1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Air Conditioning Motor?

The projected CAGR is approximately 4.62%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Air Conditioning Motor

Automotive Air Conditioning MotorAutomotive Air Conditioning Motor by Type (12 V, 24 V), by Application (Passenger Cars, Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

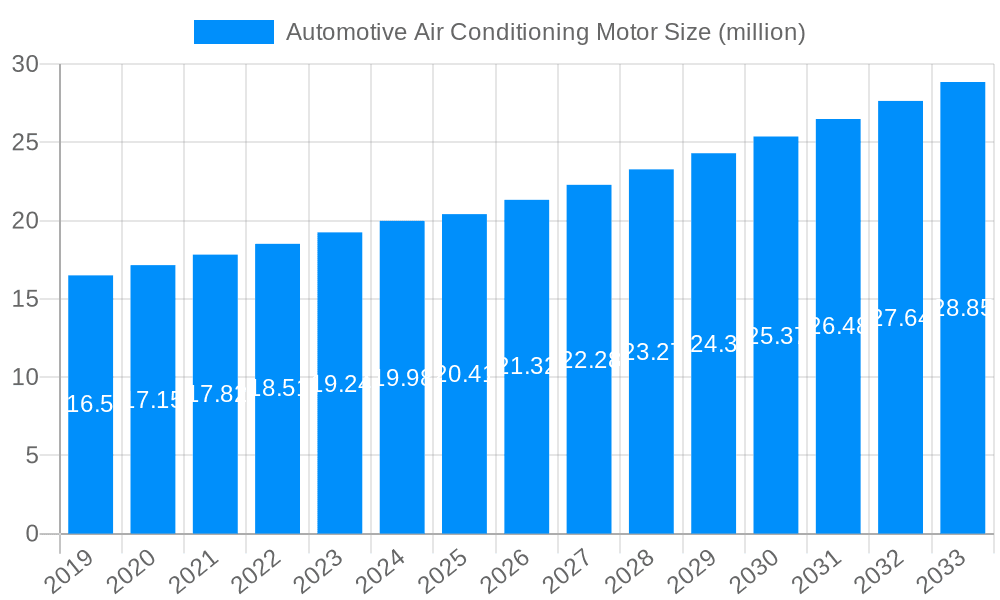

The global Automotive Air Conditioning (AC) Motor market is poised for robust expansion, projected to reach a substantial valuation of approximately $20.41 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.62% extending through 2033. This growth is primarily propelled by the escalating demand for enhanced vehicle comfort and climate control systems, a trend amplified by increasing consumer expectations and the growing popularity of premium features in both passenger cars and commercial vehicles. The continuous innovation in AC motor technology, focusing on improved energy efficiency, reduced noise levels, and enhanced durability, is a significant driver. Furthermore, the burgeoning automotive industry in emerging economies, coupled with stringent regulations mandating effective cooling systems for passenger safety and operational efficiency, further bolsters market prospects. The market's segmentation into 12V and 24V types caters to a diverse range of vehicle architectures, while the widespread application across passenger cars and commercial vehicles underscores the breadth of its reach.

