1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Body Sealing Systems?

The projected CAGR is approximately 3.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Body Sealing Systems

Automotive Body Sealing SystemsAutomotive Body Sealing Systems by Type (EPDM Sealing System, PVC Sealing System, TPE Sealing System, World Automotive Body Sealing Systems Production ), by Application (Passenger Vehicle, Commercial Vehicle, World Automotive Body Sealing Systems Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

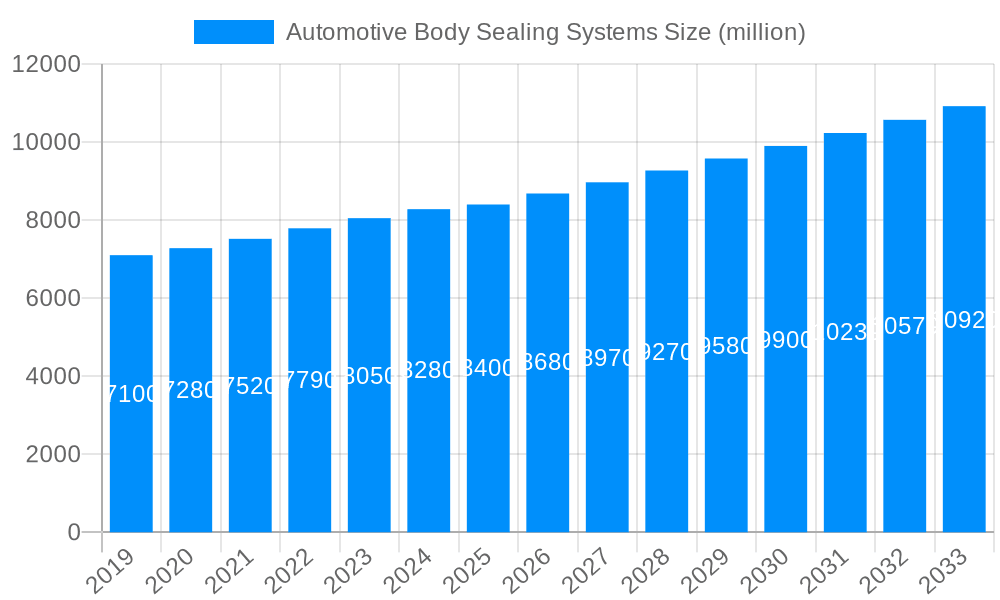

The global Automotive Body Sealing Systems market is poised for robust expansion, projected to reach a valuation of $8.4 billion by the base year of 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 3.6% anticipated throughout the forecast period of 2025-2033. This sustained upward trajectory is primarily driven by the escalating global demand for passenger and commercial vehicles, fueled by increasing urbanization, rising disposable incomes in emerging economies, and the continuous evolution of vehicle designs necessitating advanced sealing solutions for enhanced comfort, safety, and performance. Furthermore, stringent automotive safety and environmental regulations worldwide are compelling manufacturers to adopt sophisticated sealing systems that contribute to improved fuel efficiency, reduced noise, vibration, and harshness (NVH), and superior weatherproofing. The market’s dynamism is also evident in the ongoing technological advancements, with a notable trend towards lightweight and high-performance sealing materials, as well as the integration of smart sealing technologies.

