1. What is the projected Compound Annual Growth Rate (CAGR) of the Automatic Feeding Robot?

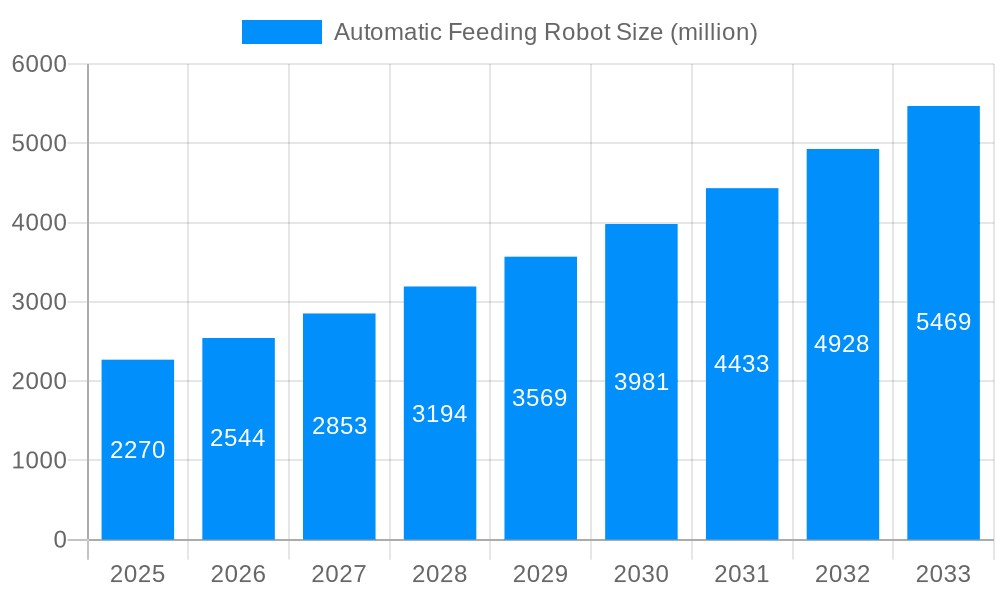

The projected CAGR is approximately 12.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automatic Feeding Robot

Automatic Feeding RobotAutomatic Feeding Robot by Type (Rail-Mounted Feeding Robot, Self-Propelled Feeding Robot, World Automatic Feeding Robot Production ), by Application (Pasture, Farm, Others, World Automatic Feeding Robot Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global automatic feeding robot market is experiencing robust growth, driven by increasing labor costs in agriculture, a rising demand for enhanced animal welfare, and the need for improved farm efficiency. Technological advancements, such as the integration of AI and IoT in robotic systems, are further fueling market expansion. This allows for precise feed management, optimized animal health, and reduced waste, leading to significant cost savings for farmers. The market is segmented by robot type (e.g., mobile, stationary), animal type (dairy cattle, poultry, swine), and farm size. Major players like Lely, GEA, and Trioliet B.V. are actively investing in research and development, leading to innovative product launches and market consolidation. While high initial investment costs represent a restraint, the long-term return on investment (ROI) and improved operational efficiencies are proving compelling for a growing number of farms, particularly large-scale operations. Regional variations exist, with developed nations like North America and Europe demonstrating higher adoption rates due to advanced agricultural practices and higher disposable incomes. However, emerging economies are showing significant growth potential as automation becomes more accessible. The increasing awareness of sustainable agriculture practices and the benefits of precision farming are contributing to the market's overall positive outlook.

The forecast period (2025-2033) is expected to witness significant expansion, propelled by ongoing technological innovations and favorable government policies supporting agricultural modernization. Further market segmentation by application (e.g., individual feeding, group feeding) will also offer niche opportunities for specialized robotic systems. The competitive landscape is characterized by both established players and emerging startups, fostering innovation and competition. Future growth will depend on factors such as the price competitiveness of automatic feeding robots, the development of user-friendly interfaces, and increasing access to financing options for farmers. Successful integration with existing farm management systems and the development of robust after-sales services will also play a crucial role in market penetration. Overall, the automatic feeding robot market is poised for substantial growth over the coming years, driven by a confluence of economic, technological, and societal factors.

The global automatic feeding robot market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing labor costs, a growing demand for enhanced animal welfare, and the need for improved efficiency in livestock farming, the adoption of automated feeding systems is rapidly accelerating. The market is witnessing a shift towards sophisticated robotic solutions capable of precise feed distribution, real-time monitoring of animal health, and data-driven optimization of feeding strategies. This trend is particularly pronounced in intensive farming operations where maximizing productivity and minimizing manual labor are paramount. The historical period (2019-2024) showcased steady growth, while the estimated year (2025) points to a significant surge in adoption, setting the stage for substantial expansion during the forecast period (2025-2033). This growth is being fueled by technological advancements resulting in more robust, reliable, and user-friendly robotic systems. Furthermore, government initiatives promoting sustainable and efficient agricultural practices are playing a crucial role in encouraging the wider adoption of automatic feeding robots. The market is characterized by a diverse range of solutions catering to varying farm sizes and animal types, ensuring adaptability across different segments of the livestock industry. Competition among leading manufacturers is driving innovation and price reductions, making these technologies increasingly accessible to a wider range of farmers. The market's future trajectory suggests a continued upward trend, driven by ongoing technological progress and a growing recognition of the substantial benefits of automated feeding for both economic profitability and animal well-being. By 2033, we anticipate the market will encompass millions of units sold globally.

