1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Front Wiper Blade?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Front Wiper Blade

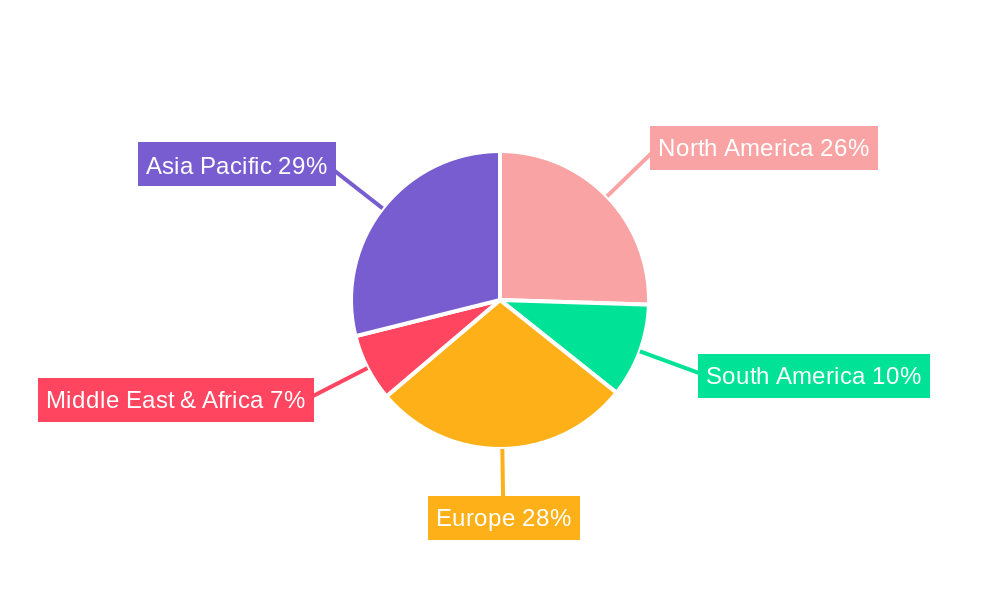

Automotive Front Wiper BladeAutomotive Front Wiper Blade by Application (OEM, Aftermarket, World Automotive Front Wiper Blade Production ), by Type (Front Wiper Blade, Rear Wiper Blade, World Automotive Front Wiper Blade Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

