1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Hair Loss Medication?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti-Hair Loss Medication

Anti-Hair Loss MedicationAnti-Hair Loss Medication by Type (Oral Medicine, External Medicines), by Application (Hospital, Clinic), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

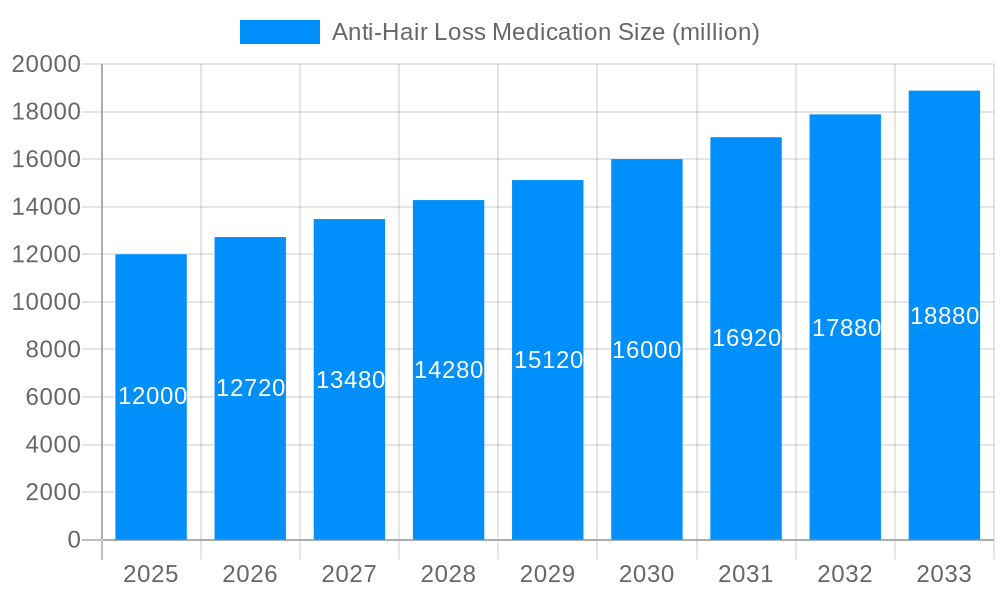

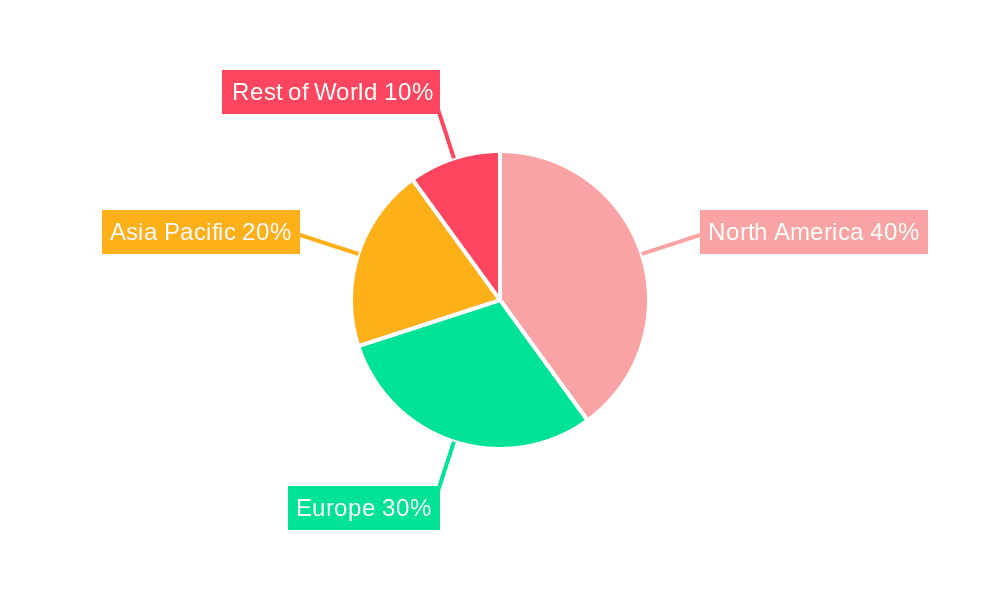

The global anti-hair loss medication market is a dynamic and rapidly expanding sector, projected to experience significant growth over the next decade. While precise market sizing data is unavailable from the provided text, a reasonable estimation based on typical CAGR values in the pharmaceutical industry and the presence of major players like Pfizer and J&J suggests a current market size (2025) in the range of $10-15 billion USD. This growth is fueled by several key drivers including rising awareness of hair loss solutions, an increasing prevalence of androgenetic alopecia (male and female pattern baldness), and the growing acceptance of hair loss treatments among younger demographics. Furthermore, advancements in treatment options, such as the development of more effective and less side-effect-prone medications and minimally invasive procedures, are contributing to market expansion. The market is segmented by medication type (oral and external) and application setting (hospital and clinic), reflecting the diverse approaches to hair loss management. Geographic distribution shows significant market share contributions from North America and Europe, given the high per capita healthcare spending and established healthcare infrastructure in these regions. However, Asia Pacific, particularly China and India, presents a substantial growth opportunity due to a burgeoning middle class and increasing healthcare awareness. Competition is intense, with established pharmaceutical giants alongside regional players vying for market share. Regulatory hurdles and potential side effects associated with some treatments represent key restraints.

Looking ahead to 2033, the market is poised for continued expansion, driven by further technological advancements and an expanding patient base. The increasing availability of generic medications alongside the emergence of innovative therapies will likely shape the competitive landscape. Regional disparities in access to healthcare and treatment affordability will remain significant factors influencing market growth. Companies are focusing on developing personalized treatments tailored to individual patient needs and genetic profiles, signaling a shift towards more effective and targeted interventions. Strategic partnerships, acquisitions, and the development of novel drug delivery systems will continue to be key strategies for players seeking to capture market share in this competitive and lucrative market.

