1. What is the projected Compound Annual Growth Rate (CAGR) of the Automobile Auxiliary Fuel Tank Installation?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automobile Auxiliary Fuel Tank Installation

Automobile Auxiliary Fuel Tank InstallationAutomobile Auxiliary Fuel Tank Installation by Type (Plastic, Aluminum Alloy, World Automobile Auxiliary Fuel Tank Installation Production ), by Application (Private Vehicles, Commercial Vehicles, World Automobile Auxiliary Fuel Tank Installation Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

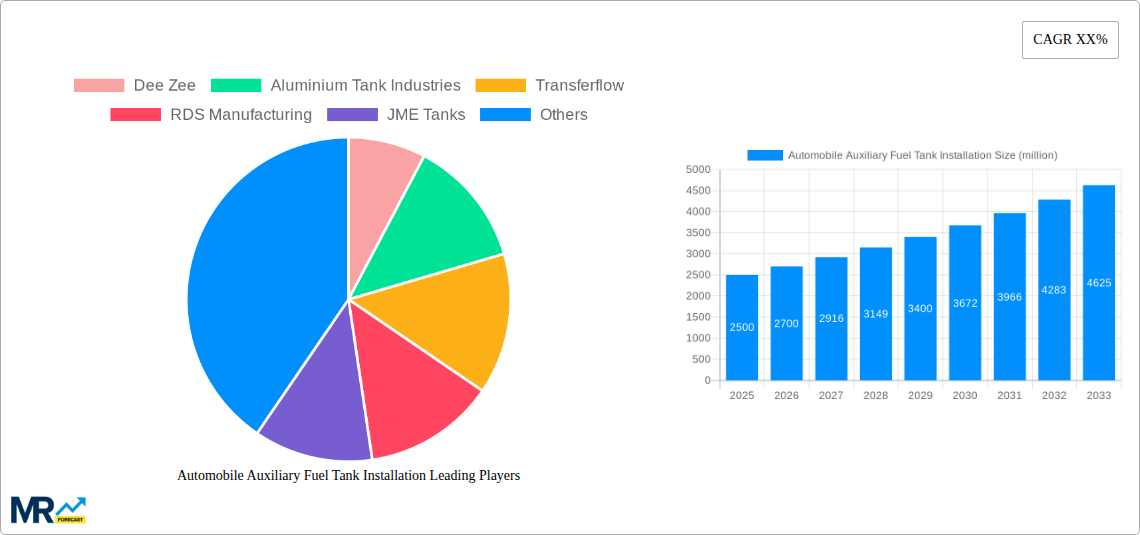

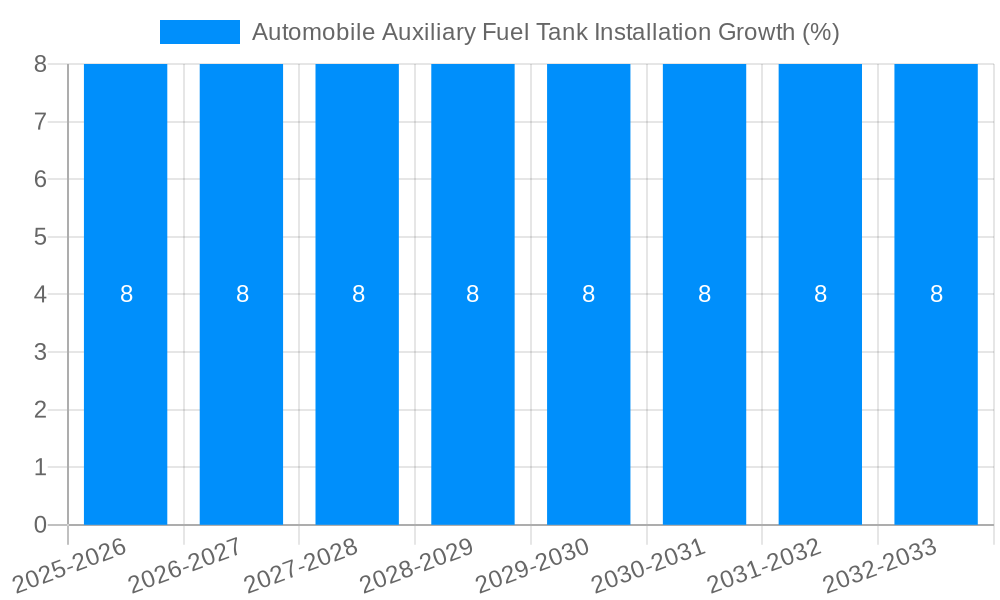

The global market for Automobile Auxiliary Fuel Tank Installation is poised for significant expansion, projected to reach approximately $2,500 million by 2025. This growth trajectory is fueled by a robust Compound Annual Growth Rate (CAGR) of around 8%, indicating sustained demand for enhanced fuel capacity solutions in vehicles. The primary drivers for this market surge include the increasing need for extended operational ranges in both private and commercial vehicles, particularly in regions with less developed refueling infrastructure or for applications like long-haul trucking, off-road expeditions, and emergency services. Furthermore, advancements in tank materials, such as lightweight yet durable aluminum alloys, are contributing to improved fuel efficiency and safety, further stimulating market adoption. The growing trend of vehicle customization and the desire for greater utility are also playing a crucial role in driving the demand for auxiliary fuel tank installations.

