1. What is the projected Compound Annual Growth Rate (CAGR) of the Auto Parts E-Commerce Aftermarket?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Auto Parts E-Commerce Aftermarket

Auto Parts E-Commerce AftermarketAuto Parts E-Commerce Aftermarket by Application (/> B2C, B2B), by Type (/> Driveline & Powertrain, Electronics, Bodies & Chassis, Seating, Lighting, Wheel & Tires, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

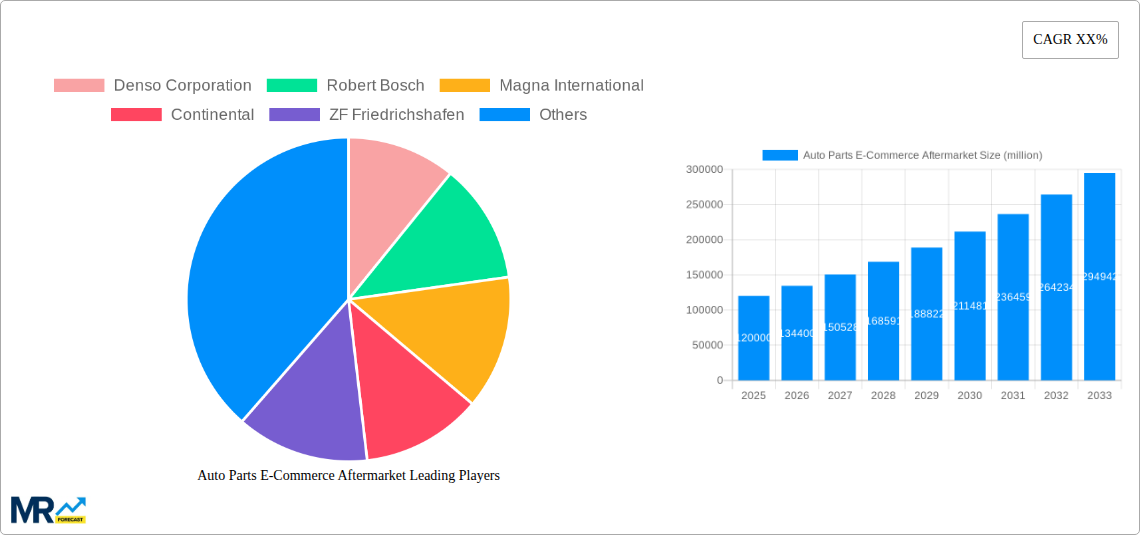

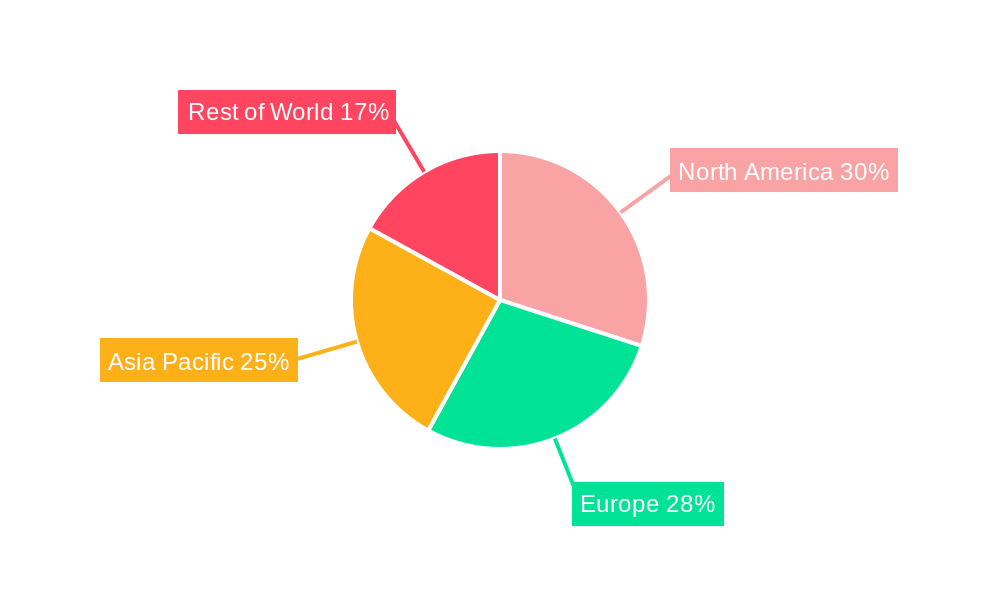

The global Auto Parts E-Commerce Aftermarket is experiencing robust growth, driven by the increasing adoption of online shopping, the convenience of e-commerce platforms, and a rising preference for direct-to-consumer (B2C) purchasing among vehicle owners. The market's expansion is further fueled by technological advancements, including improved online search functionalities, enhanced website designs focusing on user experience, and the proliferation of mobile-first e-commerce solutions. This allows consumers to easily compare prices, access detailed product information, and complete purchases from the comfort of their homes or on the go. Key segments within this rapidly evolving market include driveline & powertrain parts, electronics, and body & chassis components, each exhibiting unique growth trajectories based on consumer demand and technological innovations. The B2B segment also contributes significantly, with auto repair shops and independent garages increasingly relying on online platforms to source parts efficiently and cost-effectively. Geographical variations exist, with North America and Europe currently holding significant market shares, but regions like Asia-Pacific are showing promising growth potential owing to rising vehicle ownership and improving internet penetration. This competitive landscape features established players like Denso, Bosch, and Magna alongside numerous specialized e-commerce retailers and smaller niche players, creating a dynamic and ever-changing market environment.

