1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive AR HUD?

The projected CAGR is approximately 17.26%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive AR HUD

Automotive AR HUDAutomotive AR HUD by Type (TFT Projection Type, DLP Projection Type, LCOS Projection Type), by Application (Premium Car, Luxury Car, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

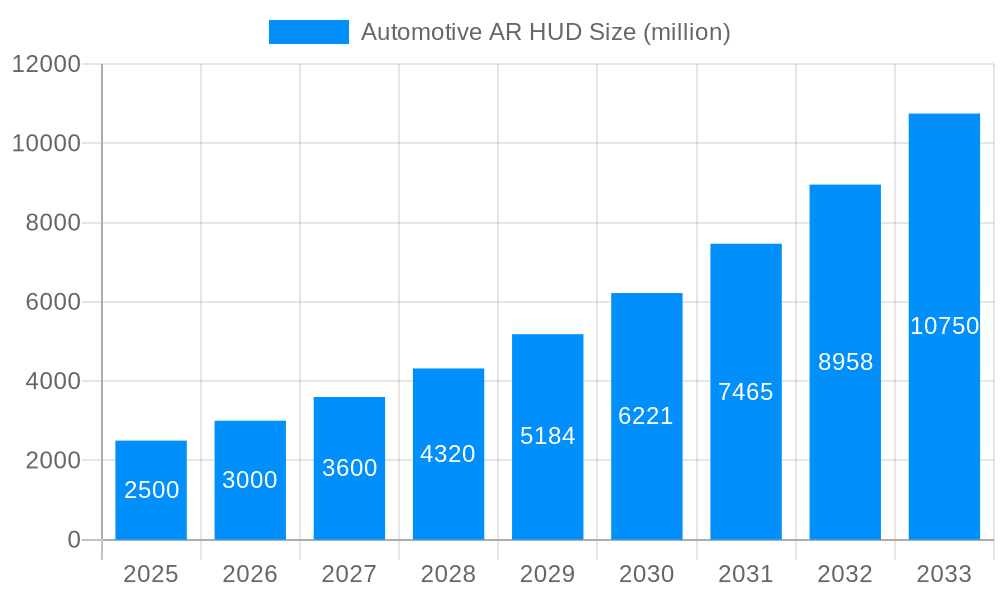

The automotive Augmented Reality Head-Up Display (AR HUD) market is experiencing robust expansion, propelled by the escalating demand for advanced driver-assistance systems (ADAS) and sophisticated in-car infotainment. AR HUDs integrate digital information seamlessly onto the windshield, enhancing driver safety and convenience through real-time navigation, alerts, and entertainment, all while minimizing distraction. The growing adoption of connected and autonomous driving technologies further amplifies the appeal of this transformative technology. We forecast a significant market growth trajectory, with a Compound Annual Growth Rate (CAGR) of 17.26%. The market size was valued at $2.45 billion in the base year 2022 and is projected to reach substantial figures by 2033. This expansion is underpinned by ongoing technological innovations in image quality, field of view, and cost-effectiveness. Leading industry players are prioritizing novel designs, strategic alliances, and partnerships to secure greater market share. Despite initial cost barriers and technical hurdles, ongoing R&D and economies of scale are expected to mitigate these challenges.

