1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Counterfeiting Aluminium Closures?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Anti Counterfeiting Aluminium Closures

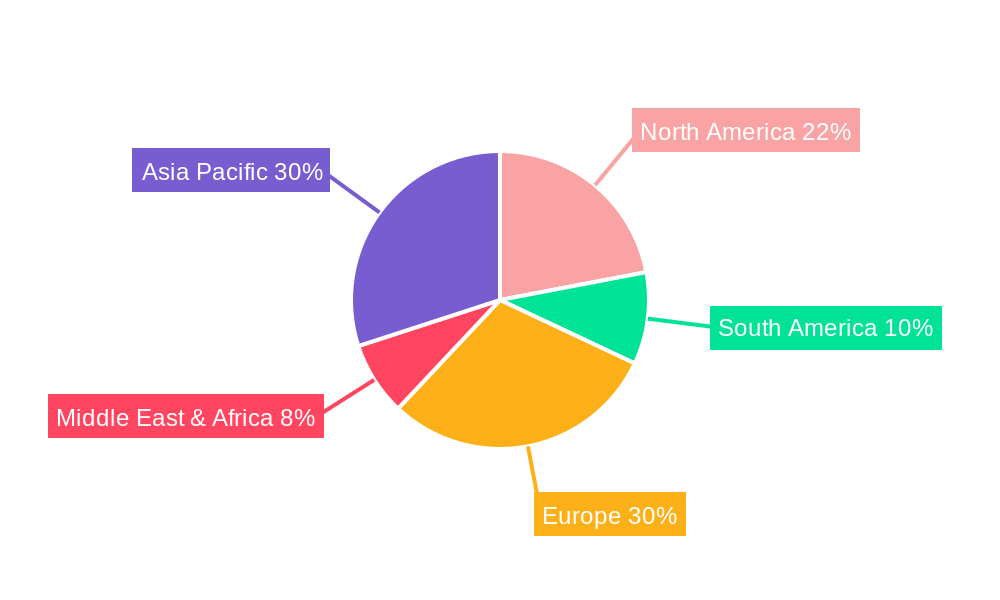

Anti Counterfeiting Aluminium ClosuresAnti Counterfeiting Aluminium Closures by Application (Beer, Wine, Spirits, Non-Alcoholic Beverages, Healthcare Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

