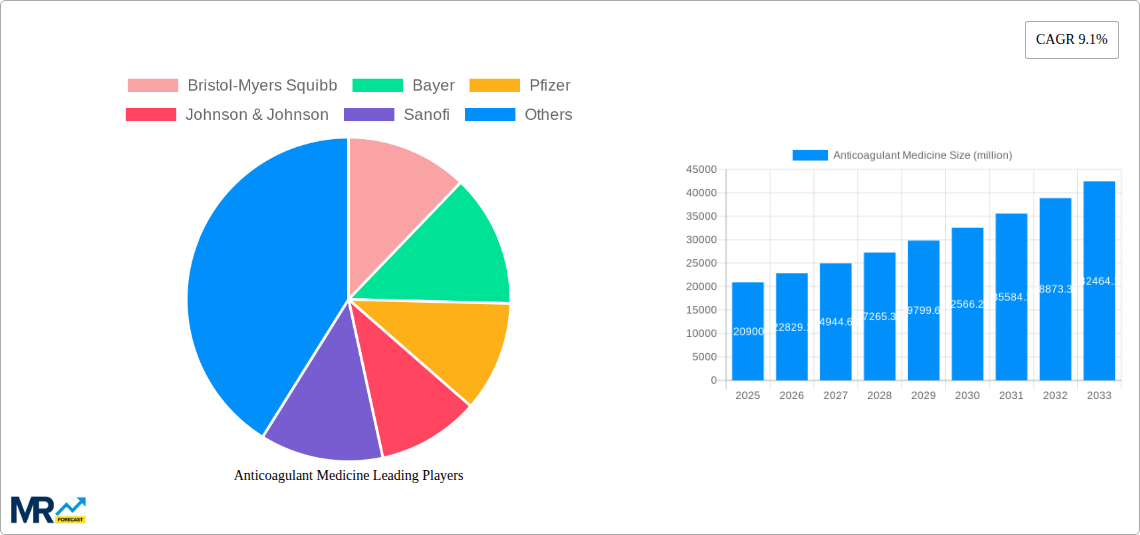

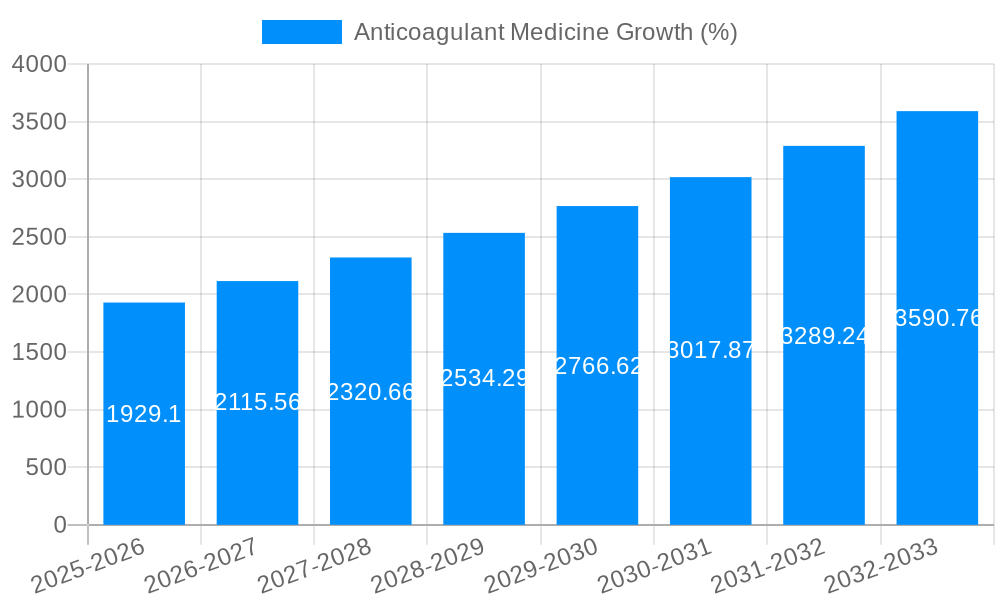

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anticoagulant Medicine?

