1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Hubcaps?

The projected CAGR is approximately 10.23%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Hubcaps

Automotive HubcapsAutomotive Hubcaps by Type (Plastic, Aluminium Alloy, Stainless Steel, Others), by Application (OEM, Aftermarket), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

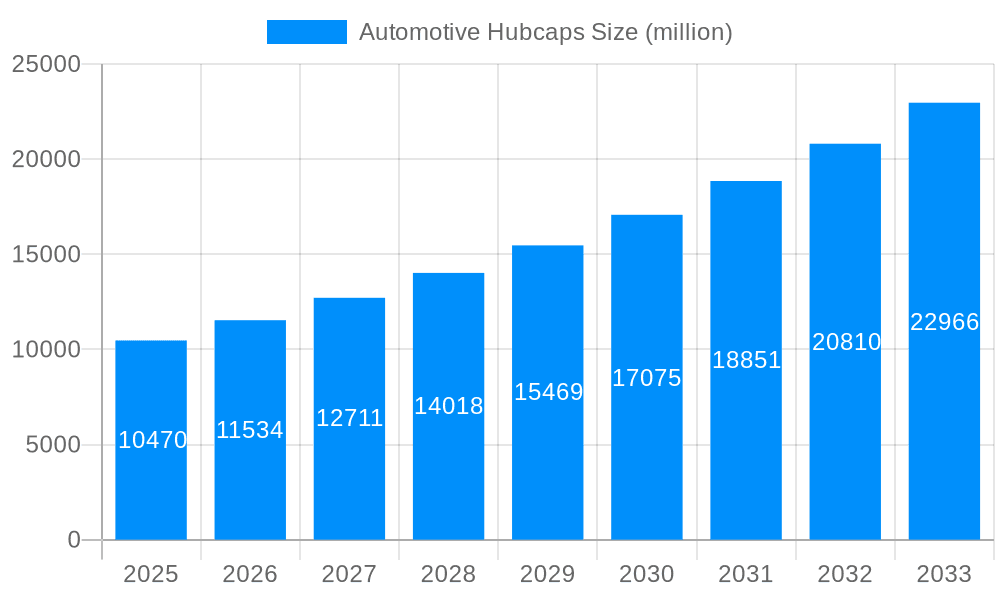

The global automotive hubcaps market is poised for significant expansion, projected to reach a valuation of $10.47 billion by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.23% anticipated over the forecast period of 2025-2033. This upward trajectory is primarily fueled by the burgeoning demand for aesthetic enhancements and personalization options within the automotive sector. As consumers increasingly view their vehicles as an extension of their personal style, the appeal of decorative and functional hubcaps, which offer an accessible and impactful way to elevate a car's appearance, continues to rise. The aftermarket segment, in particular, is a key driver, experiencing strong demand from vehicle owners seeking to customize or replace existing hubcaps. Furthermore, the ongoing evolution of automotive design, with manufacturers incorporating more visually appealing and integrated hubcap solutions, is also contributing to market vitality. The integration of advanced materials like lightweight aluminum alloys and durable stainless steel further enhances the appeal and performance of these components, aligning with consumer preferences for both style and longevity.

