1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-static Bulk Bags?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-static Bulk Bags

Anti-static Bulk BagsAnti-static Bulk Bags by Type (2 Tons and Below, More Than 2 Tons, World Anti-static Bulk Bags Production ), by Application (Chemical, Food, Pharmaceutical, Others, World Anti-static Bulk Bags Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

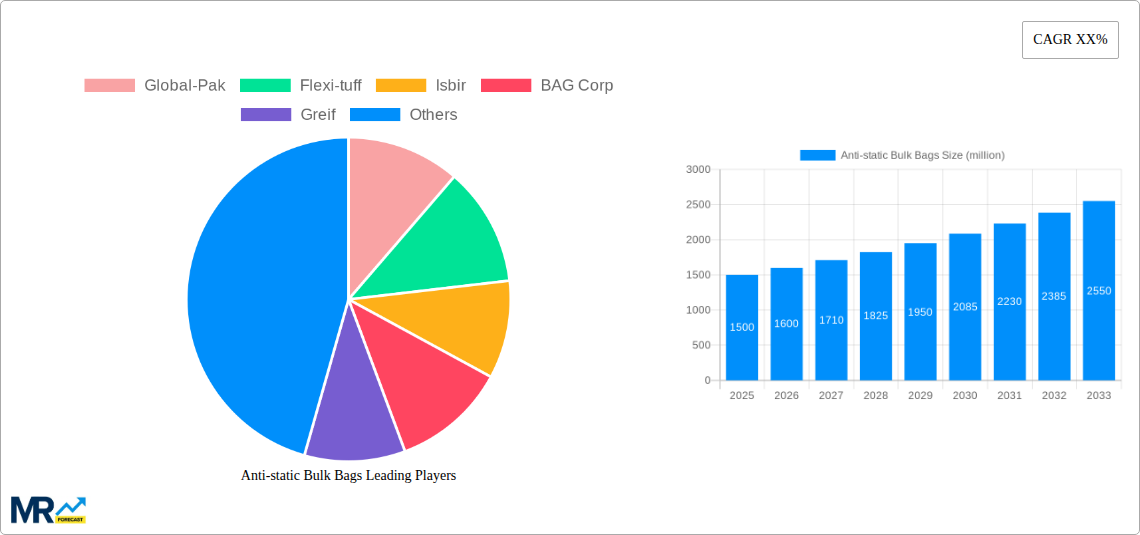

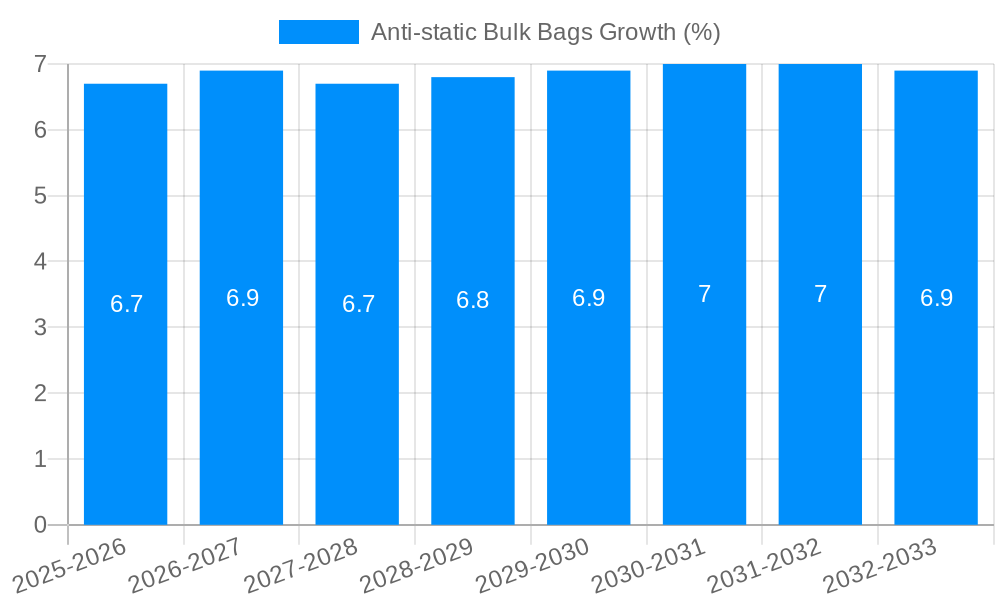

The global Anti-static Bulk Bags market is poised for significant expansion, driven by an increasing demand for safe and efficient material handling solutions across diverse industrial sectors. This market, valued at approximately $1.5 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. A primary driver for this robust growth is the escalating adoption of anti-static packaging in industries where electrostatic discharge (ESD) poses a significant risk, such as chemicals, pharmaceuticals, and electronics. The inherent properties of anti-static bulk bags, which prevent the build-up of static electricity and thus mitigate the risk of ignition or damage to sensitive materials, make them indispensable for these applications. Furthermore, growing awareness regarding workplace safety regulations and the need for enhanced product integrity during storage and transportation are bolstering market penetration. Emerging economies, particularly in the Asia Pacific region, are witnessing substantial investments in industrial infrastructure, further fueling the demand for these specialized bulk bags.

The market is segmented by type into "2 Tons and Below" and "More Than 2 Tons," with the "More Than 2 Tons" segment expected to exhibit stronger growth due to increasing large-scale industrial operations. Application-wise, the Chemical and Pharmaceutical sectors are anticipated to remain the dominant consumers, accounting for a substantial share of the market. However, the Food industry is also emerging as a significant growth area, driven by stricter hygiene standards and the need for contamination-free packaging. Despite the positive outlook, certain restraints, such as the higher initial cost compared to conventional bulk bags and the availability of alternative packaging solutions, may temper growth to some extent. Nevertheless, continuous innovation in material science, leading to enhanced durability and improved anti-static properties, coupled with increasing customization options to meet specific industry needs, are expected to overcome these challenges and ensure a sustained upward trajectory for the global Anti-static Bulk Bags market. Key players like Global-Pak, Flexi-tuff, Isbir, BAG Corp, and Greif are actively investing in research and development and expanding their production capacities to cater to the burgeoning global demand.

