1. What is the projected Compound Annual Growth Rate (CAGR) of the Automobile ACC Digital Signal Processor?

The projected CAGR is approximately 12.27%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automobile ACC Digital Signal Processor

Automobile ACC Digital Signal ProcessorAutomobile ACC Digital Signal Processor by Type (OEM, Aftermarket, World Automobile ACC Digital Signal Processor Production ), by Application (Passenger Vehicle, Commercial Vehicle, World Automobile ACC Digital Signal Processor Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

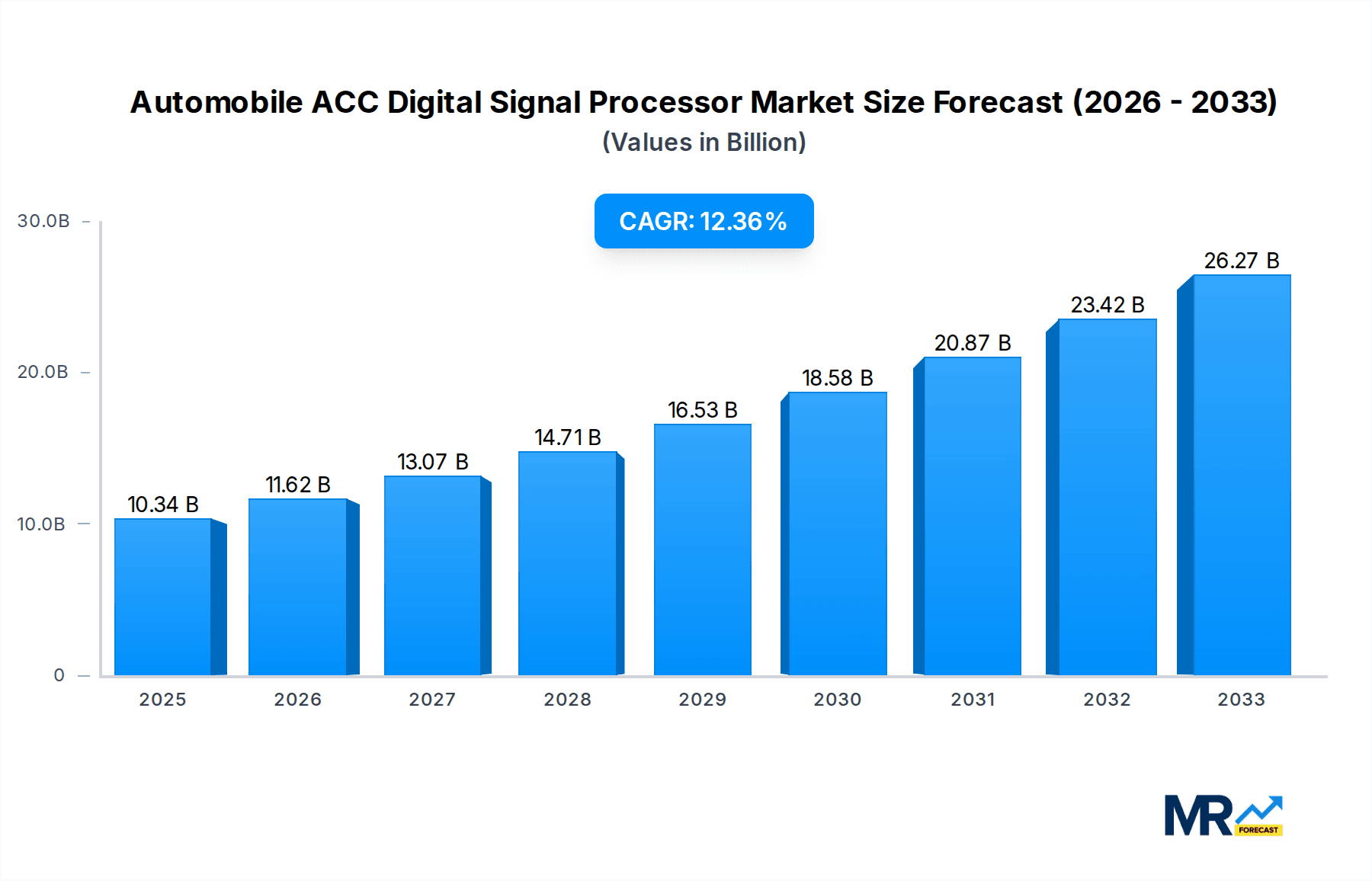

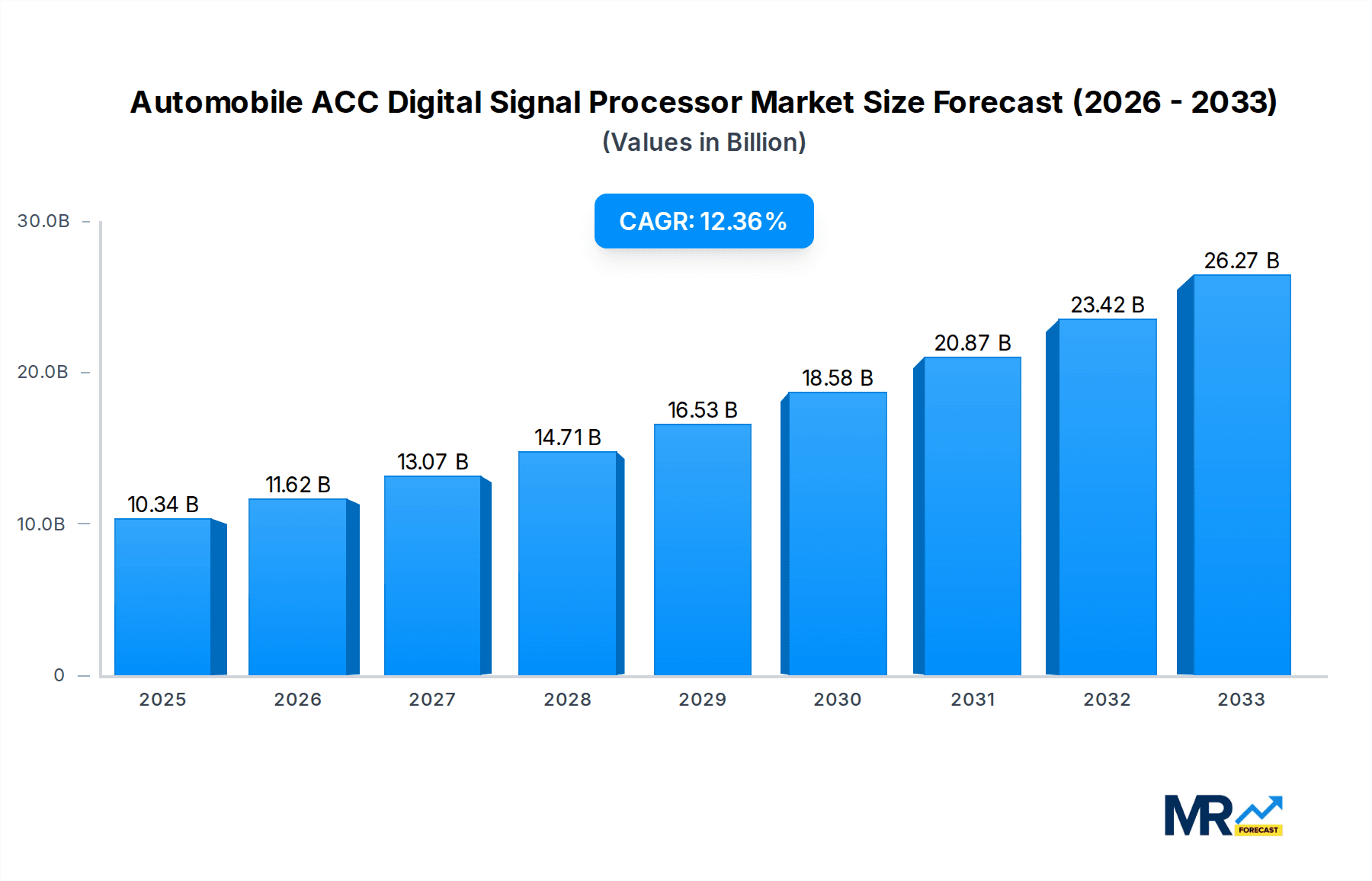

The global Automobile ACC Digital Signal Processor market is poised for substantial expansion, projected to reach a significant valuation by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.27%. This robust growth is primarily fueled by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) in vehicles worldwide. Adaptive Cruise Control (ACC), a key ADAS feature, heavily relies on sophisticated digital signal processors to accurately interpret sensor data, enabling vehicles to maintain a safe following distance from the vehicle ahead and enhance driving comfort and safety. The escalating consumer demand for enhanced automotive safety features, coupled with stringent government regulations mandating the integration of ADAS technologies, are key drivers propelling this market forward. Furthermore, the continuous evolution of automotive technology, including advancements in sensor fusion, artificial intelligence, and machine learning algorithms, is enabling the development of more intelligent and responsive ACC systems, thereby stimulating market growth. The market is characterized by a strong presence of established automotive component manufacturers, indicating a competitive yet innovative landscape.

