1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Ethernet Converter?

The projected CAGR is approximately 23.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Ethernet Converter

Automotive Ethernet ConverterAutomotive Ethernet Converter by Application (Passenger Vehicles, Commercial Vehicles), by Type (One-Way Converter, Bidirectional Converter), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

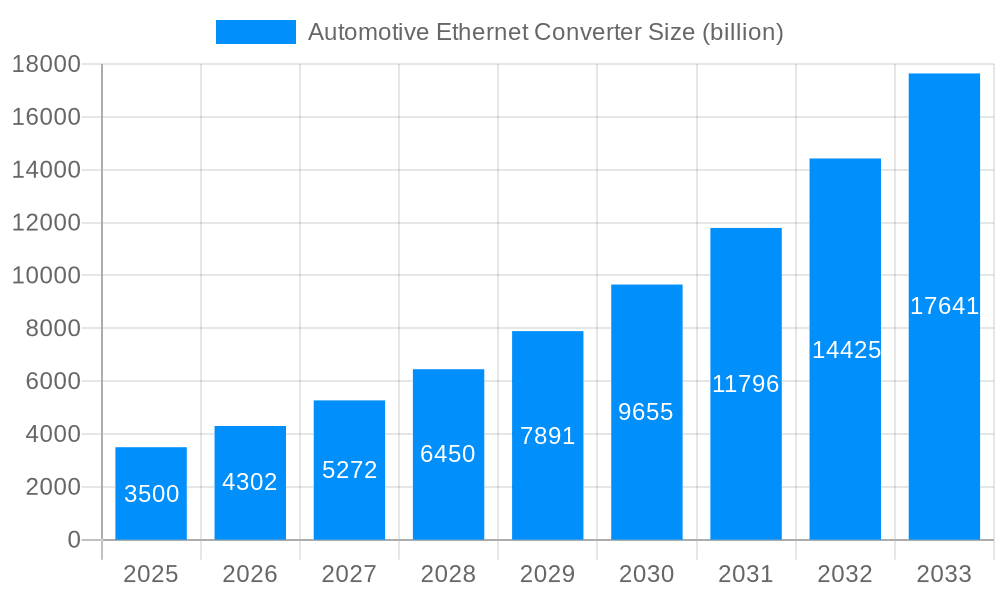

The Automotive Ethernet Converter market is poised for substantial expansion, projected to reach an estimated \$3.5 billion in the base year of 2025. This robust growth is driven by an impressive Compound Annual Growth Rate (CAGR) of 23.3%, indicating a dynamic and rapidly evolving industry. The increasing integration of advanced connectivity features in vehicles, such as sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and over-the-air (OTA) updates, necessitates high-speed and reliable data communication, making Ethernet converters indispensable. Furthermore, the shift towards software-defined vehicles and the growing demand for in-vehicle networking solutions for complex electronic architectures are significant catalysts for market expansion. The increasing adoption of Ethernet in automotive applications offers advantages like higher bandwidth, reduced cabling complexity, and improved electromagnetic compatibility, all of which contribute to its widespread adoption.

The market is segmented into key applications including Passenger Vehicles and Commercial Vehicles, with the former expected to dominate due to higher production volumes and the rapid pace of technological integration. In terms of type, both One-Way Converters and Bidirectional Converters will witness considerable demand, catering to diverse networking requirements. Geographically, Asia Pacific, led by China and India, is anticipated to emerge as a leading region, fueled by its massive automotive manufacturing base and aggressive adoption of new automotive technologies. North America and Europe will also represent significant markets, driven by the presence of major automotive manufacturers and a strong focus on innovation in connected car technology. Restraints, such as the initial cost of implementation and the need for standardized protocols, are being progressively addressed through technological advancements and industry collaborations, paving the way for sustained growth.

This comprehensive report delves into the dynamic global Automotive Ethernet Converter market, forecasting a substantial expansion driven by the increasing sophistication of vehicle electronics and the insatiable demand for high-speed data transfer. Our analysis, spanning the Historical Period of 2019-2024, establishes a crucial baseline, while the Base Year of 2025 and Estimated Year of 2025 pinpoint current market valuations and trajectories. The Study Period of 2019-2033 encompasses both historical trends and extensive future projections, with the Forecast Period of 2025-2033 offering detailed segment-wise forecasts. We anticipate the global Automotive Ethernet Converter market to reach a valuation of over $5 billion by 2025, with projections indicating a surge to potentially $15 billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR). The report meticulously examines various converter types, including One-Way Converter and Bidirectional Converter, and their adoption across key applications such as Passenger Vehicles and Commercial Vehicles. Furthermore, it highlights pivotal Industry Developments that are shaping the competitive landscape and driving innovation.