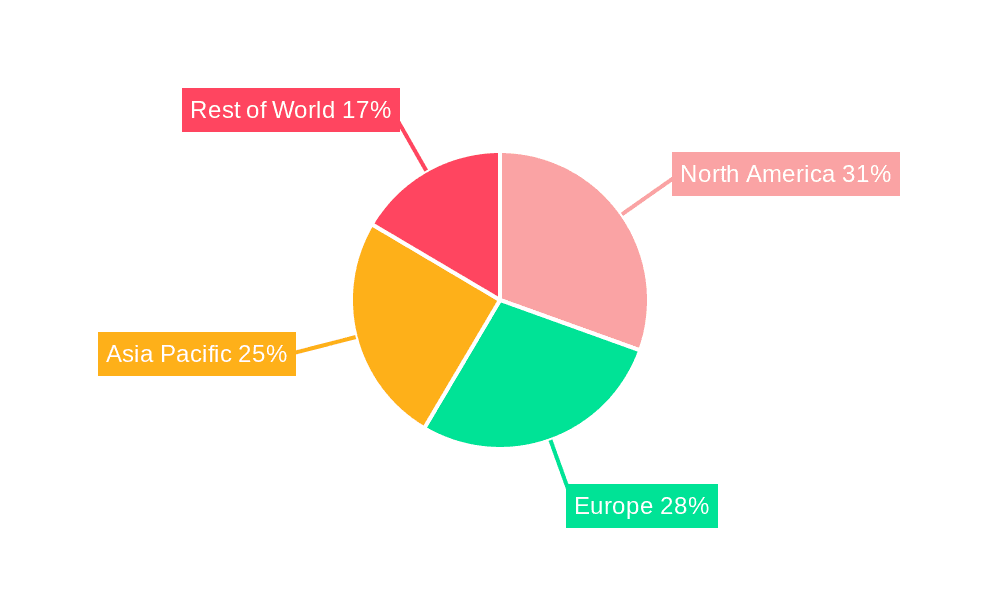

The market dynamics are further shaped by a confluence of trends and moderating factors. The growing prevalence of alloy wheels as standard fitment on a wider range of vehicles presents both an opportunity and a challenge. While it might reduce the demand for traditional plastic hubcaps in some OEM applications, it simultaneously spurs innovation in premium and custom designs for both OEM and aftermarket segments, especially for performance and luxury vehicles. The increasing customization culture, amplified by social media trends and automotive enthusiast communities, encourages investment in distinctive hubcap designs. Geographically, regions like North America and Europe, with their established automotive cultures and high disposable incomes, are expected to remain dominant markets. However, the rapidly expanding automotive industries in Asia Pacific, particularly China and India, coupled with a growing middle class and increasing vehicle ownership, present substantial growth opportunities. The market is characterized by the presence of numerous global and regional players, from established automotive parts manufacturers to specialized aftermarket designers, all vying for market share through product innovation, strategic partnerships, and a focus on diverse customer preferences.

The automotive hubcap market is experiencing a significant evolution, driven by a confluence of aesthetic preferences, technological advancements, and shifting consumer demands. Throughout the Study Period (2019-2033), and particularly in the Base Year (2025) and subsequent Forecast Period (2025-2033), the industry has witnessed a substantial global market value, projected to reach tens of billions of US dollars. This growth is not merely quantitative; it's deeply qualitative, reflecting a move beyond mere protective covers to intricate design elements that define a vehicle's persona. The Historical Period (2019-2024) laid the groundwork for this transformation, with early adoption of more complex designs and the nascent integration of advanced materials.

The burgeoning demand for personalization in the automotive sector is a paramount trend. Consumers are increasingly seeking ways to differentiate their vehicles, and hubcaps, being a readily visible and relatively accessible upgrade, play a crucial role. This desire for unique styling has propelled the aftermarket segment into a leading position. Manufacturers are responding with an ever-wider array of designs, finishes, and customizability options, moving beyond standard silver or black to encompass intricate multi-spoke patterns, brushed metal finishes, and even color-matched options. The rise of online configurators and direct-to-consumer sales channels further empowers consumers to design their ideal hubcaps, contributing to market expansion.

Furthermore, material innovation is redefining the hubcap landscape. While traditional plastic remains a staple for its cost-effectiveness and versatility, the market is seeing a significant surge in the popularity of aluminum alloys. These offer superior durability, a more premium aesthetic, and enhanced thermal properties, appealing to performance-oriented buyers and those seeking a more robust solution. Stainless steel, while less common, is carving out a niche for its exceptional corrosion resistance and high-end appeal, particularly in luxury vehicle applications. The "Others" category, encompassing advanced composites and innovative alloys, is poised for future growth as research and development continue to unlock new material possibilities. The interplay between OEM specifications and the boundless creativity of the aftermarket is shaping a dynamic and highly competitive market, where aesthetic appeal, durability, and brand identity all converge. The projected market value, estimated to be in the tens of billions of US dollars by 2025, underscores the immense economic significance of this seemingly simple automotive component.