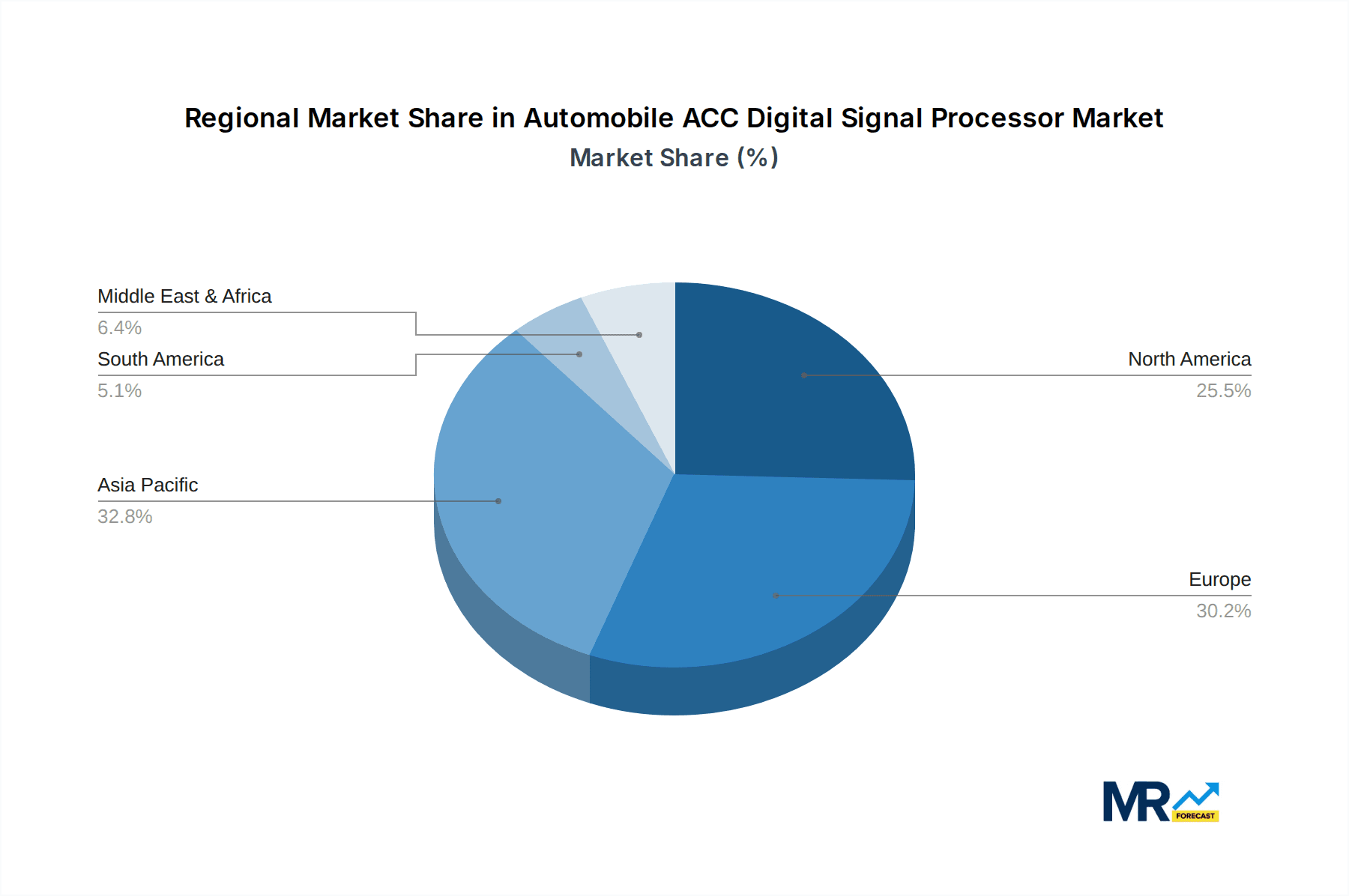

The market segmentation reveals a balanced distribution between OEM and Aftermarket sales, with both contributing significantly to the overall market size. Passenger vehicles represent the dominant application segment, driven by the widespread integration of ACC systems in new car models. However, the commercial vehicle segment is also experiencing a notable uptick in ACC adoption, as fleet operators recognize the potential for improved fuel efficiency and enhanced safety in long-haul trucking operations. Geographically, Asia Pacific, particularly China and India, is emerging as a high-growth region due to the rapidly expanding automotive industry and increasing disposable incomes, leading to a higher demand for advanced vehicle features. North America and Europe remain significant markets, driven by early adoption of ADAS technologies and a strong emphasis on vehicle safety. Key industry players such as Bosch, Denso, Continental, and Aptiv are actively investing in research and development to introduce next-generation ACC digital signal processors, focusing on improved performance, cost-effectiveness, and miniaturization to meet the evolving demands of the automotive sector.

Here is a unique report description on Automobile ACC Digital Signal Processors, incorporating your specified requirements:

This in-depth report provides a detailed examination of the global Automobile ACC (Adaptive Cruise Control) Digital Signal Processor (DSP) market, offering critical insights and forecasts for the period of 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study analyzes historical trends from 2019-2024 and provides an estimated outlook for 2025. The market, projected to reach tens of billions of dollars by the end of the study period, is undergoing rapid transformation driven by technological advancements, evolving consumer expectations, and stringent automotive safety regulations. The report delves into the intricate workings of ACC DSPs, their crucial role in enhancing vehicle safety and driver comfort, and the complex ecosystem of their production and adoption. We will explore the dominance of the OEM segment, the increasing importance of advanced features in passenger vehicles, and the burgeoning demand in emerging automotive markets. This comprehensive analysis is an indispensable resource for stakeholders seeking to navigate the dynamic landscape of the automotive electronics industry and capitalize on the substantial growth opportunities within the ACC DSP market.

The global Automobile ACC Digital Signal Processor market is experiencing a profound shift, driven by the relentless pursuit of enhanced vehicle safety, improved driving experience, and the burgeoning trend towards autonomous driving. XXX, a significant market insight, highlights the escalating demand for sophisticated ACC systems that go beyond basic speed control, incorporating features like stop-and-go functionality, predictive capabilities, and integration with other advanced driver-assistance systems (ADAS). This evolution is directly fueling the need for more powerful and efficient DSPs capable