Despite the positive outlook, the market faces certain restraints. These include the initial cost of installation, stringent environmental regulations concerning fuel emissions and storage, and the potential complexity associated with integrating auxiliary tanks into existing vehicle systems. However, the increasing focus on fuel security and the operational advantages offered by auxiliary fuel tanks are expected to outweigh these challenges. The market is segmented into Plastic and Aluminum Alloy types, with aluminum alloys gaining traction due to their superior strength and recyclability. Application-wise, both private and commercial vehicles represent substantial segments, with commercial vehicles, especially those in logistics and transportation, expected to be a dominant force in consumption. Leading players like Dee Zee, Transferflow, and Titan Fuel Tanks are actively innovating and expanding their product portfolios to cater to diverse consumer needs and regional demands.

This comprehensive report delves into the intricate dynamics of the global automobile auxiliary fuel tank installation market. Spanning a crucial study period from 2019 to 2033, with a base year of 2025, the analysis meticulously examines historical trends, current market conditions, and provides robust future projections for the forecast period of 2025-2033. The report leverages extensive data gathered during the historical period (2019-2024) to build a foundational understanding of market evolution.

The market is characterized by a complex interplay of technological advancements, evolving regulatory landscapes, and shifting consumer preferences. This report provides an in-depth exploration of these factors, offering valuable insights into the production, application, and industry developments shaping the future of auxiliary fuel tank installations. By dissecting the market into key segments such as Plastic and Aluminum Alloy types, and by analyzing the distinct demands of Private Vehicles and Commercial Vehicles, the report offers a granular perspective. Furthermore, it quantifies the World Automobile Auxiliary Fuel Tank Installation Production, providing a critical benchmark for industry participants. This extensive coverage ensures that stakeholders gain a holistic understanding of market opportunities and potential pitfalls.

The report aims to equip businesses with the strategic intelligence necessary to navigate this dynamic sector. From identifying emerging technologies to understanding regional market dominance, this research serves as an indispensable tool for strategic planning, investment decisions, and competitive analysis within the global automobile auxiliary fuel tank installation industry. The comprehensive nature of the report ensures that all facets of the market are explored, providing actionable insights for a wide range of industry stakeholders.

The global automobile auxiliary fuel tank installation market is poised for significant expansion, driven by an increasing demand for enhanced vehicle range and operational efficiency. During the historical period (2019-2024), the market witnessed steady growth, fueled by the expanding commercial vehicle segment, particularly in logistics and long-haul transportation where extended operational autonomy is paramount. The base year of 2025 is expected to see a robust market size, with projections indicating a substantial upward trajectory throughout the forecast period (2025-2033). A key trend observed is the growing adoption of lighter and more durable materials, with Aluminum Alloy tanks gaining prominence over traditional Plastic options due to their superior strength-to-weight ratio and increased resistance to environmental factors. This shift is also influenced by evolving safety regulations and a growing emphasis on fuel efficiency.

Furthermore, the report highlights a discernible shift in application preferences. While Commercial Vehicles have historically been the dominant segment, the increasing popularity of recreational vehicles (RVs), overland expedition vehicles, and even performance-oriented private vehicles is creating new avenues for growth in the Private Vehicles segment. This is particularly evident in regions with vast geographical expanses and a thriving adventure tourism industry. Technological advancements in fuel delivery systems and integration with vehicle electronic control units (ECUs) are also contributing to market evolution, enhancing safety and user experience. The World Automobile Auxiliary Fuel Tank Installation Production is expected to reflect these trends, with manufacturers increasingly focusing on innovative designs and customizable solutions to cater to diverse end-user needs. The study period (2019-2033) encapsulates a transformative phase for the industry, moving towards more sophisticated and integrated fuel management systems. The increasing awareness of fuel security and the desire to reduce the frequency of refueling stops in remote areas are also acting as underlying drivers for sustained market interest. The ability of auxiliary tanks to provide an extended range directly translates to improved productivity for commercial fleets and enhanced freedom for recreational users, making them an increasingly attractive proposition. The report anticipates that advancements in tank design, focusing on ergonomic placement and reduced impact on vehicle dynamics, will further stimulate demand.

