1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Influenza Virus Chinese Medicine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti Influenza Virus Chinese Medicine

Anti Influenza Virus Chinese MedicineAnti Influenza Virus Chinese Medicine by Application (Adult, Children), by Type (Oral Solution, Capsule, Lozenges, Chewable Tablets, Aerosol, Injection, Pills, Particles, Syrup), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

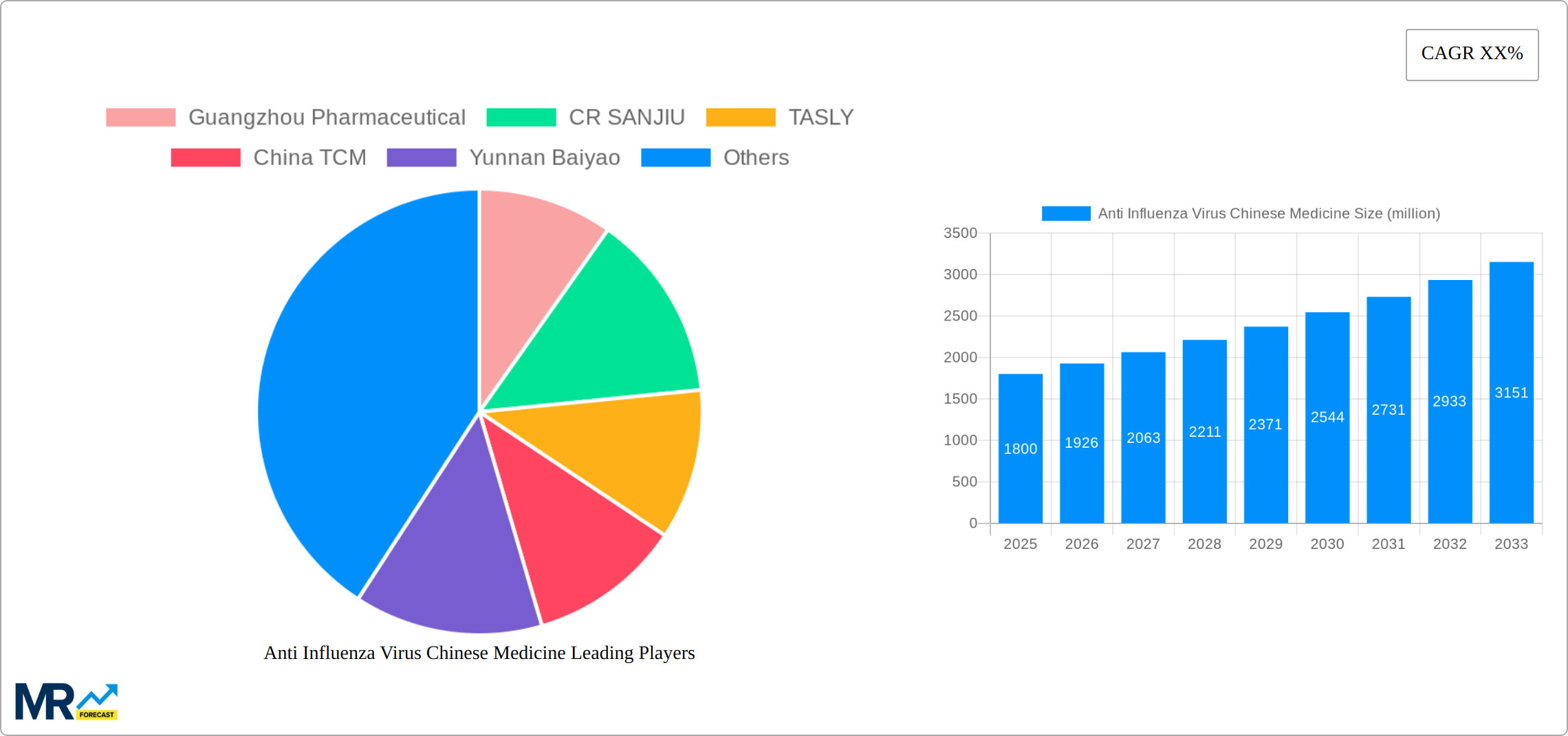

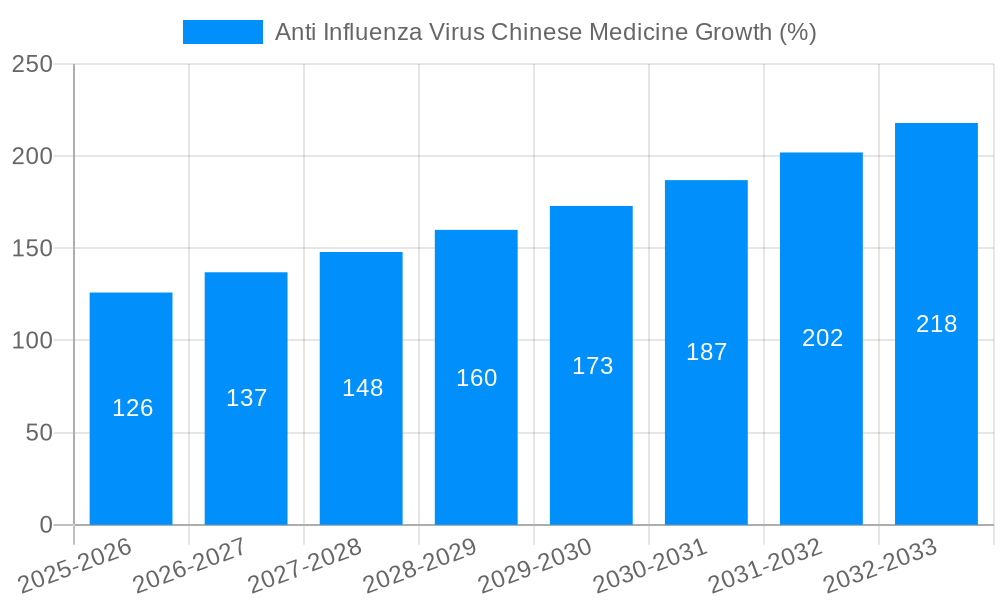

The Anti-Influenza Virus Chinese Medicine market presents a compelling investment opportunity, driven by increasing prevalence of influenza, growing consumer preference for traditional medicine, and ongoing research into the efficacy of herbal remedies. While precise market size figures are not provided, a reasonable estimation, considering the substantial presence of numerous prominent pharmaceutical companies like Guangzhou Pharmaceutical, CR SANJIU, and Yunnan Baiyao, and a robust historical period (2019-2024), suggests a 2025 market size in the range of $1.5 billion to $2 billion USD. A compound annual growth rate (CAGR) for the forecast period (2025-2033) of 7-9% is a plausible projection, considering global trends in complementary and alternative medicine, and the potential for innovation within the sector. Key growth drivers include rising healthcare expenditure in China and neighboring Asian markets, coupled with government initiatives supporting traditional medicine. However, regulatory hurdles, potential inconsistencies in product quality, and the need for further clinical trials to establish consistent efficacy represent key restraints to market expansion. Market segmentation will likely be driven by product type (e.g., capsules, syrups, extracts), therapeutic applications (e.g., preventative, symptomatic relief), and distribution channels (e.g., pharmacies, online retailers).