The global anti-hair loss medication market is experiencing robust growth, projected to reach multi-billion unit sales by 2033. Driven by increasing awareness of hair loss solutions, rising disposable incomes in developing economies, and a growing preference for aesthetic treatments, the market demonstrates significant potential. The historical period (2019-2024) showcased steady expansion, with the base year (2025) already exceeding several million units in sales. This upward trajectory is expected to continue throughout the forecast period (2025-2033). While oral medications traditionally dominated the market, external medicines are gaining traction due to their convenience and targeted application. The clinic application segment shows particularly strong growth as consumers increasingly seek professional consultation and treatment for hair loss. The competitive landscape is characterized by established pharmaceutical giants alongside emerging players, leading to continuous innovation in formulation and delivery systems. A key trend is the growing integration of advanced technologies like nanotechnology and stem cell therapy, promising even more effective hair loss solutions. The market is segmented by type (oral and external medications), application (hospital, clinic), and geographic region, with significant variations in growth rates based on these factors. Furthermore, direct-to-consumer marketing and online sales channels are expanding market accessibility, contributing to the overall growth. The rising incidence of androgenetic alopecia and other hair loss conditions, coupled with the growing demand for non-surgical hair restoration solutions, further fuels market expansion. This comprehensive report provides detailed insights into the market dynamics, regional trends, and competitive strategies of key players, aiding stakeholders in making informed decisions.

Several factors are contributing to the substantial growth of the anti-hair loss medication market. Firstly, the increasing prevalence of hair loss conditions, particularly androgenetic alopecia (male and female pattern baldness), is a major driver. This condition affects a substantial portion of the global population, creating a large potential customer base. Secondly, growing awareness and acceptance of hair loss as a treatable condition are boosting demand for effective medications. Improved access to information through the internet and media campaigns is educating consumers about various treatment options. Furthermore, the rising disposable incomes, especially in developing countries, are enabling more people to afford these treatments, which often come with a higher price tag than other healthcare solutions. The burgeoning beauty and personal care industry also plays a significant role. The societal emphasis on youthfulness and attractive appearance fuels the demand for solutions to maintain a full head of hair. Finally, advancements in the development of more effective and convenient medications, including topical treatments and oral formulations with fewer side effects, are attracting a wider range of consumers seeking treatment. These factors collectively contribute to the continued expansion of the anti-hair loss medication market.