The projected CAGR is approximately 9.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anticoagulant Medicine

Anticoagulant MedicineAnticoagulant Medicine by Type (NOACs, Heparin, Warfarin, Others), by Application (Hospital, Pharmacy, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Anticoagulant Medicine market is poised for substantial expansion, projected to reach an impressive market size of $20,900 million by 2033. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 9.1%, indicating a dynamic and evolving landscape driven by increasing prevalence of cardiovascular diseases, a growing elderly population at higher risk of thromboembolic events, and advancements in anticoagulant therapies. The market is segmented by Type, with Non-Vitamin K Oral Anticoagulants (NOACs) leading the charge due to their improved safety profiles and convenience compared to traditional treatments like Warfarin. Heparin also maintains a significant share, particularly in acute care settings. The Application segment is dominated by Hospitals, where anticoagulants are crucial for managing a wide range of conditions, followed by Pharmacies, reflecting the shift towards outpatient management and long-term use of these medications.

Key drivers propelling this market forward include the rising incidence of atrial fibrillation, deep vein thrombosis, and pulmonary embolism, all of which necessitate anticoagulant therapy. Furthermore, ongoing research and development leading to novel anticoagulant formulations with better efficacy and reduced bleeding risks are expanding treatment options and patient access. Pharmaceutical giants such as Bristol-Myers Squibb, Bayer, Pfizer, Johnson & Johnson, Sanofi, Boehringer Ingelheim, and Daiichi Sankyo are at the forefront of innovation, investing heavily in R&D and strategic collaborations to capture market share. While the market shows strong positive momentum, potential restraints could include stringent regulatory approvals for new drugs, patent expirations leading to generic competition, and the high cost of newer anticoagulant therapies, which might limit access in certain economies. However, the overall outlook remains highly positive, with significant opportunities in emerging markets and for innovative therapeutic solutions.

The global anticoagulant medicine market is poised for substantial expansion, driven by a confluence of demographic shifts, evolving healthcare landscapes, and advancements in therapeutic options. The Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also in 2025, and a Forecast Period from 2025-2033, highlights a consistent trajectory of growth. During the Historical Period of 2019-2024, the market witnessed steady progress as awareness of thrombotic events and their prevention increased. Looking ahead, the market is projected to reach a significant valuation, with the Estimated Year of 2025 serving as a critical benchmark. The rise in the prevalence of cardiovascular diseases such as atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE) remains a primary driver. These conditions necessitate long-term anticoagulation therapy, thereby fueling demand for effective and safer treatment options. The shift towards Non-vitamin K Oral Anticoagulants (NOACs), also known as Direct Oral Anticoagulants (DOACs), has been a defining trend. NOACs offer advantages such as predictable pharmacokinetics, less frequent monitoring requirements, and a lower risk of intracranial hemorrhage compared to traditional warfarin. This has led to a significant displacement of warfarin in many clinical settings, particularly in the Hospital and Pharmacy segments. The continuous innovation within the NOAC segment, with the introduction of new molecules and improved formulations, is expected to further invigorate market growth. The increasing accessibility of anticoagulant therapies in emerging economies, coupled with growing healthcare expenditure, also presents a substantial opportunity for market expansion. The focus on patient-centric care and the development of patient-friendly drug delivery systems are also influencing market dynamics, aiming to improve adherence and reduce the burden of treatment. The overall market sentiment indicates robust expansion, underpinned by a strong clinical need and a supportive innovation pipeline.