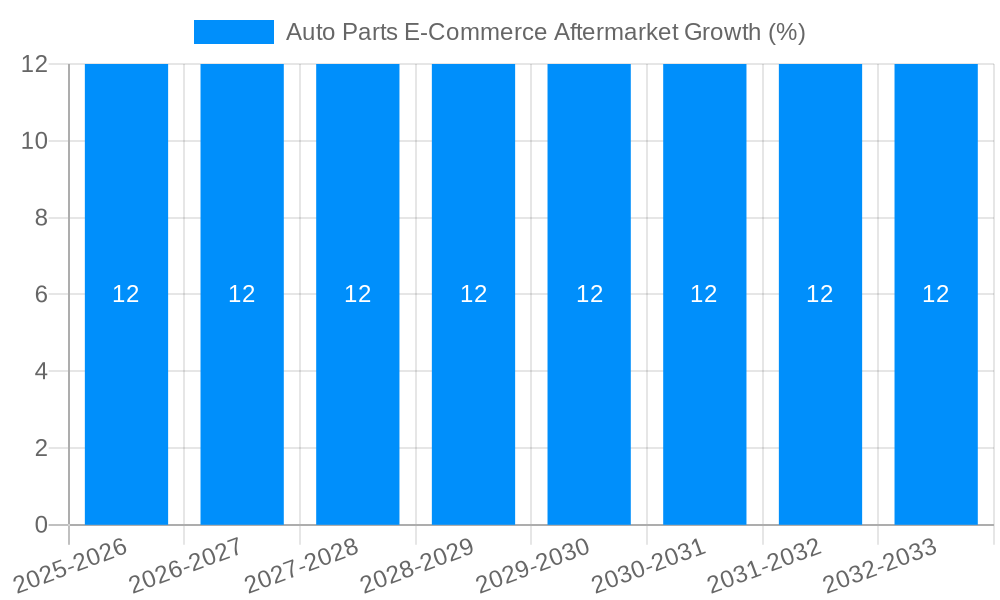

The automotive aftermarket e-commerce sector faces challenges such as the complexity of parts identification, the need for accurate fitment information, concerns about part authenticity, and the necessity for secure and reliable delivery options. Furthermore, managing returns and warranty claims requires robust systems. However, innovative solutions are being implemented to address these issues. These include enhanced online catalogs with detailed technical specifications, 3D modeling tools for part visualization, increased use of digital authentication methods, and the adoption of same-day or next-day delivery services. The growing integration of telematics and advanced driver-assistance systems (ADAS) is also shaping the market, increasing demand for specialized electronic components and creating new opportunities for e-commerce platforms. Ultimately, the continued evolution of digital technologies and rising consumer expectations will further propel the growth of the Auto Parts E-Commerce Aftermarket in the coming years, leading to a more sophisticated and customer-centric marketplace. We project a sustained CAGR (Compound Annual Growth Rate) in the high single digits for this market through 2033.

The global auto parts e-commerce aftermarket is experiencing explosive growth, projected to reach tens of billions of units by 2033. This surge is driven by several converging factors, including the increasing penetration of e-commerce across all retail sectors, a growing preference for online convenience among consumers, and the expanding availability of a wider range of auto parts online at competitive prices. The market witnessed significant expansion during the historical period (2019-2024), exceeding expectations, and this upward trend is expected to continue throughout the forecast period (2025-2033). The base year for this analysis is 2025, with estimations already indicating substantial market value in the millions of units. The shift towards online purchasing is particularly pronounced in the B2C segment, where consumers are increasingly comfortable researching, comparing prices, and purchasing auto parts directly from online retailers. This contrasts with the traditional reliance on brick-and-mortar auto parts stores. However, the B2B segment is also witnessing significant digital transformation, with businesses leveraging online platforms for faster procurement and inventory management. The diverse range of parts available online, encompassing driveline & powertrain components, electronics, body & chassis parts, seating systems, lighting solutions, wheels & tires, and numerous other categories, fuels market expansion. This comprehensive range caters to a wide spectrum of automotive needs, boosting overall market volume. The industry’s evolution is further characterized by the emergence of specialized online marketplaces catering exclusively to the automotive aftermarket, offering tailored services and expertise to both consumers and businesses. The convenience, cost savings, and expanded selection offered by e-commerce are proving irresistible to a growing segment of the automotive aftermarket, promising sustained growth in the coming years.

