicle comfort and convenience, leading to the proliferation of features like advanced infotainment systems, climate control customization, and smart interior lighting, further fuels the demand for a diverse range of user-interactive switches. Beyond these, stringent government regulations concerning vehicle emissions and fuel efficiency are pushing manufacturers to adopt more efficient powertrain technologies, indirectly boosting the demand for advanced switching solutions.

Despite the promising growth trajectory, the automotive instrument switch market faces several significant challenges and restraints that could impact its expansion. The most prominent among these is the escalating complexity of automotive electrical architectures. Integrating advanced electronic switching solutions requires substantial investment in research and development, sophisticated manufacturing processes, and rigorous quality control, which can be a barrier for smaller players. Furthermore, the automotive industry is highly susceptible to global economic fluctuations, supply chain disruptions, and geopolitical uncertainties. Events such as the semiconductor shortage that plagued the industry in recent years have highlighted the vulnerability of the supply chain for critical electronic components used in instrument switches, leading to production delays and increased costs. The increasing pressure on automakers to reduce vehicle costs, coupled with the rising prices of raw materials, also poses a challenge for instrument switch manufacturers, forcing them to optimize production and explore cost-effective alternatives without compromising quality or performance. The rapid pace of technological innovation also means that existing switch designs can become obsolete quickly, requiring continuous adaptation and investment in new technologies, which can be a significant undertaking.

The global automotive instrument switch market is poised for dominance by Asia Pacific, particularly China, owing to its unparalleled scale of automotive production and its leading position in the electric vehicle manufacturing landscape.

Dominant Region/Country:

Dominant Segment:

The automotive instrument switch industry is experiencing significant growth catalysts driven by the accelerating transition to electric vehicles (EVs) and the increasing integration of advanced electronic features in all vehicle types. The escalating demand for EVs directly fuels the need for specialized switches for battery management, charging systems, and powertrain control. Furthermore, the continuous innovation in vehicle safety, connectivity, and driver assistance systems necessitates a greater number and variety of sophisticated switches, acting as crucial interfaces for these complex technologies. The growing trend towards smart cabins and customizable user experiences also prompts the development of more advanced and aesthetically pleasing switch solutions.

This comprehensive report offers an in-depth analysis of the automotive instrument switch market, encompassing its historical trajectory (2019-2024) and projecting its future growth through 2033, with 2025 serving as the base and estimated year. It delves into the intricate trends shaping the market, driven by the accelerating global transition to electric vehicles (EVs) and the pervasive integration of advanced electronic features across all vehicle segments. The report meticulously explores the key growth catalysts, including the escalating demand for specialized EV switches for battery management and charging, alongside the evolving needs for sophisticated switches in advanced safety, connectivity, and driver assistance systems. Furthermore, it identifies the dominant regions and segments poised for significant market share, with a particular focus on Asia Pacific's (China) leadership and the burgeoning demand within passenger cars and specialized switch types. The report also provides a critical assessment of the challenges and restraints impacting market expansion, such as supply chain vulnerabilities and cost pressures. A thorough examination of leading players, their strategic developments, and the technological advancements shaping the industry from 2023 to 2033 is also included, offering a holistic view of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AB Elektronik Sachsen (Germany), Alps Electric (Japan), Amper-Auto (Italy), Aptiv (USA), Asahi Denso (Japan), CIE Automotive (Spain), Eaton (USA), Ficosa International (Spain), Guizhou Guihang Automotive Components (China), Hamanako Denso (Japan), IDEC (Japan), IHARA Electronics Industry (Japan), Kasai Works (Japan), Katecs (Japan), Kawabe Shokai (Japan), Kyowakasei (Japan), Lear (USA), Leopold Kostal (Germany), LS Automotive (Korea), MAHLE (Germany), Matsudadenki (Japan), MIYAMA ELECTRIC (Japan), Motosugi (Japan), Noba Denkoh (Japan), NOX Electronics (Japan), Plasess (Japan), Sakai Heavy (Japan), Shin-Etsu Polymer (Japan), Shinko Nameplate (Japan), Stoneridge (USA), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Instrument Switch," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Instrument Switch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.