Despite the significant market growth, several challenges and restraints exist within the anti-hair loss medication sector. One major challenge is the high cost of many effective treatments, which can be a barrier for many consumers, especially those in lower-income brackets. This often leads to patients opting for less expensive, potentially less effective, alternatives or foregoing treatment altogether. The effectiveness of some medications can also be inconsistent, with varying responses among individuals. This can lead to patient dissatisfaction and reduced confidence in the treatments. Regulatory hurdles and lengthy approval processes for new drugs and formulations pose another significant challenge, slowing down the introduction of innovative solutions to the market. Furthermore, side effects associated with some medications, such as minoxidil and finasteride, can discourage potential users and limit market expansion. The potential for drug interactions and the need for long-term usage to maintain results further complicate treatment adherence and pose challenges for market growth. Finally, the prevalence of counterfeit and unregulated products poses a significant risk to consumers and damages the credibility of the legitimate market.

The North American and European markets currently dominate the global anti-hair loss medication market due to high per capita income, greater awareness of hair loss treatments, and robust healthcare infrastructure. However, significant growth is expected from Asia-Pacific regions, driven by rising disposable incomes, increasing awareness about hair loss and aesthetic treatments, and a burgeoning population.

Oral Medications: Oral medications continue to be a dominant segment due to their systemic effects and potentially greater efficacy in some cases compared to topical treatments. The convenience and ease of administration also contribute to their market share.

Clinic Application: The clinic segment dominates due to the need for professional diagnosis and guidance on the selection and management of appropriate hair loss treatments. Clinics provide a controlled environment for treatment administration and monitoring.

United States: The United States remains a key market, accounting for a significant portion of global sales due to its large population, high healthcare expenditure, and extensive availability of treatment options.

Germany & France: These countries within Europe demonstrate significant market presence owing to a high prevalence of hair loss and substantial investment in hair care and restoration technologies.

China & India: China and India are emerging as high-growth markets due to rapid economic development, growing middle class, and increasing awareness among consumers regarding available treatments. The vast populations of these countries represent a massive untapped market potential. Further, increasing availability of effective yet cost-effective treatments contributes to their growth trajectory.

The combination of these factors – predominantly developed regions coupled with the established preference for oral medications and the reliance on professional clinical settings for treatment – positions these segments as the primary drivers of the anti-hair loss medication market.

Several factors are fueling accelerated growth within the anti-hair loss medication industry. The development of innovative formulations with improved efficacy and reduced side effects is attracting more consumers. Increased marketing and promotional activities raise consumer awareness and understanding of treatment options. Growing investment in research and development leads to new and improved products entering the market. Finally, collaborations and partnerships between pharmaceutical companies and dermatologists enhance the adoption of effective hair loss treatments.

This report provides a comprehensive overview of the anti-hair loss medication market, covering key trends, drivers, challenges, and regional dynamics. The detailed analysis of market segmentation, leading players, and significant developments provides valuable insights for businesses, investors, and healthcare professionals involved in this rapidly evolving sector. The projections to 2033 offer a long-term perspective, helping stakeholders make informed decisions and capitalize on the significant growth opportunities in this market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