Several key factors are propelling the rapid growth of the automatic feeding robot market. Firstly, the ever-increasing cost of labor globally is forcing farms to seek automation solutions to reduce their reliance on manual labor. Automatic feeding robots significantly reduce labor intensity, improving operational efficiency and profitability. Secondly, there's a rising awareness concerning animal welfare standards. Precise and consistent feeding through automation ensures that animals receive the optimal diet, leading to improved animal health and reduced stress. Thirdly, the integration of data analytics and precision farming techniques is gaining traction. Automatic feeding systems gather valuable data on feed consumption, animal behavior, and health parameters, providing farmers with insights to optimize feeding strategies and enhance overall farm management. This data-driven approach improves resource utilization and minimizes waste. Fourthly, technological advancements are continually improving the reliability, functionality, and affordability of automatic feeding robots. New sensors, advanced control systems, and improved robotic mechanics are leading to more efficient and user-friendly solutions. Finally, government support and subsidies aimed at promoting technological advancements and sustainable agriculture practices are further encouraging the adoption of these technologies. The combined effect of these driving forces is creating a robust and expanding market for automatic feeding robots.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of automatic feeding robots. High initial investment costs are a major barrier, particularly for smaller farms with limited capital. The complexity of integrating these systems into existing farm infrastructure can also pose a significant challenge, requiring specialized expertise and potentially extensive modifications. Furthermore, reliance on technology creates vulnerabilities to malfunctions and technical issues, requiring skilled technicians for maintenance and repairs. This dependency can lead to downtime and operational disruptions, resulting in economic losses. The variability in farm layouts and animal husbandry practices can necessitate customized solutions, increasing both cost and complexity. Ensuring robustness and reliability in diverse environmental conditions, such as extreme temperatures or challenging terrains, presents another technical hurdle. Moreover, concerns regarding data security and privacy related to the collection and storage of farm data need to be addressed effectively. Finally, a shortage of skilled labor capable of installing, operating, and maintaining these sophisticated systems remains a significant constraint. Overcoming these challenges will require collaborative efforts from manufacturers, policymakers, and farmers to drive down costs, improve accessibility, and enhance the overall ease of adoption.

North America: High adoption rates in intensive livestock farming operations, coupled with advanced technological infrastructure and a strong focus on animal welfare, position North America as a leading market. The region's advanced agricultural practices and considerable investment in automation technologies propel its growth trajectory.

Europe: Stringent regulations regarding animal welfare and a strong emphasis on sustainable farming practices are driving significant demand for automatic feeding robots within the European Union. The presence of established agricultural sectors and a supportive policy environment contribute to the market's expansion.

Asia-Pacific: While currently at a nascent stage compared to North America and Europe, the Asia-Pacific region is projected to witness the most rapid growth due to increasing livestock production, rising labor costs, and growing awareness of advanced farming technologies.

Dairy Segment: The dairy segment constitutes a substantial portion of the market due to the high density of livestock and the significant labor requirements associated with traditional feeding practices. The precision and efficiency offered by automated feeding systems are particularly advantageous in dairy farms.

Swine Segment: The swine sector's demand for automated feeding is driven by the need for consistent and precise feed distribution to optimize growth and minimize feed waste. The inherent scalability of automated systems makes them well-suited for large-scale swine operations.

Poultry Segment: While the poultry sector utilizes automation more extensively compared to other animal categories, the continued growth and the increasing demand for efficient feeding methods fuels demand for robotic solutions.

In summary, the combination of high adoption rates in North America and Europe, along with the potential for rapid growth in the Asia-Pacific region, signals a robust and diversified market for automatic feeding robots across various livestock segments, particularly dairy and swine. The market's evolution highlights a confluence of technological advancement, regulatory incentives, and the pursuit of sustainable and efficient agricultural practices.

The automatic feeding robot industry's growth is fueled by a confluence of factors. Increased automation demands driven by labor shortages and escalating labor costs are creating a powerful incentive for adoption. Simultaneously, a growing focus on improving animal welfare, coupled with the precise feeding capabilities of these robots, is boosting demand. Technological advancements, such as improved sensor technologies and advanced AI algorithms, continuously enhance the efficiency and functionality of these systems, further accelerating market growth. Finally, supportive government policies and initiatives promoting sustainable agriculture are creating a favorable regulatory environment, driving broader adoption across different farming regions and segments.

This report provides a comprehensive overview of the automatic feeding robot market, covering market trends, driving forces, challenges, regional analysis, key players, and significant developments. The detailed analysis offers valuable insights for stakeholders across the agricultural technology sector, providing a clear picture of the market's current state and future trajectory. The projections presented are based on rigorous market research and forecasting methodologies, ensuring the accuracy and reliability of the information. This study is essential for companies seeking to navigate this rapidly evolving market, for investors looking to assess the market's potential, and for policymakers aiming to develop supportive policies for the advancement of sustainable agriculture.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.1%.

Key companies in the market include Pellon Group, Rovibec Agrisolusions, Trioliet B.V, Jeantil, Valmetal, Lely, GEA, Wasserbauer Fütterungstechnik, Brauer GmbH, JH Agro, Schauer Agrotronic, HETWIN Automation Systems GmbH, Sieplo BV, Maskinfabrikken Cormall A/S, CRD - Concept Rolland Developpement, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Automatic Feeding Robot," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automatic Feeding Robot, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.