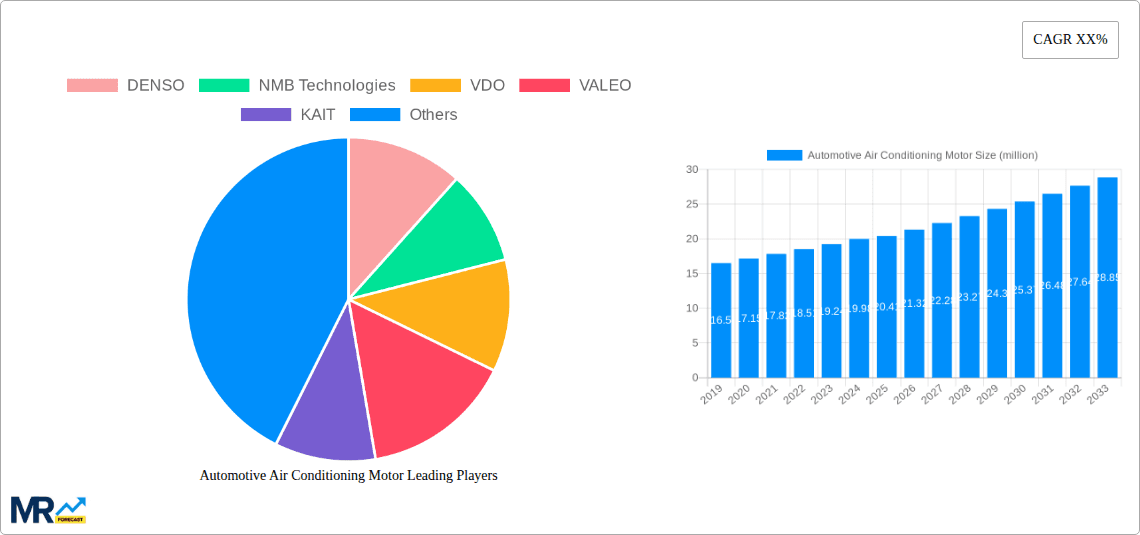

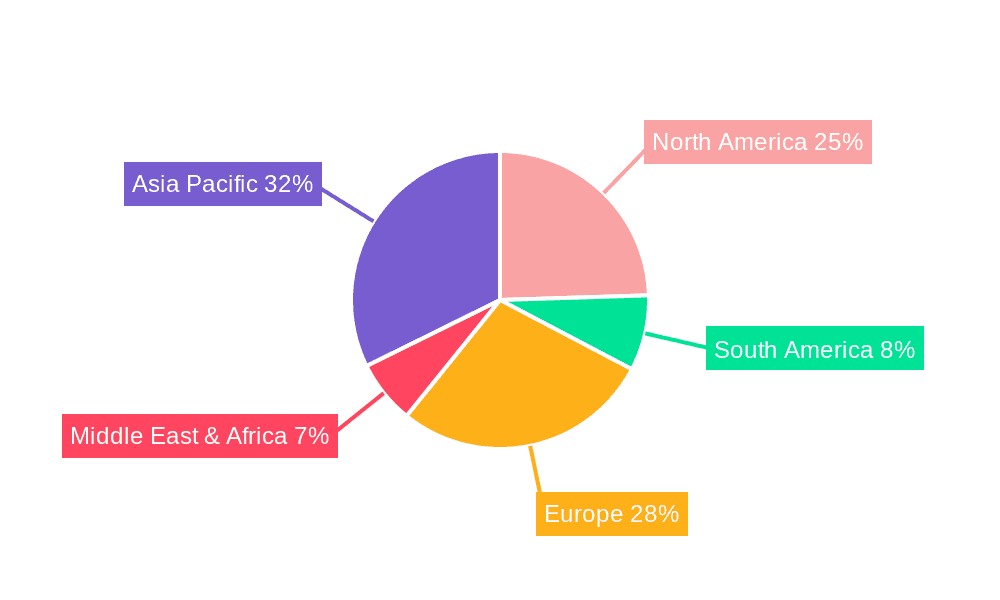

The market's trajectory is further influenced by several key trends, including the increasing integration of smart AC systems that offer advanced features like remote control and personalized climate settings, driven by the pervasive adoption of IoT in vehicles. Electrification of vehicles presents a dual-faceted influence; while it necessitates highly efficient and compact AC motors, it also opens new avenues for technological advancements. Restraints such as fluctuating raw material prices and the complex supply chain for specialized components, including rare earth magnets, could pose challenges. However, the continuous efforts by leading manufacturers like DENSO, VDO, and Valeo to optimize production processes and develop cost-effective solutions are expected to mitigate these concerns. Geographically, Asia Pacific is anticipated to emerge as a dominant force, owing to its expansive automotive manufacturing base and a rapidly growing consumer market. North America and Europe will continue to be significant contributors, driven by high vehicle penetration rates and a strong emphasis on advanced automotive technologies.

This report delves into the dynamic Automotive Air Conditioning Motor market, offering a granular analysis of trends, driving forces, challenges, and growth opportunities. Spanning a study period from 2019 to 2033, with a base year of 2025, this research provides actionable insights for stakeholders. The market, projected to be valued in the billions of units, is undergoing significant transformation driven by technological advancements and evolving consumer demands. The historical period (2019-2024) has witnessed steady growth, fueled by increasing vehicle production and the rising adoption of HVAC systems across all vehicle segments. The estimated year of 2025 serves as a crucial pivot point, highlighting current market dynamics before the extensive forecast period (2025-2033) projects a trajectory of sustained expansion.

