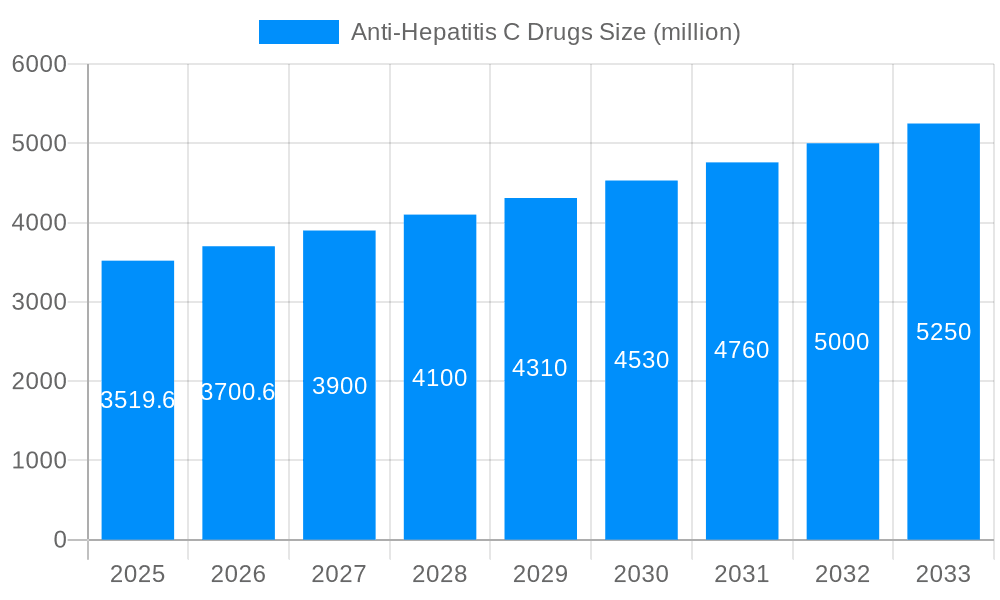

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Hepatitis C Drugs?

The projected CAGR is approximately 11.84%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-Hepatitis C Drugs

Anti-Hepatitis C DrugsAnti-Hepatitis C Drugs by Type (Acute Hepatitis C, Chronic Hepatitis C), by Application (Hospital, Clinic), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