Several potent forces are collaboratively propelling the growth of the automobile auxiliary fuel tank installation market. Foremost among these is the escalating demand for extended vehicle range, particularly within the commercial transportation sector. Long-haul trucking, fleet operations, and specialized industries like agriculture and mining are constantly seeking to minimize downtime associated with refueling, thereby maximizing operational efficiency and profitability. Auxiliary fuel tanks offer a direct and cost-effective solution to this persistent challenge. Concurrently, the burgeoning recreational vehicle (RV) and overland expedition market is a significant growth engine. As more individuals embrace off-grid adventures and cross-country travel, the need for independent fuel sources to power vehicles and onboard amenities becomes critical, creating a substantial demand for reliable auxiliary fuel storage.

The increasing sophistication of automotive technology, including the integration of auxiliary fuel systems with existing vehicle electronics for seamless fuel management and monitoring, also plays a crucial role. This technological convergence enhances user convenience and safety, making auxiliary tanks a more appealing option for a wider consumer base. Furthermore, the global expansion of infrastructure in developing regions often involves vast distances between refueling stations, making auxiliary tanks a practical necessity for both commercial and private vehicle owners operating in these areas. The ongoing development and adoption of more fuel-efficient engines, paradoxically, can also spur demand for auxiliary tanks as drivers seek to offset potential range limitations or simply extend their journeys without frequent stops. The overarching trend of increased mobility and the desire for greater self-sufficiency in vehicle operations are fundamental drivers underpinning the sustained growth of this market.

Despite the robust growth drivers, the automobile auxiliary fuel tank installation market faces several significant challenges and restraints that could impede its full potential. A primary concern revolves around stringent and often evolving regulatory frameworks governing vehicle modifications and fuel storage systems. Compliance with varying safety standards, emissions regulations, and installation guidelines across different regions and countries can be a complex and costly undertaking for manufacturers and installers alike. These regulations can also limit the types and sizes of auxiliary tanks that can be legally fitted to vehicles, thereby restricting market expansion.

Another considerable restraint is the potential impact of auxiliary fuel tanks on vehicle performance, handling, and weight distribution. Improperly installed or excessively large tanks can negatively affect a vehicle's center of gravity, potentially compromising its stability and safety, especially during cornering or in adverse weather conditions. The added weight can also lead to a decrease in fuel efficiency for the primary tank, somewhat negating the intended benefit if not carefully managed. Furthermore, consumer perception and awareness regarding the safety and reliability of aftermarket auxiliary fuel tank installations can be a barrier. Concerns about potential leaks, fire hazards, or damage to the vehicle's original fuel system can deter some potential buyers. The cost of high-quality auxiliary fuel tank systems, coupled with installation expenses, can also be a significant deterrent, especially for price-sensitive consumers in the private vehicle segment. Lastly, the increasing efficiency of modern vehicle engines and the growing availability of electric and hybrid vehicle options, while not directly competing for the same use case, could indirectly impact the long-term demand for traditional internal combustion engine fuel solutions, including auxiliary tanks.

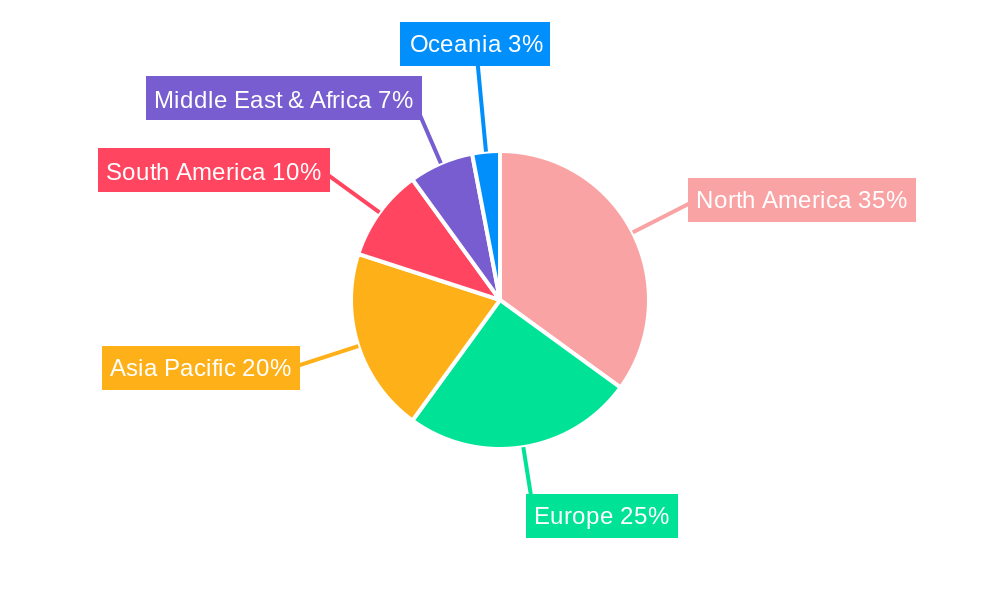

The global automobile auxiliary fuel tank installation market is characterized by regional disparities in demand and segment dominance, influenced by economic factors, infrastructure development, and specific vehicle usage patterns. North America, particularly the United States, is projected to be a dominant region due to a confluence of factors that strongly favor auxiliary fuel tank installations. This dominance stems from the vast geographical expanses and the high prevalence of large pickup trucks and SUVs, which are frequently used for long-distance travel, towing, and recreational purposes like hunting, camping, and off-roading. The strong culture of adventure and the need for extended range in remote areas within the U.S. and Canada make auxiliary fuel tanks a highly practical and sought-after accessory.