The global anti-static bulk bags market is poised for a significant upswing, driven by an escalating demand for safe and reliable material handling solutions across diverse industries. XXX projects the market to reach a valuation of over $3.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period of 2025-2033. The historical period (2019-2024) laid the foundation for this expansion, with initial market penetration fueled by increasing awareness of static electricity hazards. The base year, 2025, stands as a pivotal point, with estimated production figures for anti-static bulk bags reaching an impressive 800 million units. This growth trajectory is not merely quantitative; it's underpinned by a qualitative shift in industry practices, where the prevention of electrostatic discharge (ESD) is becoming paramount for product integrity, operational safety, and regulatory compliance.

The increasing stringency of safety regulations worldwide, particularly concerning the handling of flammable materials in the chemical and petrochemical sectors, is a primary catalyst. These regulations mandate the use of specialized packaging that can dissipate static charges, thereby mitigating the risk of ignition. Furthermore, the expanding pharmaceutical industry, with its sensitive active pharmaceutical ingredients (APIs) and sterile products, demands packaging that not only prevents contamination but also safeguards against electrostatic damage. The food industry, while perhaps less acutely impacted by immediate fire hazards, is also increasingly adopting anti-static solutions to maintain product quality, prevent ingredient clumping, and ensure compliance with food safety standards. The growth in e-commerce and the subsequent surge in the logistics and transportation of bulk goods also contribute to the demand for durable and static-safe packaging. As global supply chains become more complex and international trade in hazardous and sensitive materials expands, the need for reliable anti-static bulk bags becomes even more critical. The trend towards larger bulk handling, often exceeding 2 tons, further necessitates the use of robust and static-controlled packaging solutions to manage substantial quantities safely. The market's evolution reflects a proactive response to inherent risks, fostering a safer and more efficient global trade ecosystem.

