1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Anti-Glare Glass?

The projected CAGR is approximately 5.99%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Anti-Glare Glass

Automotive Anti-Glare GlassAutomotive Anti-Glare Glass by Type (Etching AG Glass, Coating AG Glass, Other), by Application (Central Display, Dashboard, World Automotive Anti-Glare Glass Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

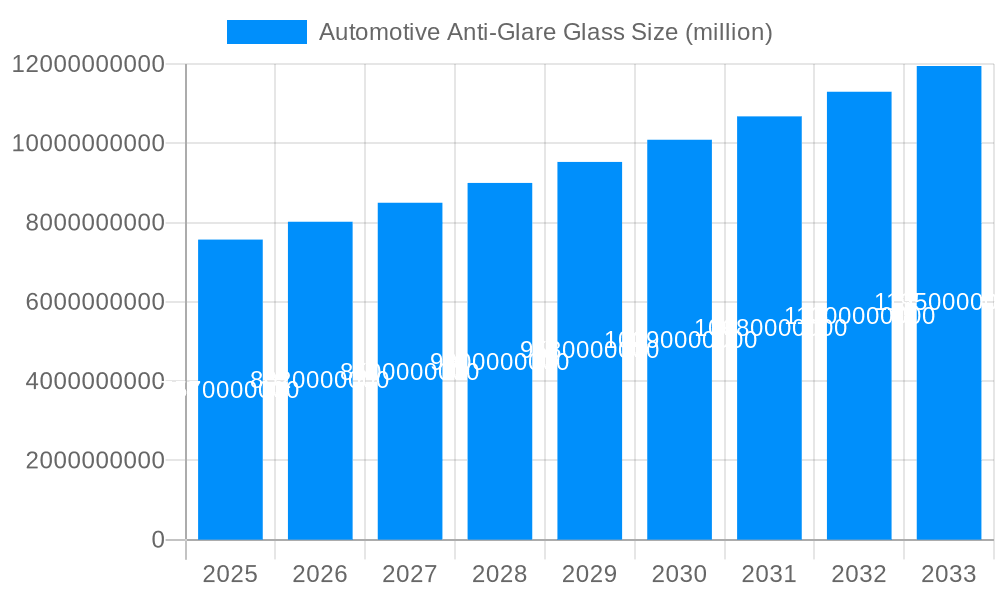

The global Automotive Anti-Glare Glass market is poised for significant growth, projected to reach an estimated USD 7.57 billion in 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 5.99% through 2033, indicating robust and sustained demand. A primary catalyst for this growth is the increasing prevalence of advanced driver-assistance systems (ADAS) and sophisticated in-car infotainment systems, which necessitate clear and glare-free displays for optimal functionality and driver safety. The demand for premium vehicle interiors, coupled with a heightened consumer awareness regarding visual comfort and reduced driver fatigue, further fuels the adoption of anti-glare glass solutions. The market is segmenting effectively, with Etching AG Glass and Coating AG Glass emerging as key technologies catering to the evolving needs of central displays and dashboards.

The market's trajectory is shaped by a confluence of factors, including technological advancements in glass manufacturing and surface treatments that enhance anti-reflective properties. Stringent automotive safety regulations and the ongoing push for enhanced user experience in vehicles are also contributing to market expansion. While the market presents substantial opportunities, certain restraints, such as the initial cost of specialized anti-glare glass and the complexities associated with integrating these technologies into mass production, need to be addressed. However, the overall outlook remains highly positive, with continuous innovation and increasing production capacities expected to mitigate these challenges. Leading players such as SCHOTT, Corning, and AGC are at the forefront of this innovation, investing in research and development to offer cutting-edge solutions that meet the dynamic demands of the automotive industry worldwide. The Asia Pacific region, particularly China and Japan, is anticipated to dominate the market due to its extensive automotive manufacturing base and rapid technological adoption.

This report provides an in-depth analysis of the global Automotive Anti-Glare Glass market, encompassing production, industry developments, and future projections from 2019 to 2033. With a base year of 2025, the study delves into historical trends, current market dynamics, and forecasts the trajectory of this crucial automotive component. The market is projected to witness significant growth, driven by increasing demand for enhanced driver safety and comfort, coupled with the proliferation of advanced in-car display technologies.