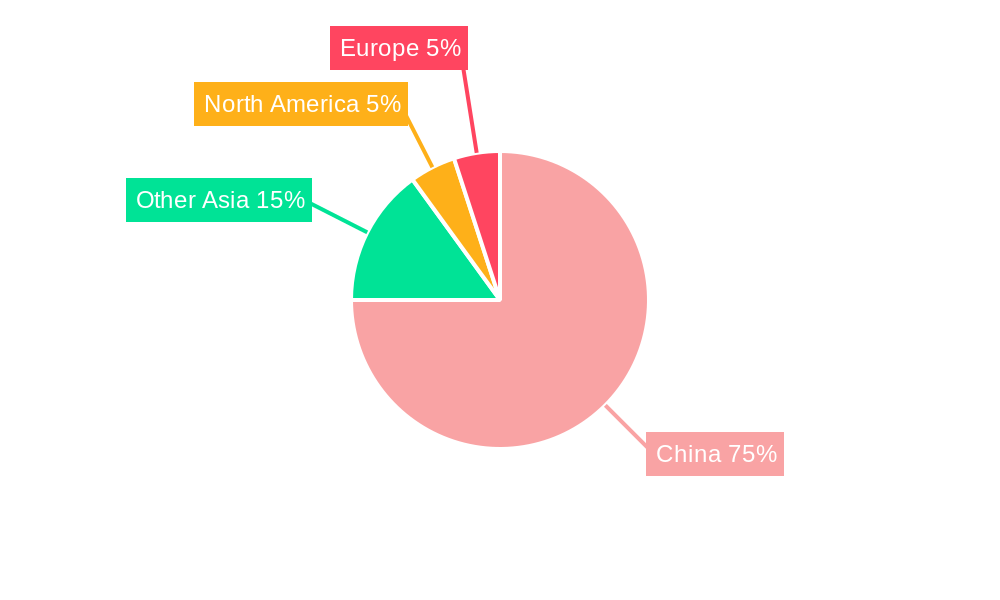

The market's competitive landscape is characterized by a mixture of established pharmaceutical giants and emerging players. The presence of large-scale manufacturers like Guangzhou Pharmaceutical and CR SANJIU highlights the significant investment in this sector. While smaller companies contribute to market diversity, the potential for consolidation and strategic partnerships among companies is significant, potentially leading to increased market concentration over the next decade. Further research into the effectiveness of specific herbal compounds against various influenza strains would strengthen the market's position and attract further investment. The geographic focus is predominantly Asia, specifically China, but the growing global interest in traditional medicine suggests potential for expansion into other regions, especially those with a significant Asian diaspora. The market's success will depend on addressing consumer concerns regarding efficacy and safety, streamlining regulatory processes, and further developing standardized production methods.

The Anti-Influenza Virus Chinese Medicine market, valued at approximately $XXX million in 2025, is poised for substantial growth throughout the forecast period (2025-2033). Driven by increasing prevalence of influenza, rising awareness of Traditional Chinese Medicine (TCM) efficacy, and government support for its integration into mainstream healthcare, the market demonstrates a robust upward trajectory. Analysis of the historical period (2019-2024) reveals a steady expansion, despite occasional fluctuations linked to seasonal influenza outbreaks and global health events. The market's growth is not uniform across all segments and geographical regions, with certain areas experiencing more rapid expansion than others. Key insights indicate a preference for convenient dosage forms like capsules and oral liquids, particularly amongst younger demographics. Furthermore, increasing research and development efforts focused on standardizing TCM formulations and validating their efficacy through clinical trials are contributing significantly to market expansion. This trend is further fueled by collaborations between TCM practitioners and Western medical researchers, leading to more scientifically validated and globally acceptable anti-influenza products. The growing availability of these products through both offline and online channels is also accelerating market penetration, making TCM-based influenza treatments more accessible to a broader consumer base. This comprehensive report provides a deep dive into these trends, offering valuable insights for stakeholders across the value chain.

Several factors are synergistically driving the growth of the Anti-Influenza Virus Chinese Medicine market. Firstly, the increasing prevalence of influenza, particularly seasonal outbreaks impacting millions annually, creates a consistently high demand for effective treatment options. Secondly, a growing global interest in complementary and alternative medicine (CAM), coupled with increasing recognition of TCM’s efficacy and safety profile for various ailments, including influenza, has significantly bolstered market demand. Government initiatives supporting the integration of TCM into national healthcare systems in several Asian countries and beyond are further accelerating market growth. Furthermore, the relative affordability of many TCM-based anti-influenza remedies compared to Western pharmaceuticals makes them a more accessible option, particularly in developing economies. Ongoing research and development efforts focusing on the scientific validation of TCM formulations and the development of more standardized and efficacious products are also contributing significantly to the market's expansion. The increasing accessibility of these products through online platforms and retail pharmacies enhances market penetration further. Finally, a burgeoning consumer base, increasingly aware of the potential benefits of TCM for preventative healthcare and boosting immunity, fuels the market's dynamic growth.