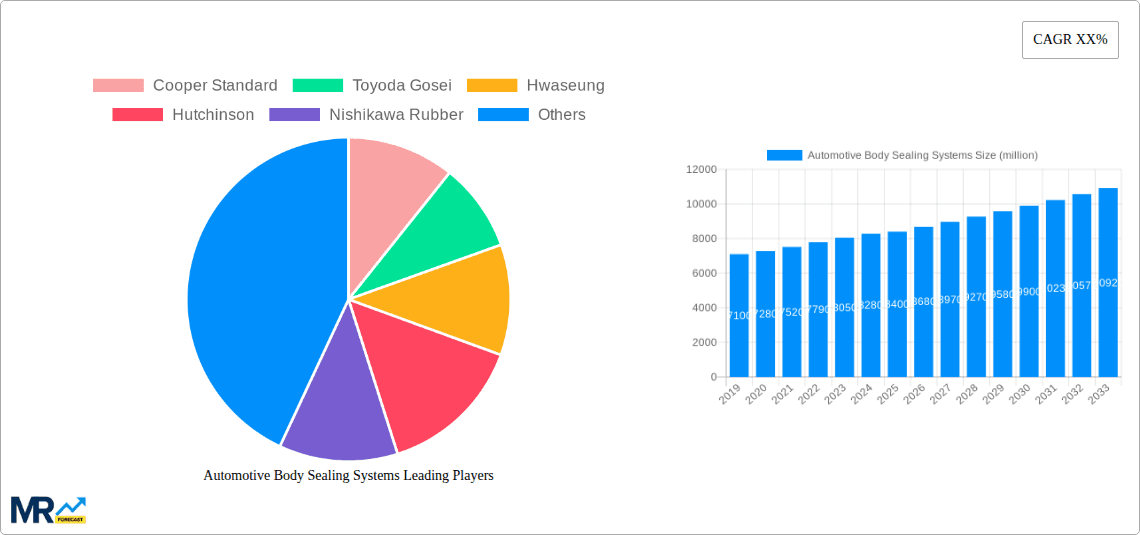

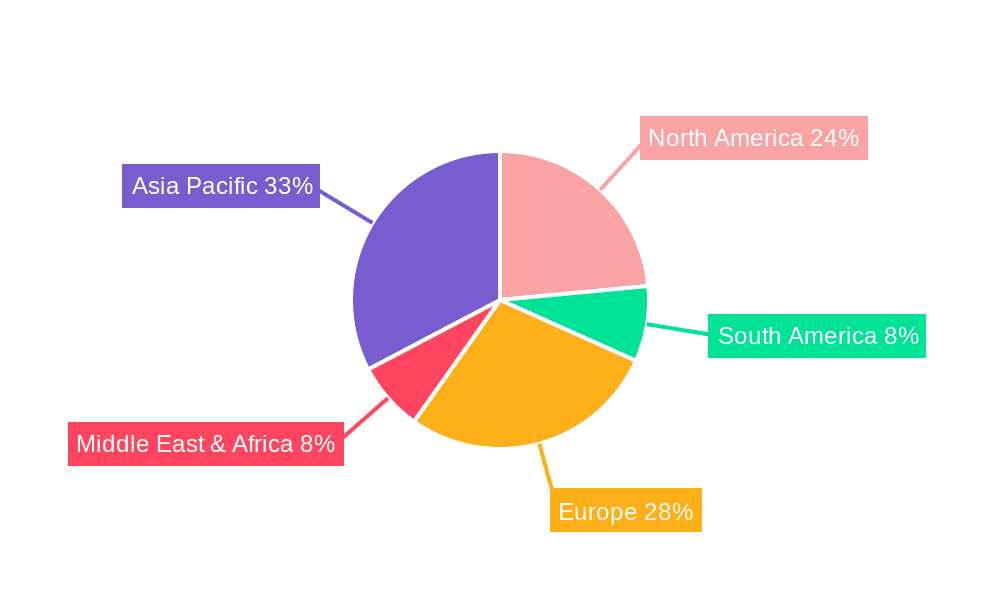

The competitive landscape for Automotive Body Sealing Systems is characterized by the presence of a diverse range of established global players and emerging regional manufacturers. Key companies such as Cooper Standard, Toyoda Gosei, Hutchinson, and Henniges Automotive are at the forefront, leveraging their extensive research and development capabilities and global manufacturing footprints. The market segmentation reveals a strong emphasis on both EPDM (Ethylene Propylene Diene Monomer) and PVC (Polyvinyl Chloride) sealing systems, with TPE (Thermoplastic Elastomer) systems gaining traction due to their recyclability and design flexibility. In terms of application, passenger vehicles represent the largest segment, followed by commercial vehicles. Geographically, the Asia Pacific region, particularly China and India, is emerging as a significant growth engine, owing to its burgeoning automotive industry. North America and Europe remain mature yet crucial markets, driven by vehicle modernization and stringent regulatory frameworks.