The automotive hubcap market's robust growth is propelled by a multifaceted set of drivers that resonate with both vehicle manufacturers and end-consumers. A primary catalyst is the escalating consumer desire for vehicle personalization and aesthetic customization. In an era where vehicles are increasingly seen as extensions of individual style, hubcaps serve as a readily accessible and impactful way for owners to express their personality, making their cars stand out from the crowd. This trend is particularly pronounced in the aftermarket segment, where a vast array of designs, finishes, and sizes caters to diverse tastes.

Another significant driving force is the continuous innovation in material science and manufacturing processes. The development of lighter, stronger, and more aesthetically pleasing materials, such as advanced aluminum alloys and composites, allows for the creation of hubcaps that are not only visually appealing but also more durable and performance-enhancing. These advancements enable manufacturers to offer products that align with the evolving demands of the automotive industry, including the focus on reducing vehicle weight for improved fuel efficiency.

Moreover, the expansion of the global automotive industry, particularly in emerging economies, directly fuels the demand for automotive hubcaps. As vehicle production and sales rise, so does the need for both Original Equipment Manufacturer (OEM) and aftermarket hubcaps. The increasing disposable income in these regions further empowers consumers to invest in upgrades that enhance their vehicle's appearance and perceived value. The interplay of these factors – personalization, material innovation, and global market expansion – collectively creates a powerful momentum that is propelling the automotive hubcaps market forward, with projections indicating a market value reaching tens of billions of US dollars by 2025.

Despite the promising growth trajectory, the automotive hubcaps market is not without its challenges and restraints, which could potentially temper its expansion. One significant hurdle is the increasing prevalence of alloy wheels as standard on a wider range of vehicles, including more budget-friendly models. As manufacturers increasingly equip vehicles with integrated alloy wheels from the factory, the need for traditional hubcaps, particularly in the OEM segment, diminishes. This trend directly impacts the market for plastic and even some lower-end aluminum alloy hubcaps, creating a shrinking base for these traditional offerings.

Furthermore, the high cost of advanced materials and intricate designs can act as a restraint, especially for consumers in price-sensitive markets or those opting for entry-level vehicles. While aluminum alloys and other premium materials offer superior aesthetics and durability, their associated manufacturing costs translate into higher retail prices. This can make them less accessible to a broad segment of the market, limiting their adoption.

Another challenge lies in the counterfeit and imitation market. The popularity of premium brands and designs can lead to the proliferation of low-quality, unbranded replicas. These imitations not only erode the brand value of legitimate manufacturers but also pose safety concerns due to their inferior materials and construction, potentially affecting vehicle safety and performance. The ongoing need for robust intellectual property enforcement and consumer education is crucial to mitigate this restraint. The substantial market value, estimated to be in the tens of billions of US dollars by 2025, highlights the potential impact of these challenges if not effectively addressed by industry stakeholders.

The automotive hubcaps market is characterized by a dynamic interplay of regional preferences and segment dominance, with the Aftermarket application and Aluminium Alloy type segments poised to lead the market in terms of value and influence.

Dominating Segments:

Application: Aftermarket: The aftermarket segment is the undisputed engine of growth and innovation in the automotive hubcaps industry. During the Study Period (2019-2033), and especially in the Base Year (2025) and Forecast Period (2025-2033), this segment is projected to command a significant majority of the market share, likely accounting for well over fifty billion US dollars in value. This dominance stems from several key factors:

Type: Aluminium Alloy: Within the material types, Aluminium Alloy is expected to be the most dominant segment, projected to contribute significantly to the market's multi-billion dollar valuation. Its ascendancy over plastic is driven by a combination of evolving consumer preferences and technological advancements:

Key Regions or Countries:

The convergence of the aftermarket application and the aluminium alloy type segment, fueled by these key regions, is set to define the future landscape of the automotive hubcaps market, pushing its valuation into the tens of billions of US dollars by 2025.