Within North America, the Commercial Vehicles segment is a consistent powerhouse, contributing significantly to overall market volume. Industries such as long-haul trucking, oil and gas exploration, agriculture, and construction heavily rely on vehicles that operate for extended periods away from refueling infrastructure. The economic imperative to minimize downtime and maximize operational efficiency directly translates into a substantial and consistent demand for high-capacity auxiliary fuel tanks. Companies like Dee Zee, Transferflow, and Titan Fuel Tanks have established a strong foothold in this segment within North America, offering robust and reliable solutions tailored to the rigorous demands of commercial applications.

Simultaneously, the Private Vehicles segment in North America is experiencing robust growth, driven by the increasing popularity of recreational vehicles (RVs), campervans, and overland expedition vehicles. The desire for self-sufficiency and the exploration of remote natural landscapes fuels the demand for auxiliary tanks that can extend the operational range of these vehicles, allowing for longer trips and greater freedom from fixed refueling points. This trend is further amplified by the growing interest in adventure tourism and the "van life" movement.

Beyond North America, Australia presents another significant market, mirroring many of the same drivers seen in North America. Its vast outback and remote rural areas necessitate extended fuel range for both commercial and private vehicles. The demand from agricultural sectors and for recreational off-roading is substantial. The Aluminum Alloy type segment is particularly strong in regions like North America and Australia, where durability, corrosion resistance, and a favorable strength-to-weight ratio are highly valued, especially for vehicles subjected to harsh environmental conditions.

In terms of global production, the World Automobile Auxiliary Fuel Tank Installation Production is influenced by the manufacturing capabilities and export strategies of key players. While North America leads in consumption for its specific needs, manufacturing hubs in Asia, particularly China, play a crucial role in the overall global production volume, often catering to a broader range of price points and specifications. Companies like Ningbo JT are indicative of the growing manufacturing capacity in this region, contributing to the global supply chain.

Several key growth catalysts are fueling the expansion of the automobile auxiliary fuel tank installation industry. The relentless pursuit of extended vehicle range, driven by commercial operators' need for enhanced efficiency and private vehicle owners' desire for greater travel freedom, remains a primary catalyst. This is closely followed by the burgeoning recreational vehicle (RV) and overland expedition market, where self-sufficiency and the ability to explore remote areas are paramount. Furthermore, advancements in material science, leading to the development of lighter, more durable, and safer tank designs, such as those made from Aluminum Alloy, are making these systems more attractive. The increasing integration of auxiliary fuel systems with advanced vehicle electronics, offering seamless fuel management and improved user experience, also acts as a significant growth stimulant. Finally, ongoing infrastructure development in emerging economies, often characterized by vast distances between refueling points, creates a fundamental need for extended fuel capacity.

This comprehensive report aims to provide an unparalleled depth of insight into the global automobile auxiliary fuel tank installation market. It delves beyond surface-level trends to dissect the intricate market dynamics, offering a granular analysis of production capacities, regional demand patterns, and segment-specific growth trajectories. The report meticulously examines the evolution of materials, with a detailed comparison of Plastic and Aluminum Alloy tanks, and evaluates their respective market shares and future potential. Furthermore, it offers a robust assessment of the World Automobile Auxiliary Fuel Tank Installation Production, providing critical data points for understanding global manufacturing landscapes and trade flows. By forecasting market growth from 2025 to 2033 based on extensive historical data from 2019-2024, the report equips stakeholders with the foresight needed for strategic decision-making. The analysis encompasses the interplay of technological innovations, regulatory landscapes, and shifting consumer preferences, ensuring that all critical facets of the market are addressed. This in-depth coverage is designed to empower businesses to identify emerging opportunities, mitigate potential risks, and solidify their competitive position within this dynamic and expanding industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dee Zee, Aluminium Tank Industries, Transferflow, RDS Manufacturing, JME Tanks, The Fuelbox, Titan Fuel Tanks, ATTA, KSH, Classy Chassis, AUX FUEL TANK, John Dow Industries, Ningbo JT.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automobile Auxiliary Fuel Tank Installation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automobile Auxiliary Fuel Tank Installation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.