1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive After-Sales Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive After-Sales Service

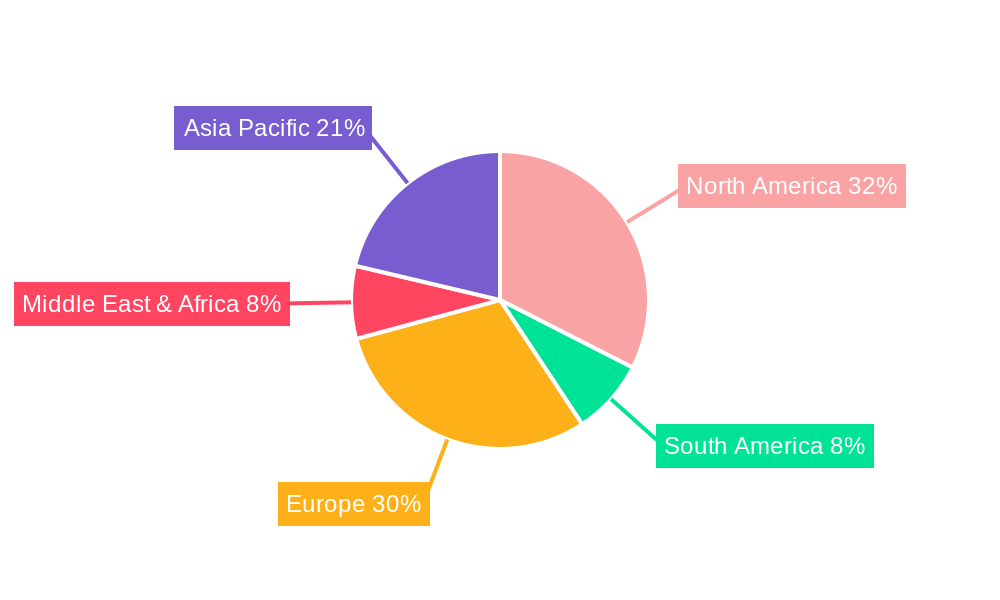

Automotive After-Sales ServiceAutomotive After-Sales Service by Type (Software, Hardware), by Application (OEMs, Aftermaket), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