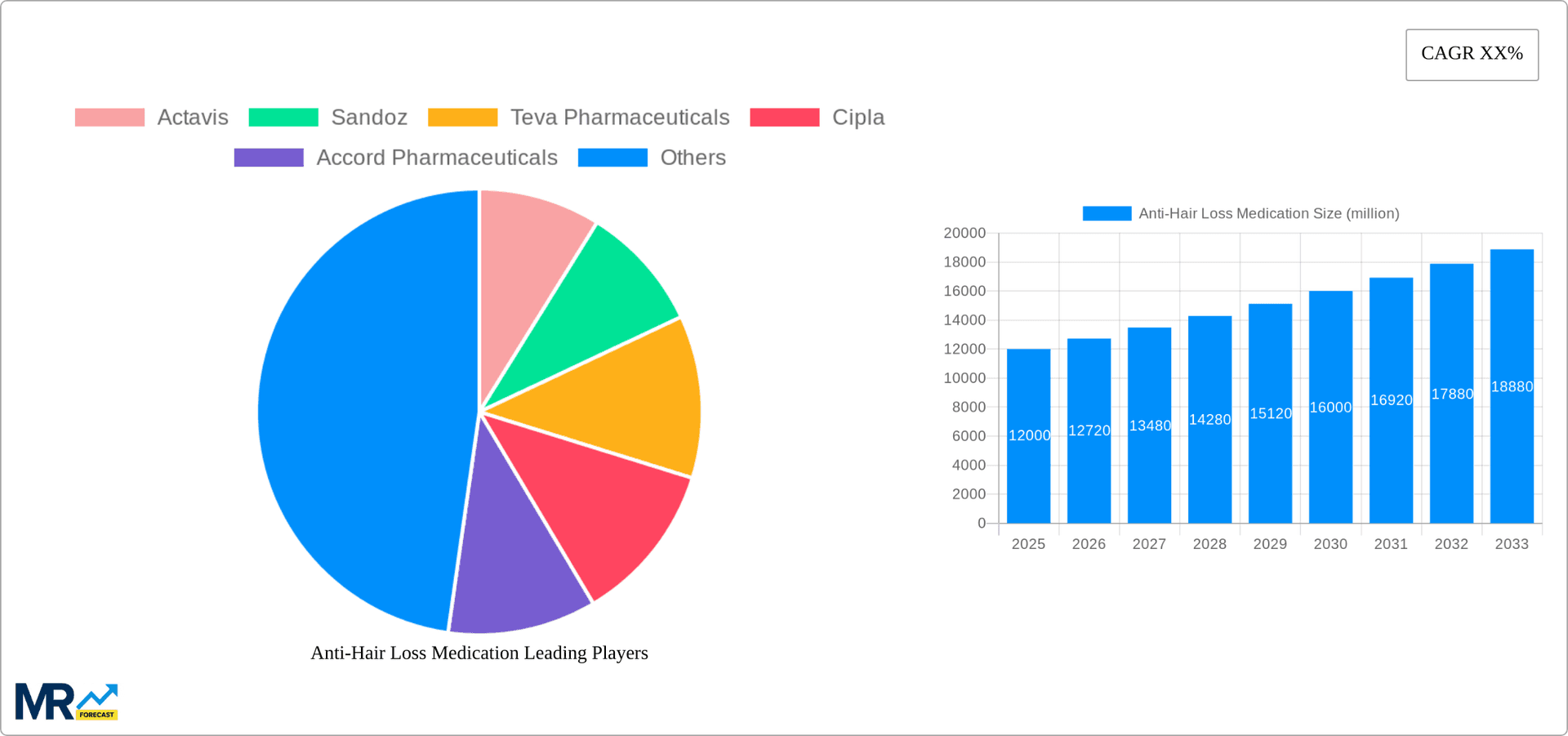

Key companies in the market include Actavis, Sandoz, Teva Pharmaceuticals, Cipla, Accord Pharmaceuticals, Zhejiang CONBA Pharmaceutical, Pfizer, Mylan Pharmaceuticals, Sun Pharmaceutical Industries, Hikma Pharmaceuticals, Shanghai Hengshan Pharmaceutical, J&J, Taisho Pharma, Costco Wholesale, Sichuan Medco Huakang Pharma.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti-Hair Loss Medication," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti-Hair Loss Medication, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.