The rapid expansion of the auto parts e-commerce aftermarket is fueled by several key drivers. The foremost is the undeniable convenience offered by online shopping. Consumers and businesses alike appreciate the ability to browse and purchase parts at any time, from anywhere, without the constraints of physical store hours or geographical limitations. This convenience is amplified by features like detailed product descriptions, customer reviews, and easy-to-use search functionalities, all of which enhance the online shopping experience. The second crucial factor is the competitive pricing often found on e-commerce platforms. Online retailers frequently offer more competitive pricing than traditional brick-and-mortar stores, owing to lower overhead costs and increased competition. Moreover, the ability to compare prices across multiple vendors with ease further empowers buyers to find the best deals. Increased smartphone penetration and internet access have significantly broadened the reach of e-commerce, enabling a larger consumer base to access and utilize online platforms for purchasing auto parts. Finally, the emergence of specialized online marketplaces dedicated to the automotive aftermarket caters to specific needs and provides expert advice, further accelerating market growth. These factors, working in synergy, are propelling the auto parts e-commerce aftermarket towards unprecedented growth.

Despite the considerable growth potential, the auto parts e-commerce aftermarket faces certain challenges. One significant hurdle is the complexity of auto parts themselves. Unlike many other consumer goods, auto parts require a level of technical understanding to select and install correctly. Misidentification or improper installation can lead to vehicle malfunctions, safety hazards, and customer dissatisfaction. This complexity necessitates robust online resources, such as detailed product specifications and installation guides, to mitigate risks. Another challenge lies in managing returns and exchanges. Unlike easily returned clothing or electronics, returning a faulty or unsuitable auto part can involve considerable logistical difficulties, including packaging, shipping, and potential compatibility issues. This can lead to increased return rates and negatively impact customer experience. Furthermore, the need for effective security measures to prevent counterfeit parts from entering the online marketplace poses a major challenge. Counterfeit parts not only compromise vehicle performance and safety but also damage the credibility of online retailers. Finally, ensuring the secure and reliable delivery of often heavy and bulky auto parts presents a logistical challenge, requiring efficient and cost-effective shipping solutions. Overcoming these hurdles will be critical to ensuring the continued healthy growth of the e-commerce auto parts aftermarket.

The North American and European markets are currently leading the auto parts e-commerce aftermarket, driven by high vehicle ownership rates, strong e-commerce adoption, and established logistics infrastructure. However, rapidly developing economies in Asia-Pacific (particularly China and India) show significant growth potential.

Dominant Segments:

B2C Segment: This segment is witnessing rapid growth driven by consumer preference for online convenience, competitive pricing, and expanded product selection. The ease of online comparison shopping and detailed product information empowers consumers to make informed purchases. Millions of units are being sold annually in this segment.

Electronics Segment: The increasing integration of electronics in modern vehicles is fueling significant demand for electronic auto parts online. This includes components like infotainment systems, sensors, and electronic control units (ECUs). This segment is expected to see high growth rates throughout the forecast period.

B2B Segment: Although traditionally reliant on direct sales, the B2B segment is progressively embracing online platforms for efficient inventory management and procurement. This is particularly true for independent garages and repair shops who can easily source parts online. Significant increases in unit sales within the B2B sector are expected.

The B2C segment, particularly within the electronics category, is positioned for significant market dominance, projected to reach multi-million unit sales within the forecast period. However, the B2B segment is expected to witness substantial growth as more businesses adopt online procurement strategies. The continuous integration of advanced electronic components in newer vehicle models contributes significantly to this trend. Growth in these segments is not solely limited to developed markets; emerging economies are experiencing rapid growth as well, contributing to the overall expansion of the auto parts e-commerce aftermarket.

Several factors are accelerating the growth of the auto parts e-commerce aftermarket. The expanding availability of high-quality product information online, including detailed specifications, installation guides, and customer reviews, significantly reduces consumer uncertainty and promotes confidence in online purchases. The increasing adoption of mobile-first e-commerce strategies provides convenient access for consumers on the go. Furthermore, strategic partnerships between online retailers and physical auto parts stores create hybrid models that leverage both online convenience and in-person expertise, building consumer trust and broadening reach. The growth of last-mile delivery services ensures reliable and timely delivery of auto parts, making online shopping more seamless and efficient.

This report provides a comprehensive analysis of the auto parts e-commerce aftermarket, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. It covers key segments including B2C and B2B, and a detailed breakdown of various auto part types. The report incorporates data from the historical period (2019-2024), the base year (2025), and projections for the forecast period (2025-2033). This in-depth analysis helps businesses, investors, and industry stakeholders to gain a clear understanding of this dynamic and rapidly growing market. The information presented is valuable for strategic decision-making, market entry strategies, and investment planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Denso Corporation, Robert Bosch, Magna International, Continental, ZF Friedrichshafen, Advance Auto Parts, Auto Zone, Hyundai Mobis, Aisin Seiki, Faurecia, Lear Corp., Valeo, Napa Auto Parts, Hella Group, Yazaki Corp., Sumitomo Electric, JTEKT Corp., Calsonic Kansei Corp., Toyota Boshoku Corp., Schaeffler, Panasonic Automotive, Toyoda Gosei, Thyssenkrupp, Mahle GmbH.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Auto Parts E-Commerce Aftermarket," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Auto Parts E-Commerce Aftermarket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.