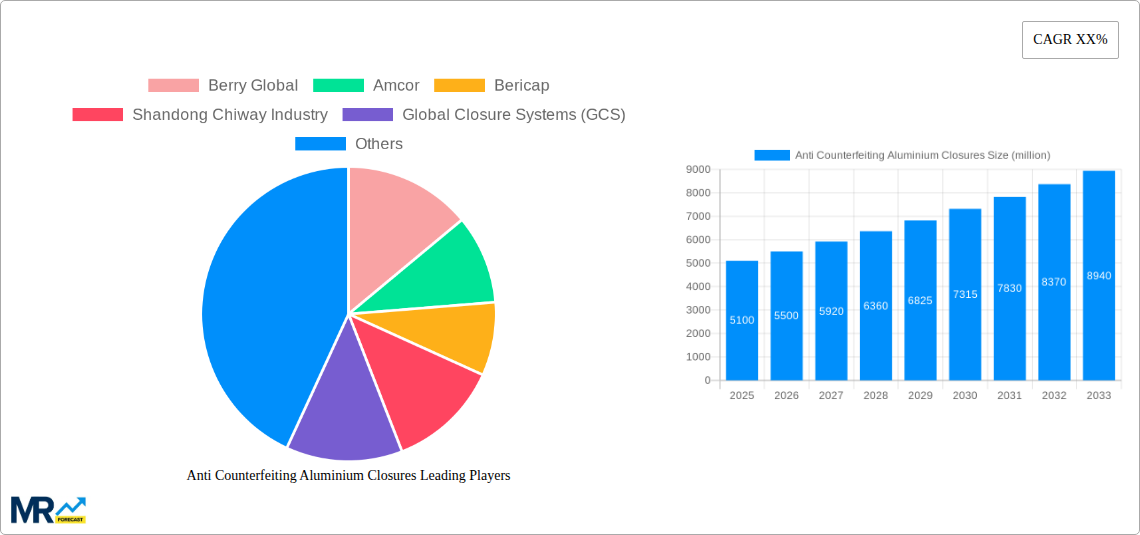

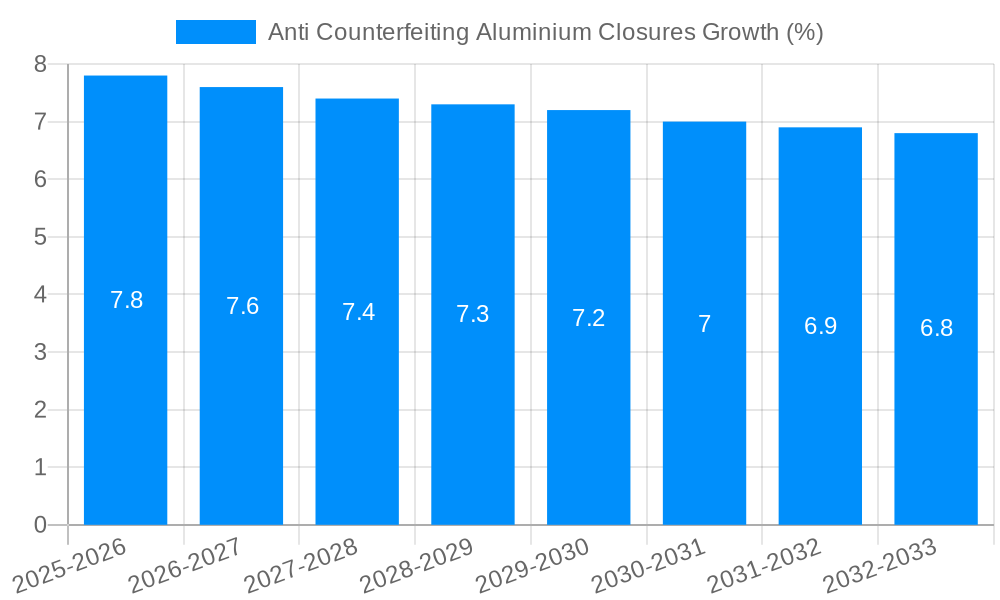

The global Anti-Counterfeiting Aluminium Closures market is poised for significant expansion, projected to reach a valuation of approximately $5.1 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.8% during the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating need to protect brand integrity and consumer safety across various industries. The increasing prevalence of counterfeit products, particularly in high-value sectors like alcoholic beverages and pharmaceuticals, necessitates advanced security features that aluminium closures effectively provide. Innovations in tamper-evident designs, holographic markings, and integrated track-and-trace technologies are further driving market demand as manufacturers seek to differentiate authentic products and build consumer trust. The growing emphasis on sustainable packaging solutions also benefits aluminium closures due to their high recyclability and durability, aligning with evolving environmental regulations and consumer preferences.

Key market drivers include the burgeoning e-commerce landscape, which has unfortunately provided new avenues for counterfeiters, thereby intensifying the demand for secure packaging. Furthermore, stringent government regulations aimed at curbing the circulation of fake goods, especially in the pharmaceutical and spirits sectors, are compelling companies to adopt sophisticated anti-counterfeiting measures. While the market exhibits strong growth potential, certain restraints, such as the initial investment costs associated with implementing advanced anti-counterfeiting technologies and the potential for fluctuating raw material prices, could pose challenges. However, the continuous development of cost-effective security features and the long-term benefits of brand protection and reduced losses from counterfeiting are expected to outweigh these concerns, ensuring sustained market expansion. The application segment of alcoholic beverages, especially wine and spirits, is expected to lead this growth due to the high premium placed on brand authenticity and the significant financial impact of counterfeiting in this segment.

Here is a unique report description for Anti-Counterfeiting Aluminium Closures, incorporating your specified details and structure:

This comprehensive report delves into the dynamic and rapidly evolving market for Anti-Counterfeiting Aluminium Closures. With a deep dive spanning the historical period of 2019-2024, a focused analysis of the base and estimated year 2025, and an extensive forecast period from 2025-2033, this report offers unparalleled insights into market trends, growth drivers, challenges, and the strategic landscape. The market, projected to witness significant expansion, is meticulously dissected to reveal opportunities for stakeholders across various applications and regions. Our analysis quantifies market size and growth in million units, providing actionable intelligence for strategic decision-making.