This comprehensive report delves into the dynamic global market for Automotive Body Sealing Systems, providing an in-depth analysis of its trajectory from 2019 to 2033. The study leverages a robust methodology, with the Base Year and Estimated Year set at 2025, and a detailed Forecast Period spanning 2025-2033, building upon the Historical Period of 2019-2024. We project the global market value to reach an impressive USD 35.7 billion by 2033, showcasing significant growth from its USD 25.9 billion valuation in the Base Year of 2025. The report meticulously examines key segments, including EPDM Sealing Systems, PVC Sealing Systems, and TPE Sealing Systems, alongside production volumes and application sectors such as Passenger Vehicles and Commercial Vehicles.

The global Automotive Body Sealing Systems market is undergoing a significant transformation driven by a confluence of factors, painting a picture of robust expansion and technological evolution. XXX reveals that the increasing demand for enhanced vehicle comfort, noise reduction, and improved energy efficiency is a primary catalyst. As consumers become more discerning, manufacturers are prioritizing superior sealing solutions that minimize wind noise, water ingress, and dust penetration, thereby elevating the overall in-cabin experience. Furthermore, the relentless pursuit of lightweighting across the automotive industry is pushing the adoption of advanced polymer-based sealing materials. These materials, such as Thermoplastic Elastomers (TPEs), offer comparable performance to traditional rubber compounds but at a reduced weight, contributing to improved fuel economy and lower emissions. This shift towards sustainable and efficient materials is not just a trend but a fundamental driver of market growth.

The rise of electric vehicles (EVs) is also creating new opportunities and challenges for the sealing systems sector. EVs often operate at higher frequencies and generate less engine noise, making the NVH (Noise, Vibration, and Harshness) performance of sealing systems even more critical. Specialized sealing solutions are being developed to address these unique NVH characteristics, ensuring a quiet and comfortable EV cabin. Moreover, the increasing complexity of vehicle designs, with more aerodynamic profiles and intricate body structures, necessitates innovative sealing designs and advanced manufacturing techniques. This includes the development of multi-material seals and advanced extrusion technologies to achieve precise fits and reliable performance. The integration of smart functionalities, such as sensors within sealing systems for monitoring purposes, is also an emerging trend, albeit in its nascent stages. Overall, the market is characterized by a strong emphasis on performance, efficiency, sustainability, and technological advancement, all contributing to its upward trajectory.

The automotive body sealing systems market is being propelled by several powerful forces, chief among them being the sustained global demand for vehicles, particularly in emerging economies. As middle-class populations expand and urbanization continues, the need for personal and commercial transportation escalates, directly translating into increased production of automobiles and, consequently, a higher demand for sealing components. Beyond sheer volume, evolving consumer expectations play a pivotal role. Modern vehicle buyers place a premium on comfort and refinement, demanding quieter cabins free from intrusive wind noise, water leaks, and dust. This elevated standard directly fuels the adoption of advanced, high-performance sealing solutions that significantly enhance the occupant experience.

The automotive industry's unwavering commitment to fuel efficiency and emissions reduction is another significant propeller. Lightweighting initiatives across vehicle design necessitate the use of lighter materials, and sealing systems are no exception. The transition from heavier traditional rubber compounds to more advanced, lighter thermoplastic elastomers (TPEs) and other composite materials not only reduces overall vehicle weight but also contributes to improved fuel economy and lower environmental impact. Furthermore, the burgeoning electric vehicle (EV) segment presents a unique set of driving forces. The inherent quietness of EVs amplifies the importance of NVH (Noise, Vibration, and Harshness) control, demanding more sophisticated and precisely engineered sealing systems to maintain a serene cabin environment. The stringent regulatory landscape, with ever-tightening emissions standards and safety regulations globally, also compels manufacturers to adopt and innovate in sealing technologies to meet compliance requirements.