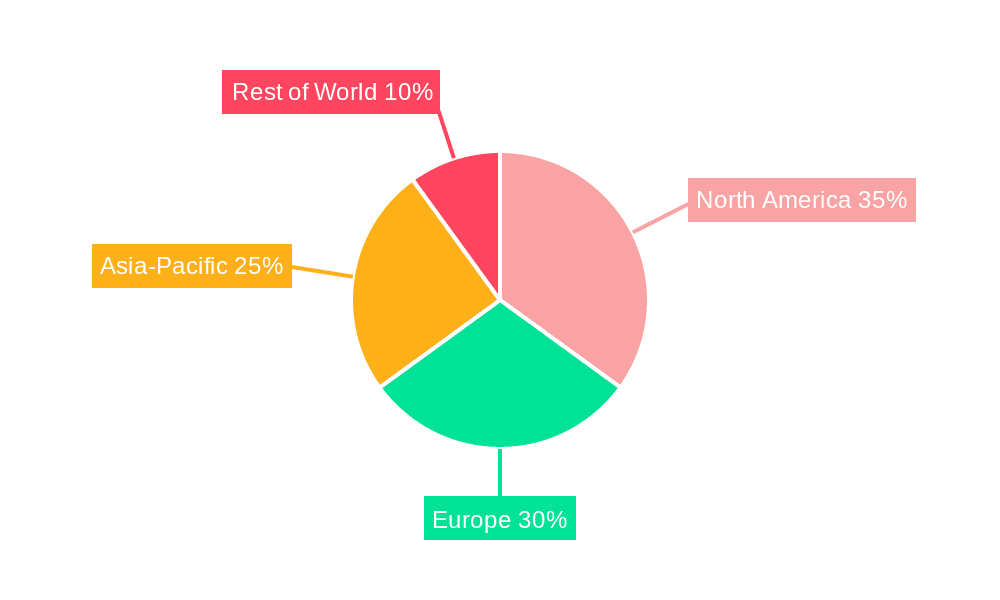

Market segmentation reveals a diverse ecosystem with specialized players focusing on various AR HUD components and technologies. Adoption rates will vary regionally, with North America and Europe leading due to higher consumer spending power and stringent safety mandates. Asia-Pacific, particularly China and Japan, is poised for rapid growth, driven by a thriving automotive sector and increased investment in technological advancements. As AR HUD technology matures, a progressive decline in production costs is anticipated, leading to broader integration across vehicle segments, from luxury to mass-market models. This widespread adoption will be a key driver of overall market expansion, cementing AR HUDs as a pivotal component in the evolution of automotive technology.

The automotive Augmented Reality Head-Up Display (AR HUD) market is experiencing explosive growth, projected to reach multi-million unit shipments by 2033. The study period of 2019-2033 reveals a significant shift from traditional HUDs to AR HUDs, driven by increasing consumer demand for enhanced safety features and immersive infotainment experiences. The estimated market size in 2025 underscores this trend, with millions of units already deployed. This transition isn't merely incremental; it represents a paradigm shift in how drivers interact with their vehicles. The forecast period (2025-2033) indicates a sustained period of high growth, propelled by technological advancements and the escalating integration of AR HUDs into higher vehicle segments. Analyzing the historical period (2019-2024) reveals a steady increase in adoption, setting the stage for the explosive growth predicted for the coming decade. Key market insights highlight a strong correlation between the increasing adoption of advanced driver-assistance systems (ADAS) and the demand for AR HUDs. The ability to seamlessly overlay crucial driving information directly onto the driver's field of vision enhances safety and situational awareness. Moreover, the market is witnessing a rise in demand for customized AR HUD solutions tailored to specific vehicle models and driver preferences, further fueling market expansion. The incorporation of features like navigation, speed warnings, and even entertainment overlays within the driver's line of sight is dramatically altering the driving experience, increasing user satisfaction and driving the market forward. The integration of AR HUDs with other vehicle technologies such as voice assistants and cloud-based services is creating a more connected and intelligent in-car experience, ultimately contributing to the market's overall growth trajectory and positioning AR HUDs as a crucial component of future vehicles.

Several factors are propelling the growth of the automotive AR HUD market. Firstly, the ever-increasing demand for enhanced driver safety is a primary driver. AR HUDs provide critical driving information directly within the driver's line of sight, minimizing distractions and improving reaction times. This is particularly crucial in situations requiring quick decision-making, such as navigating complex intersections or reacting to unexpected events. Secondly, the integration of advanced driver-assistance systems (ADAS) directly benefits from AR HUD technology. Features like lane departure warnings, adaptive cruise control, and blind-spot monitoring are significantly enhanced by presenting visual cues directly onto the windshield, enhancing situational awareness and driver confidence. Thirdly, consumer preference for improved infotainment experiences is also driving the market. AR HUDs allow for the seamless integration of navigation systems, entertainment options, and communication features directly into the driver's view, enhancing convenience and creating a more immersive driving experience without the need to look away from the road. Lastly, advancements in display technology, such as improved resolution, brightness, and image clarity, are continuously making AR HUDs more attractive and affordable, leading to wider adoption. The decreasing cost of production and improved performance are crucial factors that contribute to the widespread acceptance of AR HUDs among consumers and automakers alike.