The anticoagulant medicine market's robust growth is primarily propelled by the escalating burden of thrombotic and thromboembolic disorders worldwide. The increasing incidence of cardiovascular diseases, including atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE), directly correlates with an increased demand for effective anticoagulation therapies. Furthermore, the aging global population is a significant contributing factor, as older individuals are more susceptible to these conditions. Advances in medical technology and a growing understanding of the pathophysiology of clotting disorders have led to the development of novel anticoagulant agents. Specifically, the introduction and widespread adoption of Non-vitamin K Oral Anticoagulants (NOACs) have revolutionized treatment paradigms. These newer agents offer enhanced safety profiles, reduced drug-drug interactions, and greater convenience compared to older therapies like warfarin, leading to improved patient compliance and clinical outcomes. The expanding healthcare infrastructure, particularly in emerging economies, along with increased per capita healthcare spending, is further broadening access to these life-saving medications. Government initiatives aimed at improving cardiovascular health outcomes and public awareness campaigns regarding the prevention and management of blood clots are also playing a crucial role in driving market demand. The integration of these medications within routine clinical practice, from Hospital settings to Pharmacy dispensaries, solidifies their importance in managing a broad spectrum of patients at risk of thromboembolic events.

Despite the promising growth trajectory, the anticoagulant medicine market faces several significant challenges and restraints. One of the primary concerns is the risk of bleeding complications associated with anticoagulant therapy. While newer agents offer improved safety profiles, the potential for hemorrhage remains a critical consideration for both healthcare providers and patients. This necessitates careful patient selection, dose management, and ongoing monitoring, which can add to the overall cost and complexity of treatment. The high cost of novel anticoagulant medications, particularly NOACs, can be a substantial barrier to access, especially in resource-limited settings. This cost factor can limit market penetration and adoption, leading to disparities in treatment availability. Furthermore, the availability of generic alternatives for older anticoagulants like warfarin creates price competition and can impact the revenue streams of companies producing newer, more expensive drugs. The need for effective reversal agents for anticoagulants, particularly for newer oral agents, is an ongoing area of development. The lack of readily available and universally effective reversal agents can create challenges in managing emergency bleeding situations. Regulatory hurdles and the lengthy approval processes for new anticoagulant drugs can also impede market growth. Moreover, physician and patient education regarding the appropriate use, monitoring, and management of side effects of various anticoagulant classes remains crucial. Inadequate understanding or adherence to treatment protocols can lead to suboptimal outcomes and increase the incidence of adverse events. The ongoing need to manage the interplay between different therapeutic classes and to address the specific needs of diverse patient populations presents a continuous challenge for market expansion.

The Hospital segment is anticipated to be a dominant force in the anticoagulant medicine market, propelled by its crucial role in the diagnosis, treatment, and management of acute thrombotic events. Patients presenting with conditions like deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke often require immediate anticoagulation initiation and close monitoring within a hospital setting. This makes hospitals the primary point of care for initiating and managing a significant proportion of anticoagulant therapies. The prevalence of cardiovascular diseases, which are the leading cause of hospitalization globally, further amplifies the importance of this segment.