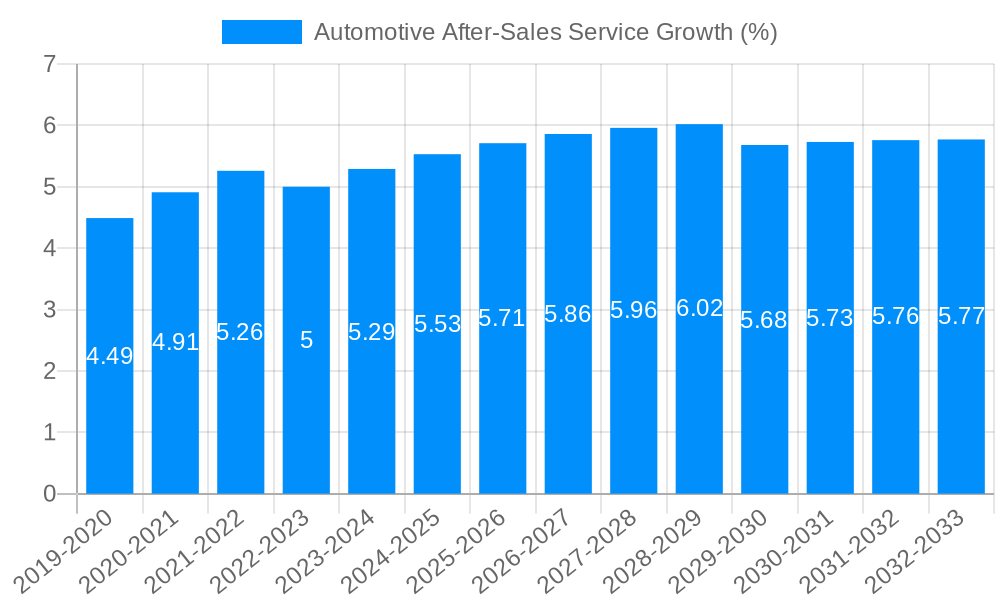

The Automotive After-Sales Service market is poised for significant expansion, projected to reach an estimated USD 1.1 trillion by 2025, driven by a burgeoning global vehicle parc and the increasing complexity of modern automobiles. This growth is fueled by several key factors, including a rising demand for routine maintenance and repair services, the growing adoption of connected car technologies requiring specialized diagnostics and software updates, and the increasing average age of vehicles on the road, leading to more frequent repair needs. Furthermore, the aftermarket segment is experiencing robust growth as vehicle owners seek cost-effective alternatives to dealership services, especially for older vehicles. The shift towards electric and hybrid vehicles is also introducing new service requirements and opportunities, necessitating specialized training and equipment for technicians. The increasing stringency of emission norms and safety regulations further mandates regular servicing and the use of genuine or certified parts, underpinning the market's upward trajectory. The market's Compound Annual Growth Rate (CAGR) is estimated at a healthy 6.8%, indicating sustained expansion over the forecast period.

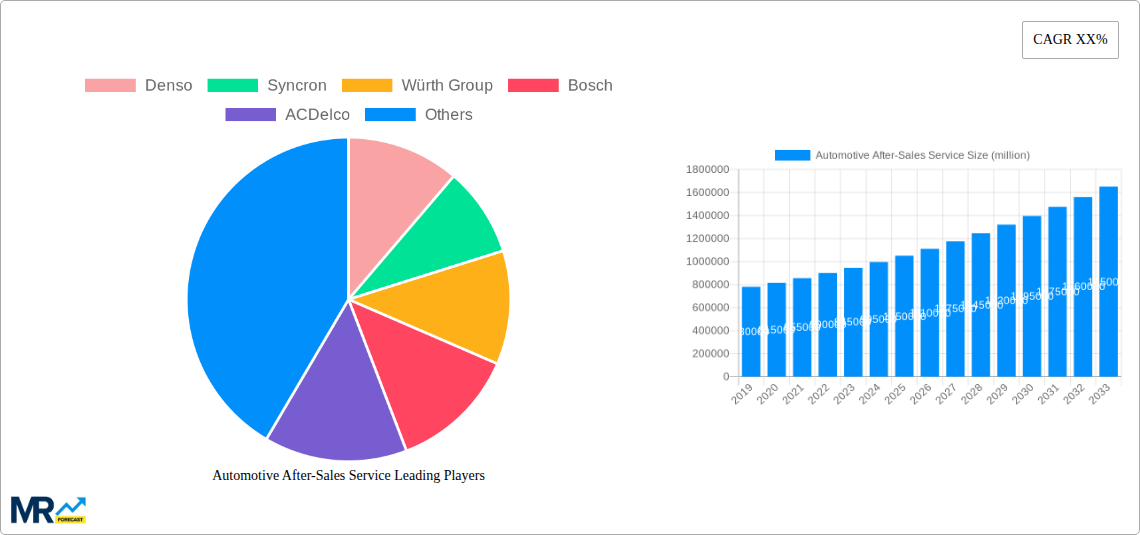

The market is segmented into Software and Hardware, with applications spanning both Original Equipment Manufacturers (OEMs) and the aftermarket. While OEMs focus on integrated service solutions and proprietary diagnostics, the aftermarket is characterized by its agility, competitive pricing, and a wide network of independent repair shops. Key players like Denso, Bosch, and ACDelco are actively innovating in areas such as advanced diagnostics, telematics, and predictive maintenance solutions. Emerging trends include the rise of mobile repair services, the integration of AI and machine learning for predictive diagnostics, and a greater emphasis on sustainability through eco-friendly repair practices and parts. However, challenges such as the shortage of skilled technicians, evolving vehicle technologies that require continuous upskilling, and the impact of economic downturns on discretionary spending on vehicle maintenance could temper growth. Geographically, North America and Europe currently lead the market, but the Asia Pacific region, particularly China and India, is emerging as a significant growth engine due to its rapidly expanding automotive sector and increasing vehicle ownership.

This report provides an in-depth analysis of the global Automotive After-Sales Service market, projecting significant growth and evolution between 2019 and 2033. The study meticulously examines key market dynamics, identifies crucial growth drivers and challenges, and forecasts future trends based on robust data analysis. The Base Year of this study is 2025, with projections extending through the Forecast Period of 2025-2033, building upon insights from the Historical Period of 2019-2024. The Study Period encompasses 2019-2033, offering a comprehensive historical and future outlook. The report leverages an estimated market size in the millions of units to quantify trends and opportunities.