The global Anti-Counterfeiting Aluminium Closures market is experiencing a transformative surge, driven by escalating concerns over product authenticity and brand integrity. The historical period (2019-2024) has seen a steady rise in adoption, fueled by increasing awareness of the economic and reputational damage caused by counterfeit goods across diverse industries. By the base and estimated year of 2025, the market is poised for a substantial leap, projecting millions of units in consumption. This growth is intrinsically linked to the increasing sophistication of counterfeiting techniques, compelling manufacturers to invest in advanced closure technologies that offer robust security features. Trends indicate a strong preference for closures that integrate covert and overt security measures, such as unique holographic patterns, micro-embossing, tamper-evident seals with intricate designs, and even embedded RFID or NFC tags. The demand for aesthetically pleasing yet highly secure closures is also on the rise, as brands seek to enhance consumer trust without compromising on visual appeal. Furthermore, the growing emphasis on sustainability within packaging solutions is influencing the development of eco-friendly anti-counterfeiting aluminium closures, incorporating recycled materials or designs that facilitate easier recycling. As we move into the forecast period (2025-2033), the market is expected to continue its upward trajectory, with emerging technologies and evolving regulatory landscapes shaping new avenues for growth. The digital integration of anti-counterfeiting measures, allowing for product authentication via mobile applications, is anticipated to become a significant differentiator. The sheer volume of units projected for the coming years underscores the critical role these closures play in safeguarding brand value and consumer safety in an increasingly globalized and interconnected marketplace. The imperative for verifiable authenticity will only intensify, making aluminium closures with advanced anti-counterfeiting capabilities an indispensable component of product packaging strategies worldwide.

The burgeoning market for anti-counterfeiting aluminium closures is propelled by a potent confluence of factors, all centered around the imperative to protect brand integrity and consumer safety. Foremost among these drivers is the relentless global surge in counterfeiting activities. The economic losses incurred by legitimate businesses due to the proliferation of fake products are staggering, impacting revenue, brand reputation, and consumer trust. Aluminium closures, with their inherent durability and malleability, offer a robust platform for integrating advanced security features that are difficult to replicate. This makes them an attractive choice for industries where product authenticity is paramount. The increasing regulatory scrutiny and government initiatives aimed at combating counterfeit goods also play a significant role. As authorities worldwide implement stricter measures and penalties for the production and distribution of fake products, manufacturers are compelled to adopt more sophisticated anti-counterfeiting solutions. Consumer awareness is another critical driver. A growing segment of consumers is becoming more discerning and actively seeks products that guarantee authenticity, especially in sensitive sectors like pharmaceuticals and high-value consumer goods. The visual and tactile cues provided by well-designed anti-counterfeiting aluminium closures can instill confidence and deter potential buyers from falling prey to fraudulent alternatives. Moreover, the desire of brands to protect their premium image and market share fuels the demand for these specialized closures. In an era of intense competition, maintaining a distinct and trusted brand identity is crucial, and anti-counterfeiting measures on closures act as a vital line of defense.

Despite the robust growth trajectory, the anti-counterfeiting aluminium closures market is not without its hurdles. A primary challenge lies in the cost of advanced security features. While basic aluminium closures are relatively cost-effective, the integration of sophisticated technologies like holography, micro-text, UV-reactive inks, or RFID chips can significantly increase the per-unit cost. This can be a deterrent for some manufacturers, especially those operating in price-sensitive segments or for lower-value products. The rapid evolution of counterfeiting techniques presents an ongoing arms race. As anti-counterfeiting technologies advance, so do the methods employed by counterfeiters to bypass them. This necessitates continuous innovation and investment in research and development to stay ahead of the curve, which can be a considerable strain on resources. Scalability and integration complexities can also pose challenges. Implementing advanced closure technologies across large-scale production lines requires careful planning, specialized equipment, and rigorous quality control to ensure seamless integration without compromising production efficiency. For smaller manufacturers, the initial investment and technical expertise required might be prohibitive. Furthermore, the lack of universal standards and interoperability across different anti-counterfeiting technologies can create fragmentation in the market, making it difficult for brands to choose the most effective and future-proof solutions. Finally, consumer education and awareness regarding the meaning and efficacy of various anti-counterfeiting features remain crucial. Without proper understanding, the perceived value of these advanced closures might not be fully appreciated by the end-user, potentially limiting their market penetration.