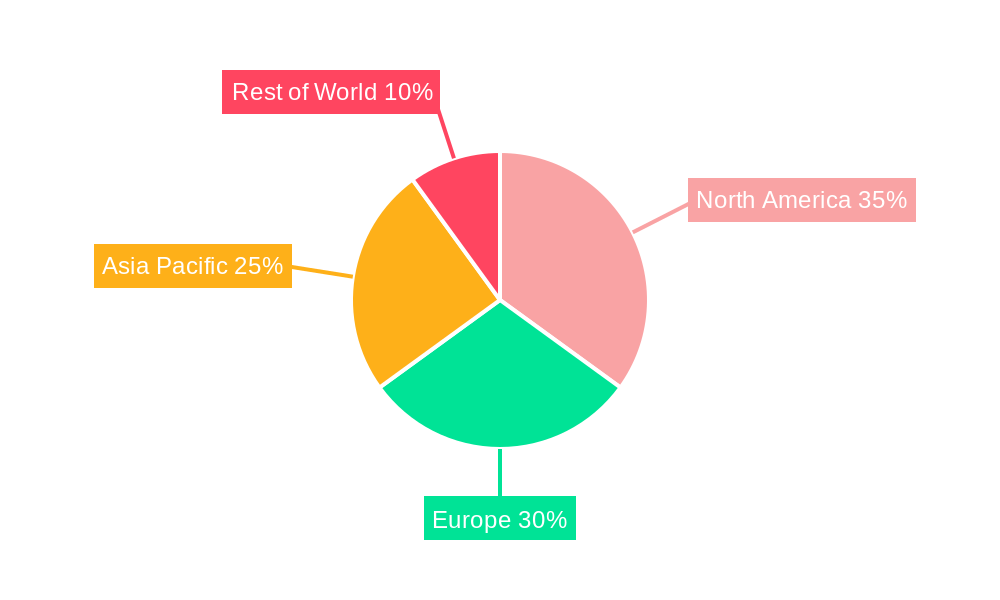

North America is expected to lead the anticoagulant medicine market, driven by a confluence of factors including a high prevalence of cardiovascular diseases, robust healthcare infrastructure, advanced technological adoption, and significant research and development activities. The region exhibits a high incidence of conditions like atrial fibrillation and venous thromboembolism (VTE), necessitating widespread use of anticoagulants. The presence of major pharmaceutical companies with substantial R&D investments in developing novel anticoagulants further solidifies North America's leading position.

Within the Type segment, NOACs (Non-vitamin K Oral Anticoagulants) are projected to witness the most substantial growth and market share. Their advantages over traditional warfarin, including predictable pharmacokinetics, no requirement for routine monitoring, fewer drug-drug interactions, and a lower risk of intracranial hemorrhage, have led to their widespread adoption in both inpatient and outpatient settings. This therapeutic shift from warfarin to NOACs has been a defining trend in recent years and is expected to continue.

Key Regions and Countries Dominating the Market:

North America:

Europe:

Asia Pacific:

Key Segments Dominating the Market:

Application: Hospital:

Type: NOACs (Non-vitamin K Oral Anticoagulants):

The interplay between these regions and segments creates a dynamic market landscape, with North America and Europe leading in current market size and value, while the Asia Pacific region offers substantial growth potential in the coming years, particularly within the NOAC and hospital application segments.

The anticoagulant medicine industry's growth is significantly catalyzed by the escalating global prevalence of cardiovascular diseases, including atrial fibrillation and venous thromboembolism. This demographic shift, coupled with an aging population, creates a persistent and growing demand for effective anticoagulation therapies. Furthermore, continuous innovation in drug development, particularly the introduction of novel oral anticoagulants (NOACs), has provided safer and more convenient treatment options, driving higher adoption rates. The expanding healthcare infrastructure and increased healthcare expenditure in emerging economies are also crucial growth catalysts, broadening access to these life-saving medications.

This report offers a comprehensive analysis of the global anticoagulant medicine market, providing in-depth insights into market dynamics, trends, and future projections. It meticulously examines the market size and share across various segments, including therapeutic types like NOACs, Heparin, and Warfarin, as well as application areas such as Hospitals and Pharmacies. The report delves into the key driving forces, such as the increasing prevalence of cardiovascular diseases and the aging global population, and analyzes the significant challenges, including bleeding risks and high drug costs. It also identifies the dominant regions and key countries poised for market leadership and highlights the crucial growth catalysts propelling the industry forward. Furthermore, the report profiles leading pharmaceutical players and chronicles significant industry developments. This detailed coverage ensures stakeholders have the essential data and strategic understanding to navigate the evolving anticoagulant medicine landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.1%.

Key companies in the market include Bristol-Myers Squibb, Bayer, Pfizer, Johnson & Johnson, Sanofi, Boehringer Ingelheim, Daiichi Sankyo, .

The market segments include Type, Application.

The market size is estimated to be USD 20900 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anticoagulant Medicine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anticoagulant Medicine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.