of processing vast amounts of sensor data in real-time. The increasing sophistication of radar, lidar, and camera technologies, essential components of ACC, necessitates advanced signal processing to interpret complex environmental cues accurately. Furthermore, the growing consumer awareness and preference for vehicles equipped with advanced safety features are compelling automotive manufacturers to prioritize ACC integration. This, in turn, is driving significant investment in research and development, leading to the introduction of next-generation DSPs with higher processing power, lower latency, and enhanced energy efficiency. The market is also witnessing a trend towards miniaturization and integration, with DSPs becoming smaller and more power-efficient, allowing for seamless integration into various vehicle architectures. The proliferation of connected car technologies further amplifies the importance of ACC DSPs, enabling them to communicate with external systems and adapt to dynamic traffic conditions. The ongoing evolution from Level 2 to Level 3 and beyond autonomous driving functionalities hinges on the capabilities of these DSPs, making them a cornerstone of future automotive innovation. The estimated market size, projected to reach well over XX billion USD by 2033, underscores the immense growth potential and strategic importance of this segment.

Several potent forces are propelling the global Automobile ACC Digital Signal Processor market to unprecedented growth. Paramount among these is the increasing regulatory push for enhanced automotive safety. Governments worldwide are implementing stricter mandates for ADAS features, including ACC, recognizing their proven ability to reduce accidents and fatalities. This regulatory impetus is compelling automakers to integrate these systems as standard or optional features, thereby driving demand for the underlying DSP technology. Concurrently, growing consumer demand for convenience and comfort in driving is a significant accelerant. ACC systems alleviate driver fatigue, particularly in highway driving and congested traffic, leading to a more relaxed and enjoyable driving experience. As consumers become more accustomed to these benefits, the preference for ACC-equipped vehicles escalates. Furthermore, the rapid advancement in sensor technology, such as high-resolution radar, lidar, and advanced camera systems, is creating a richer data stream that requires sophisticated signal processing. These sensors generate complex datasets that need to be interpreted instantaneously by DSPs to enable the ACC system to function effectively and safely. The continuous innovation in semiconductor technology, leading to more powerful, energy-efficient, and cost-effective DSPs, is also a crucial enabler, making ACC systems more accessible and feasible for a wider range of vehicle models. Finally, the ambitious roadmap towards autonomous driving places ACC DSPs at the forefront. As vehicles move towards higher levels of autonomy, the processing power and capabilities of these DSPs become increasingly critical for perceiving, predicting, and reacting to the environment.