The global Automotive Ethernet Converter market is experiencing a paradigm shift, driven by the relentless evolution of in-vehicle connectivity and data processing needs. Historically, from 2019 to 2024, the market witnessed steady growth, fueled by the initial adoption of Ethernet in higher-end vehicles for specific functionalities like Advanced Driver-Assistance Systems (ADAS) and infotainment. However, as we enter 2025 and look towards 2033, the trends are accelerating dramatically. The current market valuation in 2025 is estimated to be around $5 billion, and our projections indicate a remarkable ascent, potentially reaching $15 billion by 2033. This substantial growth is underpinned by several key trends. Firstly, the proliferation of autonomous driving technologies necessitates faster, more reliable, and higher-bandwidth data transmission, making automotive Ethernet converters indispensable. These converters bridge the gap between legacy automotive buses and the high-speed Ethernet backbone, enabling seamless communication between various ECUs, sensors, and cameras. Secondly, the increasing complexity of vehicle architectures, with a greater number of sensors and ECUs, demands efficient data aggregation and distribution. Automotive Ethernet converters play a crucial role in this by offering flexible network topologies and simplifying wiring harnesses. The shift towards Software-Defined Vehicles (SDVs) further amplifies this demand, as these platforms rely heavily on Ethernet for Over-the-Air (OTA) updates, diagnostics, and real-time data processing. The report will also analyze the growing importance of bidirectional converters, which facilitate two-way communication and offer greater flexibility in system design, compared to their one-way counterparts. The increasing integration of AI and machine learning within vehicles also contributes to this trend, requiring significant data throughput for training and inference. The market is also witnessing a rise in specialized converters designed for specific applications, such as those catering to the stringent requirements of commercial vehicle fleets or the unique demands of electric vehicle (EV) powertrains. The competitive landscape is evolving with established players introducing advanced solutions and new entrants focusing on niche applications.

Several powerful forces are propelling the Automotive Ethernet Converter market to new heights. The most significant driver is the escalating demand for advanced in-vehicle connectivity and data-intensive applications. Modern vehicles are transforming into sophisticated data hubs, generating and processing vast amounts of information from a multitude of sensors, cameras, and ECUs. This surge in data necessitates high-speed, low-latency communication protocols, a role that automotive Ethernet is increasingly fulfilling. The rapid advancement of autonomous driving technologies, from Level 1 to Level 4 and beyond, is a primary catalyst. These systems rely on real-time data exchange for perception, decision-making, and control, making Ethernet converters critical for enabling the necessary bandwidth and reliability. Furthermore, the growing adoption of sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and in-car connectivity features like Wi-Fi and 5G integration further intensifies the need for efficient data gateways. The increasing complexity of vehicle electronic architectures, with a greater number of interconnected components, also necessitates a robust and scalable networking solution, which automotive Ethernet converters provide. This enables simpler wiring harnesses, reduced weight, and improved electromagnetic compatibility (EMC), translating into cost and efficiency benefits for automakers. The push towards electrification and the integration of complex battery management systems (BMS) and charging infrastructure also contribute to the demand for high-speed communication, where Ethernet converters play a vital role in facilitating seamless data flow between critical EV components.

Despite the robust growth trajectory, the Automotive Ethernet Converter market is not without its challenges and restraints. One of the primary hurdles is the stringent validation and standardization processes within the automotive industry. Introducing new technologies, including advanced Ethernet converters, requires rigorous testing and adherence to evolving safety and cybersecurity standards, which can prolong development cycles and increase costs. The existing infrastructure and expertise within some automotive manufacturers might also pose a transitional challenge, as adopting Ethernet-based architectures requires upskilling and potential overhauls of established development methodologies. Another significant restraint is the cost sensitivity associated with automotive components. While Ethernet offers inherent advantages, the initial cost of advanced converters, especially those with specialized features, can be a deterrent for certain segments of the market, particularly in lower-tier vehicles. Cybersecurity concerns remain a constant challenge. As vehicles become more connected, the risk of cyberattacks increases, and ensuring the integrity and security of data transmitted through Ethernet converters is paramount. Developing robust cybersecurity solutions that are both effective and cost-efficient is an ongoing effort. Furthermore, the availability of alternative high-speed communication solutions, although less prevalent for the core data backbone, can also present a competitive challenge in specific niches. The complexity of integrating Ethernet converters seamlessly into diverse vehicle architectures, alongside legacy automotive communication protocols like CAN and LIN, requires careful planning and interoperability solutions, which can be a source of technical difficulty.

The global Automotive Ethernet Converter market is poised for significant growth, with specific regions and segments set to lead this expansion.

Dominant Segments:

Application: Passenger Vehicles:

Type: Bidirectional Converter:

Dominant Regions:

North America:

Europe:

Asia-Pacific:

The growth of the Automotive Ethernet Converter market is being significantly catalyzed by the accelerating pace of vehicle electrification and the relentless pursuit of higher levels of autonomous driving. As electric vehicles become more prevalent, the need for high-bandwidth communication for battery management systems, powertrain control, and charging infrastructure management intensifies, creating a substantial demand for Ethernet converters. Concurrently, the development and deployment of advanced driver-assistance systems (ADAS) and fully autonomous driving capabilities are creating an insatiable appetite for real-time data processing and inter-component communication, directly benefiting the adoption of Ethernet solutions.

This report provides an unparalleled depth of insight into the Automotive Ethernet Converter market, meticulously dissecting its intricate dynamics. It offers a granular breakdown of market size and projections, supported by robust historical data from 2019-2024 and forward-looking estimates for 2025-2033. The report details the market valuations at the Base Year and Estimated Year of 2025, alongside comprehensive CAGR forecasts. Furthermore, it presents detailed segment-wise analyses, examining the adoption of One-Way Converter and Bidirectional Converter types across Passenger Vehicles and Commercial Vehicles applications, alongside crucial Industry Developments. This comprehensive coverage equips stakeholders with the critical intelligence needed to navigate this rapidly evolving and lucrative market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 23.3%.

Key companies in the market include Flexmedia XM, Accurate Technologies Inc., NXP, X2E GmbH, Technica Engineering, Macnica, Intrepid Control Systems, ETAS, NextGig Systems, Cayee Network Systems, Radix, LINEEYE CO., LTD., Axiomatic, Keysight, GroupGets, .

The market segments include Application, Type.

The market size is estimated to be USD 3.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Ethernet Converter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Ethernet Converter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.