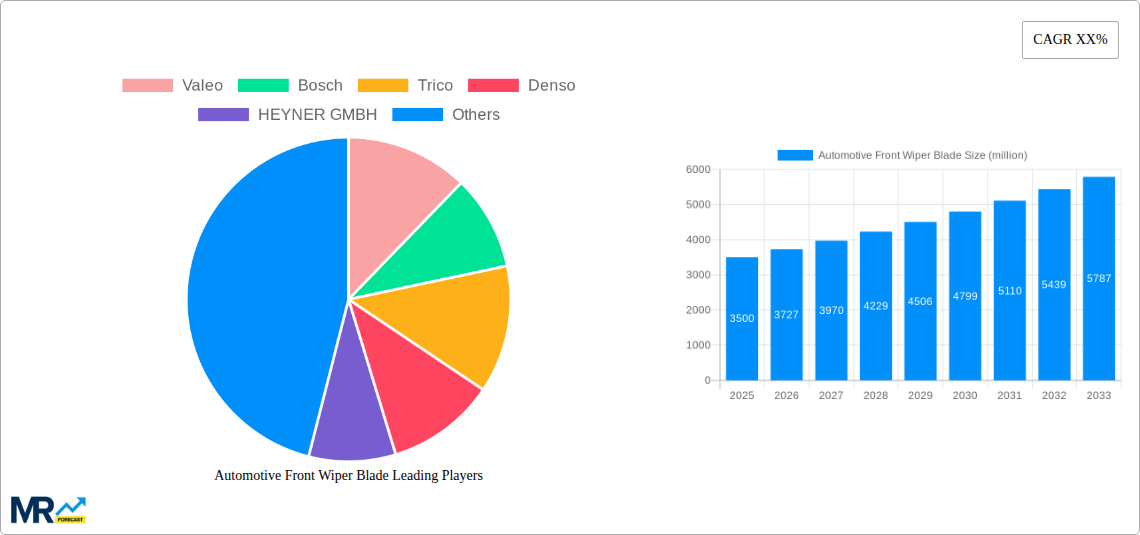

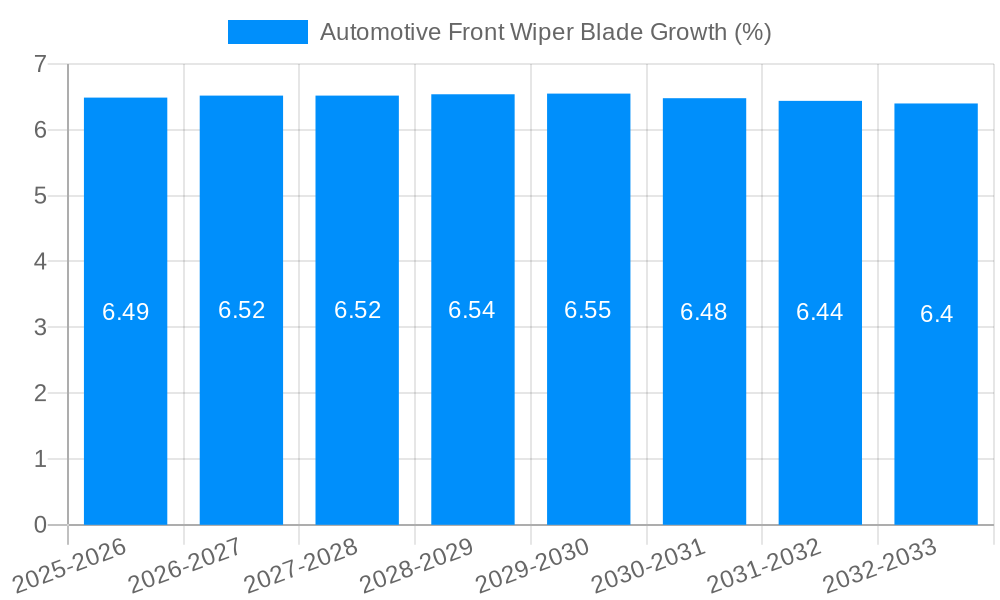

The global Automotive Front Wiper Blade market is projected for robust expansion, estimated at a market size of approximately $3,500 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This growth is propelled by a confluence of factors, including the increasing global vehicle production, a rising demand for advanced wiper blade technologies offering enhanced visibility and durability, and a growing aftermarket replacement segment driven by consumer awareness of safety and maintenance. The OEM segment will continue to be a significant revenue generator, as manufacturers integrate sophisticated wiper systems into new vehicles. However, the aftermarket is poised for substantial growth, fueled by vehicle parc expansion and a proactive approach to car maintenance among consumers. Emerging economies, particularly in Asia Pacific and Latin America, are expected to be key growth engines due to escalating vehicle ownership and infrastructure development.

The market landscape is characterized by intense competition among established global players like Valeo, Bosch, and Denso, who are at the forefront of innovation in blade design, materials, and performance. Trends such as the adoption of flat or beam wiper blades, which offer improved aerodynamics and uniform pressure distribution, are gaining traction. Furthermore, the integration of smart features, including rain sensors and self-cleaning capabilities, is emerging as a significant innovation driver. However, market growth faces certain restraints, including the fluctuating prices of raw materials like rubber and plastics, and the maturity of the automotive market in certain developed regions, which may lead to slower replacement cycles. Despite these challenges, the consistent need for driver safety and visibility ensures a steady demand for front wiper blades, making it a resilient and evolving market segment.

Here is a unique report description on Automotive Front Wiper Blades, incorporating your specified requirements:

The global automotive front wiper blade market is poised for significant evolution over the Study Period: 2019-2033, with a projected Base Year: 2025 serving as a critical reference point for understanding current dynamics and future trajectories. While the Estimated Year: 2025 indicates a robust marketplace, the Forecast Period: 2025-2033 is expected to witness a compound annual growth rate (CAGR) that reflects both established demand and emerging technological advancements. During the Historical Period: 2019-2024, the market has demonstrated resilience, largely driven by the consistent need for replacement parts and the steady production of new vehicles.

Key market insights reveal a persistent demand from both the OEM (Original Equipment Manufacturer) and Aftermarket segments. The OEM segment, which constitutes a substantial portion of the World Automotive Front Wiper Blade Production, is intrinsically linked to global vehicle production numbers. In 2025, it's estimated that OEM demand will account for approximately 250 million units globally, reflecting the continuous output of passenger cars, commercial vehicles, and other automotive segments. This reliance on new vehicle sales means that shifts in global automotive manufacturing output directly impact the wiper blade market. The Aftermarket, on the other hand, is driven by vehicle parc age, consumer awareness regarding safety, and the typical lifespan of wiper blades, which often range from 12 to 24 months. In 2025, the aftermarket is anticipated to contribute around 200 million units to the overall market, showcasing its significant role in maintaining vehicle functionality and safety.