The automotive anti-glare glass market is experiencing a profound transformation, driven by a confluence of technological advancements and evolving consumer expectations. In the historical period (2019-2024), the market saw steady growth, primarily fueled by the increasing adoption of digital instrument clusters and central infotainment displays. Consumers are increasingly valuing enhanced visibility and reduced eye strain, especially during daylight driving conditions. This has translated into a growing preference for vehicles equipped with anti-glare solutions. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion. The increasing complexity of vehicle interiors, featuring larger and more integrated displays, necessitates sophisticated anti-glare solutions. The report estimates the global automotive anti-glare glass market to reach a valuation of over $5 billion by the end of the forecast period (2025-2033). This growth is not merely a function of increasing vehicle production but also a testament to the increasing sophistication and necessity of anti-glare technology in modern vehicles. The trend towards premiumization in automotive interiors, where visual clarity and aesthetic appeal are paramount, further bolsters the demand for advanced anti-glare glass. Furthermore, the integration of augmented reality (AR) heads-up displays (HUDs) is emerging as a significant trend, creating a new avenue for specialized anti-glare glass solutions that can effectively manage light reflections while preserving the clarity of projected information. The competition is intensifying, with manufacturers focusing on developing innovative manufacturing processes and material science to achieve superior anti-glare performance, durability, and cost-effectiveness. The market is also witnessing a shift towards more sustainable manufacturing practices, with a growing emphasis on environmentally friendly etching and coating processes. Looking ahead, the forecast period (2025-2033) is expected to witness sustained double-digit growth, with the market potentially exceeding $8 billion by 2033. This robust expansion will be underpinned by continuous innovation in material science, the growing penetration of electric vehicles (EVs) with their unique display requirements, and the increasing integration of autonomous driving features, which rely heavily on clear and unobstructed visual information for safe operation. The emphasis will be on a holistic approach to glare reduction, encompassing not just the glass surface but also the display technology itself.

The automotive anti-glare glass market is experiencing robust growth, propelled by several interconnected driving forces. Foremost among these is the escalating demand for enhanced driver safety and comfort. As vehicles become more technologically advanced, with larger and more prominent digital displays for navigation, infotainment, and vehicle diagnostics, the issue of glare becomes increasingly critical. Direct sunlight or reflections from internal cabin lights can significantly impair visibility, leading to driver distraction and fatigue. Anti-glare glass mitigates these issues by scattering or absorbing light, ensuring clear and comfortable viewing of these essential displays. The proliferation of advanced in-car technology, including sophisticated infotainment systems, digital instrument clusters, and Heads-Up Displays (HUDs), directly fuels the demand for effective anti-glare solutions. These displays are becoming integral to the driving experience, and their functionality is directly tied to their visibility under varying lighting conditions. Furthermore, the increasing adoption of electric vehicles (EVs) is another significant driver. EVs often feature minimalist interior designs with large, central touchscreens that serve multiple functions, making glare reduction a paramount concern for user experience and safety. The pursuit of a premium automotive experience also plays a crucial role. As consumers increasingly expect a high-quality and sophisticated cabin environment, the aesthetic appeal and functionality of displays are paramount. Anti-glare glass contributes to a cleaner, more modern, and user-friendly interior, enhancing the overall perception of luxury.

Despite the promising growth trajectory, the automotive anti-glare glass market faces several challenges and restraints that could temper its expansion. One of the primary concerns is the cost of production and implementation. Advanced anti-glare technologies, particularly those involving sophisticated coating processes or specialized etching techniques, can be more expensive than conventional glass manufacturing. This increased cost can be a deterrent for some automakers, especially in the mass-market segment, where price sensitivity is high. Manufacturers must constantly strive for cost-effective solutions without compromising performance. Another significant challenge lies in maintaining durability and resistance to damage. Anti-glare treatments, whether through etching or coatings, can sometimes be more susceptible to scratching or abrasion compared to standard glass. Ensuring that these treatments are robust enough to withstand the rigors of daily use in a vehicle environment, including cleaning and potential impacts, is crucial. The development of new and innovative anti-glare technologies also presents a hurdle. While advancements are being made, the pace of innovation in other areas of automotive technology, such as battery technology or autonomous driving systems, can sometimes outpace the development of complementary solutions like anti-glare glass. This necessitates continuous research and development efforts to keep pace with evolving automotive needs. Furthermore, regulatory compliance and standardization can pose challenges. As display technologies evolve and integration becomes more complex, there might be a need for new standards and regulations regarding glare reduction to ensure optimal safety and performance across different vehicles and regions. The impact of environmental conditions on anti-glare performance is also a consideration. Extreme temperatures, humidity, and exposure to UV radiation can potentially affect the longevity and effectiveness of certain anti-glare treatments, requiring robust material science and testing. Finally, the supply chain complexity for specialized materials and manufacturing processes can lead to potential disruptions and lead time issues, impacting the overall production efficiency of anti-glare glass components.