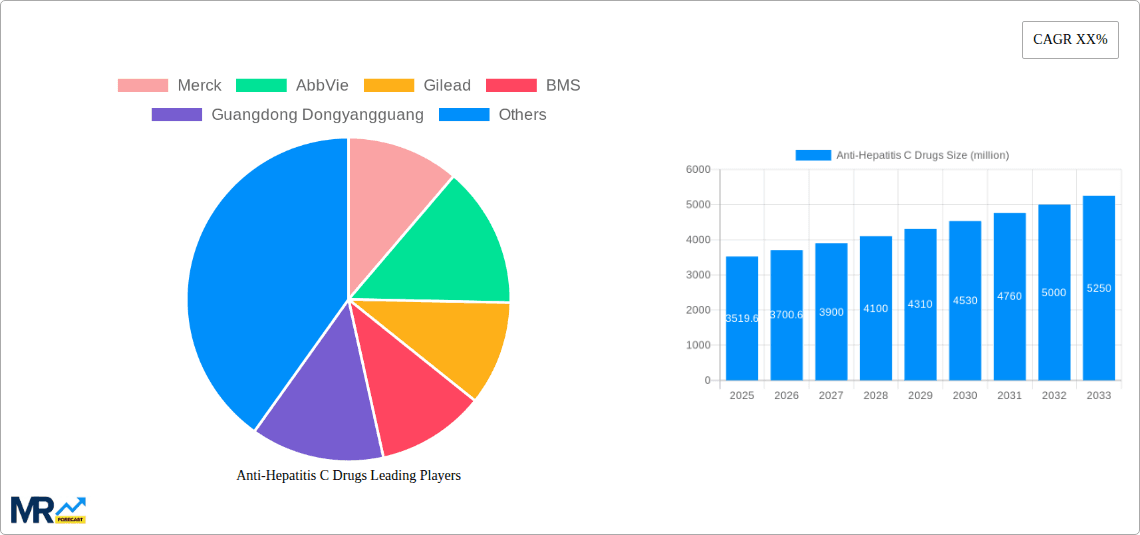

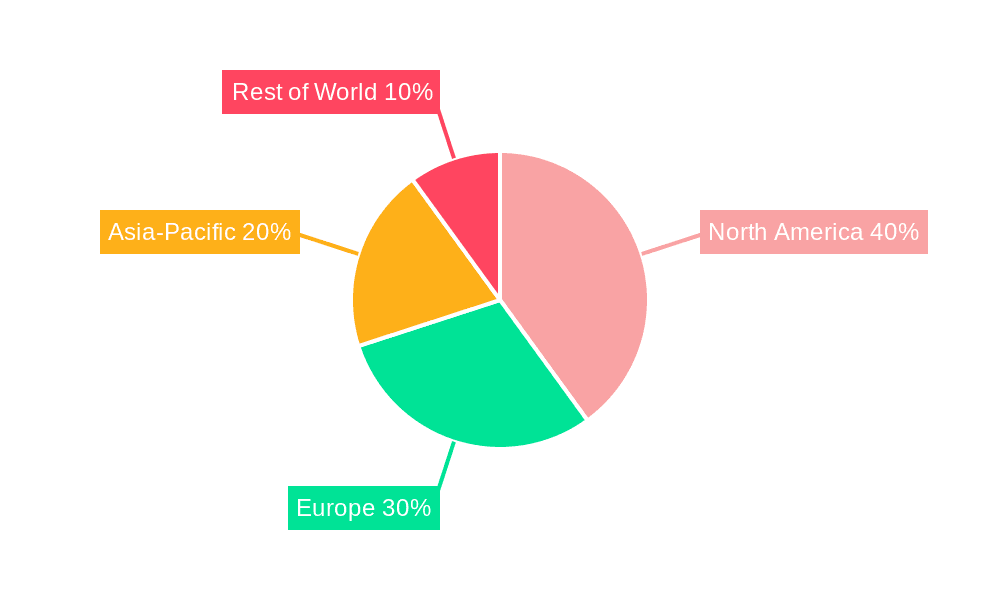

The global anti-hepatitis C drugs market, valued at $2,381 million in 2025, is projected to experience robust growth, driven by increasing prevalence of Hepatitis C virus (HCV) infections, particularly in developing nations, and advancements in direct-acting antiviral (DAA) therapies. The market's Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033 indicates a significant expansion. This growth is fueled by factors such as rising awareness about HCV and improved diagnostic capabilities leading to earlier detection and treatment. The segment encompassing chronic Hepatitis C is expected to dominate the market due to the higher prevalence of this form of the disease compared to acute Hepatitis C. Hospitals and clinics represent the largest application segment, reflecting the need for specialized medical facilities for diagnosis and treatment administration. Key players, including Merck, AbbVie, Gilead, BMS, and Johnson & Johnson, are actively engaged in research and development of novel therapies, fostering competition and innovation within the market. Geographic variations in market share are anticipated, with North America and Europe likely to maintain a significant share due to established healthcare infrastructure and higher per capita income levels. However, the Asia-Pacific region is projected to witness substantial growth due to its large population and rising healthcare expenditure. The market faces potential restraints such as high treatment costs, the emergence of drug-resistant strains, and potential side effects associated with certain medications.

The forecast period (2025-2033) anticipates continued market expansion propelled by ongoing improvements in treatment efficacy and accessibility. The introduction of newer DAAs with enhanced tolerability and shorter treatment durations will likely further boost market growth. However, challenges remain, including ensuring equitable access to these life-saving treatments, particularly in low- and middle-income countries. Government initiatives focused on public health campaigns and affordable treatment programs will be crucial in mitigating these challenges and achieving widespread eradication of HCV. Competitive landscape will continue to evolve with mergers, acquisitions, and licensing agreements shaping the industry dynamics. Ongoing research in developing pan-genotypic DAAs and novel treatment strategies holds promise for further advancements in HCV management and consequently driving continued market expansion.

The global anti-hepatitis C drugs market is experiencing a dynamic shift, transitioning from a period of explosive growth fueled by the introduction of highly effective direct-acting antiviral (DAA) therapies to a more mature phase characterized by sustained, albeit slower, expansion. The market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This growth is driven by several factors, including the ongoing prevalence of chronic Hepatitis C, particularly in developing nations, and continuous efforts to improve treatment accessibility and affordability. However, several market challenges are emerging, including the decreasing incidence of new infections in developed countries due to successful public health initiatives and the increasing competition among existing players, leading to price erosion. The market is also witnessing a paradigm shift from the blockbuster sales of first-generation DAAs towards newer, potentially more effective and better tolerated therapies, which are now being developed and marketed by several pharmaceutical giants and emerging players. The market is further segmented by drug type (e.g., protease inhibitors, polymerase inhibitors, NS5A inhibitors), route of administration, and geographic region, each demonstrating unique growth trajectories and influencing the overall market dynamics. The increasing focus on combination therapies and personalized medicine is shaping future trends, offering the potential for more effective treatments tailored to individual patient characteristics. The market's landscape is further diversified by the emergence of biosimilars and generic versions of older DAAs, particularly impacting the affordability and accessibility of treatments in various global regions.