XXX The global automotive after-sales service market is on the cusp of a profound transformation, driven by a confluence of technological advancements, evolving consumer expectations, and shifting industry paradigms. Over the Study Period (2019-2033), we anticipate a notable expansion in the market, with the Base Year of 2025 serving as a critical benchmark for future projections. A key insight is the accelerating integration of digital technologies, fundamentally altering how vehicles are maintained and serviced. The proliferation of connected car technology, with its ability to transmit real-time diagnostic data, is revolutionizing predictive maintenance. Instead of scheduled check-ups, vehicles will increasingly signal their needs proactively, leading to more efficient and personalized service experiences. This shift away from reactive to proactive servicing is expected to significantly boost the demand for advanced diagnostic software and specialized hardware solutions. Furthermore, the rise of electric vehicles (EVs) introduces new service requirements, necessitating investments in specialized training, equipment, and battery diagnostics. This segment, though nascent in the Historical Period (2019-2024), will emerge as a substantial growth driver throughout the Forecast Period (2025-2033). Consumer expectations are also evolving, with a growing demand for convenience, transparency, and speed. Mobile service offerings, online booking platforms, and personalized communication are becoming standard expectations, pushing traditional service providers to adapt or risk losing market share. The aftermarket segment, in particular, is poised for robust growth as vehicle owners seek cost-effective and specialized solutions beyond OEM offerings. This includes a growing demand for performance parts, customization options, and extended warranty services. The increasing complexity of modern vehicles also translates to a greater need for skilled technicians and advanced repair tools, fueling innovation in both training programs and diagnostic hardware. The integration of artificial intelligence (AI) and machine learning (ML) in service diagnostics and customer relationship management will further enhance efficiency and personalization. By 2025, the market is estimated to witness significant uptake in these digital solutions, paving the way for a more intelligent and customer-centric after-sales ecosystem. The long-term outlook through 2033 indicates a sustained upward trajectory, fueled by continuous innovation and the sustained demand for vehicle upkeep and performance enhancement across diverse vehicle types. The market size, measured in millions of units for parts and services, is projected to reach substantial figures by the end of the Study Period.

The automotive after-sales service market is experiencing a powerful surge, propelled by several interconnected forces. Foremost among these is the escalating sophistication of modern vehicles. With advancements in electronics, software, and new powertrain technologies like electrification, vehicles require increasingly specialized and advanced diagnostic tools and repair expertise. This complexity directly translates into a higher demand for sophisticated Software and Hardware solutions to maintain and repair these complex systems. The burgeoning Aftermarket segment is another significant driver. As vehicles age and warranty periods expire, consumers actively seek reliable and cost-effective solutions for maintenance and repairs, fueling demand for independent service providers and aftermarket parts manufacturers. Furthermore, the increasing average age of the global vehicle fleet, especially evident during the Historical Period (2019-2024), necessitates ongoing maintenance and part replacement, creating a consistent demand for after-sales services. The expanding global middle class and rising disposable incomes in developing economies also contribute to increased vehicle ownership, subsequently boosting the demand for after-sales services. The rapid adoption of connected car technologies is revolutionizing the service landscape. Vehicles are now capable of self-diagnosing issues and communicating them to owners and service centers proactively. This shift towards predictive maintenance, rather than reactive repairs, is creating new opportunities for service providers who can leverage this data for timely and efficient interventions, particularly from 2025 onwards.

Despite the robust growth trajectory, the automotive after-sales service market faces several significant challenges and restraints. One primary concern is the increasing complexity of vehicle technology, which outpaces the availability of trained and skilled technicians. The transition towards electric vehicles, for instance, requires specialized knowledge and tools that are not yet widely accessible, leading to a potential bottleneck in service capacity. Competition within the Aftermarket segment is also intense, with numerous players vying for market share, which can lead to price pressures and reduced profit margins for some. The stringent regulatory environment surrounding vehicle emissions, safety standards, and data privacy adds another layer of complexity. Adhering to these regulations requires continuous investment in compliant Software and Hardware, as well as updated service processes. Cybersecurity threats to connected car systems and customer data also pose a significant risk, demanding robust security measures and potentially impacting consumer trust. The rising cost of advanced diagnostic equipment and specialized tools can be a substantial barrier for smaller independent repair shops, potentially limiting their ability to service modern vehicles. Furthermore, disruptions in the global supply chain, as experienced during the Historical Period (2019-2024), can lead to parts shortages and extended repair times, negatively impacting customer satisfaction. The reluctance of some OEMs to share proprietary diagnostic information with independent repairers can also restrict access to essential data, hindering fair competition and consumer choice in the aftermarket.