The global Anti-Counterfeiting Aluminium Closures market is characterized by the significant dominance of the Spirits segment, closely followed by Wine and Healthcare Products. This dominance is rooted in the inherent value of the products, the high susceptibility to counterfeiting, and the stringent regulatory requirements within these sectors. The Asia Pacific region is projected to emerge as a key dominant force, driven by its vast manufacturing base, a rapidly growing middle class with increased purchasing power, and a significant increase in domestic and international trade, which unfortunately also amplifies the risk of counterfeit products entering the supply chain.

Within the Spirits segment, the premiumization trend and the high perceived value of branded liquors make them a prime target for counterfeiters. Authentic spirits brands invest heavily in their image and reputation, and the use of advanced anti-counterfeiting aluminium closures is crucial for protecting these investments. Features such as intricate holographic designs, tamper-evident seals with unique batch codes, and micro-embossing are highly sought after to differentiate genuine products from fakes. The global sales of spirits, reaching billions of units annually, translate into a massive demand for secure closures that can provide verifiable authenticity to discerning consumers and regulatory bodies.

Similarly, the Wine industry, particularly for premium and aged wines, faces significant challenges from counterfeit products. The long shelf life and high resale value of fine wines make them attractive targets. Anti-counterfeiting aluminium closures for wine often incorporate features that not only prevent tampering but also provide aesthetic appeal, aligning with the sophisticated branding of wine labels. The market for wine closures, also in the tens of millions of units, sees a strong preference for solutions that offer a combination of security and elegance.

The Healthcare Products segment is another major contributor to the dominance of these segments. The critical nature of pharmaceuticals and health supplements means that counterfeiting can have severe health implications for consumers. Regulatory bodies worldwide have mandated robust anti-counterfeiting measures for these products. Aluminium closures with advanced security features, such as unique serialized codes, tamper-proof seals that are difficult to reseal without detection, and UV-reactive inks, are essential to ensure product integrity and patient safety. The increasing global demand for medicines and health supplements, coupled with stricter regulations, drives substantial volume in this segment, measured in hundreds of millions of units.

The Asia Pacific region's dominance stems from a combination of factors. Firstly, it is a major manufacturing hub for a wide array of consumer goods, including spirits, wines, and pharmaceuticals. The sheer volume of production necessitates a proportional increase in packaging, including anti-counterfeiting closures. Secondly, the growing disposable income and the aspirational consumption patterns in countries like China, India, and Southeast Asian nations have led to a surge in demand for premium branded goods, making them more susceptible to counterfeiting. Thirdly, increasing awareness and government efforts to combat illicit trade within the region are pushing manufacturers towards adopting more advanced security features on their packaging. The sheer scale of population and economic growth in Asia Pacific, translating into billions of potential consumer units, positions it as the leading region for both the production and consumption of anti-counterfeiting aluminium closures.

Several key factors are acting as significant growth catalysts for the anti-counterfeiting aluminium closures industry. The increasing global prevalence and economic impact of counterfeiting across diverse sectors is the primary propellant. As brands and consumers become more aware of the risks associated with fake products, the demand for reliable authentication solutions like advanced aluminium closures escalates. Furthermore, stringent regulatory mandates in critical sectors such as pharmaceuticals and spirits are driving adoption, compelling manufacturers to invest in compliant packaging. The continuous innovation in anti-counterfeiting technologies, including the integration of digital solutions and enhanced material science, is creating new opportunities and making closures more effective and appealing.

This report provides an exhaustive examination of the Anti-Counterfeiting Aluminium Closures market, offering a 360-degree view of its dynamics. It meticulously analyzes market size, segmentation, and regional variations, with projections in millions of units. The study details key industry trends and their implications, alongside a thorough investigation into the driving forces and challenges that shape the market's trajectory. Growth catalysts are identified, offering strategic insights into future expansion opportunities. Furthermore, the report profiles leading players and their market strategies, supplemented by a comprehensive overview of significant past and future developments in the sector, providing stakeholders with the essential intelligence to navigate this critical and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Berry Global, Amcor, Bericap, Shandong Chiway Industry, Global Closure Systems (GCS), GualaClosures Group, Taiwan HonChuan Group, Anhui Baishijia Packaging, .

The market segments include Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Anti Counterfeiting Aluminium Closures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Anti Counterfeiting Aluminium Closures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.