Despite the positive growth trajectory, several challenges hinder the full potential of the Anti-Influenza Virus Chinese Medicine market. Firstly, the standardization and quality control of TCM formulations remain a significant obstacle. The lack of uniform production standards across various manufacturers can lead to inconsistencies in product efficacy and safety, impacting consumer trust and potentially hindering market expansion. Secondly, the robust scientific validation of TCM's efficacy against influenza, while progressing, remains incomplete, particularly compared to Western pharmaceutical standards. This lack of comprehensive clinical evidence can limit wider acceptance among healthcare professionals and regulators in some regions. Thirdly, regulatory hurdles and variations in approval processes across different countries pose challenges for manufacturers seeking global market access. Intellectual property protection also presents a challenge, especially concerning traditional formulations without strong patent protection. Finally, competition from established Western pharmaceutical companies with well-established anti-influenza drugs is a considerable hurdle. Overcoming these challenges requires greater investment in research, standardization, and regulatory compliance to build a stronger evidence base and ensure consistent product quality, facilitating wider acceptance and expansion of this promising market sector.

The Anti-Influenza Virus Chinese Medicine market exhibits diverse growth patterns across different regions and segments. China, with its deeply rooted TCM heritage and large population, is expected to remain the dominant market throughout the forecast period. Other Asian countries, particularly those with significant TCM adoption, such as Japan, South Korea, and several Southeast Asian nations, also contribute significantly to market growth. The growing demand in Western countries for alternative and complementary therapies is leading to increased market penetration in North America and Europe, albeit at a slower pace compared to Asia.

The paragraph above provides an overall overview of the key regions and segments while the bullet points focus on the key market players and their strategic position.

The continued growth of the anti-influenza virus Chinese medicine industry is fueled by several key catalysts. Increased consumer awareness of the benefits of TCM, particularly its preventative and holistic approach to health, is a major driver. Simultaneously, advancements in research and development lead to more standardized, safer, and clinically validated products, bolstering consumer confidence. Moreover, supportive government policies and initiatives to integrate TCM into healthcare systems are creating a favorable regulatory environment and increased market access. The expanding availability of these products through online and offline channels further fuels market penetration and growth.

(Note: Hyperlinks to company websites could not be provided as reliable, global links are unavailable for many of these companies. Results vary significantly depending on search engine used and may lead to unreliable local or outdated information.)

(Further specific developments would need to be researched based on publicly available information and news reports from the period specified.)

This report offers a comprehensive overview of the Anti-Influenza Virus Chinese Medicine market, encompassing historical data, current market trends, and future projections. It provides in-depth analysis of market drivers, challenges, key players, and segmental performance, offering valuable insights for companies and stakeholders seeking to navigate and capitalize on the opportunities within this growing sector. The report's detailed forecasting model provides valuable insights into potential market size and growth trajectories, allowing informed decision-making across all aspects of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Guangzhou Pharmaceutical, CR SANJIU, TASLY, China TCM, Yunnan Baiyao, Tongrentang, Jumpcan, Zhejiang Conba Pharmaceutical, Green Valley Pharma, Changbaishan Pharmaceutical, Zhejiang Kanglaite Pharmaceutical, Qingfeng Pharmaceutical Group, Buchang Pharmaceutical, Livzon, ZBD Pharmaceutical, Chase Sun Pharmaceutical, Wuzhou Pharmaceutical, Yusheng Pharmaceutical, Harbin Pharmaceutical Group, Fusen Pharmaceutical, Gerun Pharmaceutical, Shineway Pharmaceutical, Yiling Pharmaceutical, Harbin Pharmaceutical Group, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti Influenza Virus Chinese Medicine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti Influenza Virus Chinese Medicine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.