Despite the promising growth trajectory, the automotive body sealing systems market faces several discernible challenges and restraints that could temper its expansion. One of the primary hurdles is the inherent price sensitivity within the automotive supply chain. While performance and durability are paramount, cost-effectiveness remains a critical consideration for Original Equipment Manufacturers (OEMs). Suppliers are under constant pressure to deliver high-quality sealing solutions at competitive prices, which can squeeze profit margins and necessitate significant investment in process optimization and material innovation to achieve economies of scale. The volatile raw material prices, particularly for rubber and various polymers, present another significant restraint. Fluctuations in the cost of key feedstocks can directly impact the manufacturing expenses of sealing systems, leading to unpredictability in pricing and potentially affecting demand if costs become prohibitive.

Furthermore, the increasing complexity of vehicle designs, while driving innovation, also poses challenges in terms of standardization and manufacturing. As vehicles become more aerodynamically sculpted and integrate more advanced features, the design and production of custom-fit sealing solutions become more intricate and time-consuming. This can lead to longer development cycles and higher tooling costs. The global automotive industry is also susceptible to macroeconomic uncertainties, such as economic downturns, trade disputes, and geopolitical instability. These factors can disrupt production schedules, affect consumer spending on vehicles, and consequently impact the demand for automotive components, including sealing systems. The intense competition within the sealing systems market also acts as a restraint, with numerous established players and emerging entrants vying for market share, leading to price wars and the need for continuous differentiation through innovation and superior service.

Several key regions and specific segments are poised to dominate the global Automotive Body Sealing Systems market, reflecting shifts in automotive manufacturing hubs and the increasing adoption of advanced materials.

Asia Pacific: This region is a powerhouse of automotive production and consumption, making it a dominant force in the sealing systems market.

EPDM Sealing Systems: Among the material types, EPDM (Ethylene Propylene Diene Monomer) rubber sealing systems are expected to continue their dominance, particularly in the Passenger Vehicle segment.

Passenger Vehicle Application: This segment will undeniably be the largest contributor to the global automotive body sealing systems market.

The automotive body sealing systems industry is experiencing robust growth fueled by several key catalysts. The escalating global demand for vehicles, driven by expanding middle classes in emerging economies and a general increase in personal mobility, directly translates into a higher need for sealing components. Furthermore, the persistent consumer focus on in-cabin comfort, noise reduction, and protection from the elements is pushing OEMs to adopt more advanced and high-performance sealing solutions. The automotive industry's strong emphasis on lightweighting to enhance fuel efficiency and reduce emissions is a significant catalyst, promoting the adoption of innovative, lighter-weight sealing materials like TPEs. Finally, the rapid growth of the electric vehicle (EV) market presents a unique opportunity, demanding specialized sealing systems for thermal management, battery protection, and superior NVH performance in inherently quieter vehicles.

This report offers an unparalleled and comprehensive analysis of the global Automotive Body Sealing Systems market, providing stakeholders with actionable insights for strategic decision-making. It meticulously covers the market from 2019 to 2033, employing a robust framework with 2025 as the Base and Estimated Year. The analysis dissects the market by key segments including EPDM, PVC, and TPE sealing systems, examining their production volumes and crucial applications in Passenger Vehicles and Commercial Vehicles. Beyond market sizing and forecasting, the report delves into the critical trends shaping the industry, such as the increasing demand for NVH reduction and lightweighting. It identifies the primary driving forces, including evolving consumer expectations and stringent environmental regulations, while also critically evaluating the challenges and restraints that the market must navigate, such as raw material price volatility and intense competition. Furthermore, the report pinpoints the dominant regions and segments, offering a clear picture of where growth is most concentrated. The analysis is further enriched by a detailed overview of leading players, significant recent developments, and future growth catalysts, presenting a holistic and in-depth understanding of this vital automotive component sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.6%.

Key companies in the market include Cooper Standard, Toyoda Gosei, Hwaseung, Hutchinson, Nishikawa Rubber, SaarGummi Group, Henniges Automotive, Standard Profil, Jianxin Zhao’s Group, Kinugawa Rubber Industrial, REHAU, Tokai Kogyo, Zhejiang Xiantong Rubber, Haida Rubber and Plastic, Guizhou Guihang, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Body Sealing Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Body Sealing Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.