Despite the robust growth trajectory, the Automobile ACC Digital Signal Processor market faces several significant challenges and restraints that could temper its expansion. A primary concern is the increasing complexity and cost of development and integration. Advanced ACC systems require sophisticated algorithms and extensive testing to ensure reliability and safety under diverse driving conditions. The integration of these DSPs with other vehicle systems, such as braking and steering, adds further layers of complexity and expense for manufacturers. Another considerable restraint is the potential for high initial investment for consumers, particularly for aftermarket ACC solutions or higher trim levels of new vehicles equipped with advanced ACC. While costs are decreasing, the premium associated with these advanced safety features can still be a barrier for price-sensitive buyers. Furthermore, challenges related to cybersecurity and data privacy are emerging as critical concerns. ACC systems, by their nature, process sensitive real-time data. Ensuring the robustness of these systems against cyber threats and safeguarding the privacy of user data is paramount, requiring substantial investment in secure hardware and software. The need for rigorous validation and certification processes by regulatory bodies adds another layer of complexity and can prolong the time-to-market for new ACC DSP technologies. Finally, consumer perception and trust in the reliability of these systems, especially in adverse weather conditions or unpredictable traffic scenarios, can also act as a restraint, requiring continuous efforts in education and demonstrable performance. The market is also subject to supply chain disruptions, as seen in recent years, which can impact the availability and cost of critical semiconductor components required for DSP manufacturing, potentially hindering production volumes.

The global Automobile ACC Digital Signal Processor market is characterized by distinct regional dynamics and segment dominance, with a clear leadership emerging in specific areas.

Dominant Segments:

Type: OEM (Original Equipment Manufacturer)

Application: Passenger Vehicle

Dominant Region/Country:

North America & Europe: These regions have consistently led the Automobile ACC Digital Signal Processor market due to several converging factors.

Asia-Pacific: This region is emerging as a rapidly growing market for Automobile ACC Digital Signal Processors.

While North America and Europe currently hold the largest market share due to established adoption patterns and stringent regulations, the Asia-Pacific region is poised for substantial growth, driven by its vast market potential and the increasing focus on advanced automotive technologies.

The Automobile ACC Digital Signal Processor industry is being propelled by several key growth catalysts. The accelerating global push for enhanced automotive safety regulations mandating ADAS features is a primary driver. Simultaneously, growing consumer demand for driving comfort and convenience, especially in congested urban environments, is boosting ACC adoption. Furthermore, rapid advancements in sensor fusion technologies and AI algorithms, enabling more sophisticated and reliable ACC performance, are fueling innovation and market expansion. The increasing integration of ACC with other ADAS functionalities like lane keeping assist and automatic emergency braking creates a synergistic demand for advanced DSP capabilities. Finally, the declining cost of semiconductor components is making ACC systems more affordable and accessible across a wider range of vehicle segments, further catalyzing market growth.

This comprehensive report delves deep into the intricate dynamics of the Automobile ACC Digital Signal Processor market, aiming to provide stakeholders with an unparalleled understanding of its trajectory. Beyond market sizing and forecasting, the report meticulously analyzes the technological advancements shaping the future of ACC, including the evolution of sensor fusion, the role of artificial intelligence, and the increasing demand for edge computing within vehicles. It examines the competitive landscape, offering detailed profiles of leading players like Bosch, Denso, and Continental, highlighting their strategic initiatives, product portfolios, and R&D investments, which collectively drive an estimated market value of tens of billions of dollars. The report also scrutinizes the impact of regulatory frameworks across key regions and explores the burgeoning opportunities in emerging markets. Furthermore, it provides critical insights into the challenges of cybersecurity, data privacy, and supply chain resilience, offering actionable strategies for market participants. This all-encompassing analysis equips businesses with the foresight to navigate this complex ecosystem and capitalize on the substantial growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.27% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.27%.

Key companies in the market include Bosch, Denso, Fujitsu, Continental, Autoliv, Aptiv, ZF, Valeo, Hella, .

The market segments include Type, Application.

The market size is estimated to be USD 10.34 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Automobile ACC Digital Signal Processor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automobile ACC Digital Signal Processor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.