The automotive hubcaps industry's growth is significantly catalyzed by the relentless pursuit of vehicle personalization and aesthetic enhancement by consumers. This trend, particularly strong in the aftermarket segment, drives demand for a wider variety of designs, finishes, and materials. Furthermore, advancements in material science, leading to lighter, more durable, and visually appealing aluminium alloys and composites, are crucial growth catalysts. The increasing production of vehicles globally, especially in emerging economies, and the subsequent need for both OEM and aftermarket hubcaps, also contribute substantially. Finally, the ongoing integration of advanced manufacturing techniques allows for more intricate designs and cost-effective production, further fueling market expansion.

This comprehensive report delves into the intricate landscape of the automotive hubcaps market, offering unparalleled insights into its evolution and future trajectory. It meticulously analyzes market dynamics, projecting a significant global market value in the tens of billions of US dollars by 2025, with a detailed Forecast Period (2025-2033) building upon the Base Year (2025). The report provides an in-depth examination of key trends, driving forces, and challenges, leveraging data from the Study Period (2019-2033) and the Historical Period (2019-2024). It dissects dominant segments by Type (Plastic, Aluminium Alloy, Stainless Steel, Others) and Application (OEM, Aftermarket), identifying key regions and countries poised for market leadership. The report also spotlights significant developments, growth catalysts, and the leading players within the industry, offering a complete overview for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.23% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.23%.

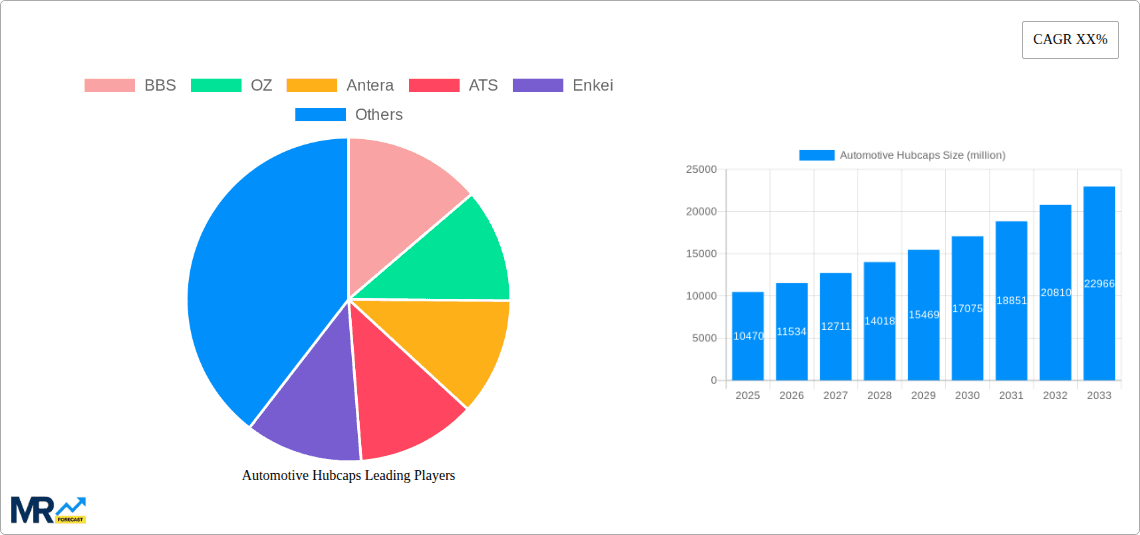

Key companies in the market include BBS, OZ, Antera, ATS, Enkei, Rays, Advan, yakuhama, Wed's, work, HRE, Giovannna, American Racing, Vossen, Forgiato, Vorsteiner, Adv.1, 3SDM, Mercedes-Benz, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Hubcaps," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Hubcaps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.