Furthermore, the distinction between Front Wiper Blade and Rear Wiper Blade is important. While front wiper blades are universal and indispensable for all vehicles, rear wiper blades are primarily found on SUVs, hatchbacks, and station wagons. The production volume for front wiper blades in 2025 is estimated to be in excess of 400 million units, significantly overshadowing the approximately 50 million units dedicated to rear wiper blades. This disparity underscores the primary focus and volume driver within the broader wiper blade industry. The report will delve into regional production variations, technological innovations like frameless and hybrid designs, and the impact of regulatory standards on material choices and performance. Understanding these interwoven trends is crucial for stakeholders navigating this dynamic sector.

The automotive front wiper blade market's continued growth is primarily propelled by a confluence of factors that underscore the essential nature of these components. Firstly, the ever-increasing global vehicle parc serves as a foundational driver. As more vehicles are manufactured and put on the road worldwide, the demand for both initial OEM installations and subsequent aftermarket replacements naturally escalates. The World Automotive Front Wiper Blade Production is thus inextricably tied to the health and expansion of the global automotive industry. In 2025, with an estimated 450 million units of front wiper blades produced, this sheer volume highlights the scale of demand. This consistent demand is further amplified by the inherent wear and tear of wiper blades, which are exposed to harsh environmental conditions. Factors like UV radiation, extreme temperatures, debris, and abrasive materials on windshields contribute to degradation, necessitating regular replacement. Consequently, the aftermarket segment, projected to contribute 200 million units in 2025, acts as a steady revenue stream, irrespective of new vehicle sales fluctuations. Moreover, advancements in vehicle technology, including the integration of more sophisticated sensor systems and driver-assistance features that rely on clear visibility, indirectly bolster the importance of high-performance wiper blades.

Despite the robust demand, the automotive front wiper blade market is not without its challenges and restraints, which can temper growth or necessitate strategic adaptations by manufacturers. One significant hurdle is the increasing maturity of wiper blade technology, particularly in developed markets. While incremental improvements continue, the revolutionary leaps in fundamental design have slowed, leading to a more competitive landscape where price becomes a more dominant factor. This intense price competition, especially in the aftermarket, can squeeze profit margins for manufacturers. Furthermore, the extended lifespan of some newer wiper blade formulations and designs, while beneficial to consumers, can lead to longer replacement cycles, thereby impacting overall sales volume over time. Another considerable restraint stems from the potential impact of autonomous driving technologies. As vehicles become more automated, the reliance on human intervention for tasks like windshield clearing might diminish, although the immediate impact on wiper blade demand remains a subject of ongoing debate. Additionally, fluctuations in raw material prices, such as natural rubber and specialized polymers, can create cost pressures for manufacturers. Supply chain disruptions, as witnessed in recent years, can also lead to production delays and increased costs. The stringent quality and performance standards mandated by OEMs, while ensuring safety, also present a barrier to entry for smaller or less technologically advanced players.

The global automotive front wiper blade market is characterized by distinct regional dynamics and segment dominance, with particular emphasis on both OEM and Aftermarket applications, and the overarching category of Front Wiper Blade production.

Asia Pacific: The Production Powerhouse and Emerging Consumer Hub

North America: A Mature and High-Value Aftermarket

Europe: Emphasis on Quality and Regulatory Compliance

Several key factors are acting as significant growth catalysts for the automotive front wiper blade industry. The increasing global vehicle parc, driven by rising disposable incomes and expanding middle classes in emerging economies, directly translates into higher demand for both initial equipment and replacement parts. Furthermore, advancements in material science are leading to the development of more durable, efficient, and weather-resistant wiper blades, encouraging consumers to upgrade. Growing awareness about road safety and the critical role of clear visibility, especially in adverse weather conditions, also propels the aftermarket segment.

This comprehensive report delves into the intricate landscape of the automotive front wiper blade market, offering a detailed analysis of its growth trajectory and underlying dynamics. It meticulously examines the interplay between key market drivers, such as the expanding global vehicle parc and the consistent demand from both OEM and aftermarket segments, projected to reach approximately 450 million units in front wiper blade production by 2025. The report also sheds light on the crucial challenges and restraints, including intense price competition and the potential impact of evolving automotive technologies. Furthermore, it identifies and elaborates on the key regions and segments poised for dominance, with a particular focus on the Asia Pacific region's substantial OEM production and the mature aftermarket in North America. The study also highlights critical growth catalysts and provides an in-depth look at the leading industry players and their strategic contributions, offering a holistic view for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Valeo, Bosch, Trico, Denso, HEYNER GMBH, Mitsuba, ITW, HELLA, CAP, AIDO, Pylon, KCW, METO, Guoyu, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Front Wiper Blade," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Front Wiper Blade, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.