The automotive air conditioning (A/C) motor market is experiencing a seismic shift driven by several intertwined trends that are reshaping its future. The overarching theme is electrification and automation, profoundly impacting how A/C systems are powered and controlled within vehicles. As the automotive industry rapidly transitions towards electric vehicles (EVs), the demand for highly efficient and integrated electric A/C motors is skyrocketing. These motors are not only crucial for cabin comfort but also play a vital role in battery thermal management, a critical factor for EV performance and longevity. This has led to a greater emphasis on brushless DC (BLDC) motors, renowned for their superior energy efficiency, longer lifespan, and quieter operation compared to traditional brushed DC motors. The report anticipates a significant surge in the adoption of BLDC motors, particularly in newer EV models, pushing the overall market volume into the billions of units within the forecast period.

Furthermore, miniaturization and weight reduction are paramount concerns for automotive manufacturers, especially in the context of EVs where every kilogram counts towards range optimization. This translates into a demand for more compact and lightweight A/C motors that deliver comparable or superior performance. Suppliers are investing heavily in research and development to create innovative motor designs that integrate seamlessly into increasingly confined engine compartments or chassis. The increasing complexity of vehicle electronics also fuels the trend towards smart and integrated A/C motor solutions. This involves motors with built-in intelligence for advanced diagnostics, self-regulation, and seamless communication with other vehicle systems. The integration of sensors and sophisticated control algorithms allows for optimized performance, reduced energy consumption, and enhanced user experience, paving the way for a more sophisticated A/C ecosystem.

The growing focus on sustainability and environmental regulations is another potent trend shaping the A/C motor market. Manufacturers are under pressure to reduce the carbon footprint of their vehicles, which extends to the components used in their A/C systems. This drives the demand for A/C motors that are not only energy-efficient but also manufactured using environmentally friendly processes and materials. The pursuit of lower energy consumption directly contributes to reduced fuel or electricity usage, aligning with global emission reduction targets. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving features also indirectly influences A/C motor design. As vehicles become more automated, the need for reliable and precisely controlled climate systems becomes even more critical for driver and passenger comfort, safety, and even cognitive performance. This necessitates A/C motors that can maintain optimal cabin temperatures without requiring constant manual adjustments. Finally, the ongoing global economic growth and increasing disposable incomes in emerging markets are contributing to a steady rise in vehicle ownership, consequently driving up the overall demand for A/C systems and, by extension, A/C motors, pushing the market volume well into the billions of units.

The automotive air conditioning motor market is experiencing robust growth propelled by a confluence of powerful driving forces. Paramount among these is the ever-increasing demand for enhanced passenger comfort and convenience. As vehicle ownership expands globally, particularly in developing economies, consumers are increasingly expecting sophisticated climate control systems as a standard feature, not a luxury. This escalating consumer expectation directly translates into a higher volume of A/C systems being manufactured, thereby boosting the demand for the underlying A/C motors, projected to be in the billions of units annually.

Furthermore, the accelerated adoption of electric vehicles (EVs) is a game-changer for the A/C motor market. Unlike traditional internal combustion engine (ICE) vehicles, EVs rely on electric motors for propulsion, and their thermal management systems, including A/C, are entirely electric. These electric A/C motors are critical not only for cabin comfort but also for regulating battery temperature, which is vital for EV performance, charging speed, and battery longevity. As EV production scales up exponentially, the demand for specialized, highly efficient EV-compatible A/C motors is skyrocketing. This segment is a significant growth catalyst, pushing the market towards new volume milestones in the billions of units.

The stringent government regulations regarding fuel efficiency and emissions are also playing a crucial role. Manufacturers are compelled to develop vehicles that consume less fuel or electricity and emit fewer pollutants. This necessitates the use of more energy-efficient components, including A/C motors. Brushless DC (BLDC) motors, for instance, offer superior efficiency compared to brushed DC motors, making them increasingly favored. The push for cleaner transportation solutions directly benefits the market for advanced and efficient A/C motors. Lastly, technological advancements and innovation within the automotive sector, such as the development of more sophisticated HVAC control systems and the integration of A/C functionality with ADAS, are creating new avenues for growth and driving the demand for specialized A/C motors.