The burgeoning anti-static bulk bags market is propelled by a confluence of powerful driving forces that underscore the critical need for static control in material handling. Foremost among these is the ever-increasing emphasis on industrial safety. Static electricity poses a significant fire and explosion hazard, particularly when handling flammable powders, gases, and solvents commonly found in the chemical, petrochemical, and pharmaceutical industries. Stringent regulatory frameworks and a heightened awareness of the potential for catastrophic accidents are compelling businesses to adopt anti-static bulk bags as a proactive safety measure, thereby minimizing liability and ensuring worker well-being. This commitment to safety translates into a direct increase in the demand for bulk bags that are designed to dissipate static charges effectively.

Beyond safety, product integrity and quality preservation are also key drivers. Many materials, especially fine powders, are susceptible to degradation or contamination caused by electrostatic attraction or discharge. In the pharmaceutical and food industries, where product purity and efficacy are paramount, anti-static bulk bags play a crucial role in preventing product loss, maintaining consistency, and avoiding costly recalls. The ability of these bags to prevent the adherence of fine particles and the potential damage from static discharge ensures that sensitive materials reach their destination in optimal condition. Moreover, the growth of end-user industries that heavily rely on bulk material transportation, such as agriculture, mining, and construction, further fuels this market. As these sectors expand, so does the volume of materials that need to be stored and transported, creating a sustained demand for reliable and safe packaging solutions like anti-static bulk bags.

Despite the promising growth trajectory, the anti-static bulk bags market is not without its challenges and restraints, which can temper the pace of expansion. A primary concern is the higher cost of production associated with anti-static bulk bags compared to their conventional counterparts. The integration of specialized conductive materials and rigorous testing procedures adds to the manufacturing expenses, which can, in turn, lead to higher pricing for end-users. This cost differential can be a significant barrier, particularly for smaller businesses or in markets where cost-effectiveness is the primary purchasing criterion, potentially hindering widespread adoption.

Another significant restraint is the lack of standardized regulations and awareness in certain developing regions. While developed economies have robust safety standards and a good understanding of static electricity risks, some emerging markets may lag in implementing and enforcing such regulations. This can lead to a fragmented market where the adoption of anti-static solutions is inconsistent. Furthermore, the availability and quality of raw materials for anti-static bags can also pose challenges. The supply chain for specialized conductive materials needs to be stable and reliable to meet the growing demand. Any disruptions or fluctuations in the availability or quality of these essential components can impact production volumes and lead times. Finally, complex recycling and disposal procedures for anti-static bags, which may contain specialized conductive elements, can also present a logistical and environmental challenge for some industries, potentially influencing their preference for simpler packaging alternatives.

Segment Dominance: World Anti-static Bulk Bags Production (More Than 2 Tons)

The "More Than 2 Tons" segment is anticipated to dominate the global anti-static bulk bags market, driven by the increasing scale of industrial operations and the inherent safety requirements for handling large volumes of materials. This segment directly addresses the critical need for robust and static-controlled solutions in high-capacity material handling scenarios. The production and demand for anti-static bulk bags in capacities exceeding two tons are intrinsically linked to sectors that manage substantial quantities of bulk materials, such as mining, agriculture, chemicals, and infrastructure development. The sheer volume of product handled in these operations magnifies the risks associated with static electricity, making the adoption of specialized anti-static bags not just a preference but a necessity for operational safety and regulatory compliance.