The Aftermarket segment is poised to be a dominant force in the global automotive after-sales service market throughout the Study Period (2019-2033), with its influence particularly amplified from 2025 onwards. This dominance stems from several interconnected factors that resonate across key geographical regions.

North America and Europe as Mature Aftermarket Hubs: In established automotive markets like North America and Europe, the aftermarket is already a significant and well-developed ecosystem. The aging vehicle parc in these regions, coupled with a strong culture of vehicle customization and cost-consciousness among consumers, fuels consistent demand for aftermarket parts, repairs, and maintenance. The presence of a vast network of independent repair shops, specialized service providers, and established aftermarket brands like ACDelco and Bosch further solidifies its leading position. These regions are early adopters of technological advancements in diagnostics and repair, making them prime markets for innovative Software and Hardware solutions tailored for the aftermarket. The Estimated Year of 2025 will see continued robust activity in these regions.

Asia-Pacific: A Rapidly Expanding Frontier: The Asia-Pacific region is projected to exhibit the highest growth rate in the automotive after-sales service market, with the Aftermarket segment being a key contributor. Rapid economic growth, increasing disposable incomes, and a burgeoning middle class are leading to a significant surge in vehicle ownership. As vehicles in this region age, the demand for affordable and reliable aftermarket services will escalate. Chinese aftermarket players like Lentuo International and Pang Da Automobile Trade are increasingly making their mark, catering to the massive domestic demand and beginning to explore international markets. The adoption of connected car technology, while perhaps slightly behind North America and Europe in the Historical Period (2019-2024), is rapidly accelerating, creating a fertile ground for digital aftermarket solutions.

Dominance of Software and Hardware in the Aftermarket: Within the Aftermarket segment, both Software and Hardware are crucial for market dominance. Advanced diagnostic Software is indispensable for identifying and resolving complex issues in modern vehicles, while specialized Hardware tools, ranging from diagnostic scanners to specialized repair equipment, are necessary for executing repairs efficiently and effectively. The Aftermarket thrives on providing these tools and associated services to independent repairers and DIY enthusiasts. Companies like Denso and Würth Group offer a wide range of aftermarket parts and tools, playing a pivotal role in this segment's growth. The shift towards electric vehicles will further necessitate specialized Hardware for battery diagnostics and repair, a segment where aftermarket providers are increasingly investing.

OEMs vs. Aftermarket Dynamics: While OEMs will continue to hold a significant share in new vehicle sales and authorized servicing, the Aftermarket is expected to gain further traction due to its competitive pricing, wider product availability, and specialized service offerings. The ability of aftermarket players to innovate and adapt quickly to evolving vehicle technologies, often with greater flexibility than OEMs, will be a key differentiator. The Forecast Period (2025-2033) will witness a dynamic interplay between OEM and aftermarket services, with increasing collaboration and competition shaping the market landscape.

Several key factors are acting as significant growth catalysts for the automotive after-sales service industry. The continuous evolution of vehicle technology, leading to more complex systems, drives demand for advanced diagnostic Software and specialized Hardware. The increasing average age of vehicles globally necessitates ongoing maintenance and part replacement. Furthermore, the burgeoning electric vehicle (EV) market presents a new and rapidly expanding service opportunity, requiring specialized knowledge and equipment. The growing adoption of connected car technologies enables predictive maintenance and personalized service offerings, enhancing efficiency and customer satisfaction. Finally, the expanding middle class in emerging economies is leading to increased vehicle ownership and, consequently, a greater demand for after-sales services.

This report offers an exhaustive examination of the automotive after-sales service market, spanning its evolution from 2019 to 2033. It delves into the intricate interplay of Software, Hardware, and their applications across OEMs and the Aftermarket. The analysis identifies critical trends, market dynamics, and the underlying forces driving growth, while also acknowledging the significant challenges and restraints that shape the industry's landscape. Key regions and dominant segments are meticulously analyzed, providing readers with a clear understanding of market leadership and future potential. The report also highlights crucial growth catalysts and presents a comprehensive overview of the leading industry players and their significant developments. With a deep dive into market forecasts and strategic insights, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the dynamic automotive after-sales service sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Denso, Syncron, Würth Group, Bosch, ACDelco, Lentuo International, Pang Da Automobile Trade, INP North America, IAV Automotive Engineering, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Automotive After-Sales Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive After-Sales Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.