Despite the promising growth trajectory, the automotive air conditioning motor market is not without its challenges. One of the most significant hurdles is the increasing complexity and cost of advanced A/C systems. The integration of smart features, advanced diagnostics, and highly efficient motor technologies, such as BLDC motors, often comes with a higher price tag. This can impact the affordability of A/C systems, particularly in cost-sensitive segments of the automotive market, potentially moderating the overall volume growth in the billions of units of the market.

Another considerable challenge is the volatility in raw material prices. The manufacturing of A/C motors relies on various commodities, including copper, aluminum, and rare-earth magnets. Fluctuations in the prices of these materials can significantly impact production costs and profit margins for A/C motor manufacturers. This economic uncertainty can lead to pricing pressures and affect investment decisions within the industry. Furthermore, intense competition and price wars among a fragmented market of manufacturers, particularly in the lower-end segments, can erode profitability and hinder innovation. The struggle to differentiate products and maintain healthy margins in a highly competitive landscape remains a constant concern.

The evolving regulatory landscape and stricter emissions standards can also pose a challenge, albeit one that also drives innovation. While regulations push for efficiency, the pace of change and the introduction of new standards can require significant investment in research and development to ensure compliance, adding to production costs and timelines. Moreover, supply chain disruptions, as witnessed in recent years, can significantly impede production and delivery schedules. Dependence on global supply chains for critical components makes the market vulnerable to geopolitical events, natural disasters, and trade disputes, potentially impacting the consistent supply of A/C motors in the billions of units. Finally, technical challenges in developing highly reliable and durable motors that can withstand the harsh automotive environment, including extreme temperatures, vibrations, and dust, require continuous innovation and rigorous testing, adding to the development cycle and costs.

The global automotive air conditioning motor market is poised for substantial growth, with specific regions and segments expected to lead this expansion, collectively contributing to the billions of units in market volume.

Key Regions/Countries Dominating the Market:

Asia Pacific (APAC): This region is unequivocally the powerhouse driving the automotive A/C motor market. Its dominance stems from several interconnected factors:

North America: This region holds a significant share due to its mature automotive market and high consumer demand for comfort.

Europe: Europe represents another crucial market, driven by stringent emission regulations and a growing focus on sustainable mobility.

Key Segments Dominating the Market:

Application: Passenger Cars: This segment is by far the largest contributor to the automotive A/C motor market in terms of volume, expected to be in the billions of units.

Type: 12 V Motors:

While Commercial Vehicles and 24V motors represent important and growing segments, particularly with the electrification of heavy-duty vehicles and the specific needs of larger trucks and buses, the sheer volume and widespread adoption of passenger cars and 12V systems ensure their continued leadership in the overall market volume.

Several key factors are acting as significant catalysts for growth within the automotive air conditioning motor industry. The relentless push towards electrification of vehicles is a primary driver, as EVs necessitate specialized and highly efficient electric A/C motors for both cabin comfort and battery thermal management, contributing to a surge in demand projected to reach billions of units. Furthermore, increasing global vehicle production, especially in emerging economies, directly fuels the demand for A/C systems and their constituent motors. Consumers' escalating expectations for enhanced passenger comfort and convenience, coupled with more stringent government regulations on fuel efficiency and emissions, are incentivizing the adoption of advanced and energy-saving A/C motor technologies. Innovations in motor design leading to miniaturization, improved performance, and reduced noise levels also act as catalysts, enabling better integration and user experience.

This comprehensive report offers an in-depth analysis of the global automotive air conditioning motor market, providing stakeholders with crucial insights from 2019 to 2033. It meticulously examines market segmentation by Type (12V, 24V) and Application (Passenger Cars, Commercial Vehicles). The report details key driving forces, such as the electrification trend and increasing consumer demand for comfort, and critically assesses challenges like raw material price volatility and intense competition. Furthermore, it identifies dominant regions and segments, with a strong emphasis on the Asia Pacific and the Passenger Cars application, projecting market volumes in the billions of units. Through a detailed look at leading players and significant developments, this report equips industry participants with the strategic knowledge needed to navigate this evolving market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.62% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.62%.

Key companies in the market include DENSO, NMB Technologies, VDO, VALEO, KAIT, Johnson Electric, Keboda, Cebi Group, XNJE, Ningbo Jinghua Electronic, HYAC, Zhaowei Machinery & Electronics, Leili.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Air Conditioning Motor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Air Conditioning Motor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.