The global automotive anti-glare glass market is characterized by distinct regional dynamics and segment dominance, with particular emphasis on the Asia-Pacific region, driven by its massive automotive manufacturing base and burgeoning demand for advanced vehicle features. Within this region, China stands out as a dominant force, not only as the world's largest automotive market but also as a rapidly growing hub for advanced glass manufacturing and technological innovation. The presence of key players like Foshan Qingtong and Yuke Glass within China underscores its significance. This dominance is further amplified by the substantial production volumes of vehicles in China, which inherently translates into a higher demand for automotive glass components, including anti-glare variants. The government's supportive policies for the automotive sector and the increasing disposable income of consumers, leading to a preference for premium and technologically advanced vehicles, further bolster the market in this region.

Beyond China, other countries in the Asia-Pacific, such as South Korea and Japan, also contribute significantly to the market's growth, owing to the presence of major automotive manufacturers like Hyundai, Kia, and Toyota, who are actively integrating advanced display technologies and prioritizing driver comfort.

In terms of segments, the Coating AG Glass type is projected to witness substantial dominance. This is primarily due to the superior performance and versatility offered by coating technologies. Various advanced coating techniques, such as anti-reflective (AR) coatings and multi-layer coatings, can effectively reduce glare by minimizing light reflection and maximizing light transmission. These coatings can be applied to the glass surface to achieve the desired anti-glare properties while also offering additional benefits like smudge resistance and improved scratch resistance. The precision and control offered by coating processes allow for tailored solutions for different display types and lighting conditions. For instance, advanced AR coatings can significantly reduce reflections from external light sources, ensuring that digital displays remain clearly visible even in bright sunlight.

Simultaneously, the Central Display application segment is expected to be the primary driver of market growth. As vehicles increasingly adopt large, central touchscreens for infotainment, navigation, and vehicle controls, the importance of glare-free visibility for these displays escalates. The central display is a focal point for drivers and passengers, and any impairment to its clarity due to glare can negatively impact the user experience and even compromise safety. The trend towards larger and more immersive central displays, often featuring high resolutions and vibrant colors, further amplifies the need for effective anti-glare solutions. The ability of anti-glare glass to maintain the visual integrity and aesthetic appeal of these displays is paramount. The integration of advanced UI/UX designs within these central displays relies heavily on the clarity and readability of information, making the central display a critical application for anti-glare glass. The forecast period (2025-2033) is expected to see a consistent rise in the adoption of sophisticated AG glass for central displays, driven by continuous advancements in display technology and the growing demand for seamless, integrated in-car experiences. The interplay between advanced coating technologies and the ever-evolving central display landscape will shape the dominant trends in the global automotive anti-glare glass market.

Several key factors are acting as potent growth catalysts for the automotive anti-glare glass industry. The relentless pursuit of enhanced driver safety and comfort remains a primary driver, as clear visibility of digital displays is crucial for reducing driver distraction and eye strain. The increasing integration of advanced in-car technologies, such as larger infotainment screens, digital instrument clusters, and Heads-Up Displays (HUDs), directly amplifies the need for effective glare reduction. Furthermore, the growing trend of automotive premiumization is pushing automakers to offer more sophisticated and visually appealing interior experiences, where glare-free displays play a vital role. The expanding market for electric vehicles (EVs), which often feature minimalist interiors with prominent digital interfaces, also presents a significant growth opportunity.

This comprehensive report provides an exhaustive analysis of the global automotive anti-glare glass market, covering every facet from production volumes and technological advancements to market forecasts and competitive landscapes. The study delves into the intricate details of various anti-glare technologies, including etching and coating methods, and explores their application across critical automotive segments like central displays and dashboards. With a detailed examination of market drivers, challenges, and regional dynamics, the report offers invaluable insights for stakeholders looking to understand the current state and future trajectory of this rapidly evolving market. The extensive coverage ensures that readers gain a holistic understanding of the factors influencing market growth, investment opportunities, and potential strategic decisions within the automotive anti-glare glass sector. The report is meticulously researched and presents data-driven projections to guide stakeholders through the complexities of the market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.99% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.99%.

Key companies in the market include SCHOTT, Corning, AGC, Foshan Qingtong, Yuke Glass, Abrisa Technologies, KISO MICRO, JMT Glass, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Anti-Glare Glass," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Anti-Glare Glass, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.