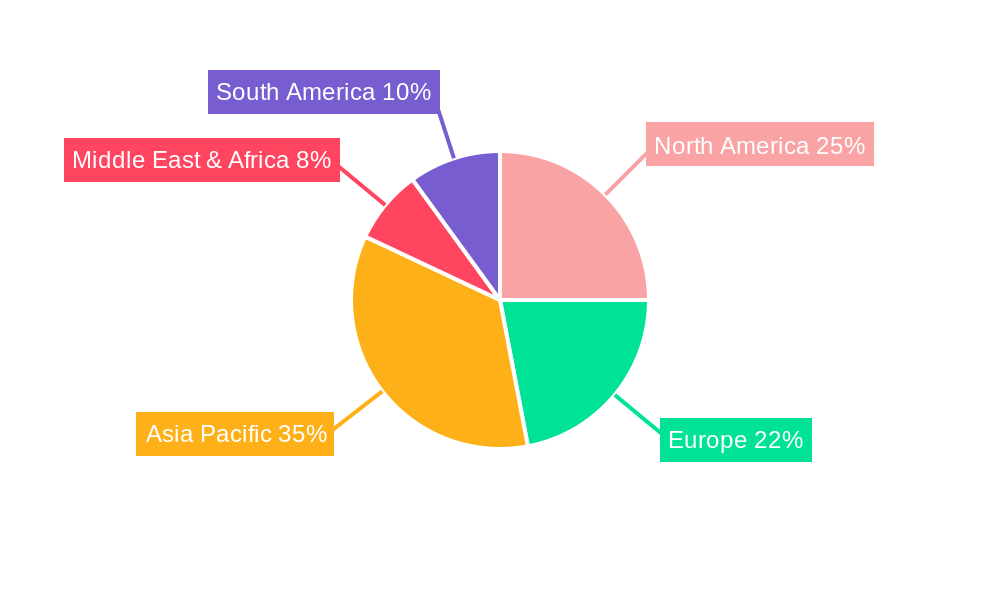

Regional Dominance: Asia Pacific

The Asia Pacific region is poised to emerge as the dominant force in the anti-static bulk bags market, both in terms of production and consumption. This dominance is fueled by a multifaceted set of factors:

In essence, the Asia Pacific region's confluence of industrial growth, stringent safety mandates, and evolving manufacturing capabilities positions it as the undisputed leader in the global anti-static bulk bags market, with the "More Than 2 Tons" segment acting as a key enabler of this dominance.

The growth of the anti-static bulk bags industry is being significantly catalyzed by a rising global consciousness regarding industrial safety and the increasing stringency of regulatory frameworks surrounding the handling of hazardous materials. As industries worldwide grapple with the inherent risks of static electricity – ranging from ignition of flammable substances to damage of sensitive electronic components – the demand for reliable preventative measures is surging. Furthermore, the expansion of key end-user sectors such as chemicals, pharmaceuticals, and food processing, coupled with advancements in material science leading to more effective and cost-efficient anti-static solutions, are providing substantial impetus for market growth.

This comprehensive report on the Anti-static Bulk Bags market offers an in-depth analysis spanning the study period of 2019-2033, with a detailed focus on the base year 2025. It meticulously dissects market trends, identifying key drivers such as escalating industrial safety mandates and the imperative to preserve product integrity across sectors like chemical, food, and pharmaceutical. The report also highlights critical restraints, including production costs and regional awareness gaps, and provides a granular segmentation analysis based on capacity (2 Tons and Below, More Than 2 Tons) and application. Furthermore, it forecasts future market trajectories, anticipates significant industry developments, and profiles leading global manufacturers, providing actionable insights for stakeholders navigating this dynamic and crucial market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Global-Pak, Flexi-tuff, Isbir, BAG Corp, Greif, Conitex Sonoco, Berry Global, AmeriGlobe, LC Packaging, RDA Bulk Packaging, Sackmaker, Langston, Taihua Group, Rishi FIBC, Halsted, Intertape Polymer, MiniBulk, Bulk Lift, Wellknit, Emmbi Industries, Dongxing, Yantai Haiwan, Kanpur Plastipack, Yixing Huafu, Changfeng Bulk, Shenzhen Riversky, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-static Bulk Bags," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-static Bulk Bags, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.