Several key factors are propelling the growth of the anti-hepatitis C drugs market. The persistent global burden of chronic Hepatitis C, affecting millions worldwide, remains a primary driver. Despite significant advancements in treatment, many patients remain undiagnosed and untreated, particularly in low- and middle-income countries where access to healthcare and diagnostic tools remains limited. The effectiveness of DAAs, offering high cure rates and significantly reduced treatment duration compared to older interferon-based therapies, is another crucial factor, making them attractive for both patients and healthcare providers. Increased government initiatives and public health programs focused on hepatitis C screening, diagnosis, and treatment are also boosting market growth, particularly in regions with high disease prevalence. Furthermore, the ongoing development and launch of newer DAAs with improved efficacy, safety profiles, and simplified regimens continue to fuel market expansion. Finally, the increasing awareness among healthcare professionals and the general public about Hepatitis C and its effective treatments is also contributing to greater demand for these medications.

Despite the significant progress made in treating Hepatitis C, several challenges and restraints impede the market's growth. The decreasing incidence of new infections in developed countries, due to successful public health interventions like blood screening and harm reduction programs, is gradually reducing the market’s total addressable population. The high cost of DAAs remains a significant barrier to access, especially in low- and middle-income countries, limiting treatment uptake and potentially slowing market growth. The emergence of drug resistance, although relatively uncommon, poses a threat to the long-term efficacy of current therapies, necessitating the development of novel drug combinations and strategies. The intense competition among established pharmaceutical companies and the entry of generic drug manufacturers further complicates the market, leading to price erosion and potentially impacting profitability. Furthermore, the potential side effects associated with some DAAs, although generally well-tolerated, can affect patient compliance and may limit market growth if alternative, better-tolerated options become available. Finally, the complexity of treatment regimens for certain patient populations, such as those with co-infections or advanced liver disease, can hinder treatment adherence and negatively impact outcomes.

The chronic Hepatitis C segment is projected to dominate the market due to the significantly larger patient population compared to acute Hepatitis C. Within the application segment, hospitals are expected to maintain a leading position, given their superior infrastructure and specialized medical expertise in managing complex liver diseases. Geographically, North America currently holds a substantial market share driven by high healthcare expenditure, advanced healthcare infrastructure, and high prevalence (although decreasing) in certain demographics. However, the Asia-Pacific region is anticipated to witness significant growth due to increasing disease awareness, expanding healthcare infrastructure, and growing adoption of DAAs, potentially becoming a dominant market in the coming years.

Chronic Hepatitis C: This segment's dominance is attributed to the much larger patient pool and longer treatment duration compared to the acute form. The market size for chronic hepatitis C is estimated to exceed $XX billion by 2033, representing the majority of overall market revenue.

Hospital Application: Hospitals are equipped to handle complex cases and possess the resources for proper patient monitoring and management throughout the treatment process. This contributes to their larger market share. The hospital segment is forecast to reach a valuation of approximately $YY billion by 2033.

North America: This region currently holds a strong market position due to higher healthcare spending, established infrastructure, and relatively high incidence rates. However, the significant growth of the Asia-Pacific region is expected to change the dynamics over the forecast period.

Asia-Pacific: This region is expected to experience the highest CAGR driven by increasing awareness, improving healthcare access, and the entry of more affordable generic medications. The market size is projected to reach $ZZ billion by 2033, a significant increase over the base year.

Several factors are accelerating the growth of the anti-Hepatitis C drugs market. The rising awareness about Hepatitis C and its treatment options is encouraging more people to undergo screening and seek treatment. Technological advancements in diagnostics leading to quicker and more accessible testing are contributing to early diagnosis and intervention. The development of more simplified, well-tolerated, and effective regimens further improves patient compliance and treatment outcomes. Furthermore, government support for nationwide screening and treatment programs, coupled with the introduction of cost-effective generic medications in many regions, is widening treatment accessibility. Finally, the development of new combination therapies with better efficacy and safety profiles continues to invigorate market expansion.

This report provides a comprehensive analysis of the anti-hepatitis C drugs market, covering market size and forecasts, key drivers and restraints, competitive landscape, and significant industry developments. It offers valuable insights into market trends, segmentation, and regional variations, allowing for informed decision-making and strategic planning in the pharmaceutical industry and related sectors. The report thoroughly covers all aspects of the market, from the historical period (2019-2024) to the forecast period (2025-2033), with a base year of 2025. It helps businesses understand the current market situation, assess future potential, and develop effective strategies for market penetration and growth. The report also includes detailed company profiles of leading players in the market, highlighting their product portfolios, market strategies, and competitive positions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.84% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.84%.

Key companies in the market include Merck, AbbVie, Gilead, BMS, Guangdong Dongyangguang, Johnson & Johnson, Bristol-Myers Squibb, Kawin Technology, Ascletis, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-Hepatitis C Drugs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-Hepatitis C Drugs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.