Despite the considerable potential, several challenges and restraints hinder the widespread adoption of automotive AR HUDs. The high initial cost of implementation remains a significant barrier, especially for entry-level vehicles. The complexities involved in integrating AR HUD technology with existing vehicle systems, software, and hardware add to the cost and complexity. Moreover, the development of reliable and robust AR HUD systems requires significant research and development investment, which restricts access for smaller companies. Concerns regarding potential driver distraction, while mitigated by careful design and implementation, still linger. Excessive information overload, poorly designed interfaces, or unexpected system glitches could lead to safety risks, requiring rigorous testing and validation processes. Furthermore, the need for effective calibration and adjustments to adapt to varying weather conditions and driver preferences introduces complexities in deployment and maintenance. The lack of standardized interfaces and protocols poses another challenge, hindering the seamless integration of AR HUDs across different vehicle brands and platforms. Finally, ensuring sufficient brightness and clarity of the projected image in various ambient lighting conditions remains a technical hurdle that needs further refinement.

North America: The region is expected to dominate the market due to high vehicle ownership, strong technological advancements, and the early adoption of advanced driver-assistance systems. The presence of major automotive manufacturers and a robust supply chain further boosts the market.

Europe: Stringent safety regulations and a growing focus on driver assistance technologies are driving the adoption of AR HUDs in this region. The presence of established automotive giants and a strong focus on technological innovation contribute to the market growth.

Asia Pacific: Rapid economic growth, increasing vehicle sales, and the expanding presence of global and local automotive manufacturers are fueling market expansion. China, in particular, is expected to witness significant growth due to its large automotive market and increasing investment in advanced technologies.

Premium Vehicle Segment: The premium vehicle segment is leading the adoption of AR HUDs due to higher consumer willingness to pay for advanced features and improved safety enhancements. These vehicles offer the ideal platform for showcasing the advanced features and capabilities of AR HUD technology, encouraging early adoption and contributing to market growth.

Luxury Vehicle Segment: Similar to the premium segment, luxury car manufacturers are heavily investing in AR HUD technology to further enhance the sophisticated and luxurious driving experience provided by their offerings.

In summary, while growth is anticipated across various regions and vehicle segments, North America and the premium vehicle segment are projected to show the most significant growth during the forecast period. The interplay of technological advancements, consumer preferences, regulatory mandates, and the concerted efforts of leading manufacturers will shape the future landscape of the automotive AR HUD market, pushing towards a more sophisticated and connected driving experience.

The automotive AR HUD industry is experiencing rapid growth due to several key catalysts. Firstly, the increasing integration of ADAS features demands more intuitive and less distracting interfaces, which AR HUDs excel at providing. Secondly, rising consumer demand for enhanced safety and convenient infotainment solutions are directly driving adoption. Lastly, technological advancements, including improved display technologies and reduced production costs, make AR HUDs increasingly accessible to a wider range of vehicle manufacturers and consumers. These synergistic forces create a positive feedback loop, accelerating market expansion.

This report provides a comprehensive analysis of the automotive AR HUD market, encompassing historical data, current market trends, and future projections. It delves into the key driving forces and challenges impacting market growth, identifies leading players and their strategic initiatives, and provides detailed regional and segmental breakdowns to offer a holistic view of the industry landscape. The report offers invaluable insights for stakeholders involved in the automotive industry, helping them understand the dynamics of the AR HUD market and make informed decisions regarding investment, product development, and strategic partnerships.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.26% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.26%.

Key companies in the market include Nippon Seiki, Continental AG, Panasonic Automotive, Konica Minolta, DENSO, Maxell, LG Electronic, Foryou, E-LEAD, Huawei, Ofilm Group, Crystal Optech, FUTURUS, Raythink, New Vision, Shenzhen 3-dragons Technology, Jiangcheng Technology, Qianhai Zinger Technology, YAZAKI METER, Carrot Technology, Shanghai Yesar Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 2.45 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive AR HUD," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive AR HUD, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.